-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk Appetite Resumes

Risk Appetite Resumes

Risk appetite gradually returned day after steady FOMC rate annc, markets leaning into the more hawkish message from policy makers despite not receiving specific details on speed or timing of tapering QE.

- Early bond support evaporated after the annc of Apple 4pt issuance ($8.5b issued May'20 -- lead to speculative rate-locks), not to mention other issuers. $6.5B Apple launched later in second half -- lion's share of $15B total high-grade issuance.

- Stronger equities helped risk appetite (ESU1 +20.0 after FI close) after China continues to quell investor concerns overnight.

- Tsys had gapped higher post data, some desks initially citing GDP miss. Others said GDP was misleading as "as all inventory drawdown" related.

- FI markets also absorbed $62B 7Y note (91282CCR0) auction: Tsys inched lower after 1.03bp tail with high yield of 1.050% vs. 1.037% WI. Bid-to-cover: 2.23x vs. 2.27x 5m avg, Indirect take-up: 58.37 vs. 59.97 in June, still well over 5M avg of 55.19%. Primary dealer take-up 22.18% vs. 18.69% last month remains below 25.06% 5 month avg. Direct take-up slips to 19.45 vs. 19.53% 5M avg.

- The 2-Yr yield is down 0.2bps at 0.1996%, 5-Yr is up 1.8bps at 0.7287%, 10-Yr is up 3.3bps at 1.2659%, and 30-Yr is up 3.2bps at 1.9124%.

MONTH-END EXTENSIONS: Preliminary Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.16Y; US Gov infl-linked 0.23Y.

| SECURITY | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.06 | 0.04 | 0.05 |

| Credit | 0.06 | 0.12 | 0.08 |

| Govt/Credit | 0.07 | 0.1 | 0.08 |

| MBS | 0.08 | 0.07 | 0.06 |

| Aggregate | 0.07 | 0.09 | 0.08 |

| Long Gov/Cr | 0.05 | 0.09 | 0.07 |

| Iterm Credit | 0.06 | 0.1 | 0.08 |

| Interm Gov | 0.08 | 0.08 | 0.08 |

| Interm Gov/Cr | 0.07 | 0.09 | 0.08 |

| High Yield | 0.06 | 0.11 | 0.1 |

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00025 at 0.07938% (-0.00075/wk)

- 1 Month +0.00375 to 0.09575% (+0.00963/wk)

- 3 Month -0.00275 to 0.12575% (-0.00313/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00012 to 0.15388% (-0.00462/wk)

- 1 Year -0.00013 to 0.23700% (-0.00438/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $65B

- Daily Overnight Bank Funding Rate: 0.08% volume: $244B

- Secured Overnight Financing Rate (SOFR): 0.05%, $862B

- Broad General Collateral Rate (BGCR): 0.05%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $345B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $5.653B submission

- Next scheduled purchase

- Fri 7/30 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED: Reverse Repo Operations -- Nearing Record High

NY Fed reverse repo usage climbs to $987.283B from 76 counterparties vs. $965.189B on Wednesday -- just off June 30 record high of $991.939B.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +10,000 Green Aug 99.12/99.25 2x1 put spds, 2.0

- +2,500 Blue Aug 98.50/98.62 2x1 put spds, 0.75 legs

- Block, 32,000 short Dec 99.12/99.37 put spds, 2.5 vs. 99.56/0.10% at 0928:26ET, additional 38,000 on screen

- +5,000 short Dec 99.12/99.50/99.62 broken put flys, 0.25 cr/wings over

- Overnight trade

- 2,000 short Dec 99.25/99.50 put spds vs. 99.68 calls

- 2,800 Blue Aug 98.87 calls, 4.5

- +5,000 wk1 TY 136 calls, 2

- +7,500 FVU 124.5 calls, 16

- -1,100 FVU 123.5/124.75 strangles, 18

- 1,000 TYX 131/131.5/132.5 2x3x1 put flys, 0.0

- Overnight trade

- 1,250 TYU 131/132.5/134 put flys

- 7,800 TYU 133.50 puts, mostly 25-26

- 7,500 TYU 133.25 puts, 20

- 5,000 TYV 131/132 2x1 put spds, 1cr

- 5,000 wk5 TY 133.5 puts, 1

EUROPE SUMMARY: Bund Combo And Stg Mid Call Buying

Thursday's options flow included:

- RXU1 175.5/178 Combo, bought the put for 15 and 16 in 25k

- DUU1 112.20/112ps, bought for half in 5k

- DUU1 112.30/112.20ps 1x2, bought for 2 in 1k

- 0LX1 99.875c, bought for 0.75 in 10k (20k total this week)

