-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI ASIA MARKETS ANALYSIS: Weaker Tsys Ahead Final FOMC for 2021

US TSYS: Pre-FOMC Pressure in Rates, Accelerated Taper Expected

Tsys finish weaker -- near the middle of the month's range on light volume (TYH2<950 after the bell) in the lead up to the final FOMC policy annc for 2021 on Wednesday. FOMC expected to shift in a hawkish direction at the December meeting as it eyes rising inflation risks.- This shift will include a doubling of the pace of the asset purchase taper, a more aggressive rate “dot plot”, and an adjustment in the Statement language (including eliminating the word “transitory” to describe inflation).

- FOMC signaling more than 2 hikes in 2022, or a hiking pace faster than 3 hikes per year, would be hawkish vs expectations.

- Early session: post-PPI react, Tsys pared losses: Already bouncing off lows ahead the release, Tsy futures extended the bounce even after Nov PPI +0.8% vs. +0.5 est, equities traded weaker in mild risk-off/risk-on unwind start to the session.

- Delayed sell-off, Tsys eventually receded: PPI's further evidence of underlying inflationary pressures, it does little to change market expectations for Wed's FOMC

- The 2-Yr yield is up 2.8bps at 0.6608%, 5-Yr is up 3.1bps at 1.2353%, 10-Yr is up 2.2bps at 1.4377%, and 30-Yr is up 1.9bps at 1.8186%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00850 at 0.06863% (-0.00363/wk)

- 1 Month -0.00225 to 0.10750% (-0.00113/wk)

- 3 Month +0.00813 to 0.21088% (+0.01263/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00400 to 0.29113% (+0.00288/wk)

- 1 Year -0.00712 to 0.49788% (-0.01150/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $250B

- Secured Overnight Financing Rate (SOFR): 0.05%, $936B

- Broad General Collateral Rate (BGCR): 0.05%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $341B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $9.301B accepted vs. $31.951B submission

- Next schedule purchases:

- Thu 12/16 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B vs. $1.425B prior

- Thu 12/16 1100-1120ET: TIPS 1Y-7.5Y, appr $1.525B vs. $1.775B prior

- Fri 12/17 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B vs. $1.600B prior

- Note, while the size of buy-operations in 10-30Y actually increased slightly to account for the drop in number of operations from 4 to 3, combined purchases still reduced.

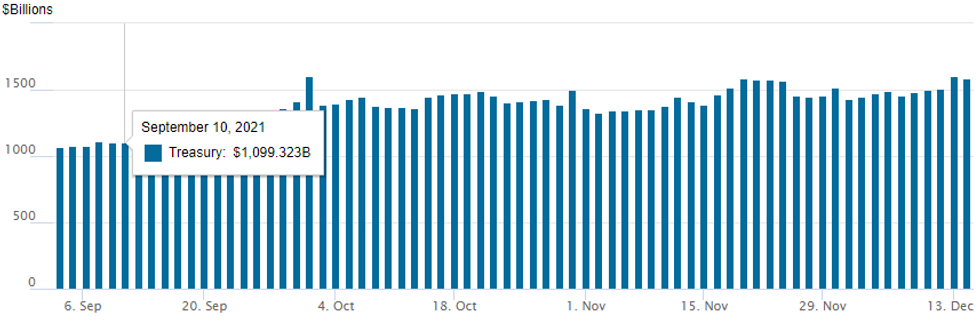

FED Reverse Repo Operation

NY Federal Reserve/MNI

After Monday's surge to second highest usage on record, NY Fed reverse repo usage recedes slightly to $1,584.488B from 79 counterparties vs. $1,599.768B on Monday. Record high still 1,604.881B from Thursday, September 30.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- +5,000 Blue Jun 97.62/97.87 put spds, 5.0

- +6,000 Green Jan 97.87/98.00/98.12 put flys, 1.5 vs. 98.30/0.05%

- Block, +10,466 Mar 99.37/99.56 put spds, 2.0

- Update, +65,000 short Mar 99.37/99.62 call spds, 2.0

- +5,000 Blue Mar 97.62/97.87 put spds, 3.25

- buyer Green Feb 98.00/98.25 2x1 put spds, 2.5

- +8,000 Mar 99.81/99.87 call spds, 0.75

- +5,000 Green Jun 98.00/98.25 put spds 1.0-0.75 over 98.50/98.75 call spds

- Overnight trade

- Blocks/screen 55,000 short Mar 99.37/99.62 call spds, 2.0

- >+30,000 TYF 128.5/129 put spds, 1-2 (includes o/n)

