-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 10YY Back Over 3% (Again)

US TSYS: Rates Back on the Downswing

Rates swung back to weaker levels Wednesday, near late session lows to around mid-range for the week, curves rebound from prior session flattening (2s10s +1.191 at 25.288; 5s10s +.534 at -.823. Current 10YY back over 3% at 3.0289% +.0553; 30YY at 3.1782 +.0537.

- It appears as if markets are trying to anticipate "either runaway inflation (stagflation) or a train wreck of a recession, with nothing in between," one desk quipped. "That puts 10yr forecasts in a range of 4+% and 2%," they jokingly estimated.

- Focus on Friday's May CPI (0.7% est vs. 0.3% prior), while futures traded lower (still off early session lows) after $33B 10Y note auction (91282CEP2) reopen tails yet again: 3.030% high yield vs. 3.017% WI; 2.41x bid-to-cover off last month's 2.49x.

- No react to Tsy Sec Yellen testimony again: "I SEE NO WAY IN WHICH INFLATION IS A DECADE-LONG MATTER" Bbg.

- SEC head Gary Gensler targeting payment for order flow as he speaks remotely for Piper Sandler conference: "Outlines Other Possible Changes to Stock-Market Rules" WSJ.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00700 to 0.81957% (+0.00043/wk)

- 1M +0.00942 to 1.19971% (+0.08000/wk)

- 3M -0.00272 to 1.68771% (+0.06171/wk) * / **

- 6M +0.02800 to 2.26643% (+0.15714/wk)

- 12M +0.02257 to 2.91214% (+0.13671/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.69043% on 6/7/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $82B

- Daily Overnight Bank Funding Rate: 0.82% volume: $252B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.77%, $947B

- Broad General Collateral Rate (BGCR): 0.78%, $365B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $349B

- (rate, volume levels reflect prior session)

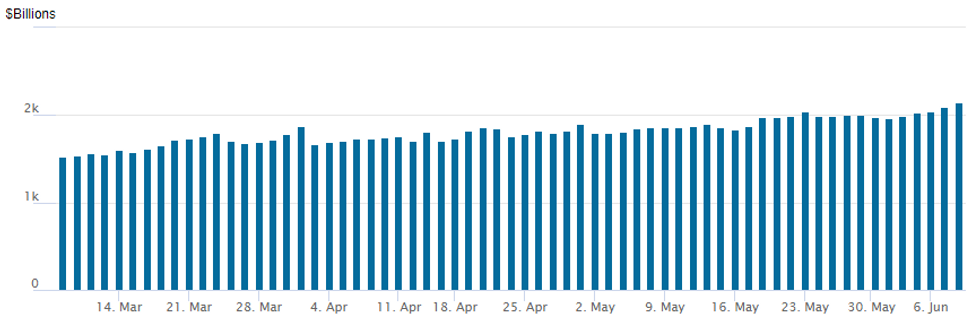

FED Reverse Repo Operation, Second Consecutive Record High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new record high of 2,140.277B w/ 98 counterparties vs. Tuesday session record high of 2,091.395B, prior record of $2,044.658B from Monday, May 23.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

FI option trade turned more mixed Wednesday as underlying futures swung back lower -- to near the middle of the week's range (10YY back over 3.0% at 3.0289% +.0553).- Limited volumes showed a pick-up in downside put structures compared to better upside call (two-way) trade anticipating direction the last couple sessions.

- Salient SOFR options included a buy of +10,000 SFRN2 97.37/97.50 put spds, 2.25 ref 97.595. Eurodollar options included a buy of 20,000 each Dec 95.75/96.50 put spds, 14.0 and Mar 95.75/96.75 put spds, 38.0 ref 96.525. Treasury options saw several smaller put spd buys in 5s, 10s and 30s after early sale of 5,000 TYN 118.75 calls at 25 and -10,000 FVN2 112.5 calls at 15 ref 111-30.

- +10,000 SFRN2 97.37/97.50 put spds, 2.25 ref 97.595

- -5,000 short Mar 98.50/99.00/99.50 call trees, 1.5

- Block, 20,000 Dec 95.75/96.50 put spds, 14.0

- +10,000 Jun 98.25 calls, 0.5

- Block, 20,000 Mar 95.75/96.75 put spds, 38.0 ref 96.525

- 2,000 Dec 95.25 puts, 2.5

- 3,000 short Aug 97.75/98.25 call spds

- 3,000 Aug 97.31/97.50 put spds

- 4,000 Dec 96.50/96.75 put spds

- 2,000 FVN 110.75/111.75 put spds, 18.5

- 4,000 TYQ 116.5 puts, 34

- +2,500 USU 128 puts, 39

- -5,000 TYN 118.75 calls, 25

- -10,000 FVN2 112.5 calls, 15 ref 111-30 -30.25

EGBs-GILTS CASH CLOSE: Rate Hike Pricing Hits Cycle High Pre-ECB

The ongoing rise in European yields resumed Wednesday after a day's pause. The German curve bear steepened while the UK belly underperformed, with Thursday's ECB meeting coming into focus.

