-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:Fed Speak Reality Check on Inflation

US TSYS: Fed's Work Far From Done

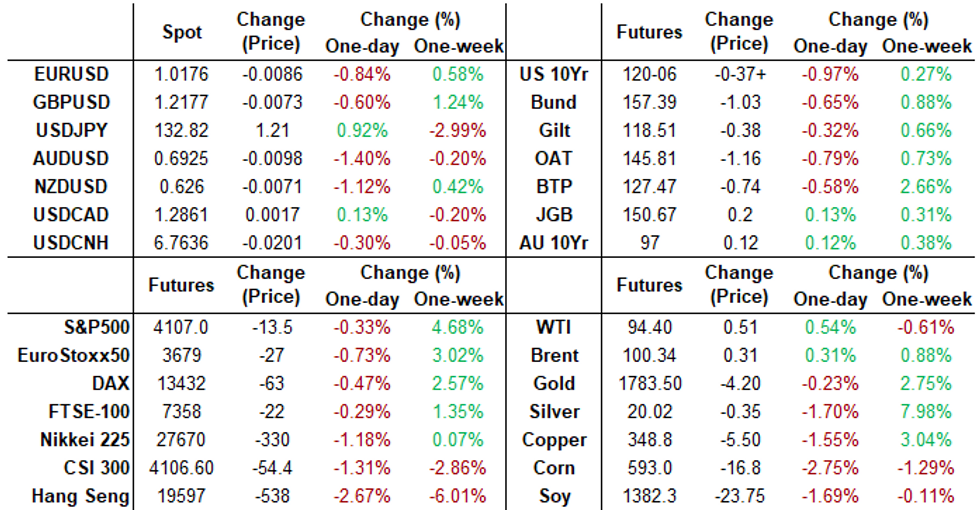

Treasury futures trading session lows after the bell, curves bear flattening with heavy selling in short end (TUU2>600k, FVU>1.13M, TYU>1.78M), 2YY back over 3.0% to 3.0814% high vs. 2.8154% early low, 2s10s hits inverted low of -35.531.

- Rates reversed early support/stocks gained on relief rally after House Speaker Pelosi's safe landing in Taiwan. Brief negative correlation to rates evaporated in the second half as trifecta of Fed speakers (Daly, Mester, Evans) reminded markets inflation is too high and 75bp hike in Sep not off the table.

- SF Fed Pres Daly stating the Fed's "work is far from done, so we are still resolute and completely united on achieving price stability"; Chicago Fed Evans: "Fifty is a reasonable assessment, but 75 could also be okay" for Sep FOMC; Cleveland Fed Mester: prices are only cooling down "if you squint" and in some pockets.

- Earlier Data: Job openings fall by more than expected in June to 10.698M (cons 11.0M) after a marginally upward revised 11.3M in May. Pushes the ratio of job openings to unemployed down to 1.81, the lowest since Feb off the March high of 1.99.

- Pick-up in data for Wednesday: S&P Global US Services/Composite PMIs (47.0, 47.5 respective ests), Durable Goods Orders (1.9% est), Factory Orders (1.2%), ISM Services (53.5 est)

- Current cross assets: spot Gold reversed direction -9.50 at 1762.67, Crude mild gain: WTI +0.37 at 94.26, stocks marginally lower ESU2 -13.5 at 4107.0

- Currently, 2-Yr yield is up 11bps at 2.9796%, 5-Yr is up 10.2bps at 2.7365%, 10-Yr is up 7.9bps at 2.6522%, and 30-Yr is up 2.8bps at 2.9421%

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00443 to 2.30714% (-0.01443/wk)

- 1M -0.00957 to 2.35729% (-0.00500/wk)

- 3M +0.00486 to 2.80700% (+0.01871/wk) * / **

- 6M -0.06271 to 3.31343% (-0.01643/wk)

- 12M -0.03443 to 3.70771% (+0.00042/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3.5Y high: 2.80586% on 7/27/22

- Daily Effective Fed Funds Rate: 2.33% volume: $93B

- Daily Overnight Bank Funding Rate: 2.32% volume: $270B

- Secured Overnight Financing Rate (SOFR): 2.28%, $1.035T

- Broad General Collateral Rate (BGCR): 2.25%, $401B

- Tri-Party General Collateral Rate (TGCR): 2.25%, $378B

- (rate, volume levels reflect prior session)

