-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:CPI Inflation Pushes Rate Cut to Nov

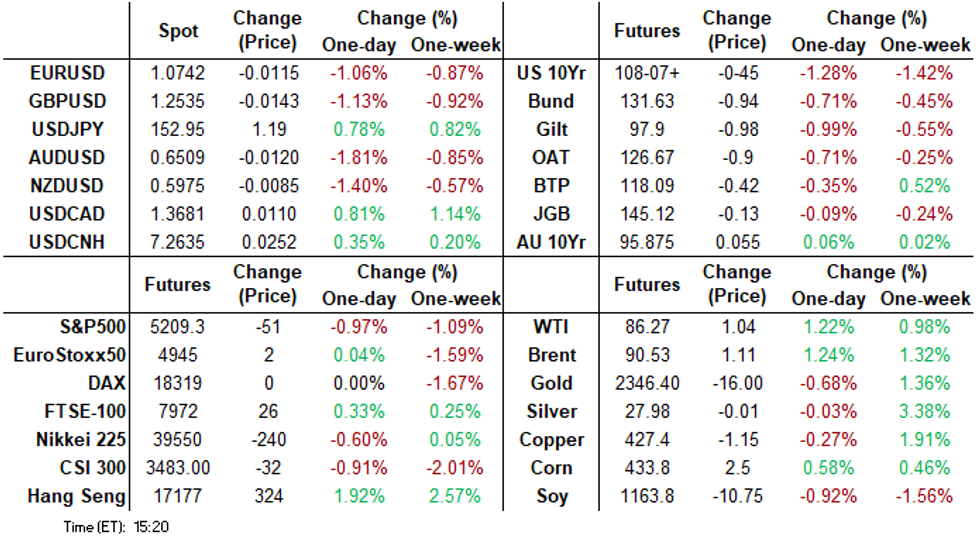

- Treasuries gapped lower early Wednesday following higher than expected March CPI inflation measures.

- Treasury curves bear flattened, projected rate cut pricing receded with first 25bp cut priced for November.

- Little to no react to March FOMC minutes, majority favor cutting QT pace by half "soon".

US TSYS CPI Inflation Data Weighs Heavily on Tsys, Rate Cut Pricing Evaporates

- Treasury futures gapped lower after this morning's higher than expected CPI inflation data kicked the day off: MoM (0.4% vs. 0.3% est), YoY (3.5% vs. 3.4% est); CPI Ex Food and Energy MoM (0.4% vs. 0.3% est), YoY (3.8% vs. 3.7% est).

- Jun'24 10Y futures fell to 108-05.5 low after a poorly received 10Y auction re-open tailed 3.3bp (largest since Dec'22: 4.560% high yield vs. 4.527% WI; bid-to-cover falls to 2.34x vs. 2.51x prior).

- Treasury futures drifting near late session lows, little reaction to March FOMC minutes where majority favor cutting QT pace by half "soon": Jun'24 10Y at 108-08.5 (-112) vs. 108-05.5 low, 10Y yield 4.5497% +.1880 vs. 4.5660% high. Curves still flatter but off lows: 2s10s -3.391 at -41.697, 5s30s inverted briefly is flatter by -10.082 at 2.015.

- Projected rate cut pricing remains well off morning levels: May 2024 at -2.6% vs. -4.7% earlier w/ cumulative -.6bp at 5.322%; June 2024 at -17.2% vs -55.1% earlier w/ cumulative rate cut -5bp vs -14.9bp at 5.279%. July'24 cumulative at -12.1bp vs. -24.4bp, Sep'24 cumulative -22.7bp vs. -41.2bp.

- Treasury futures briefly bounced off post auction lows after Bbg headline: "US SEES MISSILE STRIKE ON ISRAEL BY IRAN, PROXIES AS IMMINENT". Carry-over from late last Thursday when Tsys surged on heavy risk-off support on rumors that Iran would retaliate soon for an Israeli strike on an Iranian consulate in Syria earlier in the week.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00170 to 5.31895 (+0.00049/wk)

- 3M -0.00694 to 5.29892 (+0.00553/wk)

- 6M -0.01793 to 5.23137 (+0.01103/wk)

- 12M -0.02609 to 5.06156 (+0.03049/Wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.826T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $714B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $705B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $82B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $245B

