-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Eye on Weak Labor Supply

HIGHLIGHTS

- MNI US: New Poll Shows Biden Ahead Of Main GOP Rivals For 2024

- MNI US-RUSSIA: US Targets Russian Banks, Nuclear Sector Likely To Avoid Sanctions

- FED LOGAN: MUST BE READY TO HIKE RATES FOR LONGER THAN NOW EXPECTED, however, OVERTIGHTENING DOES RISK TOO-HEAVY JOB LOSSES

- FED BARKIN: GOOD CASE FOR LEAVING RATES HIGHER FOR LONGER, Bbg

- BARCLAYS PULLING BACK FROM CONSUMER LENDING: TIMES, Bbg

- MCCONNELL SAYS DEBT CEILING WILL BE DEALT WITH, WON'T DEFAULT, Bbg

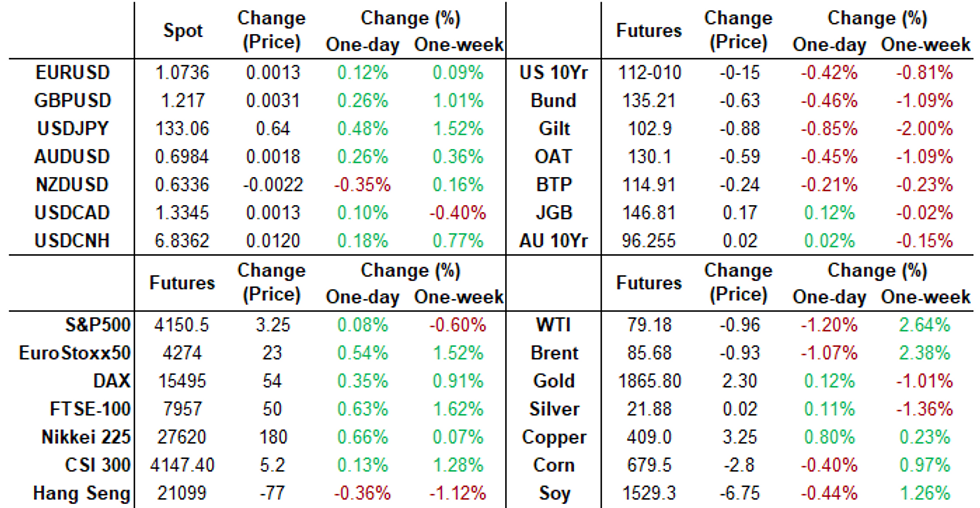

US TSYS: Implied Hikes for Second Half of 2023 Rising

Volatile post-CPI trade after the open followed by hawkish leaning Fed speak that rates to session lows by midday. Tsy futures gap lower/extend lows (30YY 3.7888% initial high) after Jan CPI climbed 0.5 percent, seasonally adjusted, +6.4% YoY - not seasonally adjusted. Tsys futures gap higher/extend highs just as quickly (30YY 3.7162% low) as mkts digested seventh consecutive decline for headline YoY CPI.

- Surge to new session highs post data more flow driven than data or headline, followed shortly after with Block sales in 5s and 10s through respective offers that started Tsys on a path to new session lows by midday.

- Equities rebound after selling off on hawkish Fed speak from Dallas Fed Logan on danger of not hike rates enough to combat inflation tempered risk appetite.

- Implied rate hikes for 2H'23 climb after -20,000 SFRU3 97.76, sell through 97.77 post-time bid at 1033:28ET, 94.76 last (-0.090). Note, lead SFRH3 holding steady while balance of quarterlies pricing in more rate hikes through year end.

