-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 2YY 4.2657% High, US$ Index 113.228

HIGHLIGHTS

- MNI US-CHINA: US Sec State Blinken Tells FM Wang: US Is "Open To Cooperation"

- Fed Chair Powell: FED DEALING WITH EXCEPTIONALLY UNUSUAL DISRUPTIONS, Bbg

- BIDEN ADMIN NOT CONSIDERING LIMITS ON OIL PRODUCT EXPORTS: RTRS

- LULA HAS 54%, BOLSONARO 37% IN BRAZIL RUNOFF POLL: IPESPE - Bbg

- UK: Fiscal Event Marks Major Shift In Conservative Gov'ts Policy Stance

US TSYS: Tsy Ylds Off New Lows, Stocks Bouncing Late, US$ Index Surge To 113.228

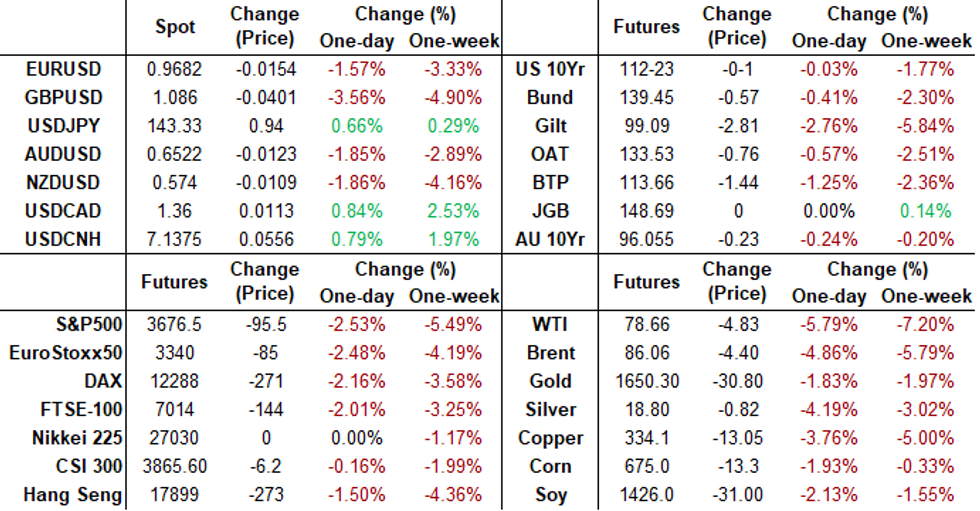

Well off late overnight lows when 2YY made new 15Y high of 4.2657%, FI markets finishing mixed, curves unwinding a large portion of Thu's steepening with bonds trading higher through the second half, 2s10s currently -10.559 at -51.613.

- Tsy dipped briefly after better than exp S&P US Sep Flash Mfg PMI: 51.8 vs. 51.0 est, much better than expected services (49.2 vs. 45.5 est) and comp (49.3 vs. 46.1) still contractionary (below 50).

- Otherwise, Tsys and EGBs tracked Gilts amid heavy selling in short end to intermediates after fiscal event concluded by Chancellor Kwasi Kwarteng in the House of Commons earlier. Event marked largest shift in the policy stance of the Conservative party in a generation. Bloomberg reports that the cost of the package will be GBP161bn over five years.

- In the aftermath of Wed's 75bp Fed and Thu's 50bp BoE hikes, debate over how much hawkish forward guidance to price in continues. Many US and London banks adjusting rate hike expectations to 75bp again in respective November policy meetings.

- Meanwhile, persistent rally in USD Index has extended through the London close, with the greenback hitting new cycle highs of 112.866. Move exacerbated by protracted weakness in GBP (making up around 12% of the USD Index) following the UK mini budget earlier today.

- Cross asset roundup: stocks making a move off late session lows, Energy sector underperforming (SPX -77 at 3695.0) crude sharply lower (WTI -4.67 at 78.82), as is Gold -28.64 at 1642.58.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00228 to 3.06943% (+0.75386/wk)

- 1M -0.00371 to 3.08029% (+0.06643/wk)

- 3M -0.01300 to 3.62843% (+0.06314/wk) * / **

- 6M +0.01858 to 4.20129% (+0.07800/wk)

- 12M +0.03529 to 4.83486% (+0.16272/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.64143% on 9/22/22

