-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI ASIA MARKETS ANALYSIS: Flatter Yld Curves Flash Recession

US Tsys: Bull Flatteners, 5s10s Inverted Again

US FI markets climbed steadily through the session, bonds leading the rally finishing near session highs (30YY -.1115 at 3.0663%).

- Yield curves bull flattening (2s10s -6.230 at 21.721, 5s10s -2.771 at -.846) amid renewed concerns over stagflation as equities tumbled on the back of mostly poor earnings/cutting guidance for large retailers this week tied to supply chain constraints, higher operating costs, etc.

- On flattening curves, BMO portends the FOMC "will hike the economy into a recession, whether the ‘blame’ for the slowdown lies with monetary policymakers, subprime mortgages, or a global pandemic is a debate that can only be conducted with the benefit of hindsight. As such, while we are very much on board with 2s/10s revisiting negative territory, this does not necessarily ensure that an economic contraction is in the offing."

- Tsy futures extending session highs (30YY 3.0968% at the moment) after $17B 20Y note auction (912810TH1) comes in on the screws: 3.290% high yield vs. 3.290% WI; 2.50x bid-to-cover vs. last month's 2.80x.

- Thursday focus:

- May-19 0830 Initial Jobless Claims (203k, 200k)

- May-19 0830 Continuing Claims (1.343M, 1.320M)

- May-19 0830 Philadelphia Fed Business Outlook (17.6, 15.0)

- May-19 1000 Existing Home Sales (5.77M, 5.65M); MoM (-2.7%, -2.1%)

- May-19 1000 Leading Index (0.3%, 0.0%)

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00015 to 0.82029% (-0.00542/wk)

- 1M -0.00114 to 0.92729% (+0.04058/wk)

- 3M +0.03043 to 1.47800% (+0.03429/wk) * / **

- 6M +0.02800 to 2.03314% (+0.03814/wk)

- 12M +0.06329 to 2.74100% (+0.08886wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.47800% on 5/18/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $80B

- Daily Overnight Bank Funding Rate: 0.82% volume: $267B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.80%, $977B

- Broad General Collateral Rate (BGCR): 0.80%, $366B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $352B

- (rate, volume levels reflect prior session)

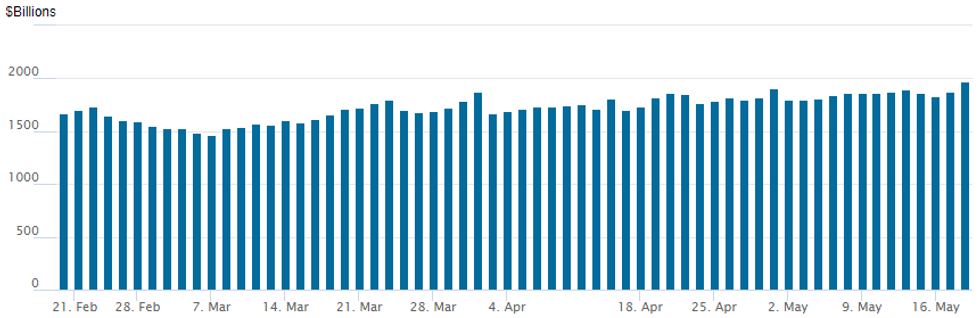

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage surges to new all-time high of 1,973.373B w/ 91 counterparties vs. prior record of $1,906.802B on Friday, March 29, 2022.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Difficult to draw any strong conclusions from Wednesday's mixed FI option flow: two-way wing trade for the most part, modest volumes on net as underlying rate futures gained all session to near highs at the close.Steady climb in risk-off tone has 30Y bonds near highs, curves bull flattening (2s10s -6.280 at 21.671; 5s30s back inverted -2.821 at .896) amid renewed stagflation concerns.

- Eurodollar trade appeared to turn bearish, more fading the underlying rally than building a hedge vs. steady rate hike expectations (200bp by year end).

