-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Ylds Off Lows Ahead Wed FOMC

US TSY SUMMARY: Muted Start to Week, FOMC Wed

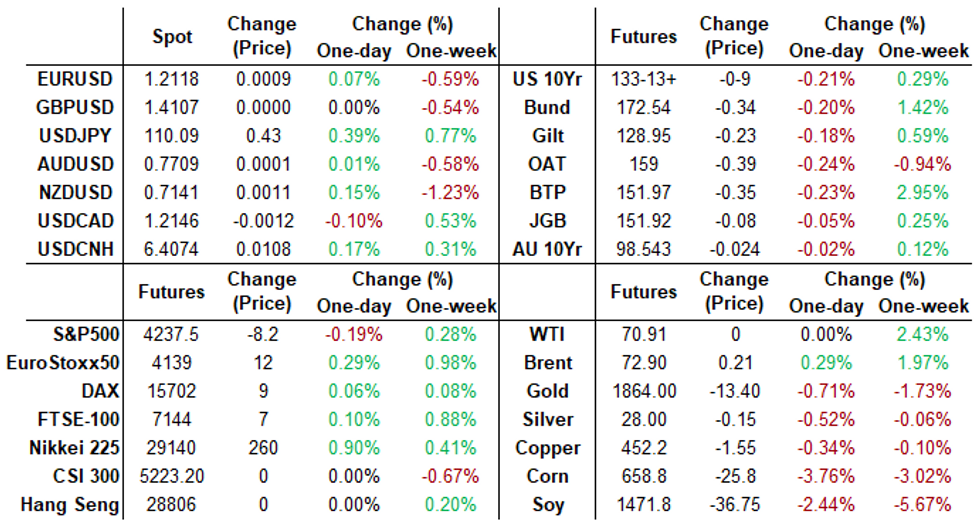

Tsy yields backed off last week's appr 4-month lows, finishing Monday near session highs on light over all volumes: TYU breaking 900k after the bell. Near $9.5B in swappable corporate issuance helped generate some two-way hedging flow on the day. Equities indexes were trading weaker as well, ESU1 -9.0 at 4227.5.- Aside from apparent position squaring ahead Wednesday's FOMC monetary policy annc, Eurodollar and Treasury option traders reported better buyers of wing insurance (low delta call and put buying reflecting indecision over direction of yields in the near term).

- Tsy option traders looked at buying the TYN 132/132.25/132.5/132.75 put condor. Current market a relatively cheap 2/64 bid -- at 3/64, 132-26 ref. Traders see 13/64 potential profit if Wed's FOMC annc turns out to be a non-event. July options expire June 25.

- Benchmark 3M LIBOR continues to make new low: -0.00088 to 0.11800% (-0.00937 total last wk): Jun'21 futures settles 99.882. New lead quarterly EDU1 holds slightly weaker.

- The 2-Yr yield is up 1.2bps at 0.159%, 5-Yr is up 4.7bps at 0.7854%, 10-Yr is up 4.6bps at 1.4973%, and 30-Yr is up 5.1bps at 2.1885%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00000 at 0.05538% (+0.00025 total last wk)

- 1 Month +0.00175 to 0.07463% (-0.00837 total last wk)

- 3 Month -0.00088 to 0.11800% (-0.00937 total last wk) ** (New Record Low: 0.11800% on 6/14)

- 6 Month -0.00212 to 0.15038% (-0.01238 total last wk)

- 1 Year -0.00188 to 0.23750% (-0.00662 total last wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $60B

- Daily Overnight Bank Funding Rate: 0.04% volume: $252B

- Secured Overnight Financing Rate (SOFR): 0.01%, $834B

- Broad General Collateral Rate (BGCR): 0.01%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $350B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.401B accepted vs. $48.056B submission

- Next scheduled purchases:

- Tue 6/15 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 6/16 ---- No buy-op due to FOMC rate annc

- Thu 6/17 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 6/18 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +20,000 Dec 99.75/99.81 2x1 put spds, 0.0