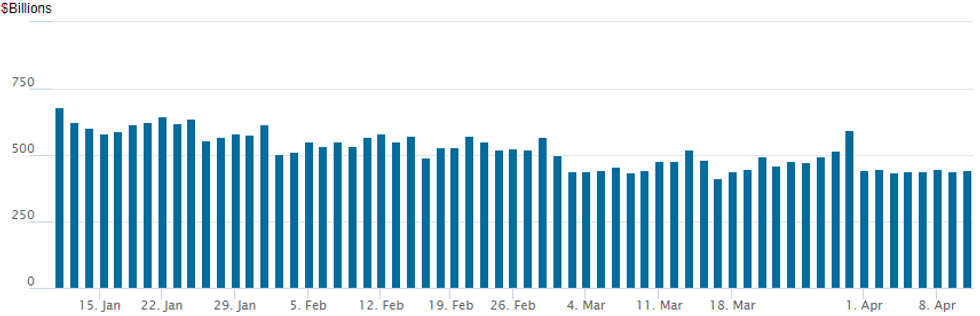

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $445.816B vs $441.792B on Tuesday. Compares to mid-March low of $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties at 67 vs. 73 yesterday, near April 4 2+ year low of 66.

SOFR/TEASURY OPTION SUMMARY

Heavy SOFR and Treasury option trade Wednesday as rates reacted negatively to a pick-up in inflation measured by March CPI data. Bearish on net, traders reported some large call position unwinds and two-way puts leaning toward better buys. Underlying futures broadly weaker, extended lows after 10Y Note auction tailed 3.3bp.Projected rate cut pricing remains well off morning levels: May 2024 at -2.6% vs. -4.7% earlier w/ cumulative -.6bp at 5.322%; June 2024 at -17.2% vs -55.1% earlier w/ cumulative rate cut -5bp vs -14.9bp at 5.279%. July'24 cumulative at -12.1bp vs. -24.4bp, Sep'24 cumulative -22.7bp vs. -41.2bp.

- SOFR Options:

- Block, 14,000 SFRZ4 95.00/95.25/95.50/95.62 broken put condor

- +10,000 SRM5 94.00/94.25 put spreads 3.25 ref 95.50

- Block, -19,230 SFRJ4 94.62/94.75 call spds, 9.5 vs. 94.735/0.70%

- Block, 50,000 SFRU4 94.93/95.06/95.50/95.62 call condors, 2.5 wings over ref 94.905

- Block, 40,000 SFRJ4 94.68/94.75 put spds, 2.5-2.75 vs. 94.735/0.55%

- Block, 5,000 2QM4 96.25/96.37/96.50 put trees, 29.5 2-legs over vs. 95.94/0.65%

- Block, 10,000 0QJ4 95.50 puts, 0.5 vs. 95.50/0.50%

- -5,000 SRZ4 94.87/95.12/95.56/95.81 Iron Condor 16.5 ref 95.11

- +5,000 2QK4 96.25 straddles, 42.5 vs. 95.90/0.70%

- -15,000 SRM4 94.75/94.87/95.00/95.12 call condors 2.75-2.25 ref 94.73

- -7,000 SRM4 94.87/94.93/95.00/95.06 call condors 1.5-1.25 ref 94.74

- +5,000 SRU4 94.62/94.87/94.93/95.06 put condor 1.0 vs. 95.085/0.07%

- -2,500 SRK4/SRM4 94.50/94.62/94.75/94.87 put condor strip, 10.5 ref 94.845

- +10,000 SFRZ4 96.00/97.00 call spds, 6.0

- 5,000 SFRJ4 94.87/94.93 call spds ref 94.835

- 12,000 2QU4 97.00/97.37 call spds ref 96.175

- 2,000 SFRM4 94.50/94.62 put spds ref 94.84

- 1,250 SFRZ4 96.50/97.25/98.50 2x3x1 broken call flys ref 95.335

- 3,000 SFRM4 94.75/94.87/95.06/95.18 call condors ref 94.84

- Block, 2,500 SFRH4 94.62/95.12 put spds, 12.0 vs. 95.54/0.15%

- Block, 4,000 0QK4 96.43/96.62 call spds, 1.0 ref 95.75

- Treasury Options:

- 30,000 FVM4 105.5 puts, 38.5 ref 105-12.75

- 5,000 FVK4 105.5/106.5 2x1 put spds, 25 ref 105-15

- -10,000 TYM4 107 puts, 23-22, total volume over 21,000

- 2,000 TYM4 106/107 put spds, 6 ref 109-23

- 3,500 TYM4 107.5 puts, 16 ref 109-21.5

- 2,000 FVK4 107 calls ref 106-08.5

EGBs-GILTS CASH CLOSE: US CPI Bear Flattens UK And German Curves

Core European FI sold off sharply Wednesday after a third successive stronger-than-expected US inflation report.