- 0LZ1 99.62/99.75/100 broken c fly, sold at 1.5 in 13k

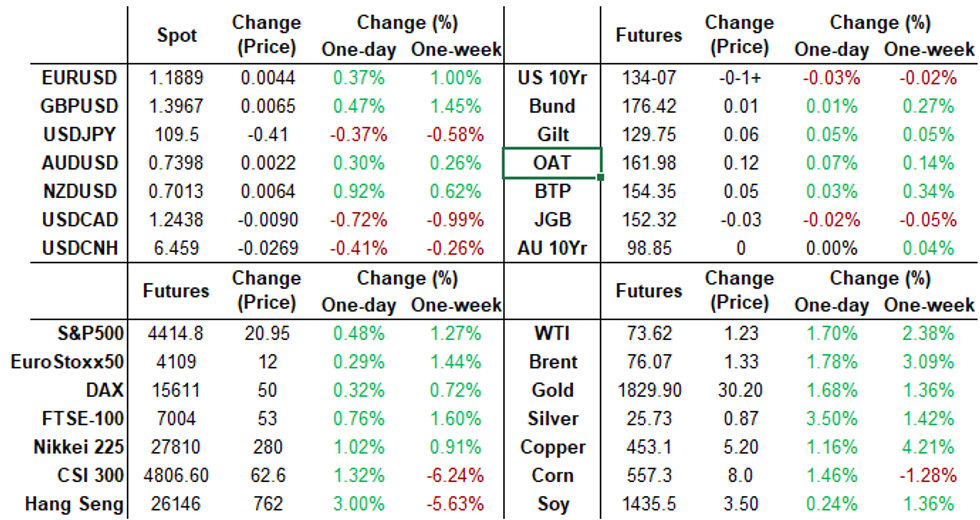

FOREX: USD Weakness Across The Board Amid Risk Rally

- The greenback extended on post-FOMC losses on Thursday. Persistent weakness saw the dollar index retreat another 0.5%, with no immediate signs of any bounce.

- The dollar sell-off was emboldened by buoyant risk sentiment, evident by both firm equities and a strong performance in the commodity space.

- As such, Antipodean currencies performed well with Kiwi the notable performer rallying 0.94% and topping the G10 pile. Closely behind was the Norwegian Krone, extending on yesterday's rally, supported by stronger oil prices. EMFX baskets also took advantage of the benign conditions with sizeable gains in high beta ccys such as TRY, ZAR and BRL, all up over 1%.

- Price action in the major pairs was lacklustre, with EURUSD (+0.35%) and GBPUSD (0.48%) moving higher in a slow grind, with the latter hovering just below 1.3990, a Fibonacci retracement and initial resistance.

- USDCNH (0.53%)pulled lower, extending the rejection following the latest breach of touted resistance at 6.50.

- An underwhelming second quarter GDP reading out of the U.S. as well as slightly higher than expected initial jobless claims kept the USD under pressure throughout the session.