- -20,000 (-10k Blocked) Green Sep 97.25/97.75 call spds, 12.75

- +5,000 Dec 97.75/98.00 call s,ds2.5

- 1,250 short Aug 96.12/96.25/96.50/96.62 put condors

- 1,865 Dec 96.00/96.25/96.50/96.75 put condor vs. 97.00/97.25/97.50/97.75 put condor

- +20,000 Jun 98.25/98.31 call spds, 0.75

- 5,250 short Jun 96.12/96.25 put spds

- 4,700 Green Jun 97.37 calls, 2.0

- Block 3,000 Green Sep 96.25/96.62 3x2 put spds, 9.5

- 7,500 TYM 119.5 calls, 13

- 1,000 TYN 115/116.5/118 2x3x1 put flys

- -8,000 USN 130/134 put spds, 33

- 10,000 TYN 122.5/124/126 call trees

- +10,000 TYQ 124 calls, 11

- Block, 11,250 TYM 119.5 puts, 34 vs. 119-03.5/0.72%

- +2,000 TYQ 116/120.5 strangles, 117 ref 118-09

- 7,000 FVM 112.5/113.25 put spds, 37.5 ref 112-15.75

- Overnight trade

- 4,000 TYN 117/117.5 put spds

- Block, 5,000 TYN 116.5/118 put spds, 32

- 3,500 TYN 115.5/116/117 put flys

EGBs-GILTS CASH CLOSE: ECB Hike Expectations Fade Late

European curves flattened Wednesday despite a late rally at the short end as ECB rate hike price expectations cooled and equities retreated to session lows.

- After implied rates rose earlier in the session on comments by ECB's Rehn calling for an end to negative rates "relatively quickly", they fell to session lows in late afternoon trade after MNI published a Policy piece which in part cited ECB sources downplaying ECB Knot's call for a possible 50bp hike.

- The German curve pared earlier flattening as short-end yields dipped. The repricing erased most of Gilts' earlier outperformance, following a high but in-line CPI print this morning.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 1.5bps at 0.392%, 5-Yr is up 0.1bps at 0.735%, 10-Yr is down 1.7bps at 1.029%, and 30-Yr is down 2.9bps at 1.147%.

- UK: The 2-Yr yield is up 1.6bps at 1.461%, 5-Yr is up 1.5bps at 1.58%, 10-Yr is down 2bps at 1.861%, and 30-Yr is down 0.3bps at 2.089%.

- Italian BTP spread up 1.3bps at 192.9bps / Spanish unch at 107.2bps

EGB Options: Several Euribor Flies

Wednesday's Europe rates / bond options flow included:

- RXN2 149.50p, bought for 76/78 in 15k

- OEN2 124.00/123.00/122.50 broken put fly, bought for 12 in 2.5k

- ERU3 99.12/99.37/99.62c fly, bought for 2 in 3k

- ERM3 99.25/99.50/99.75c fly, bought for 2.25 in 5k

FOREX: Japanese Yen Boosted As Equities Plunge, EURCHF Sharply Lower

- Weakness across major equity benchmarks placed the Japanese Yen as the best performing major currency on Wednesday. With risk-off flows also prompting a small recovery for the US dollar, it was cross/JPY that felt the brunt of the moves.

- GBPJPY sticks out after dropping around 2.1% which has a small miss in UK April inflation contributing to the weakness. The pair is closely followed by the likes of AUDJPY and NZDJPY, also dropping around 1.75% amid the 3.5% declines in e-mini S&P 500 futures.

- There was a very strong move lower in EURCHF throughout the US session. Natural risk off moves contributed, however, relative diverging central bank headlines prompted an acceleration to the downside.

- The Swiss franc has been bolstered by Swiss National Bank President, Thomas Jordan, saying it is ready to act if inflation pressures continue.

- “Uncertainty requires vigilance” and “the SNB will take care to maintain price stability,” he said at an event in Baden, northwest of Zurich. “We see the risk of second-round effects.”

- On the contrary, ECB rate hike pricing has pulled back sharply on the back of MNI's Policy piece which in part cites ECB sources downplaying Dutch central bank chief Knot's call for a possible 50bp hike, weighing on the single currency.

- EUR/CHF fell from levels just shy of 1.0500 all the way to 1.0332, the lowest level in two weeks. Firm support does not come into play until 1.0190.