- Daily Effective Fed Funds Rate: 3.08% volume: $99B

- Daily Overnight Bank Funding Rate: 3.07% volume: $308B

- Secured Overnight Financing Rate (SOFR): 2.99%, $1.023T

- Broad General Collateral Rate (BGCR): 2.99%, $387B

- Tri-Party General Collateral Rate (TGCR): 2.99%, $369B

- (rate, volume levels reflect prior session)

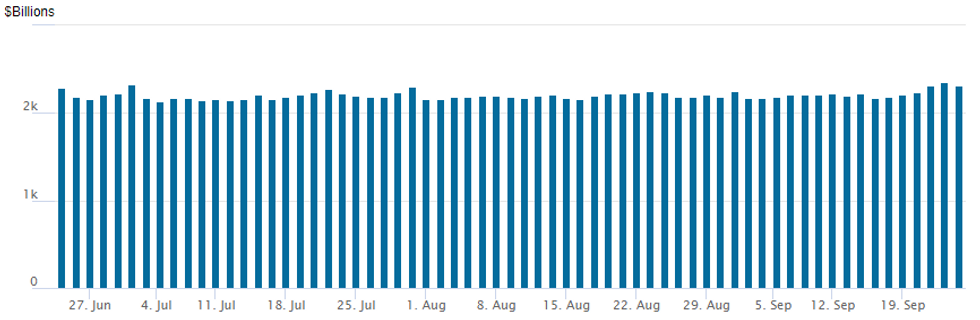

FED Reverse Repo Operation: Off Thu's Record High

NY Federal Reserve/MNI

NY Fed reverse repo usages recedes to $2,319.361B w/ 102 counterparties after climbing to new record high of $2,359.227B in the prior prior session (first new high since Thursday June 30: $2,329.743B).

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Much better option volumes Friday as underlying rates extended the week's lows (2YY tapped 4.2657% high) as markets continued to price in more rate hikes into year end. That said, option desks reported surge in upside call and call spread buying in 5- and 10Y Tsys options fading the sell-off as too far to fast.- SOFR Options:

- Block, 4,000 SFRX2 96.31 calls, 2.0

- Block, 5,000 SFRV2 95.93

- Block, 20,000 SFRZ2 96.00/96.25 call spds, 2.5 ref 95.625

- Block, 10,000 short Dec 95.25/95.75 put spds, 21.5 vs. 95.625/0.66%

- Block, 35,000 short Oct 95.75 puts, 24.0 vs 95.62/0.64% more on screen

- +15,000 short Mar 98.00/98.50 call spds, 1.25

- Block/screen 10,000 SFRZ2 96.00/96.25 call spds, 2.0

- Eurodollar Options:

- 55,000 Dec 99.37/99.50 put spds, 12.5 ref 95.265

- 10,000 Mar 95.00/95.50 2x1 put spds

- 15,000 Sep 95.00 puts vs. 12,000 Mar 95.75 puts

- Treasury Options:

- Total +20,000 TYX 110.5/111.5 put spds, 17-18

- 17,300 FVX 106/107 put spds, 19.5

- 3,000 TYX 114/114.5 call spds, 9 ref 112-16.5

- 3,100 TYZ 115.5 calls, 37 ref 112-17.5

- +10,000 TYX 114 calls, 40 - adds to +9k from 26-27 earlier

- +5,000 TYZ 117.5 calls, 16 ref 112-16.5

- +5,000 TYZ 118 calls, 13 ref 112-17.5

- +5,000 TYZ 120 calls, 6 ref 112-16

- +12,500 TUX2 103.75/104.37 call spds, 2 ref 102-23

- +9,000 TYX 114 calls, 26-27

- 5,000 TYZ 111 puts 114

- 4,000 FVV 107.75 calls, 2

- Block/screen, 14,000 FVX 107.25 puts, 33.5-34

- Block, 10,000 TYX 111.5 puts, 41

- 7,000 TYX 111/111.5 put spds

FOREX: Trends Extend, With GBP, EUR, CNH And Others Touching New Cycle Lows

- The persistent rally in the USD Index is extending through the London close, with the greenback hitting new cycle highs of 112.866.

- The move has been exacerbated by the protracted weakness in GBP (making up around 12% of the USD Index) following the UK mini budget earlier today. A number of sell-side analysts have revised lower their near-term forecasts for currency, with Citi now expected GBP/USD to trade in a range of $1.05-1.10, raising the risk of a "confidence crisis" in the currency. Similarly, JP Morgan write that the UK rate market's reaction today is a sign of a "broader loss of confidence in the government's approach".