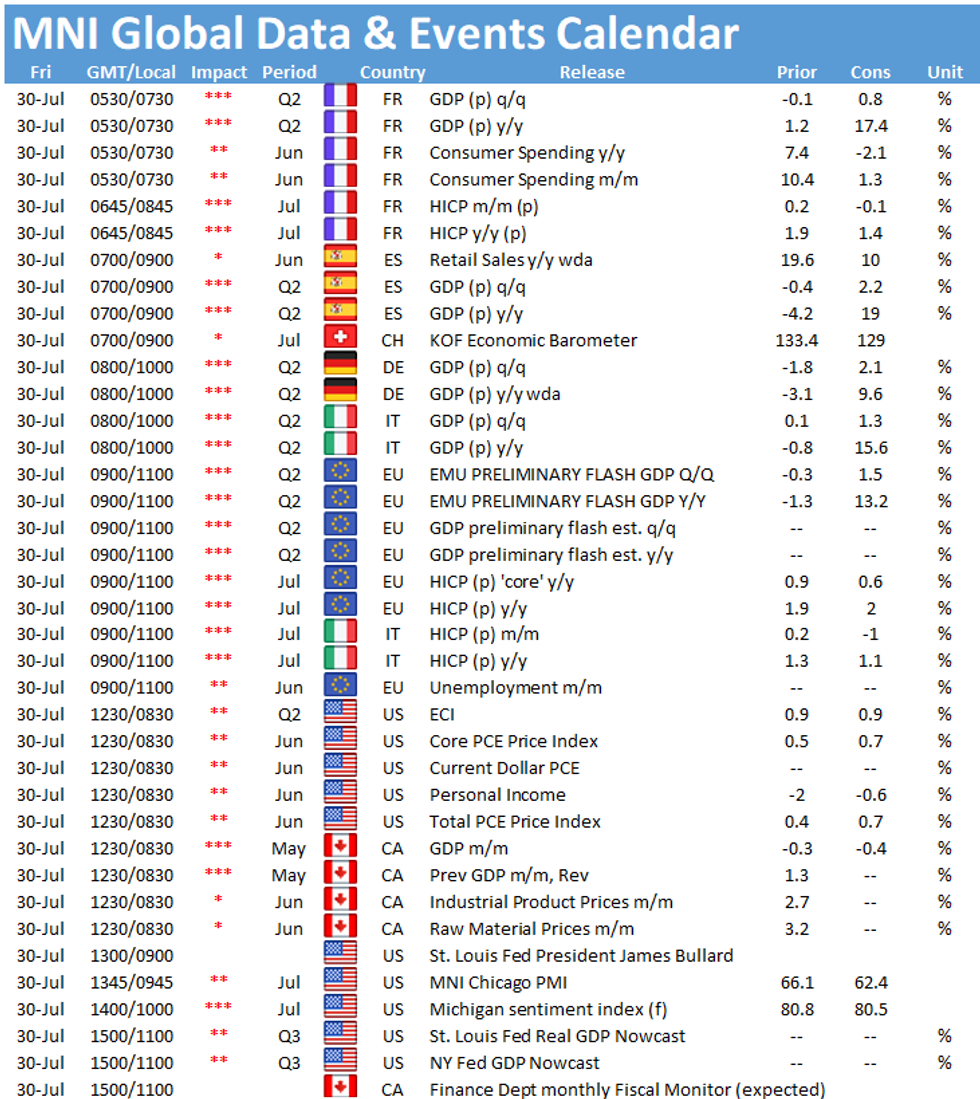

- Tomorrow's data calendar is fairly packed with European flash GDP prints to kick off before the Eurozone CPI flash estimate. The US session will be headlined by US Core PCE price index, with Canadian GDP and the MNI Chicago Business Barometer also on the docket.

FOREX/Expiries for Jul30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650(E1.2bln), $1.1700(E1.2bln), $1.1850-52(E1.6bln), $1.1865-75(E954mln), $1.1900-20(E1.3bln)

- USD/JPY: Y109.00($527mln), Y110.25-40($615mln)

- USD/CAD: C$1.2400($580mln), C$1.2450($615mln), C$1.2500($630mln)

- USD/CNY: Cny6.4650($585mln)

PIPELINE: $6.5B Apple 4Pt Jumbo Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/29 $6.5B #Apple 4pt jumbo: $2.3B 7Y +40, $1B 10Y +47, $1.8B 30Y +77, $1.4B 40Y +92 (adds to $8.5B issued back on May 4, 2020: $2B 3Y +60, $2.25B 5Y +80, $1.75B 10Y +110, $2.5B 30Y +145)

- 07/29 $3B #Humana $1.5B 2NC.5 +50, $750M 5Y +65, $750M 10Y +90

- 07/29 $2.5B Synnex $700M 3NC1 +90, $700M 5Y +110, $600M 7Y +135, $500M 10Y +145

- 07/29 $2B #Blackstone $650M 7Y +65, $850M 10.5Y +85a, 30Y +95a

- 07/29 $500M #New York Life 10Y +58

- 07/29 $500M DR Horton Inc 5Y +65a

EQITIES: Stocks Resume Incline, Hitting New Highs

- Having paused the rally on the Fed rate decision, equity markets resumed their incline Thursday, with both cash and futures markets hitting new all time highs in the process. Financials and materials names were the behind the rally, with communications services names the sole sector in the red across the S&P 500.

- Earnings remain a key driver for prices, with the season so far solidly ahead of expectations. Additionally, gold miners traded well on the rally in spot gold, with Freeport-McMoRan among the strongest performers in the index.

- A similar picture across Europe, with Italian, UK firms leading the gains, while the EuroStoxx50 and France's CAC-40 lagged slightly.

COMMODITIES: Over-Arching USD Weakness Buoys Energy, Metals

- USD weakness extended after Wednesday's Fed decision, helping buoy commodities markets across the board to help energy and metals products into positive territory. This put WTI crude futures above $73/bbl for the first time since Jul 14th.

- This opens next resistance at the Jul 13 high of $74.90 ahead of $76.07.

- Gold inched higher still after the London close, with spot trading above both the 50- and 200-dma resistance levels of 1829.9 and 1821.0 respectively.

- July highs sit just above at 1834.1 and mark the bull trigger. A break and close above here opens 1853.3 Fib level, marks the 61.8% retracement for the Jun 1 - 29 decline.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.