-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: July Minutes Dovish or Less Hawkish?

US TSY SUMMARY: Volatile Post Minutes Trade

Moderately volatile post-July FOMC minutes release, rates and equities both surged off lows, retraced and repeated the see-saw pattern into the close as markets continued to digest the minutes. Differing opinions regarding tapering.- Minutes squarely stated: "Most participants judged that the Committee's standard of "substantial further progress" toward the maximum-employment goal had not yet been met."

- Perhaps the the most dovish passage below suggests participants are more worried about Unemp and Inflation. Also helpful for market is reduced uncertainty over Tsy vs MBS pace:

- Several participants also remained concerned about the medium-term outlook for inflation and the possibility of the reemergence of significant downward pressure on inflation, especially in light of the recent decline in longer-term inflation compensation. In addition, several participants emphasized that there was considerable uncertainty about the likely resolution of the labor market shortages and supply bottlenecks and about the influence of pandemic-related developments on longer-run labor market and inflation dynamics.

- Tsys bounced after $27B 20Y Bond auction (912810TA6) stopped through: drawing a high yield of 1.850% (1.890% last month) vs. 1.855% WI. Bid-to-cover 2.44 vs. 2.33 in July.

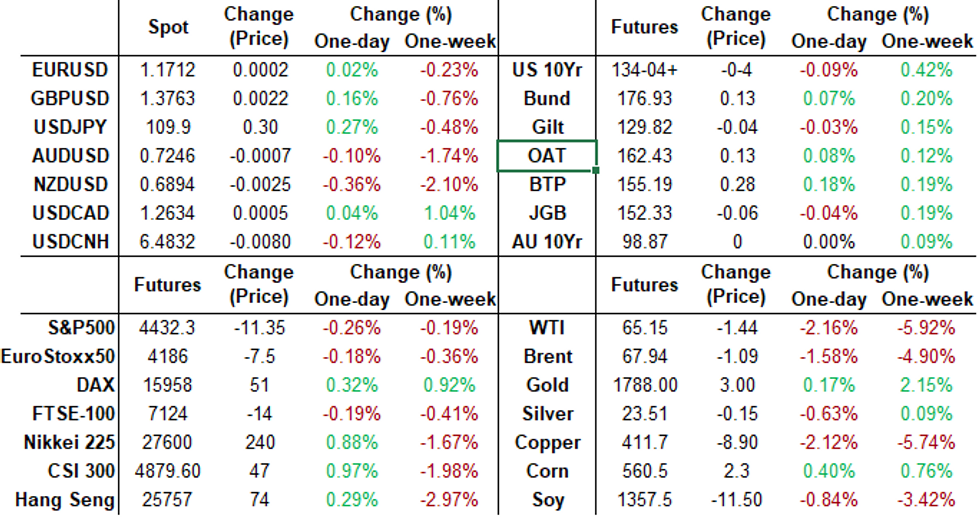

- The 2-Yr yield is up 0.2bps at 0.2155%, 5-Yr is up 0.7bps at 0.7733%, 10-Yr is up 0.8bps at 1.27%, and 30-Yr is down 0.6bps at 1.9127%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00075 at 0.07863% (+0.00100/wk)

- 1 Month +0.00188 to 0.08838% (-0.00438/wk)

- 3 Month +0.00363 to 0.13088% (+0.00663/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00213 to 0.15838% (+0.00175/wk)

- 1 Year -0.00050 to 0.23500% (-0.00375/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08% volume: $250B

- Secured Overnight Financing Rate (SOFR): 0.05%, $905B

- Broad General Collateral Rate (BGCR): 0.05%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $365B

- (rate, volume levels reflect prior session)

- TSY 2.25Y-4.5Y, $8.401B accepted vs. $23.319B submission

- Next scheduled purchases

- Thu 8/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 8/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION, New Record High

NY Fed reverse repo usage climbs to new record high of $1,115.656B from 82 counterparties vs. 1,053.454B on Tuesday. Surpasses prior record of $1,087.342B from Thursday, Aug 12.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +4,000 Green Dec 98.50 puts, 3.0 vs. 98.995/0.12%

