-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Curves Bull Flatten Ahead CPI, Claims

US TSYS: Rate Curves Bull Flatten Ahead CPI, Weekly Claims

Session started off with a strong risk on bid that carried through the close, yield curves bull flattening after trading steeper during Asia hours overnight. Some desks sited rising odds of Fed gov Brainard replacing Chairman Powell after "interview" w/ Pres Biden late last wk.

- Contributing to early Curve Flattening: Dealer desks reported central bank selling in 5s, carry-over foreign real$ buying in 10s and decent leveraged$ buying in 30s (30YY falls to 1.7940% low). Light deal-tied selling/rate locks and pre-auction short sets ahead second leg of wk's Tsy supply: $39B 10Y notes.

- Tsy futures slip off highs after $39B 10Y note auction (91282CDJ7) tailed:1.444% high yield vs. 1.430% WI; 2.35x bid-to-cover well below five auction avg: 2.56x. Indirect take-up remains high at 71.01% vs. 71.05% last two auctions; direct bidder take-up falls to 13.80% vs. 17.74% last month while primary dealer take-up bounces to 15.19% vs.1 1.21%.

- Large deferred Eurodollar spd/Block: -20,000 Green Dec'23 at 98.625 (+0.045) vs. +20,000 Gold Dec'25 at 98.34 (+0.080) at 0854:55ET -- positioning for a shorter/shallower rate hike cycle ending by late 2023.

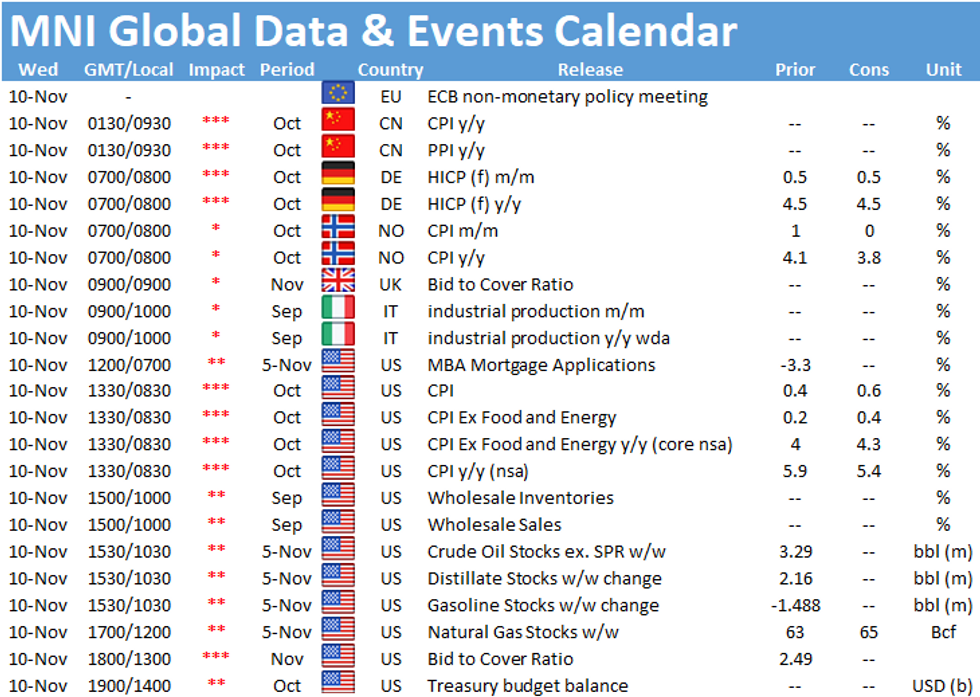

- Wednesday data: CPI and weekly claims a day early due to Thursday Veterans Day holiday closure.