- 5,300 TYG 132.5/133.5 call spds

- 2,000 USG 155/158 put spds, 21

- 10,000 FVG 119.75/120.25 2x1 put spds, 0.0

- Overnight trade

- +15,000 TYF 128.5/129 put spds, 1

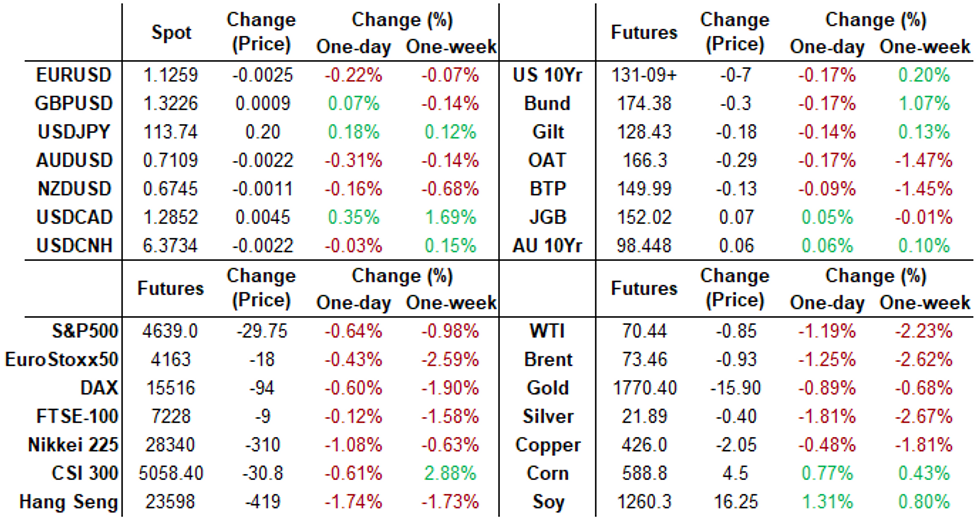

FOREX: Greenback Completes V Shape Intra-Day Recovery

- Broad risk-off in equity and commodity markets filtered through into a stronger US dollar on Tuesday, after the greenback had been under initial pressure to start the trading day.

- Lows of the 96.10 in the dollar index were short-lived as Omicron fears sapped risk optimism in global markets and prompted a flight to quality in G10 FX. The DXY rallied to the best levels of the week and the index currently hovers just below the December highs of 96.59.

- EURUSD moved in line with the broader dollar, continuing to pivot off the 1.13 mark and currently pressing recent lows around 1.1260. The recent consolidation appears to be a triangle formation. This is a continuation pattern and reinforces the current bear trend. The bear trigger is 1.1186/85. Clearance of this support would resume the trend and open 1.1128, a Fibonacci projection.

- With risk under pressure, the usual suspects AUD(-0.3%), CAD(-0.3%) an NZD(-0.15%) have all drifted lower, albeit in fairly narrow ranges.

- The risk-off tone may struggle to build too much momentum as markets turn their focus to the upcoming slew of major central bank decisions over the next 48 hours, including the FOMC and the ECB.

- Higher US yields and lower equities have weighed on emerging market currencies, with the JPMorgan Emerging market currency index currently down 0.65%. Ongoing troubles for Turkey saw the Lira plunge another 4% and in LatAm, the Mexican peso fell over 1% back to 21.20.

