-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Core Retail Sales Miss

- US DATA: "Core" Sales Measures Beat, But Retail Flatlining Overall

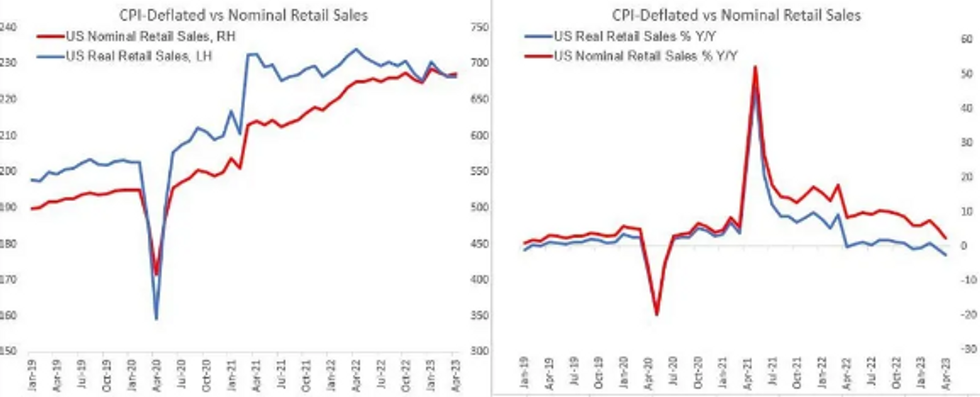

- US DATA: "Real" Retail Sales Growth Weakest Since Early Pandemic

US TSYS: No Debt Deal Yet

Treasury futures remain weaker but off midday lows (10Y at 114-30.5 -9, yield 5.5376 +.0358), curves flatter (2s10s -2.560 at -53.833) after maintaining steeper profile in the first half.

- Weaker stocks contributing (SPX Eminis 4128.0 low) to the general risk-off tone as markets fret over debt ceiling, Jake Sherman, Punchbowl News tweeting: "Speaker McCarthy says the debt limit deal MUST include something on work requirements. He said it’s a red line for him."

- President Biden meeting with congressional leaders (McCarthy, Schumer, McConnell and Jeffries) to discus the debt limit at this moment. Biden still expected to leave for G7 summit in Japan tomorrow.

- Additional factors weighing on rates: nominal retail sales levels remain well above early 2021 levels, but that appears to be largely the effect of inflation - and April's Y/Y nominal growth was also the slowest since the contractions of 2Q 2020.

- Corporate bond issuance, rate lock sales: $31B Pfizer 8pt jumbo (helping finance $43B Seagen deal) is the fourth largest on record.

- Fed-speak all generally in-line with recent comments, latest from Atlanta's Barkin: support for holding rates but remains open to hikes if data warrants.

OVERNIGHT DATA

- US APR RETAIL SALES +0.4%; EX-MOTOR VEH +0.4%

- US MAR RETAIL SALES REVISED -0.7%; EX-MV -0.5%

- US APR RET SALES EX GAS & MTR VEH & PARTS DEALERS +0.6% V MAR -0.5%

- US APR RET SALES EX MTR VEH & PARTS DEALERS +0.4% V US APR -0.5%

- US APR RET SALES EX AUTO, BLDG MATL & GAS +0.6% V MAR -0.2%

US DATA: Looking at at our series of "real" (headline CPI-deflated) Y/Y retail sales, April saw the biggest contraction since Jun 2020, at -3.4% Y/Y.

- This is a slightly unflattering comparison as Apr 2022 saw the highest level of real retail sales, and it's only a rough guide, but current levels are around where they were in 2Q 2021.

- Nominal retail sales levels remain well above early 2021 levels, but that appears to be largely the effect of inflation - and April's Y/Y nominal growth was also the slowest since the contractions of 2Q 2020.

US DATA: April retail sales came in below consensus on the headline figure (+0.4% M/M vs 0.8% expected) and was in-line on ex-autos (+0.4% vs +0.4% exp.), but there were upward revisions to March for both (respectively by 0.3pp to -0.7%, and by 0.3pp to -0.5%).

- Conversely, the more "core" categories were stronger than expected, but saw March downgraded: ex-auto and gas grew +0.6% M/M (vs +0.2% exp; March lowered 0.2pp to -0.5%), while the GDP-input control group was +0.7% M/M (vs +0.4% exp, March lowerd 0.1pp to -0.4%).

- Details by category were mixed: in the biggest 5 categories, motor vehicles strengthened, as did general and nonstore retailers; weaker were food/beverage, and food services/drinking places.

- The strength in the core readings, especially the congrol group, presents a better-than-expected picture of US consumption in April.

- But the broader picture suggests nominal retail sales continue to flatline (+2.4% Y/Y growth), and remain below the Jan 2023 peak. That's not entirely surprising given the ongoing shift toward services and away from goods consumption.

