-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessKey Inter-Meeting Fed Speak – Dec 2024

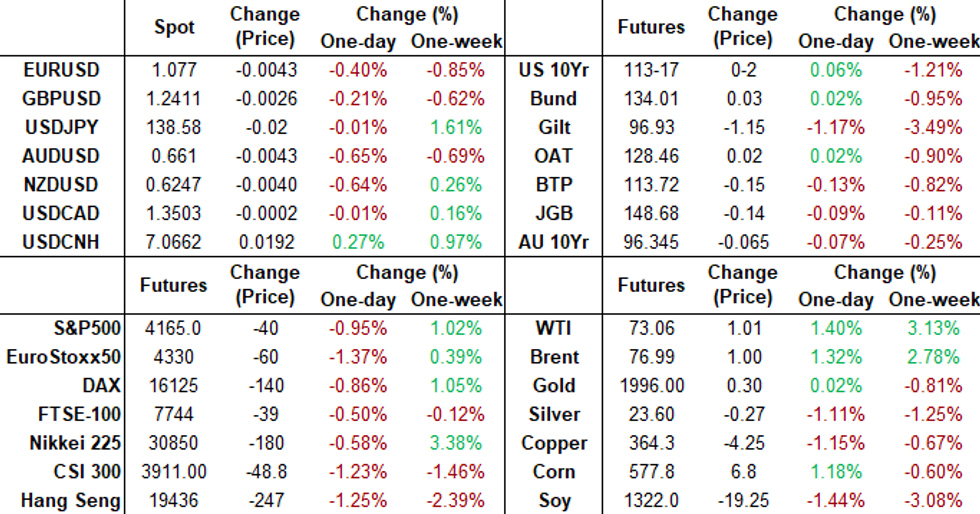

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA MARKETS ANALYSIS: Fed Gov Waller Too Soon For Pause

- MNI FED Gov Waller Probably Leaning Toward June Hike

- MNI: Fed Gov Waller Says Too Soon To Call For June Pause

- MNI US: Dem Leader Jeffries: House Republicans Are Intent On Crashing The Economy

- MCCARTHY SAYS STILL FAR APART ON DEBT TALKS BUT CAN GET TO YES, Bbg

- YELLEN TO UPDATE CONGRESS SOON WITH MORE PRECISION ON TIMELINE, Bbg

- YELLEN REITERATES TREASURY MAY RUN OUT OF CASH SOON AS JUNE 1; BIDEN TEAM OFFERED MEASURES TO CUT DEFICIT $1 TRLN MORE; REPEATS `DIFFICULT CHOICES TO MAKE' IF GO PAST X-DATE, Bbg

Key Links:MNI: Fed Minutes Show Split FOMC On Continued Rate Hikes / MNI: Fed’s Waller Says Too Soon To Call For June Pause / Waller Probably Leaning Toward June Hike / MNI: Canada Warned Ending Mortgage Bonds Could Be Costly

US TSYS: Post-FOMC Minutes Rebound Gaining Momentum

Still mildly weaker, Treasury futures continue to climb off midday lows as markets digest the May FOMC minutes.- "Many participants focused on the need to retain optionality after this meeting," the FOMC meeting minutes said. "Some participants commented that, based on their expectations that progress in returning inflation to 2% could continue to be unacceptably slow, additional policy firming would likely be warranted at future meetings," the minutes said.

- At the moment, 10Y futures are trading -3.5 at 113-16, well off early session high of 113-25 before debt ceiling headlines buffeted rates. From a technical perspective, TYM3 break of 113-30+ last week, the Apr 19 low and a key support, has reinforced a bearish theme. Tuesday’s move lower opens 112-30 next, a Fibonacci retracement. On the upside, initial resistance is seen at 113-30+ ahead of the 50-day EMA, at 114-23+. A break of the average is required to signal a potential reversal.