- Similarly, Fed funds implied hike for Mar'23 holds at 26.1bp, May'23 cumulative at 47.4bp (+1.0) to 5.053%, Jun'23 62.7bp (+4.8) to 5.209%, terminal at 5.27% in Aug'23 - off midday high of 5.295%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00057 to 4.55943% (+0.00014/wk)

- 1M +0.00214 to 4.59000% (+0.01200/wk)

- 3M +0.00800 to 4.87157% (+0.00214/wk)*/**

- 6M +0.00643 to 5.15843% (+0.03129/wk)

- 12M -0.00586 to 5.49914% (+0.01457/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.87257% on 2/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $107B

- Daily Overnight Bank Funding Rate: 4.57% volume: $294B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.153T

- Broad General Collateral Rate (BGCR): 4.52%, $467B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $452B

- (rate, volume levels reflect prior session)

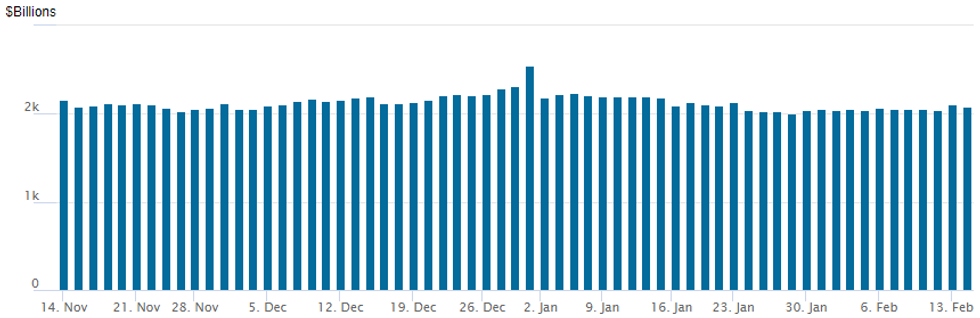

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,076.548B w/ 109 counterparties vs. prior session's $2,107.775B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better put volumes persist but direction has changed to include some large position unwinds for some accounts. Getting out while the getting is good? Paper sold -55,000 TYH3 111/112 put spreads at 12, an unwind from 4-6 low bought late January. Good timing as market pricing of rate hikes at the next FOMC on March 22 remains anchored at 25bp. Meanwhile, implied hikes for mid- to year end have risen Tuesday as several Fed speakers expressed the need for continued rate hikes and/or the risk of not hiking enough. Salient trade includes:- SOFR Options:

- Block, 5,000 SFRZ3 95.00 puts, 40.0

- Block, 10,000 2QH4 96.25 puts, 7.0 ref 96.53

- Block, 5,000 SFRZ3 94.62/95.12/95.62 put flys, 10.5 ref 94.985

- Block, total 35,000 SFRH3 95.12/95.31 2x1 put spds, 9.0-10.5 ref 95.06-.0625

- Block, -20,000 SFRZ3 94.37/95.12 put spds 29.0

- +10,000 SFRN3 94.50/95.50 put over risk reversals 6.5 vs. 94.81/0.36%

- Block, 3,000 OQJ3 95.75/2QJ3 96.50 put calendar, 1.0 short Apr over

- 5,000 SFRM3 94.93/95.06 put spds ref 94.805

- Block, 2,500 SFRJ3 94.68/94.81/94.87/94.93 put condors, 1.0 net

- 5,700 SFRM3 94.43/94.62/94.81 put flys ref 94.805

- Block, 10,000 SFRM 94.62/94.75 put spds, 4.5 vs. 94.79/0.14%

- 5,000 OQM3 97.25 calls ref 96.07

- Block, 8,000 SFRJ3/SFRK3 94.62/94.75 put spd spd, 0.5 net/May over

- 2,500 OQJ3 95.25/95.62/96.00 put flys vs. 2QJ3 96.25/96.50 put spds

- over 5,000 OQJ3 96.50 calls, 11.0 ref 96.075

- Block, 5,000 SFRM3 94.68/94.81 put spds, 5.5 ref 94.805

- 2,500 SFRM3/SFRU3/SFRZ3 94.68 put strip

- 5,500 OQH3 95.81/96.00 call spds ref 95.605 - .61

- Treasury Options:

- Ongoing 8,500 FVH3 107/107.5 put spds, 12.5 from 7 low

- -10,000 TYH 113/TYJ 111.5 put diagonal spds, 27-26 march over

- Block, 12,985 wk3 TY 111.25/112.25 put spds, 18, 5k more on screen

- 1,380 USH3 123/126 put spds 15 over USH 131 calls, ref 127-19

- 2,500 TYH3 111.75 puts, 14

- over 20,000 FVH3 109 calls, 2

- 4.000 FVH3 107/107.5 puts, 7 ref 107-19.5

- 3,200 FVH3 107.5/108 put spds, 15 ref 107-22.5

- 1,600 FVJ3 107/108.25 2x1 put spds ref 107-30.75

- 5,000 FVH3 107.25 puts, 7 ref 108-01.75

- over 11,000 TYH3 111.75 puts, 13 ref 113-01

- over -55,000 TYH3 111/112 put spds, 12, unwind from 4-6 low bought late Jan

- over 6,000 wk3 FV 109 calls 4.5 ref 108-00.25

- 3,300 TYK 115 straddles, 258 ref 112-30.5 to -31.5

- 4,000 TYH3 112.25 puts 7 over TYH 113/113.75 call spds ref 112-30

- 4,900 TYH3 111.5/112 2x1 put spds ref 112-29

EGBs-GILTS CASH CLOSE: Gilts Underperform In Bear Flattening Move

European bonds weakened Tuesday in response to stronger-than-expected UK wage data and another robust US inflation reading.

- The UK's bear flattening move stood out, with 2Y yields having their 2nd biggest daily rise of 2023 and 2s10s closing at the most inverted since September.

- This came as BoE terminal hike pricing rose 10bp on the day, following data showing UK wages posted record (ex-pandemic) growth in January, while a largely in-line US CPI print reinforced the global "higher for longer" narrative.

- ECB peak rate pricing hit a cycle high at 3.68% for September; ECB's Makhlouf said he could see rates above 3.5% this year.

- Periphery spreads tightened slightly, led by Greece.

- UK CPI is Wednesday's early highlight.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 7.6bps at 2.858%, 5-Yr is up 8.2bps at 2.505%, 10-Yr is up 7bps at 2.438%, and 30-Yr is up 5.6bps at 2.378%.

- UK: The 2-Yr yield is up 19.1bps at 3.83%, 5-Yr is up 16.1bps at 3.51%, 10-Yr is up 11.9bps at 3.521%, and 30-Yr is up 7.6bps at 3.89%.

- Italian BTP spread down 1.8bps at 178.6bps / Greek down 3.7bps at 179.9bps

EGB Options: Call Spread Buying Prevalent Tuesday

Tuesday's Europe rates / bond options flow included:

- RXH3 137/135/134 broken put fly, sold at 63.5 in 4.5k

- DUJ3 106.10/106.50 call spread bought for 3.25 in 20k

- SFIH3 95.85/95.90 1x1.5 call spread bought for 0.75 in 6k

- SFIH3 95.70/95.55 put spread sold at 1.75 in 3k (vs 95.76)

- SFIJ3 95.90/96.10 call spread bought for 1.5 in 3k

- ERM4 97.875 calls bought for 9.5 in 9.5k

FOREX: USD Index Unchanged, Higher Yields Place Pressure On JPY

Despite the initial and very volatile spin-cycle following the US inflation data, the greenback traded on a surer footing approaching the end of the European session amid pressure on the front-end of the US curve. The USD index remains close to unchanged on the day approaching the APAC crossover, claiming back pre-data declines.- Some weakness in equities acted as an additional USD tailwind in the aftermath of the data although markets have stabilised in late US trade amid a plethora of Fed speakers.

- The higher US yields are naturally weighing on the Japanese Yen and USDJPY (+0.52%) is currently consolidating above 133. As highlighted, a sustained break of the 50-day EMA (intersects today at 132.71) is required to suggest scope for an extension higher that would target 134.77 on the topside, the Jan 6 high.

- In EURUSD, prices remains above support at 1.0674, the 50-day EMA, for now. This represents a key short-term level and a clear break of the average would instead strengthen the bearish cycle and initially expose 1.0634, the Jan 9 low.

