-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:CPI Underscores Nov Taper Announcement

US TSYS: Market Creates Own Green Light For Rate Hike

- Carry-over strength in 30Y long-Bonds continued Wednesday, yield curves extending flattener move back to Sep'21 levels not seen since July 2020. Busy session w/ CPI early, Sep FOMC minutes late.

- Higher than expected CPI (+0.4 vs. 0.3% est; unrounded % M/M: headline 0.412%, core: 0.243%) underscored rate hike ests more/sooner than later: two 25bps hikes by late 2022 as long as economy continues to improve -- then perhaps faster.

- Sep FOMC Minutes, Taper Annc in Nov, Finish Mid-2022: Tsy futures holding narrow range after Sep FOMC minutes release, Bonds near highs, yield curves near lows. Not much of a reaction to what's been assumed since the policy meeting: Taper annc at Nov meet, ending around mid-2022 as long as economy continues apace. Link to Fed for full minutes: SEP FOMC

- Massive Red Dec'22 Eurodollar futures volume running over 845,000 ahead of the Sep FOMC minutes release. Front end remained under pressure but off lows as market continued to price in appr two rate hikes by end of 2022 following pick-up in CPI. Additional flow, some option accts faded flattening via conditional steepeners, outright steepener unwinds, short set/hedging today's 30Y auction having little effect. Strong 30Y Bond sale/re-open tailed: 2.049% yld vs. 2.062% WI.

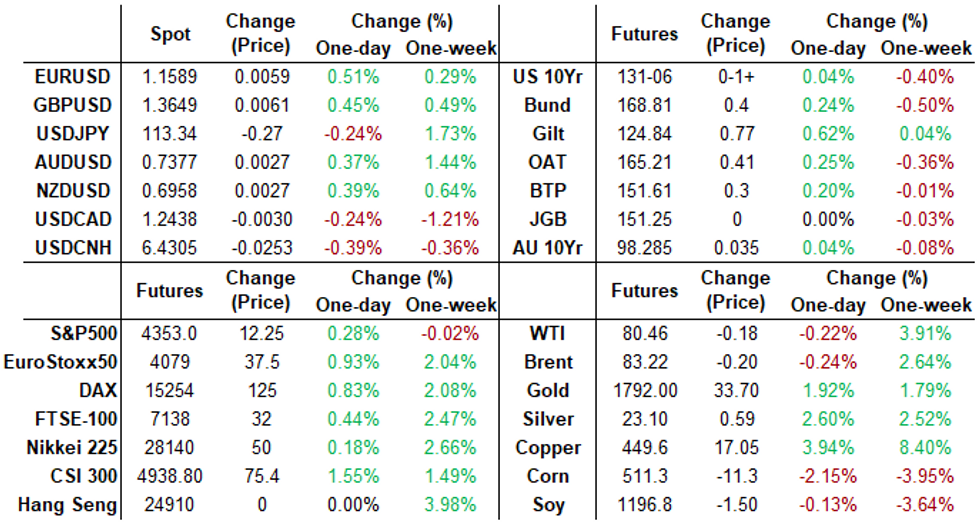

- The 2-Yr yield is up 2.8bps at 0.366%, 5-Yr is up 1.8bps at 1.0891%, 10-Yr is down 2.4bps at 1.5525%, and 30-Yr is down 5bps at 2.0456%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00037 at 0.07363% (+0.00100/wk)

- 1 Month +0.00237 to 0.09025% (+0.00662/wk)

- 3 Month -0.00300 to 0.12375% (+0.00262/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00038 to 0.15675% (+0.00025/wk)

- 1 Year +0.00437 to 0.26575% (+0.01875/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $76B

- Daily Overnight Bank Funding Rate: 0.07% volume: $275B

- Secured Overnight Financing Rate (SOFR): 0.05%, $925B

- Broad General Collateral Rate (BGCR): 0.05%, $369B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $347B

- (rate, volume levels reflect prior session)