- The UK and German curves bear flattened with notable sell-offs in the short-end/belly as near-term rate cuts were priced out. Gilts underperformed Bunds.

- Thursday's highlight is the ECB meeting - while there is no expectation of a shift in policy, communications pointing to a June cut will be closely eyed, especially as US inflation data appears to be pushing that prospect further away for the Fed.

- Just 79bp of 2024 ECB rate cuts remain priced (10bp less than pre-release), with June no longer a "sure thing" (around 84% vs nearly 100% earlier this week).

- The BoE equivalent rose 9bp post CPI but that move continued into the close, with just 57bp of 2024 reductions now priced in 2024 - vs 73bp prior.

- 2Y UK yields quickly rose nearly 8bp on the CPI data, with the selloff continuing into the close with a 14bp rise on the day.

- While periphery EGB spreads initially widened on the CPI release, they recovered as equities bounce and closed tighter to Bunds.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.8bps at 2.966%, 5-Yr is up 7.6bps at 2.461%, 10-Yr is up 6.4bps at 2.435%, and 30-Yr is up 3.9bps at 2.555%.

- UK: The 2-Yr yield is up 14.2bps at 4.347%, 5-Yr is up 14.3bps at 4.052%, 10-Yr is up 11.9bps at 4.148%, and 30-Yr is up 9.2bps at 4.62%.

- Italian BTP spread down 0.8bps at 137.2bps / Spanish down 0.4bps at 80.8bps

EGB Options: Relatively Quiet Session Pre-ECB

Wednesday's Europe rates/bond options flow included:

- ERZ4 96.87/97.12/97.50c fly, bought for 2.5 in 2.5k

- ERM4 96.12p sold at half in 10k

FOREX Greenback Soars On Hot Inflation Data, Sharp AUDUSD Reversal Lower

- Higher-than-expected US CPI figures sparked a fresh bout of USD strength, largely reflective of the 20bp move higher for the front-end of the treasury curve. Notably, USDJPY breached the 152.00 level and saw solid follow through above the crucial resistance, although rising fears of any Japanese intervention may be limiting the momentum of the move, with the pair currently up 0.75% at typing.

- EURUSD slumped 1.14% to 1.0740 and in the process has cleared initial support at 1.0791, the Apr 5 low. The break lower reinstates a short-term bearish threat and signals the end of the recent recovery between Apr 2 - 9. Short-term focus turns to 1.0725, the Apr 2 low, ahead of the key support at 1.0695, the Feb 14 low and bear trigger.

- With tomorrow’s ECB decision and press conference, it is worth highlighting some elevated levels of FX option expiries, notably $1.0700(E2.0bln) and $1.0800-15(E5.7bln).

- Other G10 currencies have experienced even sharper weakness against the dollar amid more pessimistic risk sentiment across global markets. This dynamic weighed heavily on antipodeans with AUDUSD sinking 1.90% and has erased the majority of the past week’s gains in the process.

- The sharp AUDUSD sell-off signals the end of the recent climb and reinstates a bearish threat. A continuation lower would signal scope for a test of support at 0.6478, the Mar 5 low. Clearance of this level would expose the bear trigger at 0.6443, the Feb 13 low.

- On Thursday, the ECB decision will be in focus. Given the lack of material new information since the last policy meeting, and with the ECB previously steering markets towards a rate cut in June, policy will remain on hold at the April meeting. In the US, key PCE components have raised the stakes for tomorrow's PPI, due at 1330BST/0830ET.

FX Expiries for Apr11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E2.0bln), $1.0750(E1.0bln), $1.0775-85(E900mln), $1.0800-15(E5.7bln), $1.0850-65(E2.5bln), $1.0925-40(E2.7bln), $1.0945-50(E2.3bln)

- USD/JPY: Y148.80($1.3bln), Y150.00($674mln), Y151.00-20($2.8bln), Y152.00($1.9bln), Y152.50-55($836mln), Y152.88-00($675mln), Y155.00($859mln)

- AUD/USD: $0.6475-85(A$954mln)

- NZD/USD: $0.5955(N$1.2bln)

- USD/CAD: C$1.3540-60($1.2bln)

- USD/CNY: Cny7.1685($1.0bln)

Late Equities Roundup: Hugging Lows, Oil & Gas Bounce on Geopol Risk

- Stocks remain near lows after gapping lower on this morning's higher than expected CPI inflation data squelched rate cut hopes over the next few Fed meetings. Currently, DJIA is down 559.06 points (-1.44%) at 38322.09, S&P E-Minis down 68.75 points (-1.31%) at 5191.25, Nasdaq down 192.2 points (-1.2%) at 16113.5.

