-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: ECB Expected To Cut Rates Later

MNI EUROPEAN OPEN: A$ & Local Yields Surge Following Jobs Data

MNI ASIA MARKETS ANALYSIS: Fed Delivers 75Bp Hike/Stays Course

HIGHLIGHTS

- MNI: FED RAISES RATES BY 75BPS TO 3.75% TO 4%

- MNI: FED AIMS FOR 'SUFFICIENTLY RESTRICTIVE' POLICY

- US TREASURY HAS NOT YET MADE DECISION ON WHETHER TO DO BUYBACKS, Bbg

- CHINA NHC REITERATES ADHERENCE TO COVID ZERO POLICY

Key links: MNI: Fed Hikes 75 BPs On Path To 'Sufficiently Restrictive' / FOMC Statement Comparison / MNI TRANSCRIPT: Fed Chair Powell's Nov 2 Press Conference / MNI INTERVIEW: Bank Tax Better Than Tiering- Ex-BOE Deputy

US TSYS: Fed Delivers 75Bp Hike, "Have a Ways To Go"

Tsys weaker/off lows following whipsaw reaction to expected, fourth consecutive 75bp rate hike to target range of 3.75%-4.0%. "The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time," the FOMC said.

- Bonds gapped to new high (30YY dropped to 4.0492%) then quickly fell to session low (30YY 4.1257%) immediately after the annc.

- Bonds extended lows as Fed Chairman Powell discusses the risk of entrenched inflation and not hiking enough to get it under control. "From a risk management standpoint we want to make sure that we don't make the mistake of either failing to tighten enough or loosening policy too soon."

- Follow-up comment "It's very premature in my view to be thinking about or talking about pausing our rate hike. We have a ways to go" spurring better selling across the curve. 30YY climbs to 4.1363% high.

- Harkening back to September's "riskier to hike too little than too much" tone also weighed on stocks, SPX eminis -102.5 to 3763.5 after the bell.

- Currently, 2-Yr yield is up 5.4bps at 4.5989%, 5-Yr is up 2.6bps at 4.2934%, 10-Yr is up 4.2bps at 4.0838%, and 30-Yr is up 3.1bps at 4.1225%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00428 to 3.06314% (-0.00072/wk)

- 1M -0.00586 to 3.83571% (+0.06800/wk)

- 3M +0.04872 to 4.50843% (+0.06886/wk) * / **

- 6M +0.05214 to 4.97071% (+0.03985/wk)

- 12M +0.09057 to 5.53600% (+0.16700/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.50843% on 11/2/22

- Daily Effective Fed Funds Rate: 3.08% volume: $108B

- Daily Overnight Bank Funding Rate: 3.07% volume: $289B

- Secured Overnight Financing Rate (SOFR): 3.05%, $1.079T

- Broad General Collateral Rate (BGCR): 3.01%, $420B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $395B

- (rate, volume levels reflect prior session)

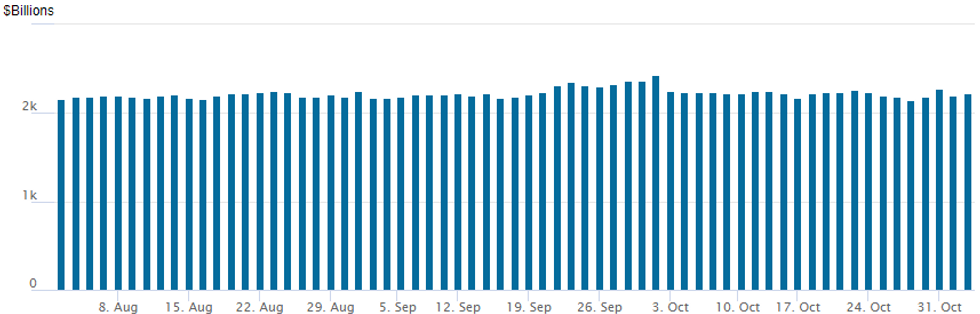

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces to $2,229.861B w/ 108 counterparties vs. $2,200.510B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

- SOFR Options:

