-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Awaiting July Jobs Report

US TSYS: Short End Gains Late, Yld Curves Off Lows

Treasury futures currently trading firmer, upper half relatively narrow range. Modest volumes, TYU2 just over 1M with active accts staying close to sidelines ahead Fri's headline jobs data. Short end gaining momentum in late trade, yield curves well off early inverted lows: 2s10s currently +0.249 at -36.414 vs. -39.611 (lvl not seen since Sep 2000).

- After initial post-BOE rate annc bounce, Bonds extended highs with desks citing mix of higher than expected continuing claims (1.416M vs 1.383M est) as well as geopolitical risk as tensions in APAC region. Tension high after China launched multiple rockets over Taiwan, five of which landed inside Japan's EEZ region. Def Dept asst sec Kirby said he hopes China is not trying to engineer a conflict in region after House Sp Pelosi visit Tuesday.

- Data on tap for Friday: Change in Nonfarm Payrolls (250k est), Change in Private Payrolls (230k est), Unemployment Rate (3.6%), Average Hourly Earnings MoM (0.3%), Labor Force Participation Rate (62.2%), Consumer Credit ($26.0B).

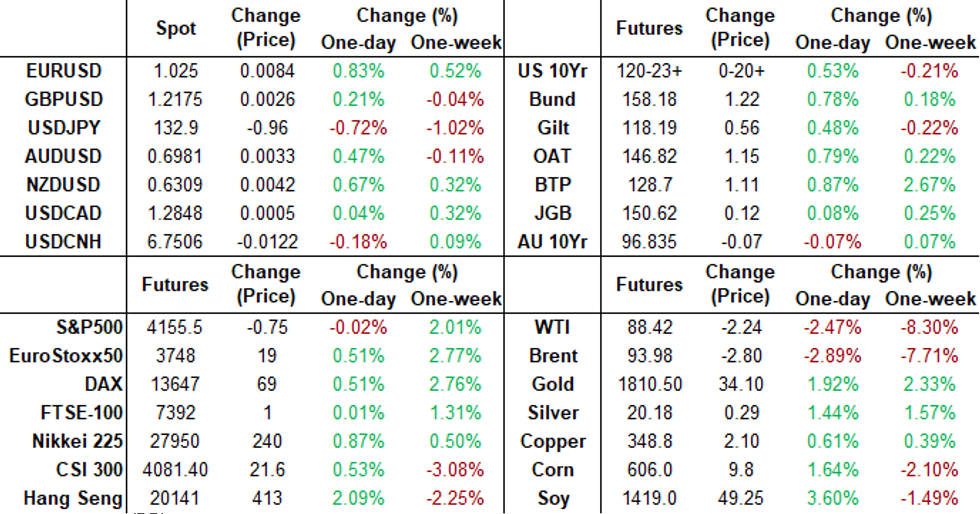

- Cross asset update: Stocks near steady (SPX eminis at 4156.0), DJIA -82.53 (-0.25%) at 32731.34; Nasdaq +35 (0.3%) at 12703.56; Spot Gold surge continued +28.15 at 1793.44; Crude continues to fall (WTI -2.25 at 88.41).

- Currently, 2-Yr yield is down 3.5bps at 3.0305%, 5-Yr is down 5.6bps at 2.7702%, 10-Yr is down 3.4bps at 2.6702%, and 30-Yr is up 1.2bps at 2.9573%

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00072 to 2.30957% (-0.01200/wk)

- 1M -0.00358 to 2.37271% (+0.01042/wk)

- 3M +0.03100 to 2.86329% (+0.07500/wk) * / **

- 6M +0.00371 to 3.39271% (+0.06285/wk)

- 12M +0.03586 to 3.87900% (+0.17171/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3.5Y high: 2.80586% on 7/27/22

- Daily Effective Fed Funds Rate: 2.33% volume: $92B

- Daily Overnight Bank Funding Rate: 2.32% volume: $274B

- Secured Overnight Financing Rate (SOFR): 2.29%, $984B

- Broad General Collateral Rate (BGCR): 2.27%, $379B

- Tri-Party General Collateral Rate (TGCR): 2.27%, $373B

- (rate, volume levels reflect prior session)