- 2Y yields reached the highest in over a decade, with 5Y highest since 2013. 10Y hit a fresh post-2014 high.

- Despite a slow session in terms of news and data, hawkish central bank speculation continued. End-2022 hike pricing hit a fresh cycle high (ECB 134bp of tightening priced, UK 155bp).

- Pre-ECB peripheral EGB volatility continued; Greek 10Y spreads rose by over 9bp.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 3.2bps at 0.701%, 5-Yr is up 4.8bps at 1.077%, 10-Yr is up 6.1bps at 1.354%, and 30-Yr is up 6.6bps at 1.592%.

- UK: The 2-Yr yield is up 3.3bps at 1.78%, 5-Yr is up 3.7bps at 1.881%, 10-Yr is up 3.2bps at 2.246%, and 30-Yr is up 3.3bps at 2.458%.

- Italian BTP spread up 1.9bps at 202.1bps / Greek up 9.6bps at 261.9bps

EGB Options: Flatteners And Bobl Combos

Wednesday's Europe rates/bond options flow included:

- RXN2 153.5c, bought for 8 in 3k

- RXQ2 150.50/151.00 cs, sold at 19.5 in 2k

- RXQ2 149/146/143p fly, bought for 55 in 2k

- RXU2 142.5/140.5/138.5p fly, bought for 9.5 in 5k

- DUN2 108.30 put bought for 5 in 9.6k

- DUN2 109.3/109.5cs sold at 3 in 3k vs RXN2 152/153.5cs, bought for 13 in 500

- OEN2 124.50/125.25cs 1x2, sold at 6.5 in 1.5k

- ERU2 99.50/99.375/99.25 2x3x1 put ladder sold at -4.5 in 15kx22.5kx7.5k

- ERZ2 98.375/98.00ps, bought for 4.5 in 10k

Large bobl rolling down Combo:

- OEN2 124/128 RR, sold the put at 56.5/57 in 25k

- OEN2 123/125 RR, bought the put for 7 in 12.5k

- OEN2 123/126 RR, bought the put for 20 in 18.75k

FOREX: Yen Weakness Sees EURJPY Surge To 7-Year High Ahead of ECB

- The latest leg lower for JPY comes as the BoJ governor acknowledged some of the outcry around the weaker currency, but pledged that the BoJ will firmly support the economy with the current monetary easing strategy. He also added that "stable" JPY weakness is a positive for the Japanese economy.

- EUR/JPY was the notable climber today amid the broad JPY downtrend. The cross traded on four different big figures today, extending its winning sequence to ten trading days and eventually peaking at Y144.25, levels last seen in January 2015.

- Nearest resistance stands at 144.58 which is the 0.764 projection of the Mar 7 - 28 - Apr 5 price swing. Further out, the 2014 highs, closer to the 150.00 mark appear a potential target for the move.

- USDJPY (+1.17%) continues to climb following pair resuming its primary uptrend, after the break of 131.35, May 9 high. The focus today was on 134.48, a Fibonacci projection which has held at the first time of asking. Despite a sharp pullback to 133.61, the pair has resumed its supportive price action and looks set to close above the 134.00 mark.

- Weaker equities and higher US yields lent support to the greenback which saw the USD index advance a quarter of a percent. In similar vein, the likes of GBP, AUD, NZD and CAD all came under pressure, retreating around 0.5%.

- EURUSD sits marginally in the green ahead of tomorrow’s ECB meeting/statement. The ECB is now clear that the APP will end in early July, policy rate lift-off will occur in the same month and policy rates will reach zero by September. A 50bp hike in July is a low, but increasing, risk. However, the probability is rising of a one-off 50bp hike or a series of such hikes from September onward.

- US CPI data and Canadian Employment will be released on Friday.

