-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Chair Buoys Tsys Ahead Minutes

- Treasuries bounced off the week openers lows Tuesday, mildly dovish comments from Chair Powell from ECB forum in Sintra, Portugal contributed to the rebound.

- Recent inflation data suggest that "we are getting back on a disinflationary path", Powell stated, he reiterated that more is needed to be more confident that inflation is headed sustainably to 2% before loosening policy.

- Focus turns to Wednesday's heavy data schedule: Challenger Job Cuts, ADP Employment, Weekly Jobless claims, ISM Services, Factory/Durables Orders and June FOMC Minutes, ahead of Thursday's 4th of July Holiday.

US TSYS Decent Short Covering Ahead Heavy Data, FOMC Minutes Wednesday

- Treasuries are firmer, off midmorning highs after the bell. Treasuries pared gains after higher than expected JOLTS job openings of 8.14M vs. 7.946M est, while prior was down-revised to 7.919M from 8.059M.

- Futures extended midmorning highs (TYU4 109-19.5) after Fed Chair Powell made mildly dovish comments from from central bank economics conference in Sintra, Portugal. Recent inflation data suggest that "we are getting back on a disinflationary path", Powell stated, with the caveat that more is needed to be more confident that inflation is headed sustainably to 2% before loosening policy.

- Tsy Sep'24 10Y futures currently trade 109-13.5 last (+8) -- still well off last Friday's post-Core PCE highs of 110-16. Decent volumes for typically muted summer trade, TYU4 over 1.4M contracts at the moment -- likely due to positioning ahead Thursday's 4th of July holiday closure.

- Technical resistance above at 110-00 20-day EMA. Curves reversed/pared early steepening are still near the least inverted levels since May 3: 2s10s currently -0.512 at -30.362 (-27.845 high), 5s30s +1,644 at 21.238 (+24.086 high).

- Heavy data drop on Wednesday's shortened session (floor closes at 1300ET, cash at 1300ET while Globex closes at normal time of 1700ET): Challenger Job Cuts, ADP Employment, Weekly Jobless claims, ISM Services, Factory/Durables Orders and June FOMC Minutes. Friday's full session sees June Non-Farm Payroll data.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00228 to 5.33192 (-0.00525/wk)

- 3M -0.00272 to 5.31817 (-0.00643/wk)

- 6M +0.00469 to 5.25274 (-0.00197/wk)

- 12M +0.02454 to 5.05029 (+0.01025/wk)

- Secured Overnight Financing Rate (SOFR): 5.40% (+0.07), volume: $1.967T

- Broad General Collateral Rate (BGCR): 5.33% (+0.01), volume: $752B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.01), volume: $733B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $239B

FED Reverse Repo Operation

NY Federal Reserve/MNI

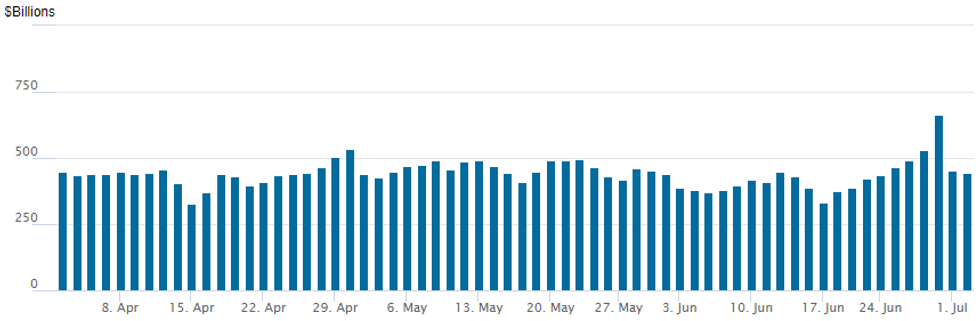

RRP usage continues to wane with latest read at $443.369B. Usage gapped below $500M to $451.783B yesterday vs. $664.570B last Friday when moth/quarter end usage pushed figure to highest level since January 10. Number of counterparties rises to 78 from 67 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury options trade remained mixed late Tuesday, volumes gradually improved amid ongoing interest in SOFR puts even as underlying futures gained as did projected rate cut pricing through year end vs. early morning levels (*): July'24 at -8.5% w/ cumulative at -2.1bp at 5.307%, Sep'24 cumulative -18.5bp (-17.4bp), Nov'24 cumulative -27.1bp (-26.8bp), Dec'24 -46.3bp (-45.4bp). Salient flow includes:

- SOFR Options:

- -10,000 SFRZ4 95.00/95.50 put spds, 3.5 ref 95.14

- +17,400 SFRH5 94.56/94.68/94.87/95.00 put condors, 2.5-2.62 ref 95.43 to -.425

- +10,000 SFRU4 94.62/94.75/94.87 put flys, 2.5 ref 94.86

- Update +20,000 SFRU4 94.56/94.68/94.81 put flys, 4.0

- +4,000 SFRU4 94.62/94.68 2x1 put spds 0.5 ref 94.855

- +5,000 2QQ4 96.37/96.87/97.25 call flys vs 2QV4 96.37/96.87/97.37 call flys 1.5 net