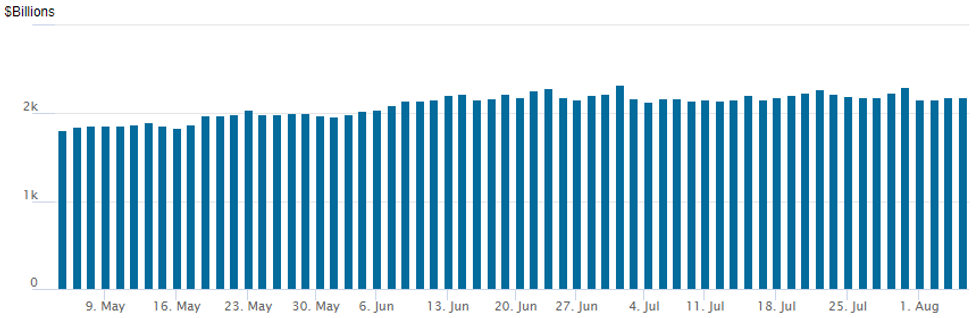

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,191.546B w/ 101 counterparties vs. $2,182.238B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Thursday's FI option trade mirrored the prior session on lighter volumes, active accounts close to the sidelines ahead of Friday's July employment report (+250k est). Traders reported carry-over put buying despite a modest rebound in underlying futures as mildly hawkish Fed speak moderated slightly.- SOFR volumes outpaced for the second consecutive session, salient trade included Block buys of 20,000 short Aug 96.75 puts from 4.5-5.0, ngoing/adds to 12.5k bought Wed, opener w/OI 19.465. Limited downside put fly buy of 5,000 SFRU2 96.62/96.81/97.00 put flys, 6.0 net. Eurodollar options saw modest buying in October 95.75 puts in the first half.

- Blocks, another 10,000 short Aug 96.75 puts, 4.5 - ongoing

- Block, 5,000 SFRU2 96.62/96.81/97.00 put flys, 6.0 net

- Blocks, 10,000 short Aug 96.75 puts, 5.0, ongoing/adds to 12.5k bought Wed, opener w/OI 19.465

- 5,000 SFRU2 97.00/97.12 call spds

- 2,000 short Aug 96.12/96.25 put spds

- 6,000 Oct 95.75 puts

- 5,000 TYU 120/121 call spds, 35

- 1,250 TYU 120.25/121.25 put spds, 32

- 1,500 TYU 118/119 2x1 put spds

- 2,000 TYV 122/123.5 call spds

- 4,000 USU 136/140 put spds, 25

- 2,000 FVU 112.5/113/113.5 iron flys

- 2,000 TYU 122 calls, 19

FOREX: Greenback Continues To Fade Approaching APAC Crossover

- The greenback spent the latter half of Thursday’s session drifting lower as bullish short-term price action following the sharp recovery from Tuesday’s lows has reversed course.

- Downside USD momentum picked up a little around the WMR fix, with EURUSD (+0.77) popping above Wednesday’s highs at 1.0210 with the pair now trading in marginally positive territory ahead of tomorrow’s payrolls report. Similar price action being conversely reflected in the Dollar Index which has fallen -0.69%.

- In similar vein, USDJPY briefly made fresh late session lows below the 133 handle. The Japanese Yen has once again traded in a volatile manner on Thursday, continuing the currency’s significant intra-day volatility throughout the week. Despite multiple 100+ pip swings throughout today’s session in USDJPY, the pair remained within the bounds of Wednesday’s range.

- The nearest technical resistance point lies at 135.32, the 20-day EMA, however, given the fact that the short-term gains have been considered technically corrective, renewed weakness would place focus back on a sustained break of 131.50 and then 130.41, Tuesday’s low.

- GBP the major move throughout the session following the Bank of England decision. Despite hiking by a slightly above-consensus 50bps, the rather bleak set of attached economic forecasts put immediate pressure on sterling. GBPUSD fell from 1.22 all the way to 1.2066 during the press conference, however, the most recent greenback weakness has seen cable pare losses to 1.2170 as of writing. GBP weakness does still exude through the cross with EURGBP rising 0.6% to a one-week high back above 0.8400.

- Looking ahead to tomorrow, consensus sees US non-farm payrolls growth moderating to 250k in July in a resumption of a downward trend after four remarkably steady months as the gap on pre-pandemic employment levels is almost completely shut.

- Particular focus will be on the strength of jobs growth plus any differences between establishment and household surveys, with FOMC speakers putting weight on labour market strength as evidence against the economy already being in recession.

FX: Expiries for Aug05 NY Cut 1000ET (Source DTCC)

- EURUSD: 1.0100 (379mln), 1.0175 (205mln), 1.0195 (318mln), 1.0200 (2bn), 1.0300 (1.24bn).