- Block, 20,000 SFRZ2 95.25/95.37 put spds, 4.5 - 4.75

- Block, 3,000 Red Jun24 93.00/94.00/95.00 put flys, 2.5 ref 95.85

- Block, 2,500 SFRU3 94.50/94.75/95.00/95.25 put condors, 5.0 ref 95.19

- 2,000 SFRH3 96.50/96.75 call spds ref 95.005

- 3,000 SFRF 95.25/95.75 call spds ref 95.00

- Block, 2,000 SFRZ2 95.37/95.50/95.62/95.75 put condors, 5.0 ref 95.38

- Eurodollar Options:

- 8,000 Jun 94.75/95.25 put spds ref 94.735 to -.725

- Treasury Options:

- Block, -7,500 TYZ 109/110 put spds, 21 (unwound on screen)

- -5,000 TYZ2 112.5 calls, 27 ref 111-02.5

- +5,000 FVZ2 105 puts, 12

- Block, +10,000 TYZ 112.75 calls, 18 ref 110-22

- -5,000 TYZ2 109.25/111.75 strangles, 103-101

- 4,000 TYZ 108/109 2x1 put spds

- 1,750 TYZ2 106/107.75 put spds

- over 15,000 TYZ2 108.75/110 put spds vs. 112.5 calls

EGBs-GILTS CASH CLOSE: Pre-BoE Short-End Gilt Rally Continues

Short-end Gilts rallied strongly again ahead of the BoE, leading to bull steepening in the UK curve Wednesday. The German curve twist flattened, while periphery EGBs were mixed.

- With global attention on the Federal Reserve meeting outcome after European hours Wednesday, volumes were on the light side and trading was mostly within limited ranges.

- 2Y Gilt yields stood out again, falling by double-digits for the second consecutive session - now off 26bp since Monday's close.

- BoE hike pricing slipped further down the rates strip but there is still around 88% of a 75bp (as opposed to 50bp) hike still priced for Thursday's decision, in line with MNI's preview.

- Not much change in ECB pricing, having already reversed most of last Thursday's bullish move in the past 3 sessions.

- BTPs underperformed on the EGB periphery with spreads slightly wider; GGBs tightened 1.5bp to Bunds.

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is up 4.1bps at 1.982%, 5-Yr is up 4bps at 2.023%, 10-Yr is up 1bps at 2.141%, and 30-Yr is down 4.3bps at 2.097%.

- UK: The 2-Yr yield is down 12.7bps at 3.058%, 5-Yr is down 14.1bps at 3.363%, 10-Yr is down 7.1bps at 3.399%, and 30-Yr is down 1.5bps at 3.571%.

- Italian BTP spread up 2.5bps at 215.6bps / Greek down 1.5bps at 244.2bps

EGB Options: Some Unwinds In Bobl And Euribor

Wednesday's Europe rates / bond options flow included:

- DUZ2 108c, bought for 4 in 5.5k

- DUZ2 107.00/107.30cs, bought for 12 in 4k

- OEZ2 118.00/116.00/115.00p fly 1x3x2 at 16.5 with OEZ2 120.50/121.00cs at 15,sold the strip and receive 31.5 in 1k. Hearing unwind

- ERZ2 97.875/97.75ps, sold at 8 in 10k (ref 97.70), said to be an unwind

Greenback Extends Reversal & Strengthening After Presser Ends

- The initial weakness in the US Dollar following the FOMC statement has abated with most G10 pairs trading back to pre-announcement levels and the USD reversal/strength extending in recent trade amid Chair Powell confirming it is 'very premature' to think about pausing rate hikes amid other hints that it is not clear they will slow the pace in December.

- EURUSD sharply lower back through 0.9880 and then through the lows of the day after previously reaching a high of 0.9976.

- As noted earlier, further weakness is now testing the validity of last week's reversal higher and whether the channel top that previously marked firm resistance will now act as support.

- The channel top now intersects at 0.9821, closely matching the current low of 0.9823.

- Overall, the USD index is 0.44% higher on the session and the sharp reversal lower for major equity indices has prompted a substantial reversal in the likes of AUD and NZD, previously trading with 1.5% gains and now in negative territory against the greenback.

- Likewise, USDJPY has completed a significant round trip, bouncing from a low of 145.68 and now trading 200 pips higher as of writing.

- Focus immediately will turn to the latest set of employment data on Friday for the next major determinant of the greenback’s direction.

