-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Bond Bid Resumes

US TSYS: Bond Bid Resumes As Yld Curves Fall To April 2020 Lvls

Back to last week's theme: Tsy 30Y Bonds outperformed Monday, near late session highs after the bell (30YY 2.0076 low) that lent to broad yld curve flattening with 5s30s back to late April 2020 levels.- After some position unwinds in Tsys last Friday as equities climbed to new October highs, support for Bonds returned even as equities made new highs for October: ESZ1 4478.0.

- Trading desks report better selling in 5s-10s from real$ and bank portfolios, tactical steepener unwinds, deal-tied selling as corporate and supra-sovereign issuance picked up. Note, Goldman Sachs issued $9B over 5 tranches Monday, while the Peoples Rep of China held investor calls over multi-tranche sr bond issuance ($4B est over 3-, 5-, 10- and 30Y bonds) later this week.

- Little react to data: Sep industrial production -1.3%; capacity utilization 75.2%, Aug IP revised -0.1%.

- Heavy option volumes continued to focus on downside put buying as rate hike expectations for late 2022 gained momentum.

- Notable headlines: re-appointment odds for Fed chairman Powell fell to as low as 43% on PredictIt in the last couple of hours - triggered by The American Prospect publishing a piece titled "Jerome Powell Sold More Than a Million Dollars of Stock as the Market Was Tanking".

- After the bell, 2-Yr yield is up 2.2bps at 0.4173%, 5-Yr is up 3.5bps at 1.1601%, 10-Yr is up 1.2bps at 1.5826%, and 30-Yr is down 2.6bps at 2.0153%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00100 at 0.07213% (-0.00150 total last wk)

- 1 Month +0.00525 to 0.08563% (-0.00325 total last wk)

- 3 Month +0.00787 to 0.13150% (+0.00250 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00575 to 0.16625% (+0.00400 total last wk)

- 1 Year +0.02250 to 0.30213% (+0.03263 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07% volume: $266B

- Secured Overnight Financing Rate (SOFR): 0.05%, $889B

- Broad General Collateral Rate (BGCR): 0.05%, $374B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $351B

- (rate, volume levels reflect prior session)