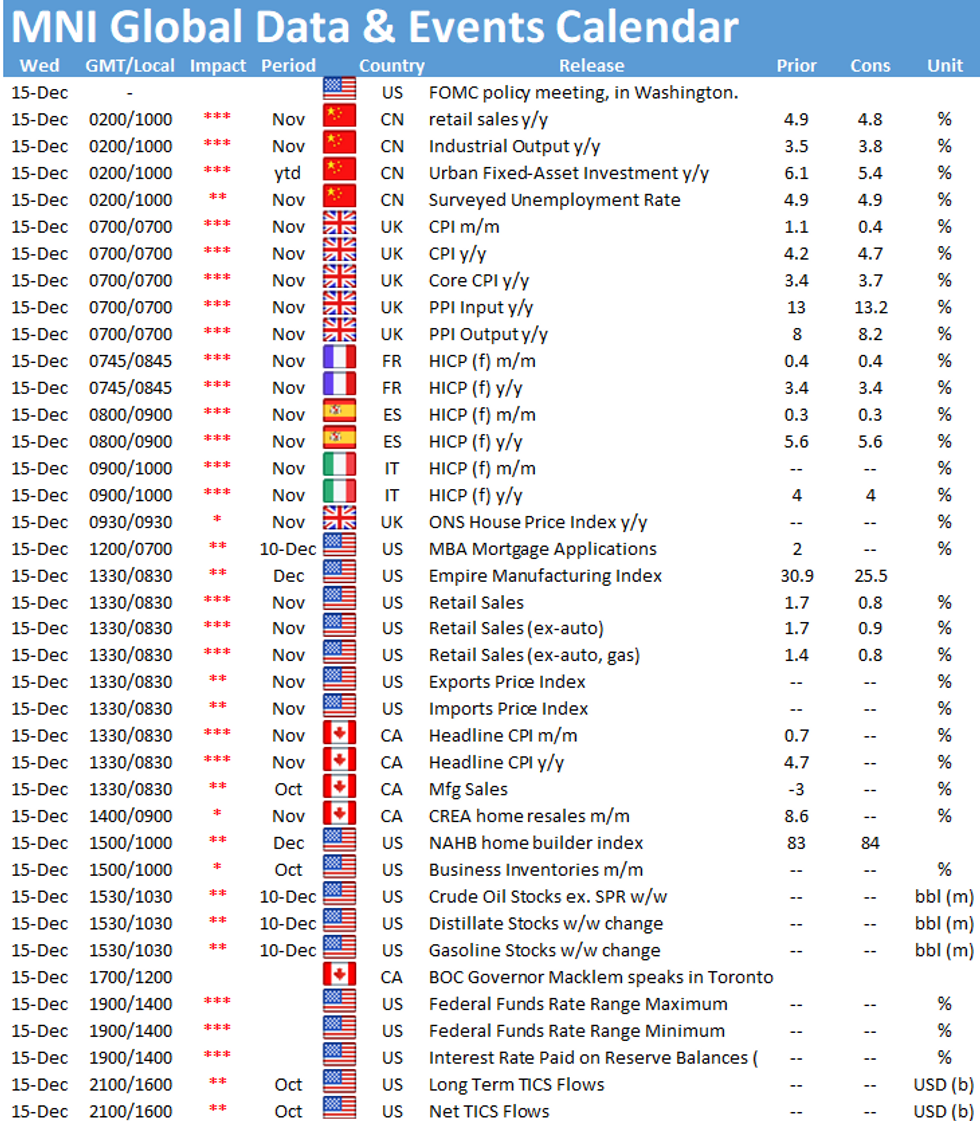

- Despite the build up to the Fed, we have a busy data schedule with Chinese retail sales overnight and US retail sales headlining the early US docket. Additionally, CPI data from both the UK and Canada will be published. The FOMC decision/statement takes place at 1400ET/1900GMT.

FX: Expiries for Dec15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1200-15(E1.0bln), $1.1300(E670mln), $1.1350(E529mln), $1.1400(E2.2bln)

- USD/JPY: Y112.95-05($1.1bln), Y113.75-80($1.5bln), Y113.90-05($1.1bln), Y114.20($1.1bln)

- GBP/USD: $1.3235-50(Gbp705mln)

- EUR/GBP: Gbp0.8575-80(E811mln)

- AUD/USD: $0.7275(A$544mln)

EQUITIES: Stocks Sit Lower In Final Session Pre-Fed

- Wall Street traded uniformly lower Tuesday, with the S&P500 shedding over 1% and the tech-led NASDAQ underperforming most notably. Sentiment was shaky from the off, with a South African omicron study showing the Pfizer jab's effectiveness waned considerably in the face of the new omicron strain relative to previous variants.

- Tech names including Adobe, Microsoft and Salesforce fell most sharply, with a downgrade from JPMorgan analysts largely responsible alongside a PPI release that came in considerably higher than expected. This put factory gate price rises at their highest level on record for the index, nearing 10% Y/Y.

- Financials fared much better, with banks enjoying an uptick in the US yield curve, flattering lending margins and driving the likes of Bank of America, JPMorgan and Citigroup higher by 1% against a falling index.

COMMODITIES: Oil Slides With Broader Risk-Off Sentiment

- Oil futures are down 2% today in a broader risk-off environment, breaking through its recent range from the past week or so. Declines have been across the curve.

- Russia’s Sorokin says OPEC+ still plans its next meeting on Jan 4 and not earlier, pushing back on headlines from Saudi yesterday that the December meeting is “truly not suspended”.

- Separately, Biden is said to not be considering reinstating the crude oil export ban.

- WTI is -1.9% at $69.9, close to the first support level of $69.52 (Dec 7 low) after which the next support is materially lower at $65.6 (Dec 3 low). Resistance is up at $74.4, the 50-day EMA.

- Brent is -1.9% at $73.0, through first support of $73.2 (Dec 7 low) with the next support at $69.24 (Dec 3 low).

- DOE inventories tomorrow plus USD risk from the Fed at 1400ET/1900ET.

- Gold is down -0.7% at $1774, at the low end of the recent range and exposing the base of the bull channel of $1767.2 drawn off the Aug 9 low.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.