- US APR INDUSTRIAL PROD +0.5%; CAP UTIL 79.7%

- US MAR IP REV TO +0.0%; CAP UTIL REV 79.4%

- US APR MFG OUTPUT +1.0%

- US REDBOOK: MAY STORE SALES +1.5% V YR AGO MO

- US REDBOOK: STORE SALES +1.6% WK ENDED MAY 13 V YR AGO WK

- US MAR BUSINESS INVENTORIES -0.1%; SALES -1.1%

- US MAR RETAIL INVENTORIES +0.7%

- US NAHB HOUSING MARKET INDEX 50 IN MAY

- US NAHB MAY SINGLE FAMILY SALES INDEX 56; NEXT 6-MO 57

- CANADA APRIL CPI 4.4% YOY VS 4.1% FORECAST, MARCH 4.3%

- CPI YOY QUICKENS AS RENT AND MORTGAGE INTEREST COSTS ROSE

- CANADA APRIL CPI 0.7% MOM VS 0.5% FORECAST, MARCH 0.5%

- CANADA APRIL GASOLINE ROSE 6.3% MOM, FELL 7.7% YOY

- CORE TRIM SLOWS TO 4.2% IN APRIL FROM MARCH'S 4.4%

- CANADA MEDIAN CORE CPI SLOWS TO 4.2% FROM 4.5%

- CANADA APRIL CPI EX FOOD & ENERGY 0.5% MOM; 4.4% YOY

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 271.45 points (-0.81%) at 33077.43

- S&P E-Mini Future down 14.5 points (-0.35%) at 4135.25

- Nasdaq up 22 points (0.2%) at 12386.92

- US 10-Yr yield is up 4.3 bps at 3.5452%

- US Jun 10-Yr futures are down 10/32 at 114-29.5

- EURUSD down 0.0009 (-0.08%) at 1.0865

- USDJPY up 0.2 (0.15%) at 136.32

- WTI Crude Oil (front-month) down $0.38 (-0.53%) at $70.74

- Gold is down $25.87 (-1.28%) at $1990.66

- EuroStoxx 50 down 0.9 points (-0.02%) at 4315.51

- FTSE 100 down 26.62 points (-0.34%) at 7751.08

- German DAX down 19.31 points (-0.12%) at 15897.93

- French CAC 40 down 12.2 points (-0.16%) at 7406.01

TREASURY FUTURES CLOSE

- 3M10Y +0.774, -163.41 (L: -188.696 / H: -161.308)

- 2Y10Y -2.205, -53.478 (L: -55.025 / H: -49.516)

- 2Y30Y -4.172, -21.438 (L: -22.788 / H: -14.525)

- 5Y30Y -2.827, 34.161 (L: 33.506 / H: 39.952)

- Current futures levels:

- Jun 2-Yr futures down 5/32 at 103-0.125 (L: 102-30 / H: 103-07.75)

- Jun 5-Yr futures down 8.5/32 at 109-23.75 (L: 109-19.5 / H: 110-07.5)

- Jun 10-Yr futures down 10/32 at 114-29.5 (L: 114-23 / H: 115-18.5)

- Jun 30-Yr futures down 20/32 at 129-5 (L: 128-22 / H: 130-12)

- Jun Ultra futures down 24/32 at 137-0 (L: 136-08 / H: 138-17)

US 10YR FUTURE TECHS: (M3) Testing Support At The 50-Day EMA

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-01+ High Mar 24 and bull trigger

- RES 2: 117-00 High May 4

- RES 1: 115-18+/116-16 Intraday high / High May 11

- PRICE: 114-30+ @ 15:55 BST May 16

- SUP 1: 114-23 Intraday low

- SUP 2: 114-10 Low May 1

- SUP 3: 113-30+ Low Apr 19 and a key support

- SUP 4: 113-26 Low Mar 22

Treasury futures are trading lower again today and the contract has breached support at 115-01+, the May 9 low, and is testing the 50-day EMA, at 114-30+. A clear break of this EMA would signal scope for a deeper retracement and open 114-10 initially, May 1 low. For bulls, a reversal higher would refocus attention on resistance at 117-01+, the Mar 24 high. This is the bull trigger where a break would highlight an important bullish development.

SOFR FUTURES CLOSE

- Jun 23 -0.015 at 94.893

- Sep 23 -0.065 at 95.145

- Dec 23 -0.090 at 95.575

- Mar 24 -0.10 at 96.105

- Red Pack (Jun 24-Mar 25) -0.09 to -0.04

- Green Pack (Jun 25-Mar 26) -0.05 to -0.04

- Blue Pack (Jun 26-Mar 27) -0.05 to -0.045

- Gold Pack (Jun 27-Mar 28) -0.045 to -0.04

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00951 to 5.06642 (+.00665 total last wk)

- 3M +0.02287 to 5.08967 (+.02807 total last wk)

- 6M +0.04302 to 5.02849 (+.03996 total last wk)

- 12M +0.08027 to 4.68141 (+.04754 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 to 5.06229%

- 1M +0.00228 to 5.10771%

- 3M +0.01214 to 5.33043% */**

- 6M +0.04000 to 5.38314%

- 12M +0.04743 to 5.30343%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.34243% on 5/10/23