- Tsys 4.5Y-7Y, $5.999B accepted vs. $12.392B submission

- Next scheduled purchase

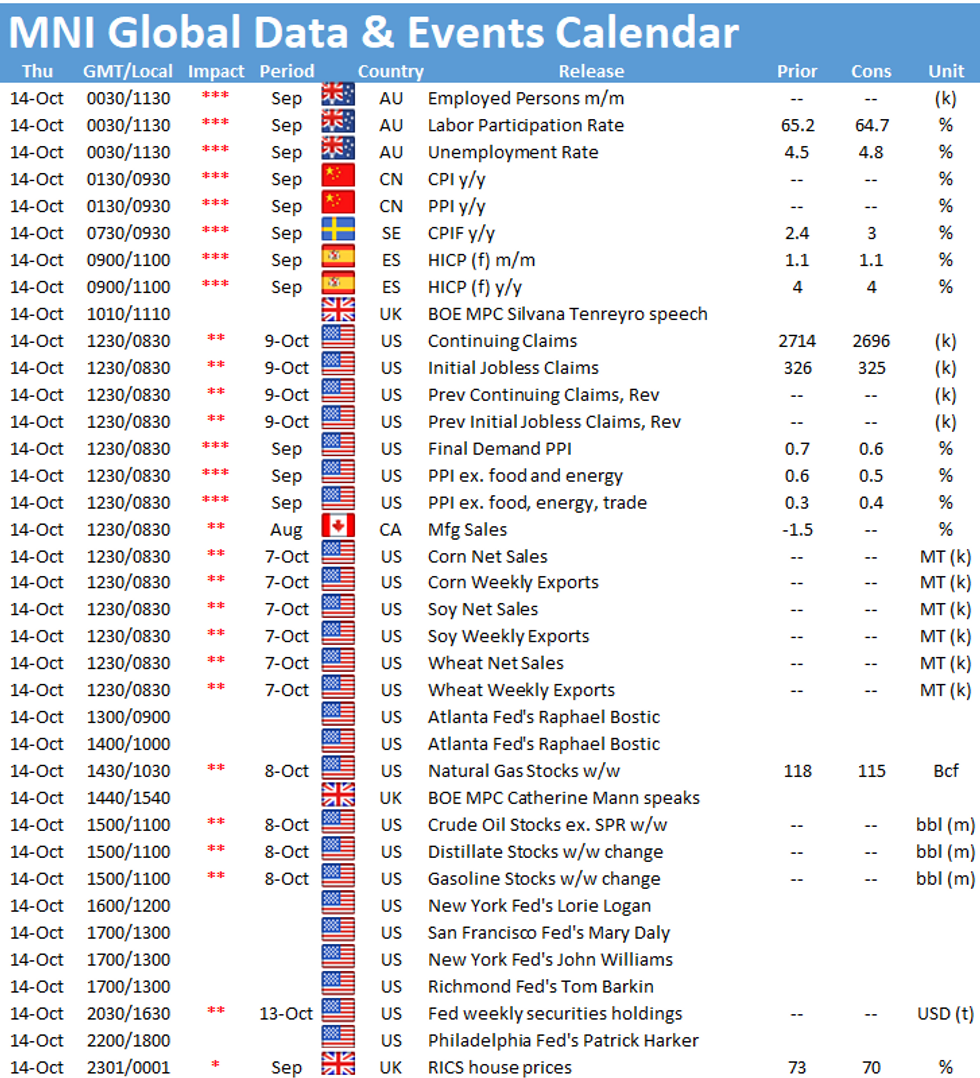

- Thu 10/14 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Thu 10/14 1500ET: Update NY Fed Operational Purchase Schedule