- Markets still have Fed Gov Waller comments to digest as well after remarking the lack of progress bringing down inflation means it’s too soon for Federal Reserve officials to stop raising interest rates, although tighter credit conditions could alter that calculus.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01084 to 5.11080 (+.01707/wk)

- 3M +0.02538 to 5.19155 (+.02808/wk)

- 6M +0.03681 to 5.20017 (+.05364/wk)

- 12M +0.05742 to 4.97115 (+.09349/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00428 to 5.06186%

- 1M +0.00286 to 5.14086%

- 3M +0.02857 to 5.42443% */**

- 6M +0.02785 to 5.53214%

- 12M +0.01157 to 5.53371%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.42443% on 5/24/23

- Daily Effective Fed Funds Rate: 5.08% volume: $126B

- Daily Overnight Bank Funding Rate: 5.07% volume: $298B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.383T

- Broad General Collateral Rate (BGCR): 5.02%, $585B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $580B

- (rate, volume levels reflect prior session)

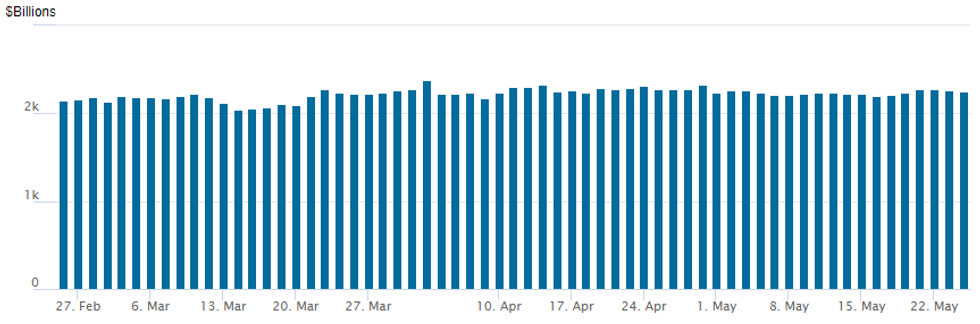

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,250.709B w/ 105 counterparties, compares to prior $2,256.689B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Option trade has been relatively mixed on lighter volumes until yesterday: Tuesday trade was decidedly bearish positioning in SOFR options (combination of rate cuts evaporating and expectation of surge in Bill issuance if debt ceiling gets raised). While treasury option trade remains bullish - outright calls, call spds bought in 2s, 5s and 10s. The gist is positioning tone has segued from upside rate cut hedging a couple weeks ago,. to non-comital as debt ceiling gyrations pushed direction players to the sidelines the last several days, to more consistent downside insurance buying the last two days. NOTE on the latter, these are NOT huge positions, more fast money, spec trades looking for projected rates cuts to continue to soften, rather than rate hike (or heavy bill issuance on back of debt ceiling agreement) positioning.

- SOFR Options:

- Block, 5,000 SFRH4 94.50/95.00/95.50 put flys, 9.5 ref 95.745

- -4,000 SFRV3 94.43/94.68/94.93/95.18 put condors, 9

- 7,000 SFRM3 94.50/94.62/94.75 put flys

- 3,000 SFRM3 94.81/94.93 call spds, ref 94.7575

- 2,500 SFRM3 94.62/94.75/94.87/94.93 broken put condors res 94.7575

- 2,000 OQU3 97.12/97.37/97.62/97.87 call condors ref 96.555

- Block, 10,000 SFRU3 94.12/94.37 put spds, 1.75 ref 94.95

- Block, 12,000 2QM3 96.25/96.50 put spds, 3.25 ref 96.92 to -.925

- 5,000 OQM3 95.25/95.50 put spds, 1.25 ref 96.24

- 2,000 2QM3 96.37 puts, 2.0 ref 96.91

- 2,000 OQM3 96.00/2QM3 96.68 put spds

- 2,500 SFRM3 94.81/94.93/95.06 call flys ref 94.77

- Treasury Options:

- +3,500 TYU3 110.5/111.5 put strip, 126 vs. 114-11

- -10,000 TYM3 113.5/114.5 put over risk reversals, 6 net

- over -17,500 TUN3 103.12/103.75 put spds 26 to 25.5 ref 103-03.25

- 5,000 TYN3 114/115/116 call flys

- +4,000 USN3 123 puts, 32 ref 127-10

- 1,000 FVN3 110/110.25/110.75/111 call condors ref 109-09

- 3,000 TYN3 116/118 call spds 21 ref 114-17.5

- 2,250 wk2 TY 113/114 put spds

- 3,600 TYM3 113.75/114 call spds ref 113-23

- 5,250 FVM3 109.25 calls, 6 ref 108-23.5

EGBs-GILTS CASH CLOSE: Inflation Shock Sinks UK Short End

The UK short-end sold off the most since September 2022 in a strong bear flattening curve move Wednesday, with Gilts easily underperforming Bunds.

