-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA MARKETS ANALYSIS: Fed Goolsbee on High Inflation Risk

- FED'S GOOLSBEE: RISK OF INFLATION STAYING TOO HIGH BIGGER RISK

- EVERGRANDE UNIT MISSED PAYMENTS ON 4B YUAN ONSHORE BOND, Bbg

- ECB LAGARDE: DETERMINED TO RETURN INFLATION TO 2% IN TIMELY MANNER, Bbg

- ECB LAGARDE: ECB AIMS TO FINISH FRAMEWORK REVIEW BY SPRING 2024, Bbg

- US: $2B LOAN AGREEMENT TO SUPPORT POLAND DEFENSE MODERNIZATION, Bbg

US TSYS New 16Y High for 10Y Yld: 4.5436%

- Treasury yields climbed to new multi-year highs late Monday, 30YY 4.6604% (+.1359) - highest since late June 2011, while 10YY overtook last Fri's 16Y high of 4.5064% to 4.5436 (+.1099).

- Treasury curves bear steepened on the day, finishing near highs after the bell (3M10Y +12.286 at -94.341, 2Y10Y +8.861 at -59.173).

- Fed indexes weaker than expected: Chicago Fed national activity index came in weaker than expected in August at -0.16 (cons +0.10) after a downward revised +0.07 (initial +0.12). The Dallas Fed manufacturing index fared slightly worse than expected in September as it dipped to -18.0 (cons -14) from -17.2.

- Federal Reserve Bank of Chicago President Austan Goolsbee said U.S. interest rates are near their peak and soon the debate will shift to how long they'll stay there. "It's certainly possible" rates won't need to go any higher, he said. "Pretty soon the question is going to stop being how much more are they going to raise and it's going to transform into how long do we need to hold rates at this kind of restricted level to feel convinced that we're back on this path to 2%."

- Meanwhile, MN Fed Kashkari will attend a moderated discussion at Wharton later this evening at 1800ET, livestreamed.

- On another note, next week's scheduled market data (NFP on Oct 6) may be postponed if lawmakers are unable to come up with stopgap funding measures to keep the US Government open past this Friday. Stay tuned.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00006 to 5.31745 (-0.00953 total last wk)

- 3M -0.00869 to 5.39112 (-0.00197 total last wk)

- 6M -0.01025 to 5.46926 (+0.01367 total last wk)

- 12M -0.01875 to 5.46688 (+0.06419 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $94B

- Daily Overnight Bank Funding Rate: 5.32% volume: $252B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.511T

- Broad General Collateral Rate (BGCR): 5.30%, $579B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $563B

- (rate, volume levels reflect prior session)

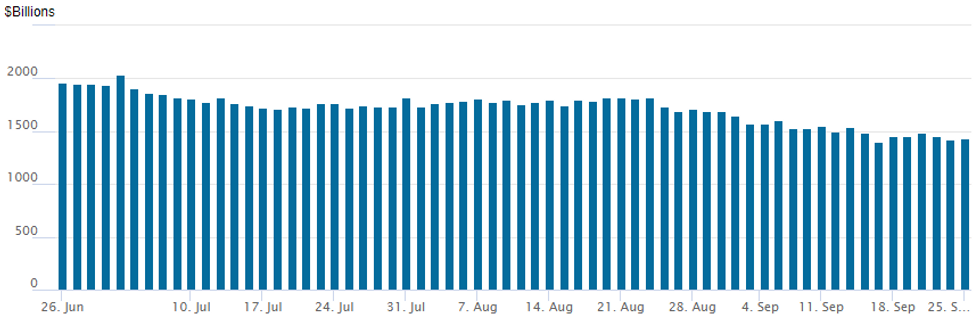

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation climbs to 1,437.310B w/99 counterparties, compared to $1,427.575B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option trade rotated around low delta puts and put structures Monday as underlying futures continued to sell-off. Tsy curves bear steepened with short end rates outperforming (3M10Y +11.412 at -95.215, 2Y10Y +8.249 at -59.785) while 10Y yield marked new 16Y high of 4.5334%. Rate hike projections into early 2024 continued to recede from last week's post-FOMC high: November at 18.6% w/ implied rate change of +4.7bp to 5.374%, December cumulative of 11.4bp at 5.441%, January 2024 12.5bp at 5.453%. Fed terminal at 5.455% in Feb'24.

