-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

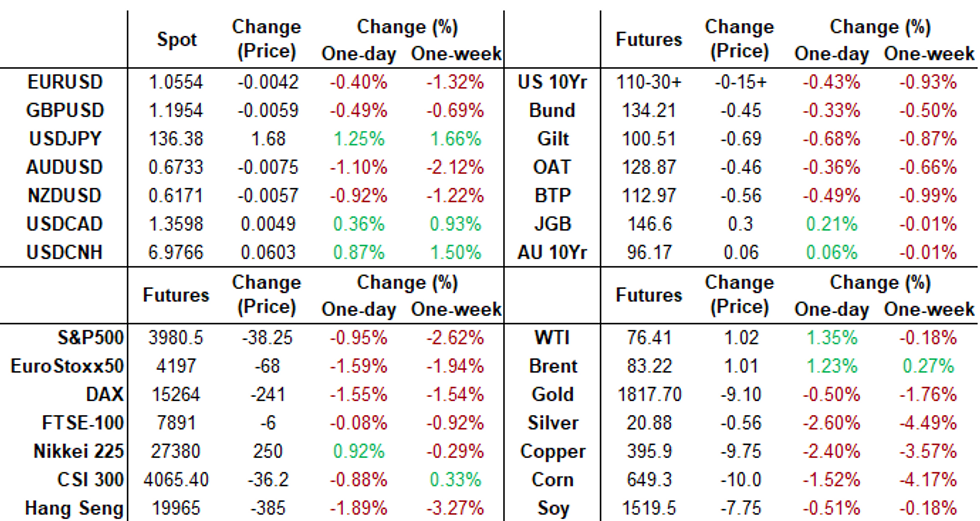

Free AccessMNI ASIA MARKETS ANALYSIS: 2YY Over 4.83% on Sticky Inflation

HIGHLIGHTS

- FED MESTER REPEATS SAW GOOD CASE FOR 50 BPS AT LAST MEETING, Bbg

- FED MESTER SAYS SHE FAVORS GETING RATES SOMEWHERE ABOVE 5%, Bbg

- BULLARD: SOFT LANDING POSSIBLE DUE TO FED INFLATION CREDIBILITY, bbg

- MNI GLOBAL POLITICAL RISK: Zelensky Says He Plans To Meet Chinese President Xi

- MNI UKRAINE: US Warns Of Ceasefire Calls; Zelenskyy Seeks Global South's Support

- MNI GERMANY: For Min Doubts Over China Peace Plan; Def Min Says 18 Tanks To Ukraine

- Wall Street Banks Are Cracking Down on AI-Powered ChatGPT, Bbg

US TSYS: Hot PCE Green Light For More Fed Hikes

Tsys near lows after the bell. Hot PCE read points to "more to do" by the Fed to reel in inflation, yield curves flatter but off lows as 30s races 2s to new contract lows: TUH3 new contract low of 101-17.88, 2YY hits 4.8364% - highest level since July 2007; USH3 133-20 low, 30YY tapped 3.9597% high.

- Tsys gapped lower as nominal personal spending was stronger than expected in Jan (1.8% vs 1.4) and incomes weaker (0.6% vs 1.0), with the savings rate rising further to 4.7% in Jan from 4% in Q4 and a low of 2.7% in June (albeit prone to sizeable revs). Stronger inflation meant that real spending came in as expected, bouncing strongly after yesterday's surprise downward revision with the 1.1% M/M the strongest since Mar'21.

- Jump in new home sales added to the FI sell-off, 7.2% M/M in Jan (cons 0.7) after an upward revised 7.2% M/M (initial 2.3), leaving sales at 670k (cons 620k) for the highest since March.

- Fed funds implied hike for Mar'23 at 31.0bp, May'23 cumulative 58.1bp (+1.9) to 5.164%, Jun'23 75.5bp (+3.0) to 5.338%, terminal at 5.40% in Aug'23/Sep'23, off first half high of 5.445%.

- Early Fed speak from Cleveland Fed Mester in line with previous, favoring getting rates somewhat above 5%, won't pre-judge next meeting size.

- Boston Fed President Susan Collins said Friday she sees the need for more rate increases amid high inflation and then likely holding there for an extended period of time.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00286 to 4.56171% (+0.00485/wk)

- 1M +0.01786 to 4.63486% (+0.04357/wk)

- 3M -0.00443 to 4.95343% (+0.03814/wk)*/**

- 6M -0.04186 to 5.23514% (-0.00786/wk)

- 12M -0.00315 to 5.63871% (-0.00415/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.95786% on 2/23/23

- Daily Effective Fed Funds Rate: 4.58% volume: $106B

- Daily Overnight Bank Funding Rate: 4.57% volume: $299B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.137T

- Broad General Collateral Rate (BGCR): 4.51%, $457B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $444B

- (rate, volume levels reflect prior session)

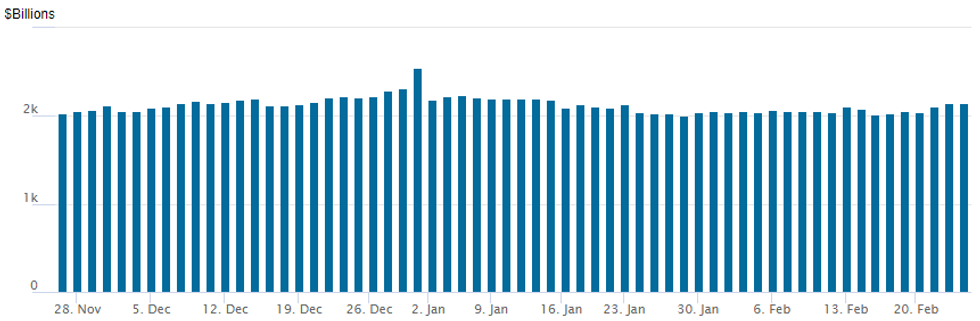

FED Reverse Repo Operation

NY Fed reverse repo usage slips to $2,142.141B w/ 104 counterparties vs. prior session's $2,147.417B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Friday's "hot" PCE data spurred continued interest in rate hike put insurance, particularly in SOFR options, salient trade includes:- SOFR Options:

- total +60,000 2QZ3 97.75/98.75 call spds, 7.0-7.5

- Block, 15,000 SFRZ3 94.12/94.37/94.62 put trees, 0.5 net 2-legs over

- Block, 52,000 OQM3 94.50/94.75 put spds, 3.75

- Block, 45,000 SFRZ3 94.25/94.75/95.87 broken call flys, 0.0

- Block, 20,000 SFRZ3 94.25/94.75/95.87

- Block, 25,000 SFRU 94.00/94.50 put spds, 14.5 vs. 94.575/0.30%

- Block, 30,000 SFRM3 94.50 puts, 5.5 vs. 94.64/0.30%

- Block, 3,000 OQM3 95.50/95.75/96.37 3x7x4 broken put flys, -137.0

- Block, 5,000 OQM3 95.75/2QM3 96.62 put spds, 0.5 net

- Block, 2,500 OQU3 95.25/95.75 put spds, 15.0 ref 96.055

- Block, 5,000 SFRH4 95.00/95.75/96.50 call flys, 15.0 ref 95.21

- Treasury Options:

- 6,000 TUH3 102.62 puts ref 101-18.75

- 5,000 FVH3 108.75 puts, ref 106-11.75

USD Re-Extends Push Above Historical Average In REER Terms

- The US dollar extended gains in real effective terms this week, rising 0.5% on a 5d/5d basis to move further above its 5- and 10-year averages at 6.6% and 11.4%, according to daily JPM data [scatter shows comparison of the two].

- Whilst it tops the G10 table for differences to these longer-term averages, AUD, NZD and GBP sit relatively higher compared to ranges over the 5-year period.

- CAD and NOK meanwhile have led declines on the week but JPY remains a clear standout at -16% below its 5-year average.

Late Equity Roundup: Paring Losses

Stocks remain weaker ahead the FI close, SPX near lowest levels since January 20 tapped in the first (ESH3 3951.75) after hot PCE data sapped risk appetite on sticky inflation. SPX eminis are drawing late short covering last few minutes, currently trading -37 (-0.92%) at 3981.25; DJIA -262.3 (-0.79%) at 32891.28; Nasdaq -182.2 (-1.6%) at 11407.77.

- SPX leading/lagging sectors: Still weaker but off lows: Information Technology (-1.84%) and Consumer Discretionary (-1.69%) and Real Estate (-220%) sectors lead the sell-off. IT weighed by Autodesk (ADSK) -12.7% after missing earnings est late Thu, Adobe -7.47%; auto makers weighing on consumer discretionary: Tesla -3.43%, F -1.78%, GM -0.76%.

- Leaders: Materials (+0.37%) buoyed by industrial gas shares (LIN +3.98%, APD +0.5%), Financials (+0.11%) and Utilities (+0.7%) with banks helping the former (Zion +1.10%, JPM +0.70%, CMA +0.39%).

- Dow Industrials Leaders/Laggers: JPM +1.06 at 140.73, DOW +0.19 at 57.38, Verizon (VZ) steady at 38.53. Laggers: Boeing (BA) -8.86 at 199.27, Microsoft (MSFT) -6.26 at 248.51, United Health (UNH) -4.20 at 487.49.

- Earnings cycle starts to wind down next week, Occidental Petroleum after Mon's close (OXY 1.79 est), AutoZone (AZO $21.75 est) and Target (TGT $1.47 est) early Tuesday

COMMODITIES: Oil Grinds Out Recovery But Only Just Up On The Week

- Crude oil has seen an impressive intraday recovery having earlier slid with risk assets on the stronger than expected US PCE print and the ripple effect it had on rate expectations. The recovery however only leaves both WTI and Brent little changed on the week after a mixed week with fluctuating demand expectations.

- Pioneer CEO Scott Sheffield forecasts crude prices will reach 90$/bbl over the summer and 100$/bbl by the end of the year due to rising oil demand from China and a lack of supply growth.

- WTI is +1.5% at $76.49, further off support at $73.80 (Feb 23 low) but still below resistance at $80.62 (Feb 13 high).

- Brent is +1.3% at $83.25, between support at $80.40 (Feb 23 low) and resistance at $86.95 (Feb 14 high).

- Gold is -0.5% at $1812.53 against a backdrop of renewed USD strength. A session low of $1809.09 sets initial resistance above the $1800.1 2.0% 10-dma envelope.

- Weekly moves: WTI +0.2%, Brent +0.3%, Gold -1.6%, US nat gas +2.6%, EU TTF nat gas +4%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/02/2023 | 0030/1130 |  | AU | Business Indicators | |

| 27/02/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 27/02/2023 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/02/2023 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/02/2023 | 0900/1000 | ** |  | EU | M3 |

| 27/02/2023 | 0900/0900 |  | UK | BOE Broadbent Opens BEAR Research Conference | |

| 27/02/2023 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 27/02/2023 | 1330/0830 | * |  | CA | Current account |

| 27/02/2023 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 27/02/2023 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 27/02/2023 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 27/02/2023 | 1530/1030 |  | US | Fed Governor Philip Jefferson | |

| 27/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 27/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 27/02/2023 | 1700/1800 |  | EU | ECB Lane Lecture at Goethe University Frankfurt |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.