-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Calming Tones of Fed Chair Powell

US TSYS: Calming Tones of Fed Chair Powell, Equities New Highs

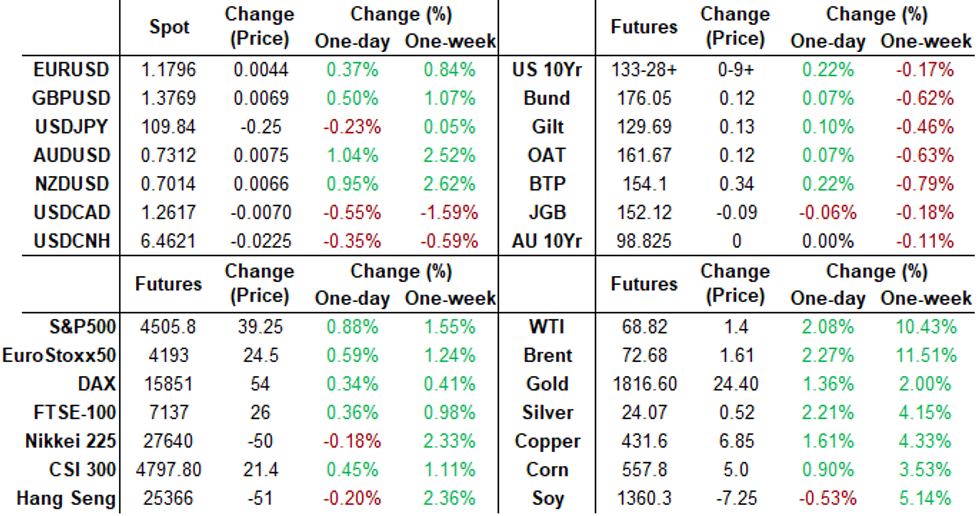

Quiet finish to week and an eagerly awaited session focused on KC Fed's Jackson Hole economic symposium. Hawkish buildup -- six generally hawkish Fed speakers interviewed on CNBC, Bbg prior to the Fed chair speech: Macroeconomic Policy in an Uneven Economy (not to mention KC Fed's George, StL's Bullard and Dallas' Kaplan on Thu).- Rates pared losses/marched higher after Fed Chair Powell's calming/dovish tones: modest pace of tapering, hikes on hold, inflation transitory. Improved risk appetite: S&P eminis made new all-time highs, ESU1 4509.75 +42.75; Gold surged over 25.0, Crude climbed to 69.5 high, while US$ weakened: DXY index -3.98 to 92.664 after the rates close.

- Heavy futures volume: Sep/Dec Tsy rolling nearly complete before Dec takes lead next Tuesday, while Sep option expiry generated decent two-way trade as TYU neared strike with appr 160k open interest.

- Eurodollar futures: over -80,000 EDM2/EDU2 (Jun/Red Sep'22) spds sold at +0.090 to 0.085 last few minutes. Traders note that Reds (EDU2-EDM3) and Greens (EDU3-EDM4) were trading higher pre-Fed chair comments on rate hike positioning -- are scaling back gains with Greens-Blues (EDU3-EDM5) outperforming on unwinds of hike positioning in general. "Market now feels caught" one desk offered.

- The 2-Yr yield is down 2.6bps at 0.2151%, 5-Yr is down 5bps at 0.7995%, 10-Yr is down 3.9bps at 1.3104%, and 30-Yr is down 3.1bps at 1.9154%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00038 at 0.07613% (-0.00125/wk)

- 1 Month +0.00137 to 0.08600% (+0.00012/wk)

- 3 Month -0.00087 to 0.11988% (-0.00850/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00313 to 0.15475% (+0.00213/wk)

- 1 Year -0.00025 to 0.23513% (-0.00150/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $246B

- Secured Overnight Financing Rate (SOFR): 0.05%, $864B

- Broad General Collateral Rate (BGCR): 0.05%, $377B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $350B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $3.845B submission

- Next scheduled purchases

- Mon 8/30 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B

- Tue 8/31 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 9/01 1100-1120ET: Tsy 7Y-10Y, appr $3.225B

- Thu 9/02 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 9/03 no buy operation ahead holiday, resume Tuesday Sep 7

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage climbs to 1,120.015B from 76 counter-parties vs. $1,091.792B on Thursday. Record high of $1,147.089B set Wednesday, Aug 25.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +12,000 Green Oct 98.0/98.62 put spds, 2.0

- +5,000 short Mar 99.12 puts, 4.5

- +3,000 Blue Dec 97.62 puts, 1.0

- +2,000 short Dec 99.37/99.43/99.56 put trees, 1.5 vs. 99.565/0.05%

- earlier buyer Green Mar 98.00/98.25 2x1 put spds, 0.5

- 4,000 Green Sep 99.18 calls, 1.5

- -5,000 TYU 134 straddles

- 10,000 TYV 135.5 calls, 4

- 5,000 TYU 134/134.5 call spds

- 2,500 TYV 135 calls, 6

- 2,500 USV 166 calls, 29

US TSY OPTIONS: Sep Quarterly Expiration Update: Pin Risk for 5s and 10s Climbs

September options expire today, latest open interest below.

- Pin risk changes slightly with underlying futures climbing. Paper selling TYU 134 straddles as underlying nears strike w/appr 165,000 open interest. Sep 5Y pin risk also climbs as underlying trades around the 124 strike.