- Laggers: Reversing direction after leading gainers yesterday, Real Estate and Utilities continued to underperform in late trade, estate management and investment trusts weighed on the former: Extra Space Storage Inc -6.82%, SBA Communications -6.40%, Boston Properties -6.28%. Independent power and water utilities weighed on the latter: AES -4.48%, American Water Works -3.43%, Pinnacle West -3.22%.

- Leading Gainers: Energy and Communication Services outperformed in late trade, oil and gas shares gained as crude prices rallied on renewed chatter over Middle East tensions: Marathon +1.25%, Pioneer Natural Resources +1.08%, EOG Resources +0.91%. Interactive media and entertainment shares up next: Meta +0.46%, Netflix +0.16%, Google -0.16%, Disney -0.86%

- Reminder, the next quarterly earnings starts in earnest late this week with JP Morgan, BlackRock, Wells Fargo, State Street and Citigroup reporting Friday, April 12.

E-MINI S&P TECHS: (M4) Corrective Bear Cycle Extends

- RES 4: 5434.54 Bull channel top drawn from the Jan 17 low

- RES 3: 5428.25 1.00 proj of the Oct 27 - Dec 28 - May 1 price swing

- RES 2: 5400.00 Round number resistance

- RES 1: 5308.50/33.50 High Apr 4 / 1 and the bull trigger

- PRICE: 5205.00 @ 1518 ET Apr 10

- SUP 1: 5176.50 Intraday low

- SUP 2: 5153.24 50-day EMA

- SUP 3: 5100.00 Round number support

- SUP 4: 5018.00 Low Feb 21

The trend condition in S&P E-Minis is unchanged and remains bullish. The recent move down highlights a short-term corrective cycle and last week's sell-off plus today's move lower, reinforces this condition. The contract has breached bull channel support drawn from the Jan 17 low, and cleared the 20-day EMA. A continuation lower would open the 50-day EMA, at 5153.24 and the next key support. Key resistance is 5333.50, the Apr 1 high.

COMMODITIES Crude Surges on Iran Strike Threat

- Oil has reversed its losses to surge after Bloomberg reported that an Iranian missile attack on Israel is imminent. This would widen the ongoing conflict in the Middle East.

- According to Bloomberg, the US and its allies believe that "major missile or drone strikes by Iran or its proxies against military and government targets in Israel are imminent," in retaliation for an Israeli airstrike on an Iranian diplomatic compound in Damascus on April 1.

- WTI May 24 is currently up 1.1% at $86.2/bbl.

- A bull theme in WTI futures remains intact and the next objective is $89.08, a Fibonacci projection. If cleared, this would pave the way for a climb towards the $90.00 handle further out. On the downside, initial firm support to watch lies at $83.03, the 20-day EMA.

- Henry Hub is ending the day trading higher, although it has tapered most of its initial gains. Lower production and higher LNG feedgas flows are being offset by milder weather and higher CPI data which could restrain future US demand growth.

- US Natgas May 24 is up 0.7% at $1.89/mmbtu.

- Meanwhile, spot gold is down 0.7% on Wednesday at $2,336/oz, despite a brief spike on the Iranian missile threat headlines.

- The trend condition in gold remains bullish and the next objective is $2376.5, a Fibonacci projection. Initial firm support is at $2234.8, the 20-day EMA.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/04/2024 | 0130/0930 | *** |  | CN | CPI |

| 11/04/2024 | 0130/0930 | *** |  | CN | Producer Price Index |

| 11/04/2024 | 0600/0800 | ** |  | NO | Norway GDP |

| 11/04/2024 | 0800/1000 | * |  | IT | Industrial Production |

| 11/04/2024 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 11/04/2024 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 11/04/2024 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 11/04/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 11/04/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/04/2024 | 1230/0830 | *** |  | US | PPI |

| 11/04/2024 | 1245/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 11/04/2024 | 1245/0845 |  | US | New York Fed's John Williams | |

| 11/04/2024 | 1400/1000 |  | US | Richmond Fed's Tom Barkin | |

| 11/04/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/04/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/04/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/04/2024 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 11/04/2024 | 1600/1200 |  | US | Boston Fed's Susan Collins | |

| 11/04/2024 | 1630/1730 |  | UK | BOE's Greene at Delphi Economic Forum on Greece | |

| 11/04/2024 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.