- Tsys 22.5Y-30Y, $1.999B accepted vs. $4.042B submission

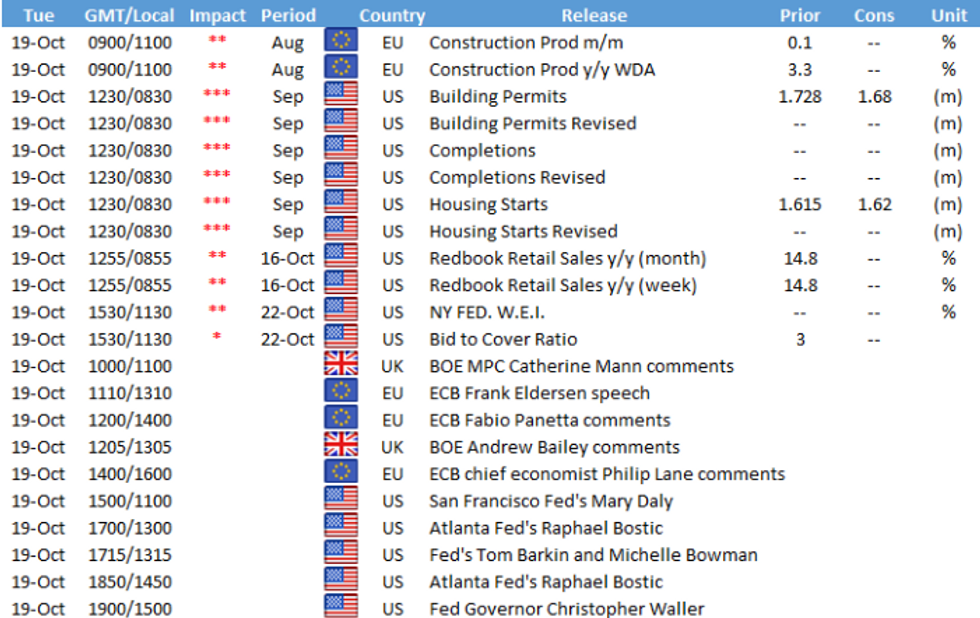

- Next scheduled purchases, note Tuesday's double operation

- Tue 10/19 1010-1030ET: 2.25Y-4.5Y, appr $8.425B

- Tue 10/19 1100-1120ET: TIPS 1Y-7.5Y, appr $2.025B

- Wed 10/20 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

- Thu 10/21 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 10/22 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

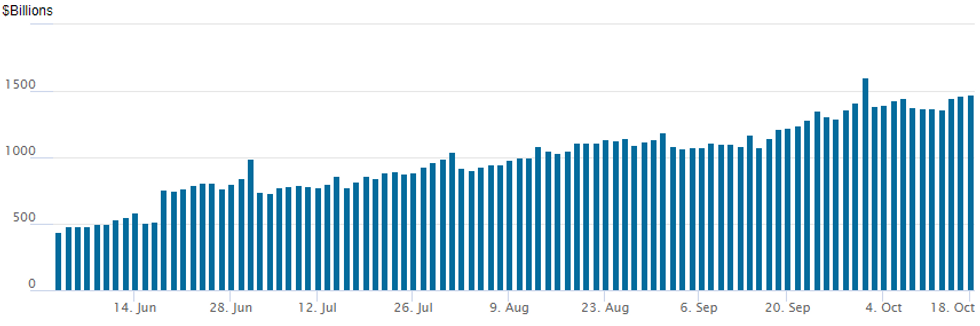

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,477.114B from 79 counterparties vs. $1,462.297B on Friday. Record high remains at $1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, 11,269 Blue Dec 98.37 puts, 20.5

- +50,000 short Mar 98.00 puts, 1.5

- -10,000 short Dec 99.37 calls, 5.0

- +5,000 Blue Dec 98.75 calls, 1.5

- Block, 12,500 short Dec 99.12/99.37 put spds, 10.0

- Block, 5,000 Red Dec'22 98.50/99.25 5x4 put spds, 56.0 net vs. 99.24

- 25,000 short Dec 99.00/99.12/99.31

- Overnight trade

- -50,000 short Dec 99.12/99.25 put spds, 4.5

- +39,000 short Dec 98.87/99.12 put spds, 4.5 vs. 99.22/0.22%

- +20,000 short Nov 98.93/99.12 put spds, 4.0 vs. 99.185/0.19%

- +25,000 Green Dec 98.62/98.75 put spds, 8.0 vs. 98.57/0.05%

- +15,000 short Dec 99.25/99.31 put spds, 2.5

- 6,000 Blue Dec 98.00/98.37 2x1 put spds

- Block, 5,300 Green Dec 98.25/98.50 put spds, 7.5 vs. 98.535

- 4,000 Green Dec 98.50/98.81 2x1 put spds

- 3,000 Green Dec 97.87/98.12 2x1 put spds

- 1,600 Blue Dec 97.75/98.00 2x1 put spds

- +10,000 short Dec 99.31/99.43/99.56 call flys, 3.0

- 5,000 short Nov 99.25 puts

- 2,500 short Dec 99.62/99.68 call spds

- 5,000 Gold Dec 98.00/98.12 put spds

- -10,000 TYZ 129/130 put spds, 18

- 10,000 TYZ 129.5/130.5 2x1 put spds, 3 net 2-legs over

- Overnight trade

- 20,000 TYZ 130 puts, 40 adds to +20k Blocks late Sunday

- 9,100 TYZ 127.5 puts, 6

- Blocks, total 20,000 TYZ 130 puts, 30-33

- 10,000 FVX 121.5 puts, 5.5

EGBs-GILTS CASH CLOSE: Bailey Comments Hammer UK Short End

The UK short end was the centre of global attention Monday, with 2Y yields rising by the most in over a decade following BoE Gov Bailey's weekend comments that were seen signaling a more aggressive rate hike path than had been priced.