- Options 0.5 tic ITM (0.25 tic for 5-, 2-yr opt's) are auto-exercised.

| Expiry | Calls | Puts | Total | Nearest ATM Strike (Totals) |

| Sep 30Y | 230,686 | 329,114 | 559,800 | 164.00 (15,289C, 20,700P) |

| 164.50 (6,689C, 3,295P) | ||||

| 165.00 (17,066C, 7,903P) | ||||

| Sep 10Y | 856,118 | 1,372,439 | 2,228,557 | 133.75 (20,300C, 28,858P) |

| 134.00 (100,670C, 64,404P) | ||||

| 134.25 (28,722C, 19,364P) | ||||

| Sep 5Y | 270,860 | 538,012 | 808,872 | 123.75 (11,213C, 33,783P) |

| 124.00 (31,600C, 43,174P) | ||||

| 124.25 (42,697C, 32,567P) | ||||

| Sep 2Y | 1,141 | 982 | 2,123 | 110.12 (0C, 2P) |

| 110.25 (0C, 7P) |

EGB/Gilt: Drifting higher after Powell, back to domestic next week

EGBs and gilts waited patiently for Fed's Powell to speak, moving little through the European morning and early US session before drifting higher.

- Bund futures hit their low of the day just ahead of Powell's speech (175.66 - the lowest in over a month) but at the time of writing had recovered to a high of 176.10 (close to yesterday's low of 176.14) and are now trading around 176.00.

- Gilt futures moved to a high of 129.74, above yesterday's high but a long way from Wednesday's high above 130.

- With equities generally moving higher post-Powell, Eurozone spreads have generally tightened on the day, led by 10-year BTP spreads coming in 2.2bp and Portuguese 10-year spreads 1.3bp. The exception in peripheral space was Greek spreads which have widened 0.5bp, continuing yesterday's widening.

- With Powell's speech out of the way, and with the caveat of geopolitical risk lingering with Afghan events, European markets can go back to focusing on more domestic events. Supply is due to pick up next week after the summer lull while the ECB meets the following week and markets are already looking ahead to 6-months time when PEPP is scheduled to end and what that means for the APP and markets more generally.

- Gilt futures are up 0.13 today at 128.66 with 10y yields down -2.3bp at 0.577% and 2y yields down -2.6bp at 0.113%.

- Bund futures are up 0.02 today at 175.95 with 10y Bund yields down -1.7bp at -0.425% and Schatz yields down -0.4bp at -0.748%.

- BTP futures are up 0.42 today at 154.18 with 10y yields down -3.8bp at 0.631% and 2y yields down -1.4bp at -0.501%.

- OAT futures are up 0.05 today at 161.60 with 10y yields down -1.7bp at -0.70% and 2y yields up 0.2bp at -0.719%.

FOREX

US$ weakened after Fed Chair Powell comments today from remote Jackson Hole eco-summit event: modest pace of tapering, hikes on hold, inflation transitory. DXY index -3.98 to 92.664 after the rates close.- USDJPY still trades in a range. Despite recent gains, the pair appears vulnerable and attention remains on the key support at 108.72, Aug 4 low. A breach of this level would strengthen a bearish case and expose the 108.47 Fibonacci retracement. For bulls, key near-term resistance is unchanged at 110.80, Aug 11 high. A break would ease bearish concerns and instead open key resistance at 111.66, Jul 2 high.

EQUITIES: Moving higher post-Powell

- Japan's NIKKEI down 101.15 pts or -0.36% at 27641.14 and the TOPIX down 6.58 pts or -0.34% at 1928.77

- China's SHANGHAI closed up 20.493 pts or +0.59% at 3522.157 and the HANG SENG ended 7.8 pts lower or -0.03% at 25407.89

- German Dax up 58.13 pts or +0.37% at 15851.75, FTSE 100 up 23.03 pts or +0.32% at 7148.01, CAC 40 up 15.89 pts or +0.24% at 6681.92 and Euro Stoxx 50 up 21.11 pts or +0.51% at 4190.98.

- Dow Jones mini up 215 pts or +0.61% at 35375, S&P 500 mini up 36 pts or +0.81% at 4502.75, NASDAQ mini up 132.5 pts or +0.87% at 15407.5.

COMMODITIES: Metals Firm Following Powell's Testimony, Platinum Momentum Shifts

- Gold, platinum & iron ore are among the many commodities that have caught a bid on the back of comments from Powell that have been broadly interpreted by the markets as dovish – with his comments aligning with a more gradual taper and no rush to hike rates.

- This precipitated a sharp appreciation in both commodities and EM FX: Gold has bumped up +0.85%, platinum +2.64% & iron ore +6.35%

- Platinum has been struggling in recent months to break out of its recent downtrend, shedding -21% from its May 2021 high at $1,281/Oz.

- Prices, however, have stabilised just below $1,000/Oz, with momentum showing positive divergence on the RSI and pointing to a potential near-term reversal higher

- While the bear channel pattern remains intact, a move through $1,035/Oz would likely confirm a break of the trend and reinforce more bullish conditions.

- Miners also expect platinum to remain in a supply deficit for the next 5 years amid higher demand from the green revolution.

- WTI Crude up $1.29 or +1.91% at $68.71

- Natural Gas up $0.19 or +4.45% at $4.37

- Gold spot up $25.13 or +1.4% at $1817.61

- Copper up $7.05 or +1.66% at $433

- Silver up $0.48 or +2.03% at $24.0434

- Platinum up $32.19 or +3.28% at $1013.72

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.