-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI ASIA MARKETS ANALYSIS: Russia/Ukraine Tension Simmering

US TSYS: Cautious Markets Ahead Long Weekend, Russia/Ukraine Tension High

Long weekend ahead: US markets closed for Presidents Day holiday Monday, while US officials are on high alert over Russia positioning for attack on Ukraine.

On/off risk action (more the latter through the US Session) continued Friday.

- After falling more than 2% Thu, SPX eminis bounced early overnight on reports US Sec of State Blinken will meet w/ Russian foreign minister Lavrov next week (providing Ukraine isn't invaded) in ongoing attempts to find diplomatic solution to tensions. Reports separatists in Donetsk, East Ukraine evacuating some 700k women and children to Russia, report of car bomb in city center, Denials, reprisals and threats of sanctions -- saw equities fall through technical support.

- Tsy futures rallied, curves bull flattened after steepening Thu, 30YY fell to 2.2363% low. Late Friday: 2-Yr yield is up 0.8bps at 1.4737%, 5-Yr is down 1.4bps at 1.8255%, 10-Yr is down 3.3bps at 1.9286%, and 30-Yr is down 4.6bps at 2.2486%.

- March Pricing Trimmed Further On Williams: Fed Funds pricing for Mar 16 has fallen from 34bp to 31bp after NY Fed’s Williams said he doesn’t see a compelling argument for a big first rate increase, another voice to lean towards a 25bp hike. In turn, lead quarterly Eurodollar futures climbed to 99.37 high after tapping 99.3375 on large -20k EDH2 sale Block at 99.34.

- Decent futures volumes as Mar/Jun rolling picked up, March Tsy option expiration a contributing factor.

- On market return Tuesday: housing data, Markit PMIs, flurry of Tsy auctions, NY Fed buy-op on tap.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00072 at 0.07557% (-0.00286/wk)

- 1 Month +0.00900 to 0.17071% (-0.02043/wk)

- 3 Month -0.00143 to 0.47957% (-0.02686/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00772 to 0.78129% (-0.05914/wk)

- 1 Year -0.00300 to 1.28586% (-0.10643/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07% volume: $249B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $911B

- Broad General Collateral Rate (BGCR): 0.05%, $346B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $340B

- (rate, volume levels reflect prior session)

NY Fed Purchase Operation: The Desk plans to purchase approximately $20 billion, ending Thu, March 9.

- Next scheduled purchases:

- Tue 02/22 1010-1030ET: TIPS 1Y-7.5Y, appr $1.025B vs. $2.025B prior

- Thu 02/24 1010-1030ET: Tsy 0Y-22.5Y, appr $6.225B steady

- Tue 03/01 1100-1120ET: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior

- Thu 03/03 1100-1120ET: Tsy 7Y-10Y, appr $1.625B vs. $3.225 prior

- Tue 03/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 03/09 1010-1030ET: Tsy 2.25Y-4.5Y, appr $4.025B

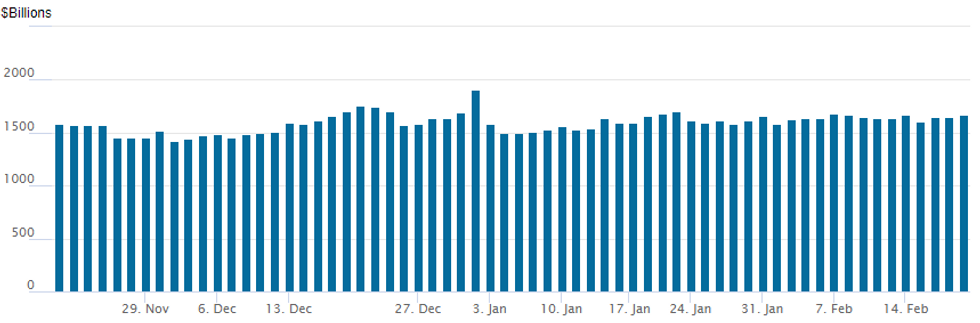

FED Reverse Repo Opration

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,674.929B w/ 79 counterparties vs. $1,647.202B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, 12,000 short Sep 97.25/97.75 put spds, 16.5 vs. 97.795/0.20%