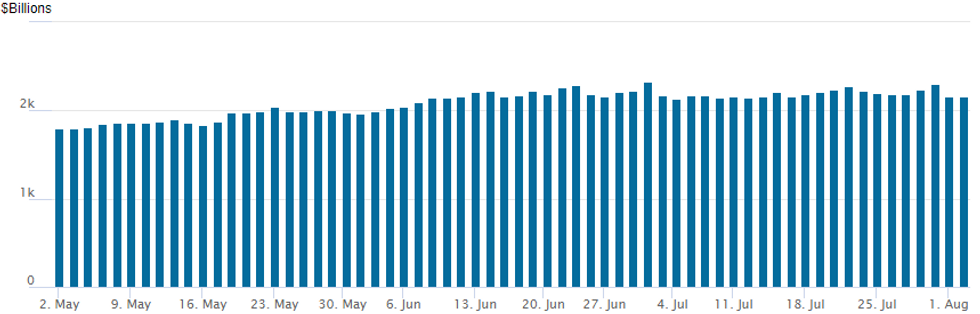

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,156.013B w/ 105 counterparties vs. $2,161.885B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

SOFR Options:- 10,000 SFRV2 95.75/96.25 put spds, 3.75 (2.5k blocked)

- Block, 1,250 SFRU2 97.12/97.25/97.37 call flys, 1.0

- 8,000 Dec 96.00 puts vs. Mar 97.62 calls

- Block, +8,000 TYU 120.25 puts, 36 vs. 121-08/0.34%

- 5,000 TYZ 116/117 2x1 put spds,

- 4,000 FVU 111.5 puts, 3.5

- Block, +8,500 FVV 111/111.75 put spds, 7 total appr +35k 6.5-7

- 3,000 TYU 121.75/122.5 call spds

- 1,500 FVU 112.5/113.5 put spds, 17.5

- 4,000 USU 138 puts, 8

- 9,000 TYU 124 calls, 25

- Block, total 24,615 FVV 111/111.75 put spds, 6.5 from 0825:01-:50ET

- 13,400 TYU 120/121.5 put spds, 32 ref 121-29

- +6,000 USU 136/138/140/142 put condors, 21

- 10,000 wk1 FV 112.5/113 put spds

- 3,000 TYZ 114/116 put spds

- Block, 4,000 TYU 120/121 call spds, 44 ref 121-29

FOREX: USD Index Snaps Losing Streak As US Yields Reverse Course

- The greenback has been significantly boosted on Tuesday in conjunction with a substantial move higher across US yields. Notable comments from Mary Daly on the Fed being "nowhere near done" on curbing inflation and subsequent Fed speak were largely responsible for the turnaround and subsequent pressure on US treasuries. The price action supported the USD index (+0.80%), which is set to snap a four-day losing streak.

- Equity markets shrugged off the ongoing tensions surrounding Speaker Pelosi’s trip to Taiwan and following her safe landing, major benchmarks staged a strong recovery, rallying to the best levels of the session. In sharp contrast to the APAC session, firmer risk sentiment proved enough to place downward pressure on the Japanese Yen, prompting USDJPY to stage a significant recovery. Even with the latest renewal of pressure in equity markets the USD remains firmly on the front foot with USDJPY extending its recovery to 250 pips.

- USDJPY’s 130.41 low came within close proximity of key support at 130.24, the 100-day MA, a level last crossed in September 2021.

- AUD remains the worst performer in G10 following the RBA delivering the widely expected and largely priced 50bp hike at the end of it August meeting. However, the formal introduction of some well-used phrases to the post-meeting statement left a dovish tinge to the post-meeting takeaway.

- Wednesday's data focus will be on US ISM Services PMI. Later this week, the Bank of England’s monetary policy decision on Thursday precedes Friday’s US employment data.

FX: Expiries for Aug03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0150(E589mln), $1.0193-00(E1.8bln), $1.0245-50(E654mln)

- USD/JPY: Y131.25($530mln), Y131.50($495mln), Y132.25($500mln)

- EUR/JPY: Y135.85-00(E664mln)

- USD/CNY: Cny6.75($1.1bln)

Late Equity Roundup: Reevaluating Risk, What's Your Vector Victor?

Stock indexes trading mixed after the FI close, SPX reversed midday gains, joining Dow stocks in modestly weaker territory. Brief negative correlation to rates evaporated in the second half as trifecta of Fed speakers (Daly, Mester, Evans) reminded markets inflation is too high and 75bp hike in Sep not off the table.