- Daily Effective Fed Funds Rate: 5.08% volume: $124B

- Daily Overnight Bank Funding Rate: 5.07% volume: $294B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.352T

- Broad General Collateral Rate (BGCR): 5.02%, $581B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $574B

- (rate, volume levels reflect prior session)

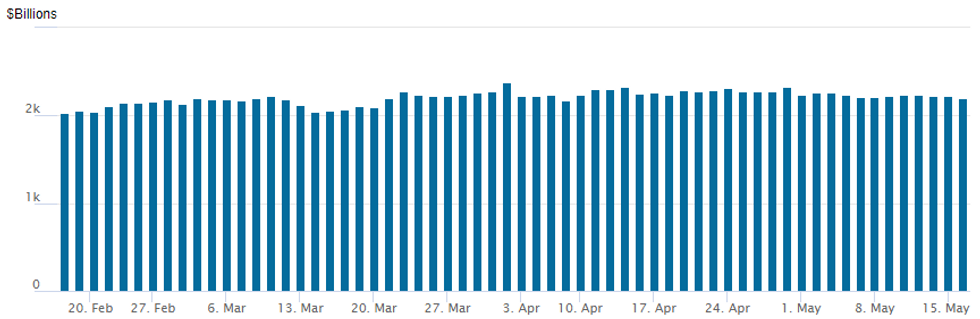

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,203.214B w/ 101 counterparties, compares to prior $2,220.927B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $31B Pfizer 8-Part Jumbo Launched

- Date $MM Issuer (Priced *, Launch #)

- 05/16 $31B #Pfizer 8pt jumbo: $3B 2Y +60, $3B 3Y +75, $4B 5Y +95, $3B 7Y +115, $5B 10Y +125, $3B 20Y +130, $6B 30Y +145, $4B 40Y +160

- 05/16 $6B *Saudi Arabia Sukuk $3B 6Y +80, $3B 10Y +100

- 05/16 $3B *CADES 5Y SOFR+45

- 05/16 $1.25B *JICA (Japan Int Coop Agcy) 5Y SOFR+76

- 05/16 $1B *COE Development Bank 3Y SOFR+24

- Today's $31B Pfizer 8-part debt issuance marks the forth largest on record, $1B over prior AbbVie and ATT/Discovery deals:

- Record Size Issuance

- 8/11/13 $49B Verizon

- 1/13/16 $46B AB InBev

- 9/04/18 $40B CVS 9-part

- 05/16/23 $31B Pfizer 8-part

- 11/12/19 $30B AbbVie jumbo 10-part

- 3/9/2022 $30B ATT/Discovery 11pt via Magallanes inc

EGBs-GILTS CASH CLOSE: Bund Weakness Extends

Gilts easily outperformed Bunds Tuesday after weaker-than-expected UK labour market data spurred a reconsideration of potential BoE hikes.

- The early bullish move reversed and both German and UK yields closed at/near session highs, but implied BoE hikes (and the UK short end) didn't quite recover lost ground - terminal cumulative pricing was pared by 4bp to 41bp, with June pulling back 2bp to 19bp.

- Other than UK jobs, European data again had little impact: a weaker-than-expected German ZEW figure was worth a few ticks higher in Bunds - but 10Y German yields finished higher for the 3rd consecutive session..

- Periphery spreads were little changed. Following Monday's outperformance, GGBs underperformed - though spreads vs Bunds tightened slightly intraday after Wed's GGB auction announcement with size up to E400mln.

- Indeed supply looms large Wednesday, with France selling up to E11bln in OAT, UK GBP3.75bln of Gilt, and Germany E4bln of Bund.

- Apart from that, final Eurozone CPI and multiple ECB speakers feature.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.3bps at 2.657%, 5-Yr is up 6bps at 2.306%, 10-Yr is up 4.4bps at 2.353%, and 30-Yr is up 3.7bps at 2.55%.

- UK: The 2-Yr yield is down 1.4bps at 3.812%, 5-Yr is unchanged at 3.628%, 10-Yr is down 0.1bps at 3.816%, and 30-Yr is up 0.7bps at 4.257%.

- Italian BTP spread down 0.9bps at 186.8bps / Greek up 0.5bps at 170.9bps

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 16/05/2023 | 2300/1900 |  | US | Chicago Fed's Austan Goolsbee | |

| 17/05/2023 | 2350/0850 | *** |  | JP | GDP |

| 17/05/2023 | 2350/0850 | *** |  | JP | Japan GDP 1st Estimate |

| 17/05/2023 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 17/05/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/05/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/05/2023 | 0900/1100 |  | EU | ECB Elderson Panels Beyond Growth Conference | |

| 17/05/2023 | 0930/1130 |  | EU | ECB Panetta Presentation on Digital Euro Kangaroo Group Event | |

| 17/05/2023 | 0950/1050 |  | UK | BOE Bailey Keynote Speech at British Chambers of Commerce | |

| 17/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/05/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/05/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 17/05/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 17/05/2023 | 1515/1715 |  | EU | ECB de Guindos Closes IESE Banking Meeting | |

| 17/05/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.