- Block, 20,000 Dec 97.75/98.12 put spds, 12.5

- +10,000 Jun 98.81/98.93/99.00/99.18 broken call condors, 1.5

- +5,000 Mar 99.37/99.43 put spds, 4.0

- -2,500 Dec 98.25/98.50/98.75 iron flys, 21.25/leg

- buyer 99.31/99.50/99.56 call flys, 1

- Overnight trade

- +5,000 short Mar 82 calls, 3

- Block, 2,000 short Mar 97.50/97.62 4x3 put spds, 3.0 net ref: 97.955

- +9,000 TYJ 127.5 calls, 37

- -10,000 TYJ 125.5 puts, 32

- +5,000 TYJ 126.5 straddles 154-155

- -15,000 TYJ 125 puts, 22 total volume just over 22k, ref 126-19

- 3,675 TUJ 104 puts ref 107-14

- 3,000 TYJ 129.5 calls, 8

- 2,000 TYJ 131 calls, 4

- -20,000 TYH 127 calls, cab-7 adds to overnight trade

- 4,000 FVK 115.25 puts

- Overnight trade

- -7,500 TYH 127 calls, from 3 to cab-7

- 1,500 FVH 118 straddles, 11.5

- +3,000 FVJ 118.5/119 call spds, 6.5 vs. 117-31.25/0.10%

EGBs-GILTS CASH CLOSE: Geopolitics Keep Safe Havens Bid

The safe haven bid was alive and well going into the European weekend, with Ukraine-Russia flashpoints underpinning Bunds and Gilts.

- Unlike Thursday though, periphery EGBs failed to keep pace, with BTPs underperforming amid renewed spread widening.

- Once again, the drop in UK short-end yields was steady throughout the session, with the curve modestly flattening; Bobl outperformed in Germany.

- After the cash close, headlines broke that the ECB would hold an "informal" meeting in Paris on Feb 24. Bund futures hit the highest level since Feb 4 though ticked higher rather than a sharp move as the implications were unclear.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.9bps at -0.478%, 5-Yr is down 5.6bps at -0.073%, 10-Yr is down 3.9bps at 0.192%, and 30-Yr is down 3.2bps at 0.471%.

- UK: The 2-Yr yield is down 7bps at 1.265%, 5-Yr is down 7.3bps at 1.281%, 10-Yr is down 8.5bps at 1.378%, and 30-Yr is down 8bps at 1.466%.

- Italian BTP spread up 4.3bps at 164.7bps / Spanish up 2.5bps at 101.1bps

EGB Options: Mostly Downside To Finish The Week

Friday's Europe rate / bond options flow included:

- RXJ2 151p, , bought for 3.5 in 3.75k

- OEJ2 130.5/129.5ps 1x1.5, bought for 14.5 in 5k

- ERU2 100.25c, bought for 12 in 10k

- ERZ2 99.75/50ps bought for 5.5 in 5k (ref 99.995, 12 del)

- ERZ2 100.50/100.625cs 1x2,sold at 0.25 in 7.5k

FOREX: US Dollar Firms As Geopolitical Risks Reverberate

- The greenback came back into favour on Friday as a multitude of Russia/Ukraine headlines left risk on the backfoot for the majority of Friday’s trading session. The Dollar Index rose a quarter of a percent to 96.05 and was unaffected by the late bounce in equity benchmarks.

- Greenback demand brought the index back close to unchanged in a week where currency volatility played second fiddle to the swings seen in equity/bond/commodity markets.