- SOFR Options:

- +5,000 2QV3 96.00/96.25/96.37/96.62 call condor, 7.5 ref 96.02

- over 14,000 SFRX3 93.50 puts cab

- +9,000 0QH4 95.00/95.25 put spds 1.25 over 0QH4 96.50/97.00 call spds vs. 95.635/0.20%

- +5,000 SFRZ3 94.06/94.25/94.93/95.12 iron condor, 1.0 ref 94.535

- +5,000 SFRV3 94.31 puts, 0.5

- Block, 8,450 SFRF4 94.00/94.25 put spds, 1.5 ref 94.615

- 2,000 0QX3 95.62/95.87/96.12 call trees ref 95.36

- 1,400 0QH4 95.00/95.25 put spds ref 95.63

- 1,400 SFRM4 95.25/95.50 call spds ref 94.775

- 4,000 0QV3 95.31/95.43/95.62 broken call trees ref 95.34

- Treasury Options:

- 2,300 TUZ3 102 calls, 8.5 ref 101-10.38

- over 23,000 TYX 108 puts, 47 last (wide range from 35-52)

- over 17,300 10Y weekly midcurve 110 puts, 142-145 ref 108-11.5 to -10.5

- 3,500 USZ3 117/119 call spds, 45 ref 115-11

- 8,400 USZ3 111 puts, 63 ref 115-20

- 3,000 USX3 113 puts, 53 ref 115-26

- 2,200 TUX3 101-87 calls, 4.5 ref 101-09.12

- 2,400 TUX3 101 puts, 7.5 ref 101-09.12

- 3,600 USX3 114 puts, 62 ref 115-31

- 2,300 TYX3 106.5 puts, 15 ref 108-11.5

EGBs-GILTS CASH CLOSE: Long-End Rout

The German curve twist steepened while the UK's bear steepened Monday, with standout sell-offs at the long end.

- Higher energy prices (including a jump in European gas futures) and the continuation of the "higher for longer" theme for global rates continued to weigh, with steepening evident across European curves.

- The 30Y segment underperformed with yields up double-digits across the space: Buxl had one of its biggest selloffs this year and yields touched 3% for the first time since 2011. Gilt 30Y yields remain below the 2022 mini-budget highs though.

- BTPs underperformed EGB periphery peers, with the 30Y yield at a decade-high.

- Data had little apparent lasting impact. September German IFO was slightly better than feared but still pointed to a recessionary end to Q3.

- ECB Pres Lagarde repeated many of the talking points of last week's decision, while Schnabel explored the debate about what signal the growth and subsequent collapse in money supply aggregates were sending to central bankers.

- Tuesday's data docket is thin, but we get plenty of ECB speakers including Lane, Simkus, Muller, and Holzmann, with Eurozone CPI data eyed later in the week (MNI's preview will be out Tuesday).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.1bps at 3.237%, 5-Yr is up 1.5bps at 2.765%, 10-Yr is up 5.9bps at 2.798%, and 30-Yr is up 10.5bps at 2.998%.

- UK: The 2-Yr yield is up 1.3bps at 4.816%, 5-Yr is up 3.7bps at 4.401%, 10-Yr is up 7.4bps at 4.323%, and 30-Yr is up 11.3bps at 4.796%.

- Italian BTP spread up 0.9bps at 186.4bps / Spanish bond spread down 0.8bps at 107.2bps

EGB Options: Busy Opening To The Week Includes Several Closers

Monday's Europe rates / bond options flow included:

- RXZ3 130.00 calls bought for 108.5 and 109 in 5k

- RXZ3 130/128/126p ladder, bought for 50 in 2k

- RXX3 127.00 puts 3.5K given at 41, looks like a closer. Delta -24%.

- RXX3 126.50p, bought for 27 up to 34 in 8.7k.

- RXX3 131/132/132.5c fly sold at 14 in 4k

- 0RZ3 96.75/96.50/96.00p ladder sold at 10.75 in 12k total

- ERU4 96.375^ sold at 72 in 5k

- ERU4 96.375^ vs ERH4 96.00^ bought in 45 in 2.5k (buys the Sep, sells the Mar)

- SFIZ3 94.10/94.25/94.80/95.00 call condor sold at 12 in 5k

FOREX USD Index Continues Ascent, Prints Fresh 2023 Highs

- The USD index has risen a further 0.35% on Monday, continuing its impressive upward trend and reaching fresh 2023 highs in the process alongside the bear steepening move along the treasuries curve which saw the 10 year yield rise 10bps to 4.53%.

- The key underperformer across G10 was the Euro, declining 0.6% and trading below the 1.06 handle for the first time since March 16. The recent clearance of 1.0632, the Sep 14 low, confirmed a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. Sights are on 1.0551 next, the Mar 16 low.

- Elsewhere, USDJPY continues to grind higher following Bank of Japan Governor Ueda sticking to a dovish script in his post-meeting address last Friday. The pair has narrowed in on 149.00 and market participants will be wary of any comments from the MoF as we make headway towards 150,00, a point of reference for some sell-side institutions regarding the potential for intervention.

- Interestingly, Ueda spoke again today and said it is important for foreign exchange rates to move stably reflecting economic and financial fundamentals.

- The Swedish Krona remains the G10 outperformer, defying weakness seen elsewhere amid the broad USD strength. As noted throughout the day, drivers for the SEK strength are the SBB cash injection from the weekend and the beginning of Riksbank FX hedging today.

