-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Avoiding Recession Chances Improve

HIGHLIGHTS

- WHITE HOUSE, MCCARTHY EYE DEBT LIMIT FOCUSED MEETING: PUNCHBOWL, Punchbowl

- FED BRAINARD: RECENT DATA SUGGESTS SLIGHTLY BETTER PROSPECTS TO AVOID RECESSION, Bbg

- FED BRAINARD: STARTING TO SEE IMPACT OF FED ACTION ON INFLATION, Bbg

- FED COLLINS REMAINS OPTIMISTIC ABOUT SOFT LANDING ODDS, Bbg

- BOE'S BAILEY SAYS UK INFLATION ON TRACK TO FALL SHARPLY, Bbg

US TSYS: Aligning for Soft Landing Scenario

Tsys weaker after the bell, off session lows after dovish tone from Fed Gov Brainard helped spur risk-off unwinds in rates and equities Thursday.- Brainard Offers Broadly Dovish Speech: Headlines that the Fed needs 'sufficiently' restrictive' policy for some time belied a broadly dovish speech from VC Brainard across a number of areas, including full effects of tightening only being felt ahead as some prior accommodation offset initial tightening.

- Earlier in the session, Boston Fed President Susan Collins said interest rates will likely need to rise in more measured steps to just above 5% and then stay at that level for some time in order to tame inflation that neared 40Y highs.

- Post-data volatility, Tsys had been rebounding off pre-open lows, experienced fast two-way post data (claims +190k vs. 214k est; Philly Fed -8.9 vs. -11.0 est; house starts 1.382M vs. 1.358M est) extended bounce briefly.

- Tsy futures bounced slightly after $17B 10Y TIPS sale awarded 1.220% high yld vs. WI 1.277%, 2.79x bid-to-cover best in appr 4 years.

- Short end metrics: Fed funds implied hike for Feb'23: 26.7bp, Mar'23 cumulative 45.1bp to 4.783%, May'23 54.5bp to 4.877%, terminal at 4.880% in Jun'23.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00100 to 4.30943% (-0.000428/wk)

- 1M +0.02272 to 4.50843% (+0.05400/wk)

- 3M +0.00758 to 4.81529% (+0.02286/wk)*/**

- 6M -0.02714 to 5.08086% (-0.02028/wk)

- 12M -0.05943 to 5.30471% (-0.05229/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $106B

- Daily Overnight Bank Funding Rate: 4.32% volume: $293B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.193T

- Broad General Collateral Rate (BGCR): 4.27%, $449B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $429B

- (rate, volume levels reflect prior session)

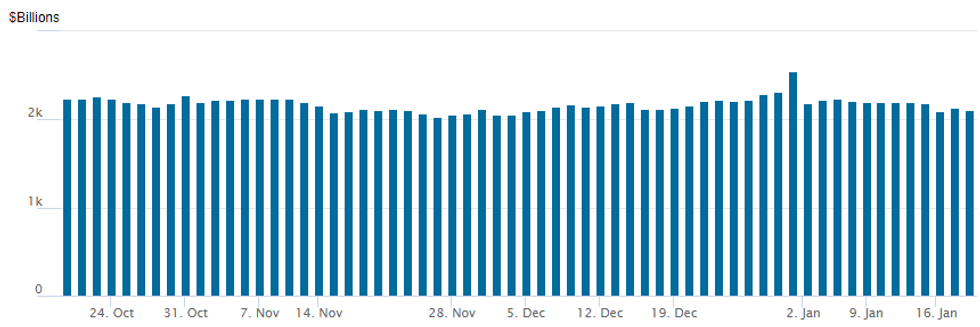

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,110.145B w/ 100 counterparties vs. prior session's $2.131.678B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Heavy spate of upside call and call spread trade in SOFR options Thursday, fading weaker underlying as traders built large policy-pivot positions to cover the next two Fed policy meetings.- SOFR Options:

- Block, 12,400 SFRH3 95.43 calls, 0.5 ref 95.16

- Block, 2,500 SFRU3 96.37/96.87 call spds, 2.5 ref 95.305

- Block, 3,000 SFRU3 95.50/95.62 call spds, 3.5 ref 95.305

- Block, 17,500 SFRG3 95.12/95.18/95.25 call flys, 2.0 ref 95.16

- Block, 2,500 SFRU3 94.81/94.93/95.12 2x3x1 broken put flys ref 95.32

- +8,000 SFRN3 94.68/94.75 put spds, .75

- Block, 3,500 SFRU3 96.25/96.75 call spds, 3.0 ref 95.32

- Block, 15,000 SFRG3 95.06/95.18/95.31 call flys, 6.5 ref 95.16

- -11,000 SFRG3 95.31 calls, 0.5 ref 95.15 -.155

- Block, 4,000 SFRK3 95.06/95.18/95.37 call flys, 1.0 vs. 95.14

- 61,000 SFRM3 95.00/95.12/95.25/95.37 call condors, 3.5

- Block, total 12,000 SFRH4 95.00/96.00 put spds, 25.0 ref 96.325 - .33

- +15,000 SFRJ3 95.25/95.43 1x2 call spds, 1.0 ref 95.155

- +20,800 SFRH3 95.12/95.18/95.25/95.37 call condors ref 95.175 (expire Mar 10) - adds to 5,000 Blocked earlier at 1.5, covers Feb FOMC:

- +9,000 SFRJ3 95.31/95.43/95.56 call flys ref 95.175 (expire Apr 14) covers Feb and Mar FOMC:

- (Note on call condor, on Wednesday appr +25,000 SFRJ3 95.06/95.12/95.25/95.37 broken call condors funded via sale of SFRJ3 94.87/94.93 put spds, 0.5 net db)

- 3,000 SFRK3 94.75/94.87/95.00 put flys, 2.5 vs. 95.13/0.05% at 0642:44ET

- 3,100 OQM3 97.00/97.25/97.50 call flys ref 96.86

- Block, 5,790 OQM3 95.75/95.87 put spds, 1.5 ref 96.88

- 11,000 SFRM 95.31/95.43/95.56 call flys ref 95.175

- Block, 2,450 SFRZ3 95.25/95.37 put spds, 4.5 vs. 95.70/0.05% at 0243:16ET

- Block, 2,000 SFRZ3 93.75/94.75/95.75 put flys, 25.0 ref 95.775 at 0212:56ET

- Treasury Options:

- 12,400 TYG3 116 calls, 18 ref 115-17

- 9,300 TYH 112.5 puts, 11 ref 115-18.5

- +2,600 TYJ3 110/112 put spds, 9 ref 116-08

- 4,500 TYM3 112 puts, 36 ref 116-09.5

- over 33,000 TYG3 113 puts, 1

- 5,000 USH3 122/124/126/128 put condors, 21 ref 131-30

- 4,000 USH3 128/136 strangles, 136 ref 131-31

- 12,000 TYG 113/114 2x1 put spds, 2 net ref 115-21.5

- Block, 10,000 FVH3 109 puts, 20.5 vs. 110-02.25/0.28%

- 1,500 TYG 116.25/117/117.75 call flys

EGBs-GILTS CASH CLOSE: Bunds Underperform As The ECB Strikes Back

European curves flattened with Bunds weakening and Gilts strengthening Thursday, as hawkish ECB commentary contrasted with a slightly softer tone from the BOE.

- ECB's Knot and, to a lesser extent, Lagarde pushed back against recent speculation that the Gov Council would downshift to 25bp hikes by March.

- The hawkish tone was heightened by December meeting accounts showing a "large number" of officials sought a 75bp hike (vs the actual 50bp).

- Comments on inflation by BOE Gov Bailey ("will fall quite rapidly this year") were a reiteration of the bank's November forecasts, but the subsequent headline saw UK rates briefly rally. Separately, the BOE's quarterly credit conditions survey also showed banks were the most pessimistic they'd been on household lending since 2007.

- Periphery spreads compressed slightly on the day.

- Attention early Friday is on UK retail sales data, while ECB's Lagarde speaks later in the morning.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.5bps at 2.528%, 5-Yr is up 6.3bps at 2.124%, 10-Yr is up 4.2bps at 2.065%, and 30-Yr is up 0.9bps at 1.998%.

- UK: The 2-Yr yield is down 4.1bps at 3.454%, 5-Yr is down 2.6bps at 3.237%, 10-Yr is down 3.9bps at 3.275%, and 30-Yr is down 6.1bps at 3.612%.

- Italian BTP spread down 2.8bps at 171bps / Spanish down 1.3bps at 92.7bps

EGB Options: Rolling Up German Shorts And Strikes

Thursday's Europe bond / rates options flow included:

- DUH3 106.30/106.40/106.50/106.60c condor, bought for 1.5 in 7k

- OEH3 119.25/120.25cs, bought for 31 in 25k (Rolling up short position).

- OEG3 117.75/117.25 put spread bought for 11 in 6.4k

- RXH3 136/134ps, bought for 26, 24 in 9k (rolling up strikes).

- ERM3 96.75/96.50/96.37p ladder vs 97.00c, bought the ladder for 1.25 in 10k

- ERJ3 96.625/96.50/96.375 put fly bought for 2 in 6.5k

FOREX: Mixed Performance Across G10, NZD Maintains Decline

- The modest bounce for equity indices late on Thursday kept the greenback trading with a bearish tone on Thursday. G10 currencies traded in a much more subdued manner to Thursday, with mixed performance across the board.

- The Euro trades on a slightly firmer footing which can be attributed to comments from ECB's Knot, who stated he sees "multiple" 50bps rate hikes from the bank, adding that markets may be underestimating the bank's policy path. EUR/USD spent the majority of the session back above the 1.08 handle and eyes Wednesday’s cycle high at 1.0887.

- Weaker Australian employment data has weighed on AUD, which despite paring a large portion of its early declines, still resides 0.35% lower on the day. Additionally, the unexpected resignation of the NZ PM Jacinda Ardern leaves NZD at the bottom of the G10 leaderboard, falling 0.62% on Thursday.