- April UK CPI came in above all expectations, with core accelerating to a 31-year high 6.8% Y/Y vs 6.2% expected and the survey high 6.6%.

- Gilts dropped sharply in the aftermath, though pared some of those losses later in the session, in part because BoE's Bailey didn't compound the hawkish sentiment in an afternoon appearance.

- 2Y yields rose the most in 8 months (over 23bp) as 34bp of hikes were added to the BoE's hiking path, with longer-dated instruments faring relatively better.

- The German curve also bear flattened in sympathy with UK move, but yields pulled back over the course of the session, with Buxl closing stronger.

- Periphery spreads widened slightly amid risk-off trade.

- A fairly quiet data session awaits Thursday, but there will be plenty of central bank speakers including ECB's Nagel, Villeroy and Centeno, and BoE's Haskel.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.2bps at 2.854%, 5-Yr is up 1.8bps at 2.469%, 10-Yr is up 0.3bps at 2.472%, and 30-Yr is down 1.5bps at 2.627%.

- UK: The 2-Yr yield is up 23.7bps at 4.372%, 5-Yr is up 14.5bps at 4.136%, 10-Yr is up 5.6bps at 4.214%, and 30-Yr is up 1.1bps at 4.544%.

- Italian BTP spread up 1.4bps at 186.6bps / Spanish up 1.5bps at 106.4bps

EGB Options: All Sonia As BoE Hikes Recalibrated Higher

Wednesday's Europe rates / bond options flow included:

- SFIM3 95.10/95.15/9.25/95.30c condor, bought for 2.25 in 3k

- SFIN3 9485/75/70/60p condor vs 95.00/95.10cs bought the condor for 1 in 4k

- SFIU3 94.20p vs 94.80/94.95cs, bought the p for 1 in 6k.

- SFIQ3 95.00/94.90/94.70/94.50p condor bought for flat in 3k

FOREX: NZD Plummets Following RBNZ, Greenback Remains On Front Foot

- NZD (-2.32%) remains the poorest performer in G10 on Wednesday following the RBNZ rate decision. The bank raised rates by 25bps - as expected - but unexpectedly signalled that their tightening cycle has now concluded, resulting in NZDUSD dropping below 0.6150 for the first time since April. Ongoing greenback strength throughout US hours prompted a further grind lower for NZDUSD, eventually printing a 0.6094 low, narrowing the gap substantially with the year’s lows at 0.6085.

- Kiwi weakness dragged its antipodean counterpart lower, with AUD registering 1% losses, helped by the weakness for major global equity benchmarks.

- UK markets drew focus across the European morning following the higher-than-expected CPI print for April. While headline CPI dipped to 8.7% from 10.1% prior - it was a far slower step-down for inflation pressure, and core also accelerated to 6.8% from 6.2%.

- GBP's initial inflation-inspired rally faltered following the Gilt open, with markets returning to the previously observed pattern of selling the currency alongside notable increases in short-end rates. GBP/USD corrected off the high of 1.2470 down to an eventual session low of 1.2358 where spot closely resides as we approach the APAC crossover.

- Japanese yen weakness has been consistent over the course of the US session as we approached the release of the FOMC minutes which showed a split FOMC over the need for continued rate hikes.

- USDJPY extended gains above yesterday’s highs around 138.90 and then the 139 handle. Price action opens the next targets for the move which are 139.59, a Fibonacci retracement and eventually 140.62, the bull channel top drawn from the Jan 16 low.

- Thursday’s data highlight will be the second read of US Q1 GDP, as well as jobless claims and pending home sales data. US Core PCE Price index data is scheduled for Friday.