- EURUSD remains strictly rangebound on the 1.13 handle with the significant technical range of 1.1280-1.1495 demanding respect for now. In similar vein, USDJPY remains in a tight range either side of 115 with e-mini S&P futures making fresh three-lows unable to spark any weakness in the pair.

- Once again, the Ruble was the worst performing currency pair, weakening 1.37% against the greenback as of writing. The next target for USDRUB resides around 77.62, the February highs. RUB weakness had some spillover effects into TRY and ZAR, weakening 0.56% and 0.92% respectively.

- President’s day in the US on Monday, however, markets will remain attentive to any developments on the Ukraine border. Additionally, there are European Flash PMI’s that may garner focus in the European session.

- Highlights next week will be the RBNZ meeting and rate decision as well as US Core PCE Price Index.

FX: Expiries for Feb21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1300-20(E820mln), $1.1340-50(E1.2bln), $1.1485-00(E735mln)

- EUR/JPY: Y130.00(E625mln), Y132.80(E587mln)

- USD/CNY: Cny6.2500($1.1bln)

EQUITIES: Late Equity Roundup: Off Lows, Inside Range

Stocks trading weaker, off second half lows in late trade Friday but still through first support point 4354.00 Low Feb 14.- Volume of Russia/Ukraine headlines has slowed in evening European hours. Keeping markets on edge with potential for accidents: Combined Russia/Belarus life fire exercises expected to continue into Saturday.

- Reminder: US Pres Biden vid-talk w/European Leaders set for 1430ET, followed by an update on Russia/Ukraine situation at 1600ET today

- Inside range for SPX at the moment, outlook still pointed lower with downside impetus strengthened by the failure of the contract to hold above the 50-day EMA - at 4549.15. Second support at 4263.25 Low Jan 27. Recent bearish candle patterns have exposed 4212.75 the key downside target.

- SPX eminis trading -6.5 points (-0.15%) at 4369.25; Dow Industrials -26.36 points (-0.08%) at 34288.94; NASDAQ -74.2 points (-0.5%) at 13644.3.

- SPX lagging sectors:

- Energy -0.49%

- Information Technology -0.33%

- Industrials -0.31%

COMMODITIES: Gold Hangs On For Largest Weekly Gain In 9 Months

- After another volatile day with various Russia-Ukraine headlines including a car explosion in Donetsk, crude oil prices are on track to end the week down between -1 and -2% as the prospect of increased production from Iran weighs on prices.

- A further increase in US rig counts in response to high prices sees WTI underperform Brent on the day.

- WTI is -0.8% at $91.06, with dips still seen as corrective whilst it sits above the key short-term support of $88.41 (Feb 9 low). Resistance is $95.82 (Feb 14 high).

- Brent is +0.5% at $93.45, with some near-term congestion in prices but ultimately still a positive longer-term outlook. It sits above key short-term support at $89.93 (Feb 8 low) with resistance seen at $96.78 (Feb 14 high).

- Gold has largely consolidated yesterday’s surge, only dipping -0.15% to $1,895.4. It touched $1902.5 overnight, just shy of the $1903.1 high from Jun 11, 2021, after which it would open the medium-term upside target at $1916.6 (Jun 1, 2021 high). Gold for delivery in April settled 3.1% higher over the week, the largest increase in 9 months.

Data Calendar for Monday-Tuesday

| 21/02/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 21/02/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 21/02/2022 | 0700/0800 | ** |  | DE | PPI |

| 21/02/2022 | 0815/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 21/02/2022 | 0815/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 21/02/2022 | 0830/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 21/02/2022 | 0830/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 21/02/2022 | 0830/0930 |  | SE | Riksbank minutes Feb 3 meet | |

| 21/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 21/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 21/02/2022 | 0900/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 21/02/2022 | 0930/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 21/02/2022 | 0930/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 21/02/2022 | 0930/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 21/02/2022 | 1615/1115 |  | US | Fed Governor Michelle Bowman | |

| 22/02/2022 | 2350/0850 | * |  | JP | Machinery orders |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.