- +5,000 SFRU4 94.56/94.68/94.81 put flys 4.0 ref 94.85

- +10,000 SFRZ5 94.62/95.62 put spds, 27.0 vs. 95.935/0.25%

- 1,500 SFRU4 94.56/94.81/94.93 broken put flys ref 94.85

- 3,000 0QN4 95.37/95.62 put spds ref 95.815

- Treasury Options:

- 3,000 TYU4 106.5/109 put spds, ref 109-12.5

- +22,000 wk2 FV 108/109/110 call flys, 1

- 6,600 TYQ4 109.5 straddles, 121

- 2,700 USQ4 112/114 put spds, 20 ref 116-25

- -2,500 TYU4 108 puts, 30 ref 109-15.5 to -16

- 2,200 TYQ4 108.5/110.5 call spds ref 109-15.5

- 2,000 Wednesday weekly 30Y 115/116 put spds, 10 expire tomorrow

- 3,000 FVQ 106.5/107/107.5 call flys

- Block, +5,000 TYQ4 110.5 calls, 18 ref 109-09.5

- 1,400 wk2 FV 107.25/108 call spds ref 106-06.25

- 1,600 wk2 TY 110/110.5/111.5/112.25 broken call condors ref 109-11

EGBs-GILTS CASH CLOSE: OAT Spreads Continue To Tighten

Bund and Gilt yields fell modestly Tuesday, with semi-core/periphery EGB spreads tightening

- A flat-to-weaker morning for core FI in European trade - with June Eurozone flash inflation data coming in line with expectations - was followed by a decent rally in the afternoon with little discernable trigger.

- The bounce faded quickly after data showed surprisingly high US job openings.

- A panel appearance by ECB's Lagarde at the Sintra forum brought little new and had little impact on rate markets.

- The German curve twist steepened on the day, with the UK's bull flattening.

- EGB Periphery spreads tightened in a continuation of Monday's post-French election relief.

- Notably, French spreads continued compressing, with 10Y OAT in 2.7bp vs Bunds to a fresh post-June 13 low. Some desks cited reports of hundreds of candidates withdrawing from their runoff races ahead of the 2nd election round, in an effort to block far right gains.

- Wednesday sees final Services PMIs and Eurozone PPI, with multiple ECB speakers at Sintra.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.8bps at 2.906%, 5-Yr is down 0.8bps at 2.58%, 10-Yr is down 0.4bps at 2.603%, and 30-Yr is up 0.4bps at 2.799%.

- UK: The 2-Yr yield is down 0.9bps at 4.189%, 5-Yr is down 2.9bps at 4.081%, 10-Yr is down 3.3bps at 4.248%, and 30-Yr is down 2.8bps at 4.747%.

- Italian BTP spread down 4.6bps at 145.2bps / Greek down 5.5bps at 112bps

EGB Options: Several Euribor Call Structures Bought Tuesday

Tuesday's Europe rates/bond options flow included:

- RXQ4 132/134cs 1x1.5, bought for 18 in 2k

- ERV4 96.62/96.75/96.87c fly, bought for 2.75 in 10k

- ERX4 96.87/97.00/97.12/97.25c condor with ERZ4 96.87/97.00/97.12/97.25c condor, bought as a strip for 2.5 in 3k

- ERZ4 96.62/96.75/96.87/97.00c condor, bought for 4 in 2k

- 0RU4 96.625/96.875/97.625/97.875c condor bought for 20.5 in 8k Total

- SFIU4 95.10/95.20/95.30c fly bought for 2 in 2k

FOREX: EURGBP Respects 0.8500 Resistance, BRL Under Significant Pressure

- US yields moderately reversed lower on Tuesday and with an associated bounce in US equities, the greenback pulled back from earlier session highs, with the USD index tracking close to unchanged as we approach the APAC crossover. JOLTS job openings surprisingly increased in May to 8.14m (cons 7.95m) but the data did little to jolt the market with the focus on Friday’s NFP report.

- As such G10 currency adjustments remain limited, with tomorrow’s FOMC minutes, the US July 04 holiday & UK election Thursday keeping any conviction in check.

- However, USDJPY continues to edge higher, looking to close above 161.50, having printed another multi-decade high of 161.74. Sights are on 162.21, a Fibonacci projection.

- EURUSD’s trend outlook remains bearish and price action following the French first-round indicates that rallies remain good selling opportunities. Resistance at the 50-day EMA (intersecting today at 1.0771), has capped the latest correction well and should keep the market’s focus on the bear trigger at 1.0666, Jun 26 low.

- It is also worth noting, EURGBP (-0.21%) failed to recover back above 0.8500 (also 50-day EMA), the key technical pivot for the cross, and while remaining below this level on a closing basis the outlook remains bearish.

- In emerging markets, local pressures added weight to both the South African Rand and the Brazilian real. Brazil’s domestic situation continues to sour and USDBRL’s 0.65% climb today brings YTD gains for the pair to an impressive 17.3%. The moves could raise the risk of the central bank intervening to stabilise the currency.