- EURGBP: 0.8350 (1.48bn), 0.8450 (750mln)

- USDJY: 133.25 (410mln), 133.30 (286mln), 133.75 (284mln), 134.00 (2.05bn), 135.00 (1.09bn).

- GBPUSD: 1.2100 (590mln)

- USDCAD: 1.2800 (1.46bn), 1.2900 (1.03bn)

- AUDUSD: 0.6900 (464mln), 0.6950 (498mln)

- AUDNZD; 1.0950 (800mln)

Late Equity Roundup: Earnings Round Out Session

Stock indexes trading mildly weaker ahead the FI close, Nasdaq outperforming, on lighter volumes ahead Fri's July employment data and ongoing earnings releases after the bell. Currently, SPX eminis trades -5.25 (-0.13%) at 4151; DJIA -94.72 (-0.29%) at 32717.48; Nasdaq +21.6 (0.2%) at 12689.82.

- Earnings releases after the close: Vertex Pharmaceuticals (VRTX) $3.514 est, Expedia (EXPE $1.530 est, Corteva Inc (CTVA) $1.479 est, Amgen (AMGN) $4.402 est.

- SPX leading/lagging sectors: Industrials (+0.53%) narrowly outpaced Utilities and Materials in late trade, both +0.51%, Consumer Discretionary (+0.32%). Laggers: Energy sector continues to underperform (-1.65%), followed by Consumer Staples (-0.81%), Health Care and Financials (-0.44%).

- Dow Industrials Leaders/Laggers: 3M Co (MMM) +4.78 at 148.27, Visa (V) +4.26 at 212.74, Caterpillar bounces back from Wed selling (CAT) +2.48 at 185.35, Honeywell (HON) +1.14 at 192.64. Laggers: United Health (UNH) -6.80 at 533.85, Walmart (WMT) -4.13 at 126.37, Chevron (CVX) -2.41 at 152.95.

E-MINI S&P (U2): Bullish Extension

- RES 4: 4345.75 2.00 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 3: 4306.50 High May 4

- RES 2: 4204.75 High May 31 and a key resistance

- RES 1: 4173.25 Intraday high

- PRICE: 4159.50 @ 1515ET Aug 4

- SUP 1: 3985.44/13.25 50-day EMA / Low Jul 26 and key S/T support

- SUP 2: 3820.25 Low Jul 18

- SUP 3: 3723.75/3639.00 Low Jul 14 / Low Jun 17 and a bear trigger

- SUP 4: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis traded higher Wednesday to reinforce current bullish conditions. Conditions remain bullish. The break of Monday’s 4147.25 high confirms a resumption of recent gains and maintains a bullish price sequence of higher highs and higher lows. This opens 4204.75 next, the May 31 high and the next key resistance. On the downside, initial trend support has been defined at 3913.25, the Jul 26 low. A break would highlight a possible reversal.

COMMODITIES: Demand Fears Push WTI To Six-Month Low

- Crude oil has slumped further today through the US session, with WTI falling below $90/bbl for the first time since the Ukraine war began in February. The move is attributed to growing recession fears, further building on the surprise build in US crude and gasoline stockpiles yesterday and then gathering pace once pushing through the psychological $90/bbl.

- WTI is -2.3% at $88.60 but in touching a session low of $87.55, it briefly cleared the bear trigger at $88.23 (Jul 14 low), a more sustained clearance of which could open $85.37 (Mar 15 low).

- Brent is -2.6% at $94.25, clearing support at $94.37 (Jul 15 low) but not the bear trigger at $91.22 (Jul 14 low).

- Gold on the other hand surges +1.6% to $1793.91 on geopolitical risk plus Tsy yields and the US dollar falling. It clears resistance at the 50-day EMA of $1783.1 and next eyes $1804.6 (trendline resistance drawn from Mar 8 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/08/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 05/08/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 05/08/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/08/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 05/08/2022 | 0645/0845 | * |  | FR | Current Account |

| 05/08/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/08/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 05/08/2022 | 1115/1215 |  | UK | BOE Pill Monetary Policy Report National Agency Briefing | |

| 05/08/2022 | 1200/0800 |  | US | Richmond Fed's Tom Barkin | |

| 05/08/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/08/2022 | 1230/0830 | *** |  | US | Employment Report |

| 05/08/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 05/08/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.