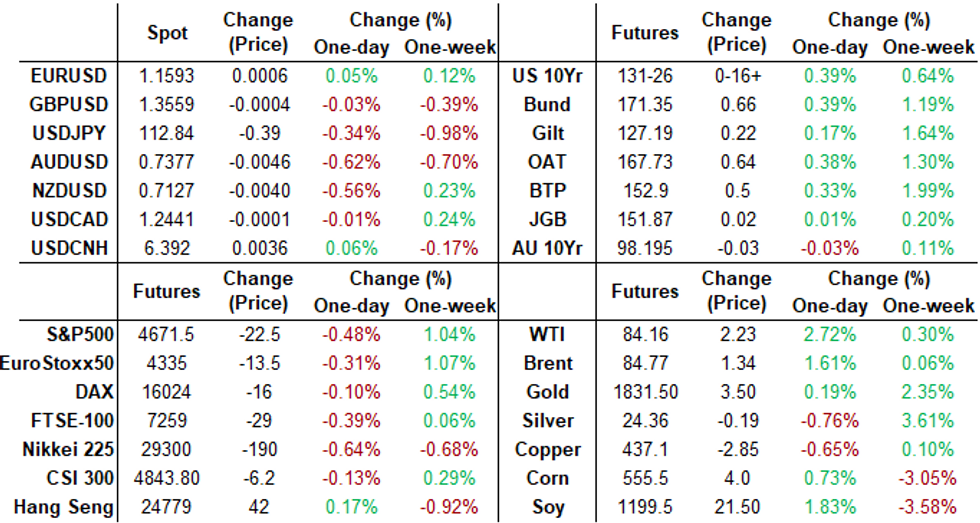

- The 2-Yr yield is down 3.4bps at 0.4088%, 5-Yr is down 4.7bps at 1.07%, 10-Yr is down 5.9bps at 1.4306%, and 30-Yr is down 6.4bps at 1.8172%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00588 at 0.07088% (-0.00175/wk)

- 1 Month -0.00188 to 0.08925% (+0.00062/wk)

- 3 Month +0.00387 to 0.14950% (+0.00675/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00387 to 0.21513% (-0.00575/wk)

- 1 Year -0.00313 to 0.34975% (-0.00775/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $76B

- Daily Overnight Bank Funding Rate: 0.07% volume: $285B

- Secured Overnight Financing Rate (SOFR): 0.05%, $907B

- Broad General Collateral Rate (BGCR): 0.05%, $357B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $332B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.199B accepted vs. $1.779B submission

- Next scheduled purchases

- Wed 11/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

- Thu 11/11 Veterans Day holiday, no purchase operation

- Fri 11/12 1500ET: Update NY Fed Operational Purchase Schedule

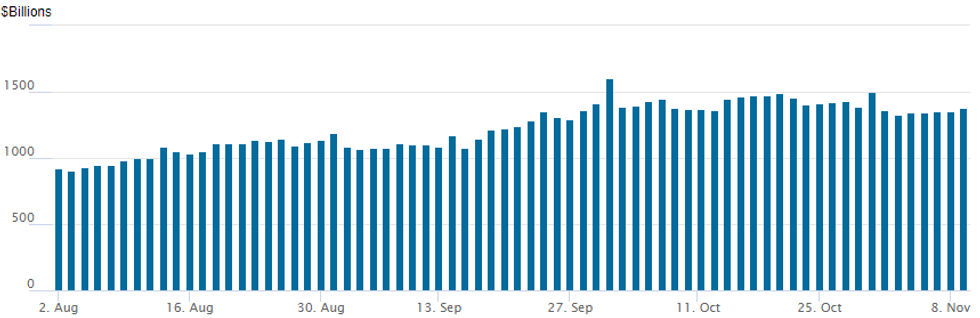

FED Reverse Repo Operation

NY Federal Reserve

NY Fed reverse repo usage climbs higher: $1,377.197B from 76 counterparties vs. $1,354.382B on Monday. Record high remains at $1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- -10,000 Dec 99.81/99.87/99.93 call trees, 1.75