- In emerging markets, the risk sensitive HUF was a notable laggard alongside the majority of Latin American currencies. With positioning likely playing a key part in today’s unwind, the Mexican Peso (-1.17%) and the Colombian peso (-1.81%) are the worst performers.

- A fairly light docket on Tuesday sees US consumer confidence and new home sales data cross. Later in the week, Eurozone CPI figures will be in focus.

Late Equity Roundup: Off Midday Highs, Energy Still Strong

- Stocks are see-sawing off midday highs in late trade, a generally quiet start to the week with many sidelined ahead a likely US government shutdown this Saturday. Currently, the DJIA is down 20.31 points (-0.06%) at 33979.99, S&P E-Mini Future up 7.75 points (0.18%) at 4375.5, Nasdaq up 27.3 points (0.2%) at 13271.61.

- Leaders: Energy, Consumer Discretionary and Materials sectors continued to outperform in the second half. Oil and gas stocks led gainers in the first half Monday, Coterra Energy and EOG Resources both gaining +2%, Marathon +1.55%, and ConocoPhillips +1.38%.

- Broadline retailers continued to support the Consumer Discretionary sector: Amazon +1.85%, Estsy +1.68%, Ebay +1.65%. Meanwhile, container/packaging stocks led Materials: Sealed Air +3.7%, International Paper +2.5%, Avery Denison +2.25%.

- Laggers: Consumer Staples, Utilities and Real Estate underperformed Monday, food and beverage shares weighed on the former: Keurig -1.8%, Conagra -1.75%, Campbell Soup -1.5%. Multi energy providers weighed on the former: Ameren -1.27%, CMS Energy and WEC Energy -1.1-1.0%.

- Meanwhile, Real Estate Investment Trusts (REITS) lagged R/E management and development share: Boston Properties -1.6%, Equity Residential and Extra Space Storage Inc both -1.25-1.20%.

E-MINI S&P TECHS: (Z3) Heading South

- RES 4: 4673.50 High Aug 1

- RES 3: 4617.40 76.4% retracement of the Jul 27 - Aug 18 sell-off

- RES 2: 4566.00/4597.50 High Sep 15 / 1 and a near-term bull trigger

- RES 1: 4447.00/4502.22 High Sep 21 / 50-day EMA

- PRICE: 4360.00 @ 1505 ET Sep 25

- SUP 1: 4338.25 Intraday low

- SUP 2: 4318.00 Low Jun 2

- SUP 3: 4300.62 50.0% retracement of the Mar 13 - Jul 27 bull cycle

- SUP 4: 4259.00 Low May 31

A bear cycle in S&P E-minis remains in play and price is trading lower today. Last Thursday’s sell-off resulted in a break of support at 4397.75, the Aug 18 low. This breach reinforces bearish conditions and signals scope for a continuation lower. Sights are on 4318.00 next, the Jun 2 low. Initial firm resistance is 4496.68, the 50-day EMA. Short-term gains would be considered corrective.

COMMODITIES Oil Ultimately Lower Whilst Gold Under Strong USD Pressure

- Crude futures are ending the session lower on the day, suggesting the market considers the wider market impact of Russian diesel and gasoline exports ban to be relatively limited with the measure generally expected to be fairly short lived.

- Crude managed money net long positions rose again to the highest since March 2022 according to latest CFTC data. Combined net long positions for Brent and WTI increased by another +27k to 522k with WTI at a 19 month high and Brent at a six month high.

- Russia has succeeded in avoiding G7 sanctions on most of its oil exports, as almost three quarters of all seaborne Russian crude flows in August have travelled without western insurance, allowing Russia to sell its oil above the $60/bbl price cap.

- US oil production has seen some focus today. Chevron CEO Mike Wirthy has US production is being held back by inconsistent energy policy, with risks to market prices remaining more to the upside rather than the downside. Separately, oil is headed for $150/b unless the US does more to encourage exploration, according to Continental Resources CEO Dough Lawler.

- WTI is -0.4% at $89.65, further away from resistance at $92.43 (Sep 19 high) but easily above support at $86.58 (20-day EMA).

- Brent is -0.06% at $93.21, pulling further off resistance at $95.96 (Sep 19 high) but remaining easily above support at $90.89 (20-day EMA).

- Gold is -0.5% at $1915.77, having come under strong pressure from a resurgent US dollar on a further large bear steepening in Treasuries as real yields surge higher. Support at $1901.1 (Sep 14 low) could start to be eyed as the yellow metal remains far below last week’s pre-FOMC high of $1947.5.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/09/2023 | 0600/0800 | ** |  | SE | PPI |

| 26/09/2023 | 0700/0900 |  | EU | ECB's Lane speaks at CEPR conference | |

| 26/09/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/09/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/09/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/09/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/09/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/09/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 26/09/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/09/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/09/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 26/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/09/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/09/2023 | 1730/1330 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.