- +5,000 short Mar 99.12/99.37 put spds, 6.5 vs. 99.41/0.05%

- -7,000 Sep 99.81/99.87 put spds, 1.0

- 4,000 Red Mar'23 99.50/99.62/99.75/99.87 call condors

- 2,000 short Dec 99.37/99.62 2x1 put spds

- Overnight trade

- +16,000 Green Dec 98.81/99.25 put over risk reversals, 0.5

- +7,500 Green Oct 98.62/98.87 2x1 put spds, 3.0

- +31,000 short Mar 99.12/99.37 put spds, 6.5 (5k Blocked)

- 3,000 short Jan 99.12/Blue Jan 98.00 2x1 put calendar/diagonal

- 10,000 short Sep 99.62 puts

- 3,500 short Sep 99.56/99.62 put spds

- 2,500 short Sep 99.62/99.75 2x1 put spds

- 3,750 Green Dec 98.75

- 30,000 TYU 134/134.5 call spds, 15

- -5,000 TYX 132/135 strangles, 49

- Overnight trade

- Block, +10,000 TYU 135 calls, 7

- 3,700 TYZ 130.5/131.5 put spds vs. TYZ 134 calls

- 2,500 TYU 135.5 calls

EGBs-GILTS CASH CLOSE: Dovish Tone Set By UK CPI Sustained In Afternoon

Bunds and Gilts has a solid session Wednesday. Weaker-than-expected UK July CPI set a bullish tone early for core FI, and with very few headline drivers, morning gains were sustained in the afternoon.

- Periphery spreads mostly compressed, led by Italy; Greece's widened slightly vs Bunds.

- UK CPI was 0.2pp lower than expected in July. Eurozone final CPI was in line with flash.

- Germany held a strong 30-Yr Bund auction (E1bln in supply).

- After hours, the minutes from the July Fed monetary policy meeting will be in focus.

- Thursday's highlights include France selling up to E7bln of MT OATs and E1bln of linkers (Spain's auction has been cancelled), with the Norges Bank decision getting attention as well.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.8bps at -0.744%, 5-Yr is down 0.9bps at -0.738%, 10-Yr is down 1.1bps at -0.482%, and 30-Yr is down 1.3bps at -0.034%.

- UK: The 2-Yr yield is down 0.8bps at 0.141%, 5-Yr is down 0.7bps at 0.292%, 10-Yr is up 0.3bps at 0.565%, and 30-Yr is up 1.8bps at 0.961%.

- Italian BTP spread down 1.1bps at 103.3bps / Spanish unch at 70bps

EGB OPTIONS: All Combos And Spreads

Wednesday's European rates/bonds options flow included:

- RXX1 172.00/170.00 1x2 put spread bought for 13 in 900

- RXZ1 172.00/176.00 combo bought for 13 in 1k (+put, -call)

- 0LZ1 99.625/99.875 call spread bought for 2.75 in 5k (d+15%, ref L Z2 99.49)

- 2LU1 99.375/99.125 1x2 put spread sold at 3.5 in 5k

FOREX: FOMC Minutes Spark Brief Dollar Weakness

- The Greenback had been in favour for the majority of Wednesday with broad dollar indices hugging the highs approaching the July Fed Minutes.

- Initial headlines expressing the broad set of views among Fed participants prompted a sharp dollar sell-off, trading the day's range within minutes and making fresh session lows.

- The move was tempered and partially reversed as further details showed "Most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year".

- EURUSD had previously tested below 1.17 for the first time since late 2020. The sharp greenback turnaround sparked a quick spike in the pair from 1.17 to 1.1742, before paring half the move. The potential false break of 1.1704/06 may be eagerly watched over coming sessions for signs of a reversal indicator.

- NZD remained the laggard following the on-hold decision from the RBNZ, slightly against market consensus. The board cited the most recent national lockdowns but still foresee rate hikes in 2021 in what is being described as a hawkish hold.

- USDCHF and USDJPY held on to 0.25% gains despite equities and the commodity complex remaining in negative territory.