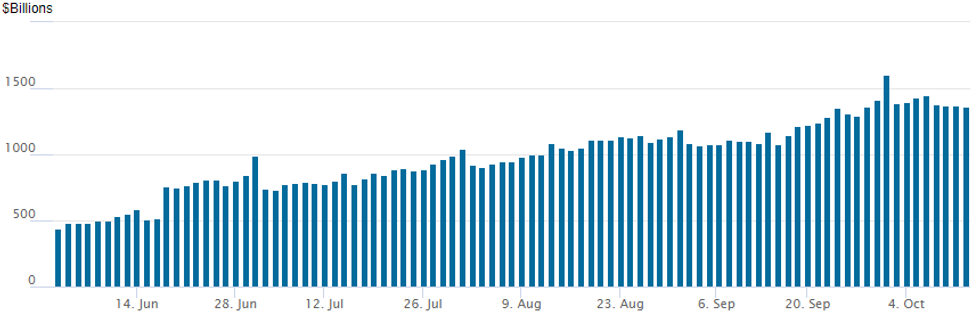

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $1,364.701B from 78 counterparties vs. $1.367.051B on Tuesday. Record high remains at $1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -70,000 short Dec 99.25 puts, 3.0

- Update, total -35,000 short Mar 99.00 puts, 6.0 vs. 99.22/0.28%

- Block, 13,325 Green Mar 98.25/98.75 put spds, 20.0 vs. 98.57/0.36%

- Block, -10,000 short Dec 99.50 puts, 14.0 vs. 99.38/0.80%

- Block, 25,930 short Jun 99.62 calls, 1.5 vs. 99.035/0.07%

- +5,000 Green Dec 99.25/Blue Dec 99.00 call spds, even net on conditional curve steepener

- +5,000 Red Dec 99.75/99.87 call spds, 1.0

- +2,500 long Green Dec 99.37 straddles, 33.5

- +2,500 short Nov 99.12/99.25 put spds, 1.5 vs. 99.33/0.08%

- +4,000 short Oct 99.25/99.37/99.50 put flys, 9.0

- +5,000 Jun 99.50 puts, 2.5

- +9,000 Green Dec 99.25 calls, 1.25

- Overnight trade

- 5,000 short Dec 99.25/99.50 put spds

- 7,800 Blue Oct 98.12/98.37 put spds

- 1,000 Blue Dec 98.00/98.12/98.25/98.50 put condor

- -1,500 TYZ 126.5/134 strangles, 4

- Overnight trade

- 18,000 TYX 130/130.5 put spds, 5

- 12,000 wk3 TY 130.5/131 put spds, 8

- 4,000 USV 151 puts

- 2,000 TYZ 130/132 risk reversal, 4 net/call over

EGBs-GILTS CASH CLOSE: UK Long End Sees Biggest Rally Since March 2020

Gilts bull flattened with a massive rally in the 30Y segment Wednesday, with Bunds and periphery EGBs also gaining but unable to keep up with their UK counterparts.

- 30Y UK yields fell by more than 17bp at one point (to 1.275%), the biggest drop since March 2020, before bouncing an hour before the cash close, still ending over 10bps lower.

- Long-maturity global FI saw little reaction to a stronger-than-expected US inflation print, preferring to fade the recent sell-off (including for Gilts vs Bunds, which had previously traded at 5-year wides).

- And as the 2-Yr yield rise in the UK illustrates, rising rate hike expectations are contributing to overall flattening in global curves.

- Greek GGBs underperformed, 10Y spreads 3.2bp wider on the session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.7bps at -0.669%, 5-Yr is down 1.4bps at -0.479%, 10-Yr is down 4.1bps at -0.127%, and 30-Yr is down 7.7bps at 0.299%.

- UK: The 2-Yr yield is up 1.3bps at 0.576%, 5-Yr is down 1.4bps at 0.763%, 10-Yr is down 5.9bps at 1.089%, and 30-Yr is down 10.5bps at 1.343%.