- Australia retail sales and European final services PMIs cross Wednesday. ADP and jobless claims from the US will play second fiddle to ISM services data for June and the FOMC minutes.

FX OPTIONS: Expiries for Jul03 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0675(E1.5bln), $1.0685-00(E2.9bln), $1.0745-55(E1.7bln), $1.0775(E566mln), $1.0800(E1.2bln), $1.0865-85(E1.3bln)

- USD/JPY: Y158.50($2.6bln), Y160.20-25($1.1bln), Y160.85-00($1.1bln), Y161.30-40($783mln), Y162.00($660mln)

- AUD/USD: $0.6645-55(A$745mln)

- USD/CAD: C$1.3660($690mln)

- USD/CNY: Cny7.2400-10($1.1bln), Cny7.2500($722mln)

Late Equities Roundup: Autos, Banks Outperform

- Stocks have drifted higher in late Tuesday trade, DJIA joining Nasdaq stocks in outperforming S&P Eminis. Currently, the DJIA is up 103.83 points (0.27%) at 39273.54, S&P E-Minis up 22 points (0.4%) at 5556.25, Nasdaq up 119.6 points (0.7%) at 17998.9.

- Consumer Discretionary and Financials sectors outperformed in late trade, automaker Tesla underpinning the discretionary sector as it rallied 8.88% on better than expected deliveries. Financials outpaced earlier industrial gainers, banks leading: Citigroup +1.83%, US Bancorp +1.58%, Fifth Third +1.49%.

- Materials and Health Care sectors continued to underperform in late trade, container and packaging shares weighed on the former: Packaging Corp of America -1.75%, Amcor -1.0%, Westrock -0.73%. Pharmaceutical names weighing on the former: Incyte Corp -2.60%, AbbVie -2.19%, Viatris -2.17%.

- Reminder, the latest equity earnings cycle kicks off in earnest Friday next week, banks headline: Wells Fargo, Bank of NY Mellon, JP Morgan and Citigroup.

E-MINI S&P TECHS: (U4) Bull Flag Formation

- RES 4: 5622.69 2.764 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5600.00 Round number resistance

- RES 2: 5594.66 2.618 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5588.00 High Jun 20

- PRICE: 5557.00 @ 1450 ET Jul 2

- SUP 1: 5488.93/5397.39 20- and 50-day EMA values

- SUP 2: 5267.75 Low May 31 and key support

- SUP 3: 5213.25 Low May 6

- SUP 4: 5155.75 Low May 3

The trend condition in S&P E-Minis is unchanged and signals remain bullish. Resistance at 5430.75, the May 23 high and bull trigger, has recently been cleared. This break confirmed a resumption of the primary uptrend. Note that the recent pause in the trend appears to be flag formation - a bullish continuation signal. Sights are on 5594.66, a Fibonacci projection. Support to watch is 5488.93, the 20-day EMA.

COMMODITIES Crude Loses Ground as Hurricane Fear Abates, Gold Rangebound

- Crude prices have slipped back as US close approaches. Downward pressure late in the day comes from abating fears of disruption in the Gulf of Mexico due to Hurricane Beryl.

- WTI Aug 24 is down 0.5% at $83.0/bbl.

- For WTI futures, a bull cycle in remains in play, with the recent breach of $80.11, the May 29 high and a key resistance, strengthening a bullish theme.

- Note too that $82.24, 76.4% of the Apr 12 - Jun 4 bear leg, has been cleared. This opens $85.27, the Apr 12 high and a bull trigger.

- Initial firm support to watch is $79.19, the 50-day EMA.

- Meanwhile, Henry Hub is headed for its lowest close since May 15, continuing the steady decline since June 11. Reduced LNG feedgas flows and consistently high production levels are maintaining downside.

- US Natgas Aug 24 is down 1.5% at $2.44/mmbtu.

- Spot gold has edged down by 0.2% to $2,327/oz today, as the yellow metal continues to trade in a very tight $2,320-$2,340 range, ahead of key US payrolls data this week.

- For gold, a clear break of the 50-day EMA, at $2,319.2, would open $2,277.4, the May 3 low. Initial firm resistance is $2,387.8, the Jun 7 high.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/07/2024 | 0130/1130 | ** |  | AU | Retail Trade |

| 03/07/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/07/2024 | 0800/1000 |  | EU | ECB's De Guindos chairing MonPol Cycles session | |

| 03/07/2024 | 0900/1100 | ** |  | EU | PPI |

| 03/07/2024 | 0900/1100 |  | EU | ECB's Cipollone chairing Productivty session | |

| 03/07/2024 | 1030/1230 |  | EU | ECB's Lane chairing panel on equilibirum interest rates | |

| 03/07/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/07/2024 | 1100/0700 |  | US | New York Fed's John Williams | |

| 03/07/2024 | 1230/0830 | ** |  | US | Trade Balance |

| 03/07/2024 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 03/07/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 03/07/2024 | 1330/1530 |  | EU | ECB's Lagarde closing remarks at ECB Forum | |

| 03/07/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/07/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 03/07/2024 | 1600/1200 | ** |  | US | Natural Gas Stocks |

| 03/07/2024 | 1800/1400 | *** |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.