- Aussie employment data highlights the APAC session on Thursday ahead of the Annual Budget release from New Zealand. The latest ECB Monetary Policy Meeting Accounts are then due before US Philly Fed and Existing Home Sales figures.

Late Equity Roundup: Southbound

More than reversing Tuesday's gains, the steady US equity market sell-off brings SPX emini futures back to last Thursday levels. Steady climb in risk-off tone has 30Y bonds near highs, curves bull flattening (2s10s -6.280 at 21.671; 5s30s back inverted -2.821 at .896) amid renewed stagflation concerns.

Additional impetus on the back of mostly poor earnings/cutting guidance for large retailers this week tied to supply chain constraints, higher operating costs, etc.

- SPX emini futures currently -159.75 (-3.91%) at 3926, Dow Industrials -1142.04 (-3.5%) at 31513.59, Nasdaq -552.9 (-4.6%) at 11434.

- After Walmart's huge miss Tue, US retail giant Target's miss on EPS and weaker guidance is dragging stock futures lower. Target is now down appr 27.13%; it had been an outperformer this year, down 7% this year as of Tuesday vs -26% for the S&P consumer discretionary index.

- Tech earnings: Cisco reports after the bell today, Applied Materials late Thu.

- SPX leading/lagging sectors: Utilities (-0.77%), Health Care (-2.41%) and Real Estate (-2.65%). Laggers: Consumer Discretionary (-6.69) weighed by retailers, consumer durables and autos again, Consumer Staples (-6.10%) as food retail and super-center retailers underperform, Information Technology (-4.73%).

- Dow Industrials Leaders/Laggers: Verizon (VZ) +0.29 at 49.23; Amgen (AMGN) -0.42 at 244.93 and Merck (MRK) -0.84 at 92.16. Laggers: United Health (UNH) -19.92 at 472.61, Home Depot HD) -18.02 at 282.93 , Microsoft (MSFT) -12.31 at 254.51.

E-MINI S&P (M2): Stalls Ahead Of First Resistance

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4099.00/4275.94 High May 9 / 50-day EMA

- PRICE: 3925.50 @ 1445ET May 18

- SUP 1: 3855.00/3843.25 Low May 12 / Low Mar 25 2021 (cont)

- SUP 2: 3820.25 2.50 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis short-term gains are considered corrective and the primary trend direction remains down. The contract has found resistance - for now - at today’s high of 4095.00. Trend signals remain bearish, last week’s continuation lower and fresh cycle lows reinforce this theme and signal scope for a continuation lower. The next objective is 3843.25, the Mar 25 2021 low (cont). Initial resistance to watch is at 4099.00, the May 9 high.

COMMODITIES: Crude Oil Eyes 20-Day EMAs On Risk-Off

- Crude oil prices have slipped -2.5% amongst broad risk-off sentiment and in China, Tianjin’s Binhai put another area under lockdown.

- Japan also announced plans to sell 4.7mbbls of crude from national oil reserves in June to fulfil its 15mbbls IEA commitment, whilst EIA data in the US were in line with APIs (crude production back up after a surprise fall last week and crude stocks falling), which saw a continuation of trading lower.

- WTI is -2.5% at $109.58. The slide on the day sees it move nearer to support at the 20-day EMA of $106.17, clearance of which would open $102.00 (50-day EMA).

- Brent is -2.43% at $109.2, close to the 20-day EMA of $108.26 after which it would open $101.30 (May 11 low).

- Gold is +0.17% at $1818.18 supported by haven flows. It remains vulnerable, with support eyed at $1787.0 (May 16 low) whilst resistance is $1858.8 (May 12 high).

- The North American Electric Reliability Corporation warns that a vast swath of North America from the Great Lakes to the West Coast is at risk of blackouts this summer as heat, drought, shuttered power plants and supply-chain woes strain the electric grid – BBG.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/05/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 19/05/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 19/05/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/05/2022 | 1130/1330 |  | EU | ECB April meeting Accounts | |

| 19/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 19/05/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 19/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 19/05/2022 | 1230/1430 |  | EU | ECB de Guindos Keynote Address at Harvard | |

| 19/05/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 19/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 19/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/05/2022 | 2000/1600 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.