- +20,000 Green Dec99.00 calls, 2.0 vs. 98.62-.64/0.08%

- +10,000 Jun 99.37/99.50 put spds, 2.25 vs. 99.645 ref

- +5,000 short Dec 99.06/99.25 2x1 put spds 1.0 over 99.50 calls

- 5,000 short Dec 99.06/99.18/99.31 put flys

- 10,000 short Nov 99.06/99.125/99.25 put flys, 2.5

- +10,000 Blue Mar 97.87/98.12/98.37 put flys, 3.75 legs

- -15,000 short Dec 99.12 puts, 5.5 vs. 99.235/0./0.34%

- Overnight trade

- +15,000 short Dec 99.37 calls, 4.0 vs. 99.235/0.24%

- +5,000 Green Dec 98.25/98.37/98.50 put flys, 1.5 vs. 98.61/0.05%

- +2,000 short Dec 98.93/99.06/99.18 put flys, 1.5 vs. 99.265/0.05%

- Put strip/spd package: (15.5 DB 2EZ and 3EZ bought over)

- -7,500 short Dec 99.12/99.37 put strip vs. 99.23 vs.

- +5,000 Green Dec 98.25/98.37 put strip vs. 98.595 w/

- +5,000 Blue Dec 98.00/98.12/98.25 put strip vs. 99.37

- 5,000 TYZ 134.5 calls, 2

- 3,600 FVZ 123.25 calls, 2.5

- -5,000 TYF 129/132.5 strangles, 32

- +3,000 TYZ 133.5/134.5 1x2 call spds, 0.0

- 3,000 FVZ 121/121.25/121.5/121.75 put condors

- Overnight trade

- +7,000 TYH 128.5 puts, 32-31

- 4,000 wk1 TY 132.75 calls, 3

- Block, -5,000 FVZ 122.5 calls, 13 another -5k on screen at 11.5

- +3,000 FVZ 121.5 puts, 4.5

- +5,000 FVZ 121/121.5 2x1 put spds, 1.5

EGBs-GILTS CASH CLOSE: Long-End Yields Lurch Lower

Long-end UK and German yields dropped sharply Tuesday, led this time by a near-11bp drop in 30Y Germany. Periphery EGB spreads widened slightly, with Greece underperforming.

- The session saw decent gains in the morning, with few apparent catalysts (the Europe move appeared largely US Tsy led), and volumes fairly limited.

- Gains in core FI extended in mid-afternoon as equities fell sharply on the US stock market open, led by a drop in Tesla's share price.

- Once again, a limited data slate (German ZEW was mixed, but had little impact).

- The UK, Germany, and Portugal hold auctions Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2bps at -0.742%, 5-Yr is down 3bps at -0.586%, 10-Yr is down 5.5bps at -0.298%, and 30-Yr is down 10.8bps at 0.007%.

- UK: The 2-Yr yield is up 3.5bps at 0.452%, 5-Yr is up 2.8bps at 0.597%, 10-Yr is down 3.2bps at 0.824%, and 30-Yr is down 7.7bps at 0.927%.

- Italian BTP spread up 0.2bps at 113.9bps / Greek up 3.5bps at 138bps

EGB Options: Downside Euribor Structures

Tuesday's bond / rates options flow included:

- OEZ1 135.00/134.50ps 1x2, bought for 5.5 in 4k

- DUZ1 112.20/112.30/112.40c ladder, sold at 5 in 3.25k

- 2RH2 99.87/99.75ps vs 100.37c, bought the ps for half in 6k

- 2RH2 99.875/99.625/99.375 put fly bought in 4k vs 2RH2 100.37c, sold in 2k,paid 1 for the package

FOREX: Cross/JPY Suffers As Equity Indices Turn Lower

- The Japanese Yen was in favour on Tuesday as benchmark US indices fell roughly 0.5% on Tuesday ahead of US CPI data tomorrow.