- Support for GBP/USD has proved ineffective on today's sell-off, with markets reaching new multi-decade lows of 1.0897. This narrows the gap with levels last seen in 1985 - with 1.0520 printed in February of that year.

- Friday's fiscal statement - marking the most significant wave of tax cuts in a generation - will cause considerable uncertainty for BoE rates policy, with SONIA futures falling sharply throughout the day and prompting BoE rate pricing to spike to an implied rate of near 5.50% for the August 2023 meeting.

- GBP/JPY also a notable mover given Thursday's BoJ intervention. The cross approaches support at 155.60 ahead of 155.17 - the 76.4% retracement for the March - June upleg.

FX: Expiries for Sep26 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700-20(E701mln), $0.9800(E594mln), $0.9900-10(E1.7bln), $1.0000-20(E563mln)

- USD/JPY: Y140.00($1.0bln)

- GBP/USD: $1.1500(Gbp513mln)

- AUD/USD: $0.6550(A$966mln)

- USD/CAD: C$1.3600($704mln)

Late Equity Roundup: Fresh Lows in Late Trade, Energy Still Weighing

Stock indexes continue to extend sell-off, SPX close to breaching mid-June low (3636.87) which would put focus on early Jan 2021 levels. Energy sector still weighing heavily on indexes, Materials and Consumer Discretionary distant second and third underperformers. Currently, SPX eminis trade - 96 (-2.55%) at 3677; DJIA -708.97 (-2.36%) at 29371.98; Nasdaq -287.7 (-2.6%) at 10781.06.

- S&P E-Minis have gone from weak to weaker, with the downside accelerating on the break of July support. Continued weakness here has confirmed a resumption of the bear cycle that started mid-August. The break lower strengthens bearish conditions and note that support at 3741.75, Jul 14 low, has been breached. This exposes critical support at 3657.00, Jun 17 low.

- SPX leading/lagging sectors: Health Care shares outperform Fri (-1.51%) lead by pharmaceuticals and biotech for second consecutive session, next up: Real Estate (-1.95%) and Utilities sectors (-2.04%). Laggers: Energy sector hammered (-7.22%) lead by oil shares as crude levels fell (WTI -5.07 at 78.43 - appr Jan'21 lows): Marathon (MRO) -11.08%, Halliburton (HAL) -9.92%, Hess (HE) -9.57%. Next up: Materials (-3.31%), Consumer Discretionary (-3.27%) autos weighing on the latter GM -5.70%, Ford -5.25%, Tesla -4.36%.

- Dow Industrials Leaders/Laggers: JNJ +0.41 at 166.62 Home Depot (HD) +0.46 at 269.60, Verizon (VZ) -0.54 at 39.39. Laggers: Goldman Sachs (GS) -13.30 at 299.62, Chevron (CVX) -9.94 at 144.95, Boeing (BA) -8.01 at 130.07.

E-MINI S&P (Z2): Nearing Critical Support

- RES 4: 4313.50 High Aug 18

- RES 3: 4234.25 High Aug 26

- RES 2: 4022.08/4175.00/47 50-day EMA / High Sep 13

- RES 1: 3936.25 High Sep 20

- PRICE: 3679.50 @ 17:33 BST Sep 23

- SUP 1: 3676.00 Low Sep 23

- SUP 2: 3657.00 Low Jun 17 and critical support

- SUP 3: 3600.00 Round number support

- SUP 4: 3558.97 1.382 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis have gone from weak to weaker, with the downside accelerating on the break of July support. Continued weakness here has confirmed a resumption of the bear cycle that started mid-August. The break lower strengthens bearish conditions and note that support at 3741.75, Jul 14 low, has been breached. This exposes critical support at 3657.00, Jun 17 low. On the upside, initial firm resistance has been defined at 3936.25, the Sep 20 high.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/09/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 26/09/2022 | 0700/0900 |  | EU | ECB de Guindos Speaks with AED in Madrid | |

| 26/09/2022 | 0730/0930 |  | EU | ECB Panetta Speaks at Bundesbank | |

| 26/09/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 26/09/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 26/09/2022 | 1300/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 26/09/2022 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 26/09/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/09/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 26/09/2022 | 1600/1700 |  | UK | BOE Tenreyro Speaks on Climate Change | |

| 26/09/2022 | 1630/1230 |  | US | Dallas Fed's Lorie Logan | |

| 26/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/09/2022 | 2000/1600 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.