- With cross/JPY trading with an upward bias and extending yesterday’s supportive price action, attention for EURJPY is on 142.99, the Feb 06 high, where a break would confirm a continuation of the recovery that started on Jan 3. The technical outlook remains bullish and resistance levels/targets above include 144.53, the 76.4% retracement of the Dec 15 - Jan 3 bear leg and 145.83, High Dec 20.

- NZDUSD (-0.33%) continues to be one of the weakest pairs in G10 following inflation expectations data overnight. 2y inflation is seen at 3.30% for Q1, down from 3.62% late last year - feeding into the view that domestic inflation may have peaked for now.

Late Equity Roundup: Consumer Discretionary, IT Rebound

Stocks mixed after FI close, well off midday lows with Nasdaq shares outperforming. Tsys and stocks both extended lows by midday as hawkish Fed speak from Dallas Fed Logan on danger of not hike rates enough to combat inflation tempered risk appetite. Stocks currently near middle session range, SPX eminis +4.25 (0.1%) at 4151.25; DJIA -95.52 (-0.28%) at 34150.62; Nasdaq +68.2 (0.6%) at 11959.85.

- SPX leading/lagging sectors: Real Estate (-0.87%), Consumer Staples (-0.59%) and Financial (-0.40%) sectors underperformed. Specialized and Industrial REITs weighed on Real Estate (WY -3.99%, EQIX -1.62%, PEAK -1.59%) while insurance names weighed on Financials (MMC -3.62%, AJG -2.71%, MTW -2.05%, AFL -2.01%).

- Leaders: Consumer Discretionary (+0.77%) and Information Technology (+0.54%) and Materials all rebounded from earlier weaker levels. Autos and parts makers lead consumables (APTV +7.72%, Tesla 5.92%) while chip makers underpinned IT (NVDA +4.96%, MPWR +3.43%, ON +3.19%. AMD +3.15%).

- Dow Industrials Leaders/Laggers: Boeing (BA) extended gains +3.49 at 219.14, Chevron (CVX) +2.18 at 173.19, Microsoft (MSFT) +1.70 at 273.02. Laggers: Home Depot (HD) -5.25 at 318.28, Caterpillar (CAT) -3.21 at 244.94, Travelers (TRV -3.01 at 184.59).

- Earnings after the close: Devon Energy (DVN, $1.76 est), GoDaddy (GDDY $0.67 est), Akamai Technology (AKAM $1.27 est), Airbnb (ABNB $0.31 est), Livent (LTHM $0.37 est), Comstock Resources (CRK $0.75 est), Generac (GNRC $1.62 est).

COMMODITIES: Crude Oil Settles Lower Post US CPI Despite Intraday Recovery

- Crude oil on balance has moved lower today after what looked like an in-line US CPI report showed some signs of accelerating broader price pressures and sparked higher Treasury yields. Like other asset classes, major commodities weren’t immune to high volatility in the interim.

- WTI currently trades -1.35% at $79.06 off a high of a $79.61 and low of $77.46, the latter not troubling support at $76.52 (Feb 9 low).

- Of a mixed day of trading, most active strikes in the CLH3 have been $80/bbl calls followed by $78/bbl puts.

- Brent is -1.2% at $85.54, off a high of $86.42 and low of $84.13, but also not troubling support at $83.05 (Feb 9 low).

- Gold is +0.1% at $1855.22 having recovered from a low of $1843.37, clearing the 50-day EMA of $1855.5, where it’s since reverted to, plus also the Feb 14 low of $1850.5. It potentially opens a key near-term support at $1825.2 (Jan 5 low).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 15/02/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 15/02/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/02/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 15/02/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 15/02/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 15/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/02/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 15/02/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/02/2023 | 1400/1500 |  | EU | ECB Lagarde at Plenary Debate on ECB Annual Report | |

| 15/02/2023 | 1415/0915 | *** |  | US | Industrial Production |

| 15/02/2023 | 1500/1000 | * |  | US | Business Inventories |

| 15/02/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 15/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 15/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 15/02/2023 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.