- Slightly more pronounced moves in the EM space where the negative tilt to risk sentiment across global markets has further weighed on the likes of ZAR (-0.98%) and MXN (0.56%), in the face of the weaker US dollar.

- UK and Canadian retail sales data will be published on Friday, as well as US existing home sales. There remains potential for commentary from central bankers and politicians in Davos. Most notably, ECB’s Lagarde will be participating in a panel discussion titled "Global Economic Outlook: Is this the End of an Era?"

FX: Expiries for Jan20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E611mln), $1.0650(E1.2bln), $1.0800(E1.0bln), $1.0900(E933mln), $1.0950(E500mln), $1.1000-05(E1.4bln)

- USD/JPY: Y125.00($708mln), Y129.75-00(E1.1bln), Y130.00($1.1bln), Y133.95-05($1.3bln)

- AUD/USD: $0.6900(A$3.7bln), $0.7200(A$2.3bln)

- USD/CAD: C$1.3450($828mln), C$1.3500($1.5bln)

- USD/CNY: Cny6.8000($2.6bln)

Late Equity Roundup: Off Lows On Dovish Fed Speak

Major indexes trading weaker but well off midday lows as dovish tones from Fed Gov Brainard spurred late round of risk-off unwinds. SPX eminis currently trades -13.75 (-0.35%) at 3931.5; DJIA -131 (-0.39%) at 33164.26; Nasdaq -55.2 (-0.5%) at 10901.13.

- SPX leading/lagging sectors: Energy (+1.48%) and Communication Services (+1.32%) continued to extend gains in late trade. Oil and gas names supported the former (APA, CTRA, KMI and OXY all up appr 2.5%; interactive media services the latter: Meta (+3.07%) and Google +2.59%.

- Laggers: Industrials (-1.48%) and Consumer Discretionary (-1.18%) sectors underperformed all session, latter weighed by auto makers (Ford, GM and Tesla all -1.0-1.5%).

- Dow Industrials Leaders/Laggers: Bouncing back from Wed's selling United Health (UNH) +8.43 at 484.67, Chevron (CVX) +2.46 at 179.69, Goldman Sachs bounced +2.42 at 351.51 Laggers: Home Depot (HD) -9.75 at 313.94, Caterpillar (CAT) -5.34 at 247.48 and MMM -3.20 at 119.55.

E-MINI S&P (H3): Trades Through The 50-Day EMA

- RES 4: 4194.25 High Sep 13

- RES 3: 4180.00 High Dec 13 and the bull trigger

- RES 2: 4090.75 High Dec 14

- RES 1: 4035.25 High Jan 18

- PRICE: 3931.50 @ 1526ET Jan 19

- SUP 1: 3906.75/3891.50 50-day EMA / Low Jan 10

- SUP 2: 3788.50/78.45 Low Dec 22 / 61.8% of Oct 13-Dec 13 uptrend

- SUP 3: 3735.00 Low Nov 3

- SUP 4: 3670.00 76.4% retracement of the Oct 13 - Dec 13 uptrend

S&P E-Minis traded lower Wednesday and a key short-term resistance has been defined at 4035.25, the Jan 17 high. Attention is on support at 3931.73, the 50-day EMA. This average has been breached and a continuation lower would highlight a potential bearish reversal and expose support at 3891.50., the Jan 10 low. On the upside, price needs to clear 4035.25 to cancel any developing bearish threat and confirm a resumption of recent bullish activity.

COMMODITIES: Crude Oil Bounces Despite US Inventory Build

- Crude oil prices have reversed yesterday’s, surprisingly so given and a much larger than expected inventory build in the US (8.4M vs -1.3M) along with at the margin a further fall in equities (currently almost reversed). The increase in cushing crude stocks was the most since Apr’20.

- JPMorgan raised its estimate for China’s oil demand growth, on track for consumption to hit 16mbpd with the reopening proceeding one quarter sooner and more rapidly than they first expected.

- WTI is +1.0% at $80.29 but off earlier highs of $81.18. Resistance remains at $82.38 (Jan 18 high). Most active strikes in the CLH3 are for $89/bbl calls.

- Brent is +1.4% at $86.15 off earlier highs of $86.85. Key short-term resistance remains at $87.85 (Jan 3 high).

- Gold is +1.3% at $1929.70 with particularly large gains compared to relatively little change in the USD and Treasury yields climbing. It’s close to session highs of $1930.44 and moving closer again to resistance at $1934.4 (Apr 25, 2022 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/01/2023 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 20/01/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 20/01/2023 | 0700/0800 | ** |  | DE | PPI |

| 20/01/2023 | 0745/0845 | * |  | FR | Retail Sales |

| 20/01/2023 | 1000/1100 |  | EU | ECB Lagarde Panellist at World Economic Forum | |

| 20/01/2023 | 1330/0830 | ** |  | CA | Retail Trade |

| 20/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/01/2023 | 1400/0900 |  | US | Philadelphia Fed's Pat Harker | |

| 20/01/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/01/2023 | 1530/1630 |  | EU | ECB Elderson Into at European Financial Services Roundtable | |

| 20/01/2023 | 1800/1300 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.