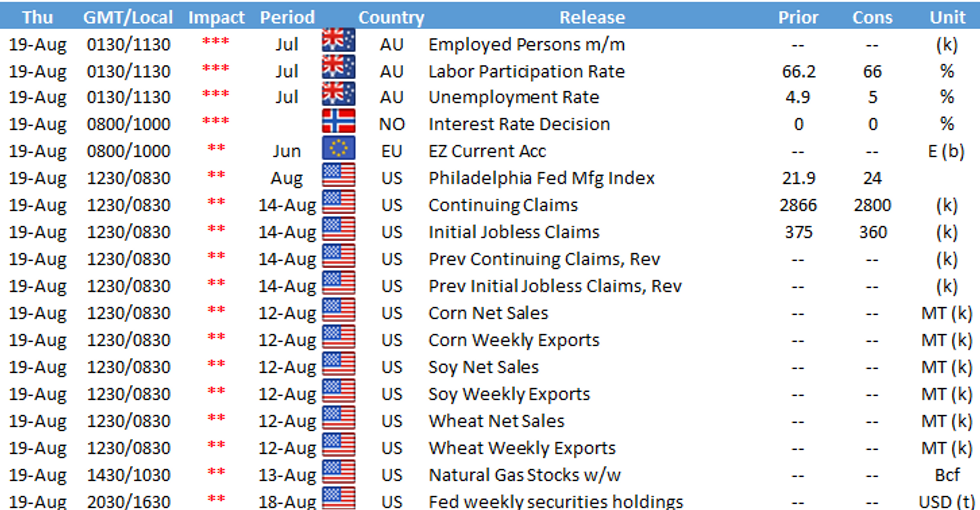

- Overnight, Australia will release their employment data before Thursday's US docket is headlined by Philly Fed Manufacturing Index.

FX/Expiries for Aug19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-10(E610mln), $1.1650(E656mln), $1.1670-90(E2.9bln), $1.1700(E2.3bln), $1.1750(E2.0bln), $1.1780-00(E4.0bln), $1.1850(E1.3bln)

- USD/JPY: Y108.15($500mln), Y108.50-70($612mln), Y109.00-20($1.3bln), Y109.35-50($752mln), Y109.65-80($1.4bln), Y110.00($512mln), Y110.50-60($1.6bln), Y111.50($606mln)

- GBP/USD: $1.3800(Gbp720mln)

- EUR/GBP: Gbp0.8500-20(E691mln)

- AUD/USD: $0.7250(A$2.0bln), $0.7320-35(A$1.3bln), $0.7350-60(A$1.4bln)

- NZD/USD: $0.6800(N$1.4bln)

- USD/CAD: C$1.2575-85($1.6bln)

- USD/CNY: Cny6.4720($750mln)

PIPELINE: $3.6B To Price Wed; ADB Rolled to Thu

Flurry of corporate issuance around the Tsy 20Y Bond auction/stop.

- Date $MM Issuer (Priced *, Launch #)

- 04/18 $1B #Baidu $300M 5.5Y +83, $700M 10Y +113

- 04/18 $1B #HDFC Bank inaugural 5Y 3.7%

- 04/18 $1B #AON Corp $400M 10Y +80, $600M 30Y +100

- 04/18 $600M #Principal Life $300M 3Y +33, $300M 3ZY FRN/SOFR+38

- Rolled to Thursday:

- 04/19 $Benchmark ADB 5Y FRN/SOFR +18a

EQUITIES: S&P Edges Off Highs, But Support Remains Untroubled

- The S&P 500 opened lower and remained in negative territory for much of the US afternoon, keeping the vague risk-off feel present since the Monday open intact. Nonetheless, the pullback in the index has done little to trouble equity bulls, with evidence of stubborn dip-buying still present as markets hold close to recent alltime highs.

- In a minor reversal of the trends present at the beginning of the week, staples and healthcare trade in negative territory, with cyclicals from the consumer discretionary and financials sectors the best performers so far.

- Moving average studies continue to point north, reinforcing current trend conditions. The focus is on 4481.75 next, a Fibonacci projection. Firm support is 4365.25, Aug 3 low.

- The picture was more mixed in Europe, with core French and UK markets declining while German, Spanish and Italian markets made minor gains.

COMMODITIES: Oil Slips on Sizeable Build in Gasoline Inventories

- WTI and Brent crude futures added to recent losses Wednesday, slipping after the weekly DoE crude oil inventories showed a surprisingly large build in gasoline inventories - with stockpiles rising by 696,000 bbls, against an expected draw of over 2.3mln bbls.

- This countered both the crude oil and distillates headlines, which both showed larger draws on inventories than forecast.

- WTI and Brent edged lower by around 1% apiece, with the WTI-Brent spread widening slightly as the latter continues to receive some modest support from instability across the Middle East.

- The greenback added to Tuesday gains, with the USD index hitting the best levels since April - this weighed on precious metals, with both gold and silver slipping into the red.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.