-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI ASIA MARKETS ANALYSIS: NFP Miss Kindles Stim Prospects

US TSY SUMMARY

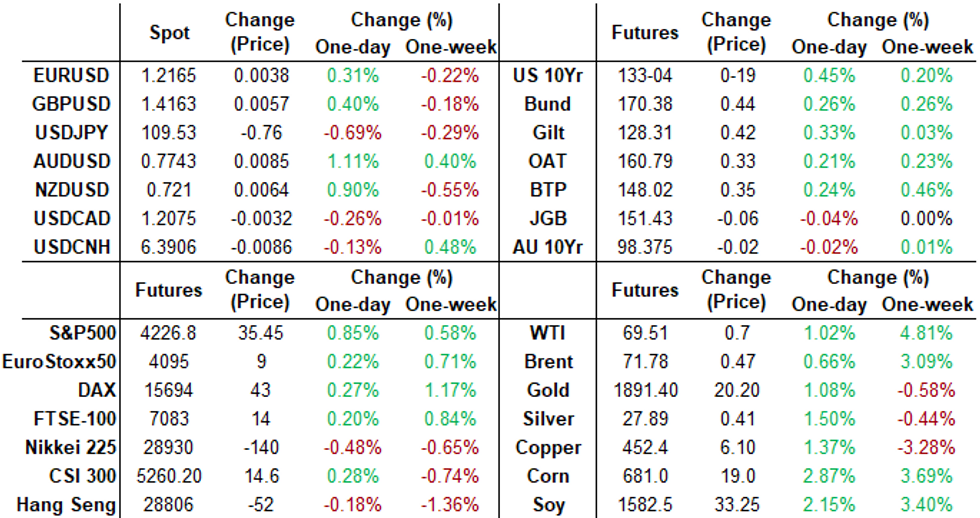

Large May employment gain of +559k jobs for May was still well below expectation of +680k (+800k whisper) spurred choppy two-way trade immediately after the release. Took a few minutes before a rally in rates gained momentum followed by equities soon after amid prospects of further stimulus.- Eminis climbed to within $10.0 of May 9 all-time high of 4236.25 to session high of 4229.25. After making strong gains in the prior session, USD slid on the headline jobs miss, the unexpected tick lower in the labor force participation adding some weight, which slipped to 61.6% vs. Exp 61.8%.

- With decent action and one-way bearish option put buying early -- trade evaporated by noon. Rates drifting near session highs through the second half. TYU breached near-term resistance of 132-05.5 earlier to 132-07 high but have receded back to -05.5 to -06.

- Fed enters blackout at midnight tonight through June 17.

- The 2-Yr yield is down 0.6bps at 0.1487%, 5-Yr is down 5.6bps at 0.7836%, 10-Yr is down 6.5bps at 1.5602%, and 30-Yr is down 5.8bps at 2.2384%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00050 at 0.05513% (-0.00600/wk)

- 1 Month +0.00125 to 0.08125% (-0.00463/wk)

- 3 Month -0.00250 to 0.12825% (-0.00312/wk) ** (New Record Low 0.12825% on 06/04)

- 6 Month +0.00013 to 0.16488% (-0.00613/wk)

- 1 Year +0.00037 to 0.24600% (-0.00213/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $69B

- Daily Overnight Bank Funding Rate: 0.04% volume: $272B

- Secured Overnight Financing Rate (SOFR): 0.01%, $903B

- Broad General Collateral Rate (BGCR): 0.01%, $391B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $360B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.201B accepted vs. $11.664B submission

- Next scheduled purchases:

- Mon 6/07 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 6/08 1010-1030ET: TIPS 1-7.5Y, appr $2.425B

- Wed 6/09 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Thu 6/10 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 6/11 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 6/11 1500ET Update NY Fed Operational Purchase Schedule

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -10,000 Green Sep83/86/88/91 put condors, 5.0

- +10,000 Blue Sep 85/87 put spds, 5.0 vs. 99.615/0.12%

- -10,000 Green Sep 93 calls, 4.0 vs. 99.18/0.25%

- Update +35,000 short Sep 96 puts, 2.5-2.0

- +10,000 short Sep 96/97 2x1 put spds, 1.0

- +13,500 Blue Sep 78 puts, 2.5

- +15,000 Green Dec 88/90 put spds 1.0 over 92/93 call spds

- +17,500 short Mar 87/92/97 put flys, 13.0-12.75, bought earlier in week at 12.0-12.5