FX: Expiries for May25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0765(E786mln)

- USD/JPY: Y138.10($838mln), Y138.50-55($611mln), Y139.50($764mln)

- USD/CAD: C$1.3600-05($808mln)

- USD/CNY: Cny7.0250($1.6bln), Cny7.0500($1.2bln), Cny7.1000($1.0bln)

Equities Roundup: Weaker/Narrow Range After Breaking 50D EMA Support

Pensive trade as markets continue to wait for some break in the debt ceiling impasse. Stocks holding weaker/narrow range, SPX eminis near session lows after breaking technical support earlier (50D EMA of 4124.34) that exposes a stronger short-term reversal and open 4062.25, the May 4 low.

- Reflecting a more pessimistic tone on the Hill negotiations, House Minority Leader Hakeem Jeffries (D-NY) told reporters Thursday afternoon that “it’s increasingly clear to me that House Republicans are intent on crashing the economy and defaulting on our debt. That’s wrong. It will hurt everyday Americans in the brinksmanship.”

- Currently, S&P E-Mini futures are down 28 points (-0.67%) at 4130.5; DJIA down 196.58 points (-0.59%) at 32855.24; Nasdaq down 77.6 points (-0.6%) at 12482.15.

- Leading laggers: Real Estate and Financials sectors underperformed, Banks and financial institutions weighing on the latter amid the prospect of a debt default.

- Leading gainers: Energy and Consumer Discretionary narrowly outperformed, oil and gas shares stronger but off highs as crude oil prices traded firmer (but off highs) after a large draw in US crude inventories was reported earlier.

E-MINI S&P TECHS: (M3) Corrective Cycle Extends

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4231.00 High Feb 3

- RES 1: 4227.25 High May 19

- PRICE: 4122.25 @ 1515ET May 24

- SUP 1: 4115.25 intra-day Low May 24

- SUP 2: 4062.25 Low May 4 and key support

- SUP 3: 4052.50 Low Mar 30

- SUP 4: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

The S&P E-minis outlook remains bullish, however, the contract has entered a short-term corrective cycle. Price has breached the 20-day EMA and this exposes a more important support at 4124.34, the 50-day EMA. A clear break of this average would highlight a stronger short-term reversal and open 4062.25, the May 4 low. Initial key resistance has been defined at 4227.25, the May 19 high.

COMMODITIES: Oil Swings With Macro Factors, Large Crude Draw Underpins Day’s Strength

- Crude oil has seen volatile price action in the past few hours of trading, sliding and then bouncing back to decent further gains of 2% on the day.

- The sharp decline appears to move in lockstep with an acceleartion in debt ceiling concerns as yields of T-bills expiring around the x-date shot higher, before bouncing and then liffting further as Treasury yields softened after the FOMC minutes.

- Gains were earlier seen after a big draw in US crude inventories and time spreads and refining margins edged higher supported by another fall in gasoline stocks and slightly higher oil product implied demand. Of note, US Gulf Coast stocks fell by 11.4mbbls and the most on record.

- WTI is +2.0% at $74.35 bouncing off a low of $73.13. It earlier tested and briefly cleared the 50-day EMA of $74.41 after which sits $76.74 (Apr 28 high).

- Brent is +2.0% at $78.37 having earlier just cleared the 50-day EMA of $78.56 after which lies $82.88 (Apr 25 high).

- Gold is -0.6% at $1963.46 off a low of $1956.85 that remains above $1952.0 (May 18 low) after which lies $1934.3 (Mar 22 low).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/05/2023 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/05/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 25/05/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 25/05/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/05/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/05/2023 | 0900/1100 |  | EU | ECB de Guindos Presents ECB Annual Report 2022 | |

| 25/05/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/05/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 25/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 25/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/05/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 25/05/2023 | 1230/0830 | *** |  | US | GDP |

| 25/05/2023 | 1350/0950 |  | US | Richmond Fed's Tom Barkin | |

| 25/05/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 25/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/05/2023 | 1430/1030 |  | US | Boston Fed's Susan Collins | |

| 25/05/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/05/2023 | 1630/1730 |  | UK | BOE Haskel Speech at Peterson Institute | |

| 25/05/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.