- While this pulled global yields higher, 2Y Gilts were in the spotlight, rising nearly 17bp at one point to above pre-pandemic levels. While the move looks somewhat overdone, with at least some of the selling in short-end futures looking like the forced variety,

- Bunds outperformed Gilts across the curve, with some significant flattening in both curves as the 30Y segment outperformed globally.

- Meanwhile, periphery spreads widened (led by Greece) amid weaker equities.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5bps at -0.627%, 5-Yr is up 5.4bps at -0.461%, 10-Yr is up 1.9bps at -0.148%, and 30-Yr is down 4.4bps at 0.237%.

- UK: The 2-Yr yield is up 14.2bps at 0.723%, 5-Yr is up 7.4bps at 0.843%, 10-Yr is up 3bps at 1.136%, and 30-Yr is down 0.4bps at 1.373%.

- Italian BTP spread up 1.2bps at 104.8bps / Greek spread up 3.9bps at 112.3bps

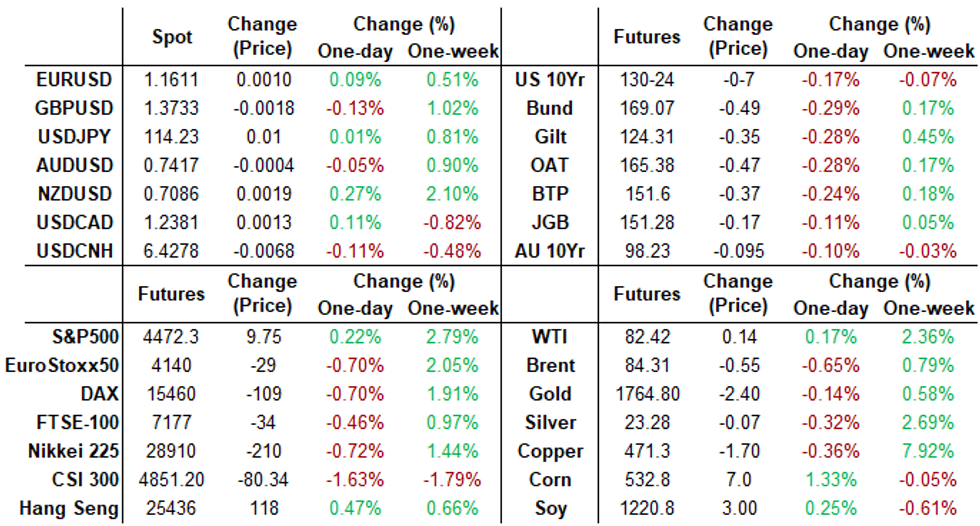

FOREX: Greenback Unchanged Amid Narrow G10 Ranges, EURSEK Back Above 10.00

- Throughout the US session, the dollar index slowly edged lower into negative territory, paring earlier gains from the open, as US treasury yields also retreated from their peak.

- G10 ranges remained confined with little news or data to move the dial on Monday.

- The underlying dollar weakness in the latter half of the day did prompt a small pop higher in EURUSD back above the 1.16 handle. The next immediate level of note resides at 1.1624 (last week's high) before 1.1640, high Oct 4. A break is required to signal scope for a stronger recovery however, short-term gains would be considered corrective with a broader bearish trend condition still intact.

- USDJPY price action has been fairly muted and rangebound, however levels of significance may be building at the boundaries of the short-term range as the pair consolidates close to recent highs.

- Notably several separate hourly highs have printed above 114.40, matching closely with the October 2018 highs at 114.55. More meaningful attention remains on a vol band resistance at 114.83.

- Of note, EURSEK gained 0.7% to start the week, representing the largest move seen in G10 FX to start the week. After breaching 10.00 for the first time since February 2018 to the downside last week, the inability to close below the psychological mark may have prompted some short covering.

- NZDUSD remains top of the G10 pile following a firm CPI reading seen shortly after the Wellington open.