- +5,000 Green Jul 98.87/98.93 put strip, 2.0

- +20,000 Jun 93/96 put spds, 2.0

- +5,000 Red Dec 98.937 calls 1.0

- +5,000 short Dec 99.87 calls, 1.0

- +5,000 short Sep 95/96/97 put flys, 2.25 legged

- -4,000 Green Dec 88 puts, 9.5 vs. 99.11/0.10%

- +5,000 Red Dec 88/91 put spds, 1.5

- +5,000 Dec 88/93 call spds, 0.75

- +3,500 short Oct 99.62/99.68/99.75 put flys, 1.5

- +10,000 short Dec 97/98 call spds, 1.5 vs. 99.625/0.15%

- -2,000 Sep 98 straddles, 5

- Overnight trade

- 3,000 short Mar 96/97 1x3 call spds

- 3,600 Green Sep 93/96 1x3 call spds

- 2,000 Green Dec 91/93 call spds

- +4,600 TYU 130.5/131.5 put spds, 16

- +2,500 TYQ 130/131/132 put flys, 9

- -5,000 wk3 TY 132 puts, 5

- +7,000 TYN 134/TYQ 134.5 call strip vs. -TYU 135.5 calls, 0.0 net

- +5,000 FVN 124.25/124.5 call spds, 3.5

- Overnight trade

- 13,500 FVN 125 calls, 0.5

- 5,000 FVN 123.25 puts, 1.5

- 1,500 FVU 123.5 puts, 20

- 6,000 TYN 132 puts, 7

- -2,500 USQ 153 puts, 10

FOREX: JPY Weakens As Most G10 Currencies Hold Narrow Monday Ranges

- The Dollar Index held a 19 pip range on Monday which was a fair barometer for G10 FX ranges on Monday.

- Market holidays in Australia, China, Hong Kong and Taiwan prompted limited activity overnight, with the US dollar making very marginal gains, however, the DXY rejected Friday's high.

- Throughout the rest of the trading day the index gradually turned from positive to negative territory, with small gains for EUR, NZD and CAD despite US yields slowly inching higher.

- Bucking the trend, JPY was the notable underperformer on Monday, alongside the Swiss Franc. USDJPY strengthened 0.38% to breach 110 to the topside. The recovery refocuses attention on 110.33, Jun 4 high, where a break would reinstate the uptrend and open this year's 110.97 high from Mar 31. Yen weakness was the key driver with EURJPY and AUDJPY advancing by a similar magnitude.

- Larger moves were seen in the EM space, with BRL (+0.92%) leading gains and TRY (-0.89%) the major laggard following President Biden's meeting with his Turkish counterpart.

- Tomorrow's overnight highlight is the RBA minutes before US Retail Sales and PPI headline the US data docket.

- Focus is undoubtedly on Wednesday's Fed meeting, where Chair Powell will likely make it clear that the FOMC is not yet ready to move any further than just talking about reducing asset purchases.

FX OPTIONS/Expiries for Jun15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900-05(E550mln), $1.2075-80(E691mln), $1.2150-65(E540mln), $1.2200(E706mln), $1.2240-50(E870mln), $1.2300(E584mln)

- USD/JPY: Y109.00-15($620mln), Y109.50-60($665mln), Y110.00-11($1.1bln-USD puts), Y111.50($799mln)

- EUR/GBP: Gbp0.8600-10(E947mln)

- AUD/USD: $0.7725-40(A$1.4bln-AUD puts)

PIPELINE: $5B Nvidia 4Pt Jumbo Leads High-Grade Issuance

- Date $MM Issuer (Priced *, Launch #)

- 06/14 $5B #Nvidia $1.25N 2NC1 +15, $1.25B 3NC2 +25, $1.25B 7Y +40, $1.25B 10Y +55a

- 06/14 $1.15B #John Deere $550M 5Y +30, $600M 10Y +52

- 06/14 $2B #BP Capital $1.45B 20Y +95, $550M 40Y +125

- 06/14 $650M #Global Atlantic Financing 10Y +165

- 06/14 $550M #AIG Global Funding 3Y +35a

- Later in week

- 06/15 $00M Kommunalbanken 2Y +2a

- 06/?? $Benchmark Rep of Turkey 5Y Sukuk

COMMODITIES: Oil Higher, Gold Lower, With Both Breaking Out of Recent Range

- Oil benchmarks hit new cycle highs Monday, starting the week strong as markets eyed reports on Iran nuclear negotiations. Iranian diplomats warned that time was running out to secure a revival of the nuclear deal, with elections this weekend providing a fair deadline for talks in Vienna.

- WTI crude futures printed a new high of $71.78, while Brent touched $73.64.

- Gold saw more outsized moves, with the precious metal trading underwater for much of the European and US mornings. Gold was pressured down to $1845.0 before finding support and rallying alongside US yields, which bounced further off the multi-month lows. Nonetheless, the initial downside brings gold well within range of key support at both the $1839.9 200-dma and the 50-day EMA of $1842.5.

EQUITIES: Stocks Fade Off Alltime Highs as Pre-Fed Trade Thins

- Equity markets started the session well, with Wall Street following Europe higher, prompting the e-mini S&P to touch new alltime highs of 4,256.75. Price action faded in NY hours, however, with US futures ebbing around 20 points off the highs into the close. Liquidity and volumes faded, with markets eyeing this Wednesday's Fed decision.

- The S&P's tech sector outperformed slightly, holding around 0.4% above water, while financials and materials lead declines.

- Performance was more positive on the continent, with Spain's IBEX-35 adding 0.8% while Germany's DAX lagged, shedding 0.1% at the close.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.