-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY177.8 Bln via OMO Wednesday

MNI ASIA MARKETS ANALYSIS: Adieu 2022

HIGHLIGHTS

- PUTIN: AIM TO STRENGTHEN MILITARY COOPERATION WITH CHINA, Bbg

- PUTIN: RUSSIA'S TRADE TURNOVER WITH CHINA TO RISE 25% IN 2022, Bbg

- ITAR-TASS: China endorses Russia’s stance, ready for peaceful solution to Ukraine crisis

- RUSSIAN FINANCE MINISTRY SAYS PLANS TO SELL OFZ BONDS WORTH 800 BLN RBLS IN Q1, IFX/Reuters

Key links: MNI: Chicago Business Barometer™ Improved to 44.9 in December / MNI EGB Issuance, Redemption and Cash Flow Matrix - W/C Jan 2 / GLOBAL WEEK AHEAD: Eyes on Eurozone Prelim CPIs

US TSYS: Heading Into Year End: Adieu 2022

Tsy futures hold weaker across the board, near midmorning lows in the last hour of trade for 2022. Yield curves running steeper as long end looks to extend lows following better than expected Chicago PMI data: 44.9 vs. 40.0 est (37.2 prior) spurred better selling in long end earlier. 30YY tapped 3.9854% high, 2s10s curve climbed to -52.612 high compared to -42.072 on Wednesday.

- This month’s recovery broke a three-month streak of falls, yet the index remained contractive for a fourth consecutive month.

- The majority of sub-indexes improved over the month, led by Order Backlogs and New Orders whilst upticks in Production and Supplier Deliveries were more muted. Inventories, Employment and Prices Paid all weakened and only Order Backlogs, Supplier Deliveries and Prices Paid were above 50.

- Light holiday volumes (USH3<160k; TYH<600k) ahead the early close: FI/FX trading floor closes at 1300ET, cash Tsys close 1 hour later at 1400ET, while GLOBEX closes at 1700ET. Markets closed Monday. LINK

- Aside from month/year end portfolio rebalancing, focus on next week's data: FOMC meeting minutes for December to be release Wednesday at 1400ET.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00614 to 4.31800% (+0.00129/wk)

- 1M +0.02286 to 4.39157% (+0.00471/wk)

- 3M +0.01343 to 4.76729% (+0.04176/wk)*/**

- 6M +0.00129 to 5.13886% (-0.01428/wk)

- 12M +0.03957 to 5.48214% (+0.03828/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 4.33% volume: $94B

- Daily Overnight Bank Funding Rate: 4.32% volume: $249B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.037T

- Broad General Collateral Rate (BGCR): 4.26%, $380B

- Tri-Party General Collateral Rate (TGCR): 4.26%, $366B

- (rate, volume levels reflect prior session)

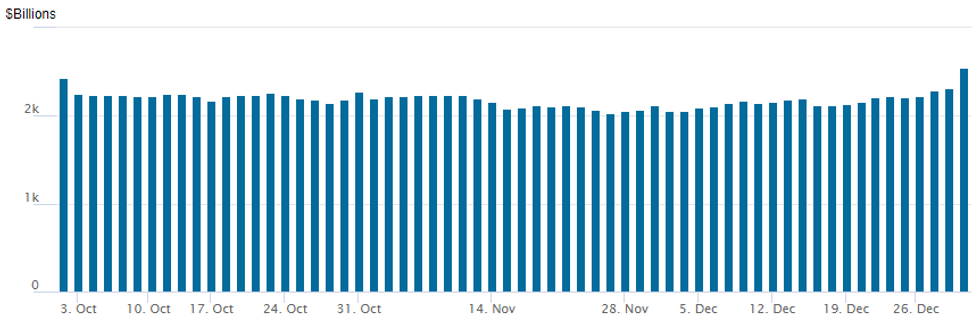

FED Reverse Repo Operation: New All-Time High

NY Federal Reserve/MNI

NY Fed reverse repo usage surges to new all-time high of $2,553.716B w/ 113 counterparties vs. $2,308.319B in the prior session. Prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

- SOFR Options:

- -2,500 SFRZ3 95.50 straddles, 100.0

- 4,700 SFRU3 94.25/94.75/95.25/95.75 put condors ref 95.175

- 1,000 SFRH3 95.25/95.50 1x2 call spds ref 95.075

- Block, 3,000 SFRH3 94.93/95.06/95.18/95.31 put condors, 5.0 net ref 95.09

- 1,000 OQG3 96.00/96.50 call spds ref 95.86

- Eurodollar Options:

- 2,000 EDM3 94.75 puts, 19.0 ref 94.855

- Treasury Options:

- -12,500 FVG 107.5/108 put spds, 15.5 ref 107-23.25 to -23.75

- 1,300 USH 119/122 put spds, 12 ref 124-22

- 3,700 wk2 TY 110.5 puts, 16 ref 112-02.5

- 1,000 TYH 113/114/114.5 broken call flys, 15 ref 112-00.5

- 1,000 TYG 112/112.75/113.25 broken call trees ref 111-30

- -15,000 FVG 106/106.75/107/107.75 put condors, 9 vs. 107-26/0.08%

Late Equity Roundup

Inside range for weaker stock indexes in late trade, Materials and Real Estate sectors underperforming. SPX eminis currently trade -29 (-0.75%) at 3843; DJIA -205.27 (-0.62%) at 33018.16; Nasdaq -91.2 (-0.9%) at 10388.05.

- SPX leading/lagging sectors: Materials (-1.00%) and Real Estate (-0.92%) edged past earlier underperformers: IT and Communication Services, metals and mining shares weighing: FTX -1.45%, NUE -1.22%, NEM -0.91%. Meanwhile specialized real-estate investment trusts (REITS) weighed on Real Estate shares.

- Leaders: Energy (+0.48%), Financials (-0.50%) and Industrials (-0.72%), energy sector making gains for second consecutive session with equipment and services outperforming.

- Dow Industrials Leaders/Laggers: Chevron (CVA) +0.88 at 179.20, JPM +0.75 at 133.97, Boeing (BA) +0.68 at 189.59. Laggers: Home Depot (HD) -4.74 at 315.67, Amgen (AMGN) -3.07 at 260.09, McDonalds (MCD) -2.95 at 262.98.

E-MINI S&P (H3): Bearish Trend Outlook

- RES 4: 4250.00 High Aug 26

- RES 3: 4194.25 High Sep 13 and a key resistance

- RES 2: 4043.00/4180.00 High Dec 15 / 13 and the bull trigger

- RES 1: 3928.91 50-day EMA and a key resistance

- PRICE: 3845.00 @ 1315ET Dec 30

- SUP 1: 3778.45 61.8% retracement of the Oct 13 - Dec 13 uptrend

- SUP 2: 3735.00 Low Nov 3

- SUP 3: 3670.00 76.4% retracement of the Oct 13 - Dec 13 uptrend

- SUP 4: 3735.00 Low Oct 21

S&P E-Minis trend signals remain bearish and recent low prints reinforce this condition. Short-term gains are considered corrective with resistance at 3928.91, the 50-day EMA. A clear break of this hurdle is required to suggest potential for a stronger recovery. On the downside, a break lower would confirm a resumption of the downtrend and open 3778.45, a Fibonacci retracement.

COMMODITIES

Brent trading near to close levels with optimism for Chinese demand next year supporting prices despite the current surge in covid cases.

- Global recession fears are limiting market upside while uncertainty remains over Russian oil output following the introduction of sanctions at the start of December. Russian Deputy Prime Minister Alexander Novak said last week that oil output may fall by 500kbpd to 700kbpd early next year.

- The latest Baker Hughes rig count data is due for release at 18:00BST. The oil rig count was last week at 622 having dipped from a peak of 627 earlier in December. The gas rig count has been holding relatively unchanged in recent weeks with last week showing a count of 155.

- The ICE and Nymex commitment of traders reports will be released after the close today at 18:30BST and 15:30EST. Both Brent and WTI net longs last week showed a small recovery after seeing a decline in previous weeks. Brent net longs have decline from a peak of 238k in November to just 100k last week.

Look Ahead

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/12/2022 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/12/2022 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 02/01/2023 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/01/2023 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/01/2023 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.