- Worth noting it is a Japanese holiday on Thursday and the major risk event if the Bank Of England’s monetary policy decision/statement.

FX: Expiries for Nov03 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750(E1.0bln), $0.9775(E614mln), $0.9850-55(E790mln), $0.9900-05(E2.2bln), $1.0000(E1.1bln)

- USD/JPY: Y144.00-25($1.6bln), Y147.60($1.1bln)

- GBP/USD: $1.1290-00(Gbp870mln), $1.1700(Gbp536mln)

- EUR/GBP: Gbp0.8625-30(E584mln), Gbp0.8695-00(E521mln)

- EUR/JPY: Y144.00(E504mln)

- AUD/USD: $0.6325(A$520mln)

- NZD/USD: $0.5835-38(N$584mln)

- USD/CNY: Cny7.2450($935mln), Cny7.2500($555mln)

Late Equity Roundup, Weaker But Off Lows

Stocks continue to trade weaker after the FI close, but off post-FOMC lows as Fed Chair Powell continues to answer journalist questions. Stocks and Tsys reversed course as Fed Chairman Powell discusses the risk of entrenched inflation and not hiking enough to get it under control. Follow-up comment "It's very premature in my view to be thinking about or talking about pausing our rate hike" saw risk markets extend lows.

- Consumer Discretionary sector continues to underperform, ZSPX eminis currently trading -35 (-0.91%) at 3831; DJIA -72.06 (-0.22%) at 32574.68; Nasdaq -150.8 (-1.4%) at 10739.24.

- SPX leading/lagging sectors: Laggers: Consumer Discretionary (-1.65%) weighed by automakers (Tesla -3.68%); Information Technology (-1.11%) and Communication Services (-1.03%) follow - media & entertainment weighing on the former (Paramount -11.45%, Warner Bros -3.90%, META -2.56% and Netflix -2.76%). Leaders: Utilities (+0.25%) and Industrials (+0.09%), and Financials (+0.02%) follow.

- Dow Industrials Leaders/Laggers: Boeing (BA) outperforming +7.79 at 151.17, Goldman Sachs +3.11 at 351.69. Laggers: Salesforce.com (CRM) -6.82 at 153.00, Microsoft (MSFT) -3.10 at 225.07, Visa (V) -4.11 at 202.82.

COMMODITIES

- US EIA: CRUDE OIL STOCKS EX SPR -3.12M TO 436.8M OCT 28 WK

- US EIA: GASOLINE STOCKS -1.26M TO 206.6M IN OCT 28 WK

- US EIA: CUSHING STOCKS +1.27M TO 28.2M BARRELS IN OCT 28 WK

- US EIA: CRUDE OIL STOCKS EX SPR -3.12M TO 436.8M OCT 28 WK

- US EIA: DISTILLATE STOCKS +0.43M TO 106.8M IN OCT 28 WK

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/11/2022 | 0030/1130 | ** |  | AU | Trade Balance |

| 03/11/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 03/11/2022 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/11/2022 | 0730/0830 | *** |  | CH | CPI |

| 03/11/2022 | 0805/0905 |  | EU | ECB Lagarde Panels Latvijas Banka Conference | |

| 03/11/2022 | 0810/0910 |  | EU | ECB Panetta Speech at ECB Money Market Conference | |

| 03/11/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 03/11/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 03/11/2022 | 0950/1050 |  | EU | ECB Elderson Panels Latvijas Banka Conference | |

| 03/11/2022 | 1000/1100 | ** |  | EU | Unemployment |

| 03/11/2022 | - |  | DE | G7 Foreign Ministers summit in Germany | |

| 03/11/2022 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 03/11/2022 | 1230/0830 | * |  | CA | Building Permits |

| 03/11/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 03/11/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 03/11/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 03/11/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 03/11/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 03/11/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/11/2022 | 1400/1000 | ** |  | US | factory new orders |

| 03/11/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 03/11/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 03/11/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 03/11/2022 | 1730/1330 |  | CA | BOC Deputy Beaudry gives opening remarks before academic lecture | |

| 03/11/2022 | 2000/1600 |  | CA | Canada FM Freeland presents fiscal update | |

| 03/11/2022 | 2030/2030 |  | UK | BOE Mann Panels American Enterprise Institute |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.