- +8,000 Green Dec 87/90 put spds 1.0 over 92 calls vs. 99.005/0.50%

- (Thu's highlight trade: +65,000 Green Dec 88/90 put spds 0.0-1.0 over 92/93 call spds)

- +5,000 TYU 130/131/132 put flys, 8 vs. 132-03.5/0.10%

- +5,000 wk2 TY 131.5/131.75 put spds, 4

- +30,000 wk2 TY 130.75/131 put spds, 1

- +20,000 wk2 TY 131 puts, 2

- +15,000 TYN 129 puts, 1.0

- 2,500 FVN 123 puts, 2.0

- +30,000 wk2 TY 130.5/130.75 put spds, 1

- -4,000 TYQ 130.5/132.5 strangles, 46

- +6,000 TYU 128.5/129.5 put spds, 9

- +13,000 TYU 129 puts, 18-19

- Overnight trade

- +3,000 FVN 122.25 puts, 2 vs. 123-18.75/0.10%

- -3,000 TYQ 132.5/134 calls, 16

- Block, +5,000 TYN 133 calls, 6

- Block, +13,125 TYQ 129 puts, 9

- +5,000 wk2 FV 123.75 calls, 8.5-9

EGBs-GILTS CASH CLOSE: U.S. Jobs Disappointment Sets Bullish Tone

The event of the day Friday was inevitably going to be U.S. nonfarm payrolls, and it indeed proved the session's biggest catalyst as a weaker-than-expected report led to a bull flattening rally in Bunds and Gilts.

- Periphery spreads closed a little wider, with Greece and Portugal underperforming (the latter on 6-/10-Yr supply announcement).

- There was no key data or bond supply, and the only central bank speakers (ECB's Lagarde and Villeroy) spoke on climate change.

- The key ratings review this evening is Fitch on Italy, but no change in outlook/rating is expected, and Italian spreads were little changed today.

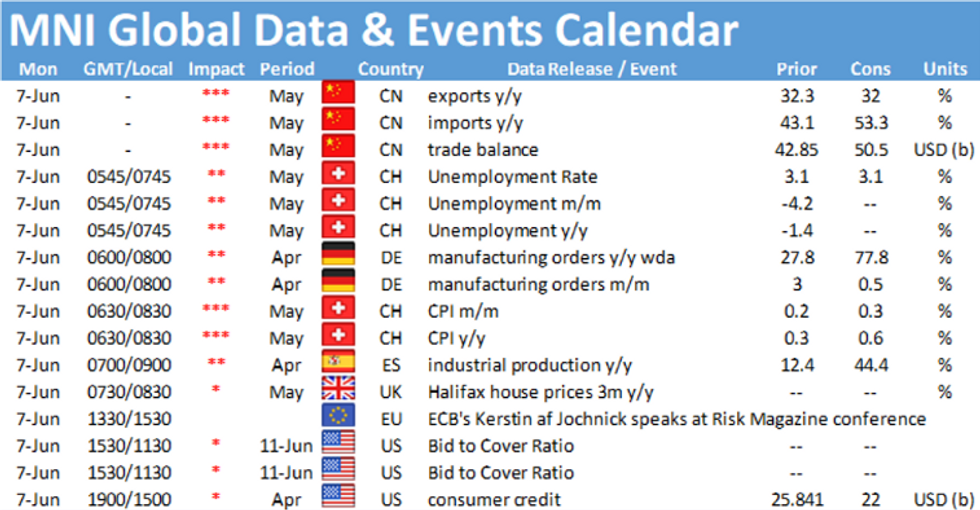

- Attention swiftly turns to next Thursday's ECB decision.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is down 0.3bps at -0.671%, 5-Yr is down 1.9bps at -0.598%, 10-Yr is down 3bps at -0.213%, and 30-Yr is down 2.8bps at 0.351%.

- UK: The 2-Yr yield is down 1.8bps at 0.069%, 5-Yr is down 3.5bps at 0.336%, 10-Yr is down 5.1bps at 0.79%, and 30-Yr is down 4.5bps at 1.326%.