- Early bid for stocks tied by some desks to safe landing in Taiwan by House Speaker Pelosi ebbed as China defense officials calling for military drills around Taiwan during. Other potential factors/tit-for-tat: China ADRs under pressure again, US officials have been eying delisting for months - could accelerate if things go poorly during Asia visit.

- Currently, SPX eminis trades -9.75 (-0.24%) at 4111; DJIA -269.41 (-0.82%) at 32528.12; Nasdaq +27.5 (0.2%) at 12395.82.

- Flood of earnings releases continues after the close: Gilead Sciences (GILD) $1.511 est, Pioneer Natural Resources (PXD) $8.856 est, Advanced Micro Devices (AMD) $1.045 est, Occidental Petroleum (OXY) $3.071 est, Chesapeake Energy (CHK) $3.823 est, Starbucks (SBUX) $0.759 est.

- SPX leading/lagging sectors: Utilities (0.51%), Energy (+0.26%), Communication Services (-0.01%). Laggers: Real Estate (-0.80%), Consumer Stales (-0.63%) and Industrials (-0.52%).

- Dow Industrials Leaders/Laggers: Travelers (TRV) +2.43 at 158.70, United Health (UNH) +1.35 at 536.73, Salesforce.COM (CRM) +1.06 at 184.05. Laggers: Caterpillar (CAT) -9.46 at 185.4, Visa (V) -4.62 at 206.74.

E-MINI S&P (U2): Bullish Outlook

- RES 4: 4345.75 2.00 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 3: 4306.50 High May 4

- RES 2: 4204.75 High May 31 and a key resistance

- RES 1: 4147.25 High Aug 01

- PRICE: 4110.00 @ 1500ET Aug 2

- SUP 1: 3973.76/13.25 50-day EMA / Low Jul 26 and key S/T support

- SUP 2: 3820.25 Low Jul 18

- SUP 3: 3723.75/3639.00 Low Jul 14 / Low Jun 17 and a bear trigger

- SUP 4: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis are rallying off the week’s lows, erasing much of the dip into the Tuesday open and reinforcing bullish conditions. This maintains the current bullish price sequence of higher highs and higher lows. Potential is for a climb towards 4204.75 next, the May 31 high and the next key resistance. On the downside, initial trend support has been defined at 3913.25, the Jul 26 low. A break would highlight a possible early reversal signal.

COMMODITIES: Oil Squeezes Out Gains Ahead Of OPEC+

- A volatile session sees crude oil ultimately firm slightly ahead of OPEC+ meeting tomorrow to set policy for September with OPEC+ watchers doubting Biden’s call for more oil will be fulfilled.

- WTI is +0.6% at $94.49 after earlier coming close to testing support at yesterday’s low of $92.42, clearance of which would open the bear trigger at $88.23 (Jul 14 low). Resistance meanwhile is eyed at $101.88 (Jul 29 high).

- Brent is +0.4% at $100.39, having cleared yesterday’s low but still above a key short-term support at $96.7 (Jul 25 low), clearance of which would strength a bearish case.

- Gold is -0.3% at $1766.68 having initially firmed closer to resistance at the 50-day EMA of $1784.8 before pulling back as surging US Tsy yields took away some of the allure of the yellow metal. It continues to sit above the 20-day EMA of $1747.7.

- EU natural gas increases further, with TTF up 2.2%% on tight supply and a lack of clarity on Gazprom flows elevating pricing, with potential for larger increases ahead as Rhine transportation difficulties come into focus with falling water levels.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/08/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 03/08/2022 | 0130/1130 | *** |  | AU | Retail trade quarterly |

| 03/08/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 03/08/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/08/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 03/08/2022 | 0630/0830 | *** |  | CH | CPI |

| 03/08/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 03/08/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 03/08/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 03/08/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 03/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 03/08/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 03/08/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/08/2022 | 0900/1100 | ** |  | EU | retail sales |

| 03/08/2022 | 0900/1100 | ** |  | EU | PPI |

| 03/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/08/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/08/2022 | 1400/1000 | ** |  | US | factory new orders |

| 03/08/2022 | 1430/1030 |  | US | Philadelphia Fed's Patrick Harker | |

| 03/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 03/08/2022 | 1545/1145 |  | US | Richmond Fed's Tom Barkin | |

| 03/08/2022 | 1830/1430 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.