- USDJPY will likely complete a fourth consecutive negative trading session, slipping through the 113 support for the first time in four weeks. Despite primary trend conditions remaining bullish, a sustained break of this support zone would signal scope for a deeper pullback and open 112.08, Sep 30 high.

- With sentiment in equity markets slightly on the backfoot, AUD and NZD came under pressure, exacerbating the moves lower in AUDJPY and NZDJPY to close to 1%.

- Following a similar haven supportive theme, the Swiss Franc also gained roughly 0.3%. Overnight, EURCHF matched the Monday high of 1.0598 before consistent selling dragged the pair back to 1.0550 and within close range of the recent lows at 1.0534.

- The move is worth noting, given recent commentary has been focusing on the key 1.0505 level. This has been garnering increased attention among market participants with the level providing crucial support following the onset of the pandemic in early 2020.

- Broad dollar indices remained steady ahead of tomorrows US data, emphasised by EURUSD trading blows either side of the 1.16 handle throughout the session.

- Potential comments later this evening from BOC Governor Tiff Macklem, before China CPI and PPI data overnight. US Consumer Price data headlines the Wednesday US docket.

FX: Expiries for Nov10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1400(E641mln), $1.1495-00(E1.2bln), $1.1550-55(E1.1bln), $1.1565-75(E2.1bln), $1.1595-00(E1.2bln)

- USD/JPY: Y111.40-55($1.1bln), Y111.80-85($501mln), Y112.20-30($643mln), Y113.00($810mln), Y113.65-85($992mln), Y114.00($1.3bln)

- GBP/USD: $1.3400(Gbp784mln), $1.3550(Gbp787mln), $1.3595-00(Gbp628mln)

- EUR/GBP: Gbp.0.8490-00(E587mln)

- AUD/USD: $0.7340-50(A$866mln), $0.7375(A$635mln)

- USD/CAD: C$1.2450-55($1bln), C$1.2500($1bln)

- USD/CNY: Cny6.4000($820mln), Cny6.5000($1.1bln)

EQUITIES: Tesla Dip Puts Equities on Backfoot

- Wall Street traded lower Tuesday, with headline indices dipping around 0.5%, led lower by a sharp pullback in Tesla shares, which dropped as much as 10%. The automaker slipped sharply within 10 minutes of the cash open, the largest intraday decline in 8 months.

- Weakness came alongside large selling in Tesla share blocks at the market open, giving way to large S&P emini futures selling volumes.

- Tesla's drop prompted automakers and consumer discretionary to lead declines in the S&P 500, with financials and tech not far behind. The moves follow the weekend's news that Tesla CEO Musk said he'd sell a 10% stake in the company after a Twitter poll on the subject.

- European markets gave up an early lead, with the UK's FTSE-100 leading declines, slipping 0.4% into the close.

COMMODITIES: Crude Rally Continues As US Mulls SPR Facility

- WTI and Brent crude futures made solid gains Tuesday, extending the recent recovery and narrowing in on both the $84/bbl handle as well as early November highs of $84.88/bbl.

- Markets remain on watch for a statement from the White House as the energy secretary earlier in the week flagged possible action from Biden on high gas and fuel prices. Deputy Energy Sec Turk spoke this morning, flagging that oil price forecasts will be a factor in any decision the Strategic Petroleum Reserve, which currently holds a capacity of around 620mln bbls.

- However, broad action using the SPR was made more difficult as the EIA forecast a pullback in prices headed into December, while also projecting a rise in oil stocks early next year, against an expected draw at the prior month's report.

- Gold and silver are more rangebound, with precious metals oscillating either side of unchanged. Gold reversed course late last week following the bounce off Wednesday's low of $1759.0.

- The turnaround reinstates a potential bullish outlook and the yellow metal has traded above $1813.8, Oct 22 high. The breach of this level strengthens a short-term bullish case and signals scope for a climb towards $1834.0, the Sep 3 high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.