FX: Expiries for Jun09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0560-70(E1.4bln), $1.0595-05(E1.1bln), $1.0750-55(E1.3bln), $1.0800(E500mln)

- USD/JPY: Y129.80-00($1.3bln)

- GBP/USD: $1.2600-05(Gbp574mln)

- AUD/USD: $0.7165-85(A$1.4bln)

- USD/CAD: C$1.2500($679mln), C$1.2820($682mln), C$1.2900($570mln)

- USD/CNY: Cny6.7000($2.3bln)

Late Equity Roundup: SPX Extends Late Session Lows

Stocks continued to extend session lows after the FI close, SPX emini futures ESM2 -43.5 (-1.05%) at 4115.25. Already trading mildly weaker through the first half, major indexes extended lows as SEC Chairman Gary Gensler discussed possible new market regulation at a Piper Sandler conference, seeking to "assure full competition, best prices for retail investors" WSJ reported.

- Other headline news included profit warnings for Credit Suisse overnight that may trigger more lay-offs (this a day after execs looked to expand managing directors at the bank by appr 40. Unverified market chatter over potential purchase of CS by State Street.

- Meanwhile, Twitter bounced (41.29H +1.16) after headlines micro-blogger will comply with Elon Musk request for more acct spam data.

- SPX leading/lagging sectors: Communication Services (-0.09%) edged past Energy sector (-0.09%). Laggers: Real Estate (-2.55%) followed by Materials (-2.02%), Utilites (-2.03%) and Industrials (-1.93%).

- DJIA -290.11 (-0.87%) at 32888.67; Nasdaq -93 (-0.8%) at 12081.94.

- Dow Industrials Leaders/Laggers: SalesForce.com (CRM) +2.68 at 189.83 edged past Caterpillar (CAT) +2.42 at 229.52, while bid for Chevron (CVX) faded: +0.43 at 180.63. Laggers: Goldman Sachs (GS) -7.18 at 314.33, United Health Care (UNH) -5.45 at 491.65, Home Depot (HD) -3.99 at 297.78

E-MINI S&P (M2): Consolidation Mode

- RES 4: 4509.00 High Apr 21

- RES 3: 4393.25 High Apr 22

- RES 2: 4303.50 High Apr 26/28 and a key short-term resistance

- RES 1: 4178.15/4202.25 50-day EMA / High May 31

- PRICE: 4140.50 @ 14:44 BST June 9

- SUP 1: 3960.50/3807.50 Low May 26 / Low May 20 and bear trigger

- SUP 2: 3801.97 38.2% of the Mar ‘20 - Jan ‘22 bull leg (cont)

- SUP 3: 3787.74 2.618 proj of the Mar 29 - Apr 18 - 21 price swing

- SUP 4: 3747.52 2.764 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis are unchanged and continue to trade inside its recent range. The current consolidation appears to be a bull flag, this reinforces short-term bullish conditions. Attention is on the 50-day EMA, at 4178.15 today. A clear break of this average would strengthen a bullish outlook and open 4303.50, the Apr 26/28 high. Gains are still considered corrective and the primary trend direction is down. First support to watch is 3960.50, May 26 low.

COMMODITIES: Oil Supported By Tight Markets But Gas Slumps With Fire

- Crude oil prices have been supported today by an unexpected EIA crude draw, driven by a 1.7mbpd drop in crude exports as imports and production remain steady.

- An already tight market sees solid gains across the WTI curve, with the front contract +2.1% at $121.94. Touching a high of $123.18, it came close to testing the third resistance level at $123.35 (1.236 proj of the May 11-17-19 price swing).

- Brent sees a similar gain, +2.3% at $123.4 off a high of $124.40, stopping just short of the bull trigger at $124.42 (Mar 7 high).

- Gold meanwhile has a more muted day, +0.1% at $1853.8, holding up well considering higher Treasury yields and a marginally stronger USD, with the impetus coming from a rolling over in equities. Resistance remains the 50-day EMA of $1873.4 with support at $1828.6 (Jun 1 low).

- US natural on the other hand falls -4.7% with a fire at the Freeport LNG terminal in Texas on implications that more US LNG could stay in the US rather than the almost three-quarters that was exported to Europe in the first four months of the year.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/06/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 09/06/2022 | 0600/0800 | ** |  | SE | Private Sector Production |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 09/06/2022 | - | *** |  | CN | Trade |

| 09/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 09/06/2022 | 1230/1430 |  | EU | ECB Press Conference Following Governing Council Meeting | |

| 09/06/2022 | 1400/1000 |  | CA | BOC Financial System Review | |

| 09/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 09/06/2022 | 1500/1100 |  | CA | BOC Governor press conference | |

| 09/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/06/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.