- Italian BTP spread up 1.9bps at 103.1bps / Greek up 3.2bps at 105.6bps

EGB Options: Several Put Spread Sellers

Wednesday's European rates/bonds options flow included:

- RXX1 169.50 put, sold at 85 and 84 in 10k (ref 168.86)

- RXX1 169/167.5 put spread sold at 34/33 in 10k

- RXX1 167 put bought for 4 in 10k

- ERU3 100.00/99.75ps, sold at 4 in 5k (likely taking profit)

- 2RH2 100.50c, bought for half in 3.25k

- 0LZ1 99.50/99.37 put spread, sold at 12 in 20k

- 3LZ1 99.00/98.50ps 1x1.5 sold at 16 in 5k

FOREX: CPI Argues in Favour of Fed Action

- September CPI data came in at the top-end of analyst expectations, with Y/Y CPI rising to 5.4%, the joint highest rate since 2008. The release was initially met with a wave of USD buying, putting most major pairs under pressure. This pattern reversed into the London close however as the US curve flattened considerably thanks to outperformance in longer-end bonds. This undermined the greenback into the close, putting the USD at the bottom of the G10 pile.

- Scandi currencies were the outperformers, with persistent strength in energy prices buoying the NOK while markets pre-positioned for the Swedish CPI release on tomorrow.

- Earnings season continues Thursday after the disappointing start from JP Morgan, with names including Morgan Stanley, Citigroup, Bank of America and Wells Fargo on the docket for Thursday.

- Australian jobs data is expected to show a a loss of 110k jobs over September, while more inflation data from China and the US is scheduled. Central bank speakers include BoE's Tenreyro, Fed's Bullard and Bostic as well as ECB's Knot.

FOREX: Expiries for Oct14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1485-00(E691mln), $1.1550-65(E904mln), $1.1600(E1.4bln), $1.1700-20(E999mln)

- EUR/GBP: Gbp0.8510-25(E1.2bln)

- USD/JPY: Y113.00($835mln), Y113.75-90($700mln)

- USD/CAD: C$1.2495($520mln), C$1.2550-60($578mln)

- USD/CNY: Cny6.4500($1.3bln)

PIPELINE: $3B KFW Priced Earlier, Manitoba Expected Thursday

- Date $MM Issuer (Priced *, Launch #

- 10/13 $3B *KFW WNG 5Y Green +19

- 10/13 $1.9B *Development Bank of Japan (DBJ) $900M 5Y +14, $1B 10Y +25

- 10/13 $1B Sonic 8NC3, 10NC5 roadshow

- Expected Thursday:

- 10/14 $Benchmark Province of Manitoba 7Y global +21a

EQUITIES: Soft Start to Earnings, With Banks Offered

- Wall Street struggled to gain traction in either direction Wednesday, with early progress hampered by earnings and the higher-than-expected US CPI reading.

- JPMorgan's Q3 release marked the unofficial beginning of the quarterly earnings cycle and headline metrics came in ahead of expectations. Nonetheless, shares suffered from the open as the release showed gross profits data was buoyed largely by a sizeable reserves release across the three-month period, artificially inflating topline metrics.

- As a result, the banking and financials sector traded broadly lower, with mark-downs of 2% or more among the likes of JP Morgan, Wells Fargo and Bank of America.

- Across Europe, performance was more favourable, with the EuroStoxx50 adding 0.7% at the close, alongside similar gains for the CAC-40 and DAX.

COMMODITIES: White House, BoJ Latest to Sound Alarm Over High Energy Costs

- WTI and Brent crude futures trade off recent highs, but in price action more reminiscent of consolidation and profit-taking rather than any sea change in sentiment as both oil contracts remain in a bullish trend.

- Monday's gains confirmed an extension of the current bullish price sequence of higher highs and higher lows, reinforcing the uptrend. Note that the $80.00 psychological hurdle has also been cleared. The focus is on $82.89, a Fibonacci projection.

- Concerns among global policy markets over the current high price of oil and energy continues to be reflected in headline newsflow, with an MNI report showing the Bank of Japan's concerns over both high energy prices and high import costs as working against corporate profits. This sentiment was reflected in Reuters reports citing sources as saying the White House is conversing with US oil and gas producers on how the industry can help bring down prices.

- Further evidence of the global shortage of energy supplies arise just after the London close, as the Moldovan Deputy PM formally issued a state of emergency in the domestic energy sector thanks to the natural gas shortage in the country.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.