- Italian BTP spread up 0.5bps at 108.6bps / Spanish spread up 1.2bps at 66.5bps

OPTIONS/EUROPE SUMMARY: Largely Downside In Rates

Friday's options flow included:

- RXN1 171.0/170.5 put spread bought for 10 in 2k

- 2RH2 100.37/50 cs vs 2x 100.12/00ps, bought the cs for 0.25 in 6.5k (13kps)

- 3RM1 100.37/25ps 1x2, sold at 7.5 in 2k (ref 100.23)

- LZ1 100.12/100ps, sold at 12 in 10k

- 0LM1 99.75/62/50p fly sold at 3.75 in 4k (ref 99.71, -80d)

- 3LU1 99.125/99.00 put spread bought for 4.25 in 10k

- 3LU1 99.00/98.75ps 1x1.5, bought for 3.5 in 5k (ref 99.13, 8d)

FOREX: Dollar Slippage Post-Payrolls as Markets Judge Fed Taper as a Way Off

- Having held steady for much of the Friday morning, the greenback reversed sharply on the back of the weaker than expected nonfarm payrolls report, in which both headline change in jobs and the participation rate fell below expectations. Markets took the data to mean the Fed were further off their taper pivot than previously seen, putting the USD under pressure while equities and Treasury markets made solid gains.

- At the other end of the table, AUD outperformed all others in G10, reversing much of the recent underperformance and garnering some support from more buoyant commodities prices. AUD/USD bounced back above the 50-dma ahead of the close, completing a solid bounce off multi-month lows at the $0.7646 lows.

- Focus in the coming week turns to rate decisions from both the ECB and BoC. Both banks are seen keeping policy unchanged, but markets remain on watch for any signals of policy tightening in the near future.

- The Fed enter their pre-decision blackout period, keeping focus on the key data releases including the German ZEW survey, CPI from both China and the US and the prelim Uni of Michigan sentiment index.

FX OPTIONS/Expiries for Jun07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2050(E677mln), $1.2175-80(E518mln), $1.2210-15(E759mln), $1.2250(E651mln)

- USD/JPY: Y108.25-35($776mln), Y109.00-20($625mln), Y109.50-65($1.3bln-USD puts), Y110.00-10($1.1bln-USD puts), Y110.50($825mln)

- USD/CAD: C$1.2000($970mln)

PIPELINE: Issuers Sidelined Ahead May Employ

$5.3B Priced Thursday, $30.45B total for week- Date $MM Issuer (Priced *, Launch #)

- 06/03 $1.5B *Consolidated Edison $750M each: 10Y +80, 40Y +130

- 06/03 $850M *Ares Capital 7Y +165

- 06/03 $750M *Travelers 30Y +75

- 06/03 $700M *Blue Owl Fnc 10Y +165

- 06/03 $500M *Puget Energy 7Y +108

- 06/03 $500M *IADB 10Y FRN SOFR+36

- 06/03 $500M *Council of Europe Development Bank (CoE) 3Y -4

COMMODITIES: Greenback Weakness Boosts Oil, Gold

- WTI and Brent crude futures topped the week's best levels to hit new cycle highs. Broad dollar weakness followed a disappointing set of payrolls figures, helping buoy commodities across the energy and precious metals sectors.

- Both WTI and Brent crude benchmarks broke to new 2021 cycle highs, resuming the medium-term uptrend and raising the real risk of a test on the 2018 highs.

- Gold and silver bounced sharply, erasing much of the Thursday move lower. Nonetheless, both metals failed to clear to new weekly highs, leaving the topside resistance intact. Focus turns to key central bank meetings in the coming week, with both the ECB and BoC due to deliver their latest rate decisions.

EQUITIES: Stocks Welcome Poor Payrolls as Stimulus Here to Stay

- Futures initially indicated a lower open on Wall Street Friday, but a disappointing set of payrolls numbers for May reassured markets that Fed stimulus is here to stay, with both headline change in nonfarm payrolls and the participation rate falling below forecast.

- The e-mini S&P added around 30 points in response, pushing the index closer toward near-term resistance at 4,230 - the week's highs.

- Tech names led the bounce in the S&P 500, closely followed by communication services and consumer discretionary names. Financials were the laggard, suffering under the weight of a far flatter Treasury curve.

- European indices also fared well, with Germany's DAX and Italy's FTSE-MIB outperforming.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.