-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Bear Steepening In Hawkish Cycle

HIGHLIGHTS

- UK Opposition Leader Kier Starmer: Govt Has Lost Control Of British Economy

- BOE Economist Pill: BETTER TO RUN POLICY WITH LOW-FREQUENCY APPROACH

- HABECK: EXTENDING GERMAN NUCLEAR POWER HAS BECOME MORE LIKELY - bbg

- BRAZIL: Lula Maintains Polling Lead Over Bolsonaro Ahead Of Oct 2 Election

- US:INDIA: Jaishankar: "I'm Very Bullish About The US-India Relationship"

Key links: MNI INTERVIEW: Too Soon To Say Inflation Peaked / US Treasury Auction Calendar / Powell-Policy Normalization / MNI INTERVIEW: BOC To Follow Through Even If Recession

US Tsys: Bond Rout Continues, 2s10s Curve 24bp Off Last Wk Lows

Tsys quickly reversed overnight gains after the NY open, bonds extending lows through midday, yield curves bear steepened with 2s outperforming: 2s10s +9.728 at -33.191 -- back to mid September levels after the spd extended inversion to new low of -57.943 pre-FOMC.

- Tsy 2YY currently -.0371 at 4.3035%, 30YY +.1130 at 3.8530%. while 10YY +.0513 at 3.9758 -- up appr 235bp already this year - more than any full year since 1962!

- Tsy futures initially scaled back gains following in-line to better than expected Durable Goods data (-0.2% vs. -0.3% est; ex-trans in line at 0.2%), Cap Goods +1.3% vs. +0.2% est.

- Surge in Aug new home sales (+28.8% to .685M SAAR), coupled with rise in consumer confidence to 108.0 vs. 104.6 est. spurred renewed selling in 5s-30s. Technical selling in TYZ2 as futures drop through first support of 111-00+ (Low Sep 26) to 110-27, next key support: 110-13+ 3.0% 10-dma envelope to 110.

- Session's Fed speak didn't really cover any new ground, while the BoE lead economist Pill comments did little to calm markets as short end Gilts priced in additional 250bp in hikes by year end! GBP knocked lower in early afternoon trade to 1.0687 -.0002.

- Tsy futures extended session lows after $44B 5Y note auction (91282CFM8) tailed: 4.228% high yield vs. 4.202% WI; 2.27x bid-to-cover vs. 2.30x last month.

- The 2-Yr yield is down 3.5bps at 4.3056%, 5-Yr is up 1.5bps at 4.2064%, 10-Yr is up 3.3bps at 3.9573%, and 30-Yr is up 8.3bps at 3.8225%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00071 to 3.06400% (-0.00543/wk)

- 1M +0.00743 to 3.12057% (+0.04028/wk)

- 3M +0.00100 to 3.64186% (+0.01343/wk) * / **

- 6M -0.03772 to 4.20814% (+0.00685wk)

- 12M -0.05329 to 4.85171% (+0.01685/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.64186% on 9/27/22

- Daily Effective Fed Funds Rate: 3.08% volume: $111B

- Daily Overnight Bank Funding Rate: 3.07% volume: $288B

- Secured Overnight Financing Rate (SOFR): 2.99%, $976B

- Broad General Collateral Rate (BGCR): 2.99%, $384B

- Tri-Party General Collateral Rate (TGCR): 2.98%, $361B

- (rate, volume levels reflect prior session)

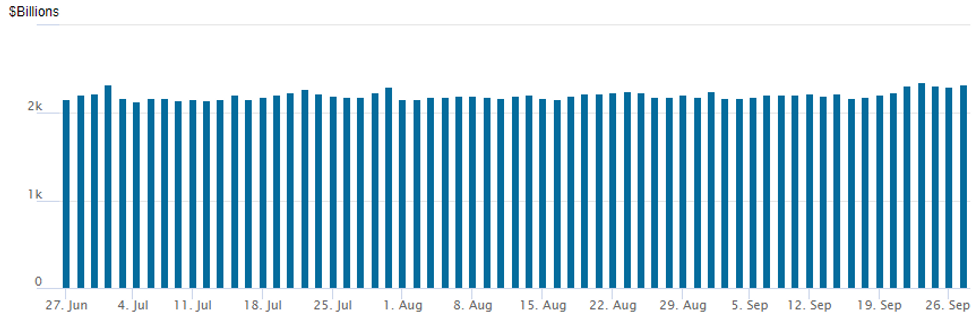

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,327.111B w/ 100 counterparties vs. $2,299.011B in the prior session.

Off last week's record high of $2,359.227B marked Thursday, September 22.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Tuesday's larger trading volumes included multiple put spread unwinds, accts consolidating downside positions in the hopes the heavy selling in underlying futures has run it's course. Short end Eurodollar and Tsy 2Y futures outperformed on multiple factors including new steepeners, swap-tied receivers/payer unwinds, outright short covering as rate hike pricing cools.- SOFR Options:

- Block, 10,000 SFRH3 96.00 calls, 17.5 ref 95.475

- -5,000 SFRH3 96.00 calls, 15.0 ref 95.44

- -25,000 short Nov 95.37 puts, 14.5 vs. 95.68/0.30%

- +4,000 SFRF3 94.62/95.00 put spds, 6.5

- Block 4,000 short Oct 95.00/95.25 put spds, 2.0

- 20,000 SFRZ2 95.00/95.37 put spds

- 5,000 short Oct 95.75/95.87/95.93 call flys

- Eurodollar Options

- +15,000 Green Mar 98.00 calls, 3.0 vs. 95.905/0.05%

- 3,000 EDZ2 95.75 puts, 52.5 ref 95.28

- Treasury Options:

- Block, 10,000 TYX 110.25/111.5 put spds, 33 ref 111-07.5

- 3,750 TYX2 109.5/110.75 put spds 12 over 113.25 calls ref 111-07

- 2,000 FVX 105/106/107 put flys

- Block -10,000 FVX2 106.25/107.25 put spds, 37.5

- 5,000 TYX2 111/111.5/112 call flys

- -20,000 TYX2 110.5/111.5 put spds, 29 ref 111-03.5

- -20,000 FVX2 106/107 put spds, 26 ref 106-26

- Block, 10,000 TYX 109/110 put spds 18 ref 111-00.5

- -5,000 TYX 113/114 call spds, 12

- -10,000 TYX 114 calls, 15, total volume near 30k

- over 5,000 USX 120/125 put spds

Late Equity Roundup: Utilities, Consumer Staples Continue to Weigh

Stock indexes trade mildly mixed after the FI close, Dow components lagging, SPX near steady, Nasdaq making modest gains. Utilities and Consumer Staples continue to weigh on SPX, currently trading -7.25 (-0.18%) at 362.75; DJIA - 103.91 (-0.36%) at 29153.51; Nasdaq +20 (0.2%) at 10819.8.

- SPX leading/lagging sectors: Energy sector (+1.57%) finally rebounds from heavy selling last few sessions as crude trades higher (WTI +1.85 at 78.56). Materials (+0.28%) and Consumer Discretionary (+0.24%) follow, bounce in autos sector leading the latter. Laggers: Consumer Staples (-1.59%), Utilities (-1.37%) w/ American Electric (AEP), Entergy (ETR), Edison Int (EIX) and Eversource Energy (WEC) between lower -$2.25-2.50 lower.

- Dow Industrials Leaders/Laggers: United Health (UNH) +1.77 at 510.13, Salesforce.Com (CRM) +1.58 at 147.90, Home Depot (HD) +1.44 at 268.02, Apple (APL) +1.06 at 151.83. Laggers: McDonalds (MCD) -6.05 at 237.71, Goldman Sachs (GS) -3.42 at 291.20, Visa (V) -2.28 at 178.27.

E-MINI S&P (Z2): Key Support Still Exposed

- RES 4: 4313.50 High Aug 18

- RES 3: 4234.25 High Aug 26

- RES 2: 3996.35/4175.00 50-day EMA / High Sep 13

- RES 1: 3783.25/3936.25 High Sep 23 / 20

- PRICE: 3712.50 @ 14:11 BST Sep 27

- SUP 1: 3657.00 Low Jun 17 and a key M/T bear trigger

- SUP 2: 3600.00 Round number support

- SUP 3: 3558.97 1.382 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 4: 3506.38 1.50proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis trend conditions remain bearish following last week’s extension lower and break of the July support. The move lower strengthens bearish conditions and attention is on key support at 3657.00, Jun 17 low and an important medium-term bear trigger. A break would confirm a resumption of the broader downtrend. On the upside, initial firm resistance has been defined at 3936.25, Sep 20 high. Short-term gains are considered corrective.

COMMODITIES: Hurricane Ian Intensifies, Energy Security Fears In Focus

- Crude oil unwinds yesterday’s slide with a strong gain today despite sliding equities, as energy security fears rise to the fore after suspected sabotage of Nord Stream gas pipelines (with Gazprom PJSC warning the last remaining route to western Europe is at risk) plus 11% of Gulf oil production shut in by an intensifying Hurricane Ian.

- WTI is +2.6% at $78.67, going against the bear cycle and still with some way to resistance at $84.77 (20-day EMA), whilst support is eyed at $76.11 (1.618 proj of the Jul 29, Aug 16-30 price swing)

- Brent is +2.7% at $86.31, pushing back on the bearish extension with resistance seen at $91.36 (20-day EMA) and support at $83.65 (Sep 26 low).

- Gold is +0.5% at $1630.52, higher against a southbound trend with support at $1621.2 (Sep 26 low) and resistance at the recent breakout level of $1654.0 (Sep 21 low).

- HH natural gas -1.9% but TTF +7.1% on the aforementioned energy security fears.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/09/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 27/09/2022 | 0035/2035 |  | US | San Francisco Fed's Mary Daly | |

| 28/09/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 28/09/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/09/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/09/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 28/09/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/09/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/09/2022 | 0715/0915 |  | EU | ECB Lagarde at Frankfurt Forum Discussion | |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/09/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/09/2022 | 0815/0915 |  | UK | BOE Cunliffe Keynote at AFME Conference | |

| 28/09/2022 | 0900/1100 | * |  | IT | Industrial Orders |

| 28/09/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 28/09/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/09/2022 | 1235/0835 |  | US | Atlanta Fed's Raphael Bostic | |

| 28/09/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 28/09/2022 | 1410/1010 |  | US | St. Louis Fed's James Bullard | |

| 28/09/2022 | 1415/1015 |  | US | Fed Chair Jerome Powell | |

| 28/09/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 28/09/2022 | 1500/1700 |  | EU | ECB Elderson Intro at Greens/EFA Event | |

| 28/09/2022 | 1500/1100 |  | US | Fed Governor Michelle Bowman | |

| 28/09/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 28/09/2022 | 1530/1130 |  | US | Richmond Fed's Tom Barkin | |

| 28/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/09/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/09/2022 | 1800/1400 |  | US | Chicago Fed's Charles Evans | |

| 28/09/2022 | 1800/1900 |  | UK | BOE Dhingra Chairs Panel at LSE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.