- Australia Monetary Policy Meeting Minutes are scheduled for overnight. Bank of England's Bailey will make remarks at an online conference on climate change before a slew of Fed speakers highlight the US session on Tuesday.

FX: Expiries for Oct19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1550-65(E1.0bln), $1.1600-15(E1.0bln)

- USD/JPY: Y113.50-70($718mln), Y113.80-00($520mln)

- GBP/USD: $1.3685-00(Gbp871mln), $1.3740-55(Gbp646mln)

- AUD/USD: $0.7350(A$661mln)

- USD/CAD: C$1.2550-70($701mln)

PIPELINE: $9B Goldman Sachs 5Pt Launched

- Date $MM Issuer (Priced *, Launch #

- 10/18 $9B #Goldman Sachs 5pt: $2B 3NC2 +50, $450M 3NC2 FRN/SOFR+499, $3.25B 6NC5 +78, $300M 6NC5 FRN/SOFR+92, $3B 11NC10 +105

- 10/18 $2B #Micron $1B +10Y +112, $500M 20Y +137, $500M 30Y +147

- 10/18 $1.5B #Korea Development Bank (KDB) $700M 3.25Y Green +15, $500M 5.5Y +30, $300M 10Y +45

- 10/18 $1.2B #ASB Bank $700M 5Y +55, $500M 10Y +90

- 10/18 $1B NRW Bank (German Fed State North Rhine-Westphalia) 3Y +19

- 10/18 $Benchmark National Rural Utilities 3Y +45a, 3Y FRN/SOFR, 5Y +60a

- 10/18 $Benchmark Lukoil +5Y, 10Y investor calls

- 10/18 $Benchmark Peoples Rep of China multi-tranche sr bonds investor call ($4B est over 3-, 5-, 10- and 30Y bonds)

- 10/19 Kommunalbanken 5TY SOFR +24a

- 10/19 $Benchmark PSP Capital 7Y +19a

- 10/19 $Benchmark CAF (Corporacion Andina de Fomento) 3Y SOFR +73a

EQUITIES: Mixed Monday, But Outlook Turning More Positive

- The S&P 500 looked to secure a fourth consecutive session of gains. The cash index broke back above the 50-dma to touch the best levels since mid-September, shifting the outlook more positive in the near-term.

- Consumer discretionary and energy names led the way higher on Wall Street, while healthcare and utilities were the laggards. This underpins the risk-on theme, helping the e-mini S&P with the set-up toward resistance at the Sep 9 high of 4519.75 and the bull trigger and the all-time high posted in early September at 4539.50.

- Elsewhere, equity markets across Europe were broadly negative, with the EuroStoxx50 lower by 0.6% while the CAC-40 dropped 0.8%.

- The Q3 earnings continues Tuesday, with focus turning to reports from BNY Mellon, Johnson & Johnson, Netflix and Proctor & Gamble. Full schedule with expectations and timings here: https://marketnews.com/mni-us-earnings-schedule-focus-shifts-to-healthcare-as-reports-pick-up

COMMODITIES: Strong Start Finishes Mixed, But Cycle of Higher Highs Extends

- WTI and Brent crude futures settled lower into the Monday close, however both contracts managed another session of higher highs, keeping the bull cycle in tact for now. WTI crude futures printed another multi-month high at $83.87/bbl, the highest level since late 2014.

- Concerns over a supply crunch in winter remains the focus for energy markets,with a spokesperson for the German economy ministry today saying Germany's gas reserves have dropped to 70% of capacity from 75% previously -underlining the pressures that many European countries could face in the coming months.

- The Russian energy minister Novak stated that the country was ready to meet the requirements of increased supply, but no European Union nation has been forthcoming with any request for extra gas.

- Concerns of a tight European gas market contrasts with that in the US, with NatGas futures off over 4% Monday the latest weather forecasts allay concerns over heating demand. The Commodity Weather Group forecast a milder-than-expected beginning to winter, lasting through to November 1st.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.