-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Powell, Focus on NFP, CPI, PPI

HIGHLIGHTS

- MNI FED POWELL: 2% INFLATION IS GOING TO REMAIN FED'S GOAL

- BANK OF CANADA HOLDS KEY INTEREST RATE AT 4.5%, MATCHING EST .. BOC 'IS PREPARED' TO HIKE AGAIN IF NEEDED TO QUELL INFLATION

- FED BEIGE BOOK: INFLATIONARY PRESSURES REMAINED WIDESPREAD, THOUGH PRICE INCREASES IN MANY DISTRICTS MODERATED

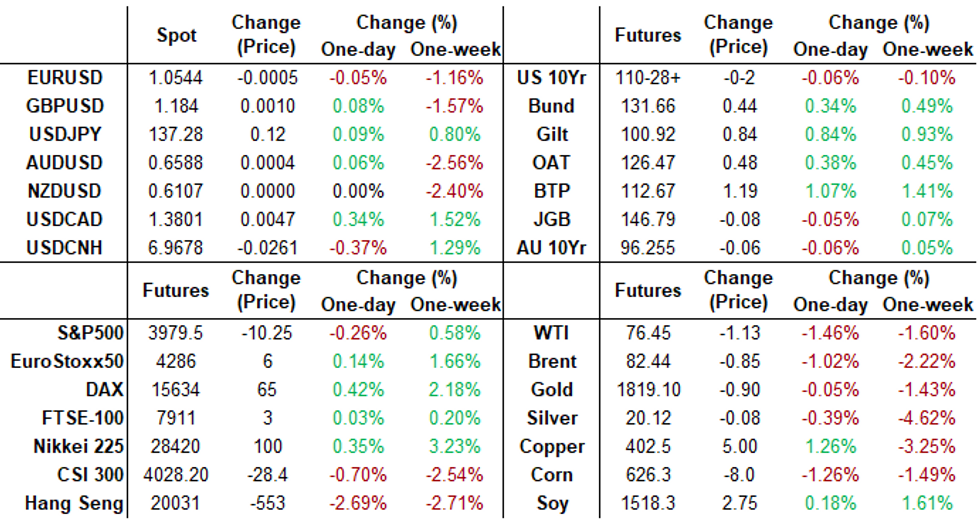

US TSYS: Fed Terminal Tops 5.685% In October

- Short end rate futures remain weak in late trade, but off early overnight lows as Federal Reserve Chairman Powell had a modicum of success in tempering Tuesday's hawkish tones at today's testimony to Congress.

- Chair Powell conceded earlier, the upcoming NFP Friday, CPI and PPI inflation metrics next week are "going to be important in our assessment," however, "we have not made any decision about the March meeting. We’re not on a preset path."

- Treasury bonds lead the initial rally (traded off highs after a weak Treasury 10Y note auction re-open tailed: 3.985% high yield vs. 3.955% WI) while short end rates still reflect higher expectations of 50Bp hike at next FOMC announcement on March 22.

- Fed funds implied hike for Mar'23 at 42.4bp, May'23 cumulative 77.9bp to 5.357%, Jun'23 99.5bp to 5.573%. The trajectory of hikes slows to 108.4bp in July'23 to 5.663%.

- Terminal rate via Fed Funds has climbed to 5.685% in Oct'23 vs. 5.695% high.

- Additional metrics: Treasury 2Y yield tapped new 16 year high of 5.0801% overnight, 2s10s yield curve fell to new inverted low of -105.513 last seen in 1981 when Volcker was Chairman of the Federal Reserve.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00415 to 4.55814% (-0.00143/wk)

- 1M +0.04071 to 4.75971% (+0.05057/wk)

- 3M +0.09900 to 5.12471% (+0.14071/wk)*/**

- 6M +0.12800 to 5.47414% (+0.15743/wk)

- 12M +0.16400 to 5.88071% (+0.18628/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.02571% on 3/7/23

- Daily Effective Fed Funds Rate: 4.57% volume: $118B

- Daily Overnight Bank Funding Rate: 4.57% volume: $308B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.151T

- Broad General Collateral Rate (BGCR): 4.51%, $474B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $463B

- (rate, volume levels reflect prior session)

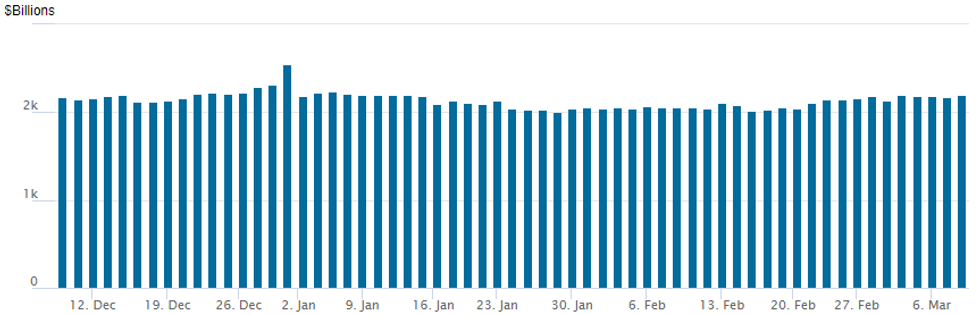

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,193.237B w/ 102 counterparties vs. prior session's $2,170.195B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Multiple downside put structures

SOFR Options:

Block, 5,000 SFRZ3 93.00/93.37 put spds, 3.5 ref 94.47

Block, 5,000 SFRK3 94.43/94.56/94.62/94.75 put condors, 2.25

Block, 20,000 SFRU3 93.62/94.37/94.62/95.12 put condors, 13.25/splits ref 94.30-.295

Block, 10,000 SFRZ3 92.50/93.00/93.50 put flys, 3.25/splits ref 94.45

Block, 10,000 OQM3 94.75/95.00/95.25 put flys, 2.5 ref 95.245

Block, 8,000 SFRJ3 94.62/94.87 call spds, 2.5 ref 94.42

+25,000 SFRK3 93.93/94.06/94.18/94.31 put condors at 2.75

Block, 30,000 SFRK3 94.00 puts, 3.0 vs. 94.39/0.14% (opener, OI 12,375)

Treasury Options:

+38,000 TYM3 112/114 call spds, 44 ref 111-07

+50,000 TYM3 111.5/113.5 call spds, 50 ref 111-08

EGBs-GILTS CASH CLOSE: Short End Continues To Underperform

The short ends of European curves continued to underperform Wednesday, with inversions increasing amid a long-end rally.

- Another day, another move higher in central bank terminal rate expectations, following Tuesday's hawkish comments by Fed Chair Powell.

- ECB terminal depo implied hit a cycle high of 4.18%; BoE's ticked 5.00% for the first time since the fiscal turmoil of October.

- Meanwhile, long-end yields moved lower. German 2s10s ticked -70bp, marking a further 20bp of inversion this week.

- Periphery EGBs shrugged off higher ECB tightening prospects, instead mirroring equity gains. 10Y BTP spreads closed below 180bp for the first time since mid-Feb.

- Italy's Visco criticised ECB colleagues giving multi-meeting rate hike guidance. BoE's Dhingra was dovish as expected. Neither provoked much market reaction.

- In data, German /Italian retail sales and German industrial production both beat expectations, while the Eurozone final GDP revision was in line.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.5bps at 3.336%, 5-Yr is down 1.3bps at 2.833%, 10-Yr is down 4.6bps at 2.646%, and 30-Yr is down 6.4bps at 2.543%.

- UK: The 2-Yr yield is down 0.9bps at 3.791%, 5-Yr is down 3bps at 3.67%, 10-Yr is down 5.7bps at 3.765%, and 30-Yr is down 7bps at 4.081%.

- Italian BTP spread down 5.3bps at 178.2bps / Spanish down 1.3bps at 101.7bps

EGB Options: Selling Rate Vol Wednesday

Wednesday's Europe rates /bond options flow included:

- ERH3 97.00^ sold down to 4.25 in 7.5k total

- ERZ3 95.75/95.625/95.375/95.25p condor, bought for 2 in 4k

- RXM3 125/122ps, bought for 34 in 8k

FOREX: USD Index Consolidates Gains, Large Round Trip For USDJPY

- Most G10 currencies held relatively narrow ranges on Wednesday after the significant volatility seen in the prior trading session. The USD index remains close to unchanged as we approach the APAC crossover, having consolidated Tuesday’s advance.

- Price action indicates the DXY is confirming a key bullish break of the 100-day moving average. Markets broke and closed above this mark (intersecting today at 105.466) for the first time since June 2021 - a move which presaged a multi-year rally for the currency amid the Fed's post-pandemic tightening drive.

- The most action was seen in the Japanese Yen, which had modestly outperformed following Powell on the back of suppressed equity markets. USDJPY gained traction to the topside overnight and printed as high as 137.91 before staging an impressive 140 pip reversal lower through the European session and into early US trade. However, the pair has since bounced back above the 137 mark and is close to yesterday’s closing level.

- The Canadian Dollar sits bottom of the G10 FX rankings today after the BoC met expectations of holding at 4.5% but didn’t give a nod to the higher rates expectations in the US, building on yesterday’s clearance of the bull trigger at 1.3705 for USDCAD. The pair printed as high as 1.3815, the highest print since October last year.

- China CPI & PPI data is due overnight, however Thursday remains void of any tier-one data releases. Focus will quickly shift to Friday’s Bank of Japan decision and the release of US Non-farm payrolls.

FX: Expiries for Mar09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.1bln), $1.0530-50(E1.1bln), $1.0570-75(E1.1bln), $1.0585(E504mln), $1.0600(E1.7bln), $1.0635-50(E2.6bln)

- USD/JPY: Y136.50-55($1.0bln), Y137.00-10($1.5bln), Y138.00($810mln)

- GBP/USD: $1.1940-50(Gbp690mln)

- EUR/GBP: Gbp0.8915(E738mln), Gbp0.8950(E684mln)

- AUD/USD: $0.6755(A$570mln), $0.6785-00(A$1.3bln)

- USD/CAD: C$1.3500($1.1bln), C$1.3875($605mln)

- USD/CNY: Cny6.9000($1.3bln)

Late Equities Roundup: Post-Powell Support Evaporated

- US equities are weaker in late trade, the e-mini S&P futures reversed midday session highs and breached technical support of 3974.0 in the second half.

- No particular headline driver, recent support tied to Chairman Powell sounding less hawkish than Tuesday's testimony, appears to have evaporated as participants set sights on Friday's employment report.

- A significantly stronger jobs gain over the current consensus 225k (or anywhere near January's +517k gain) will rekindle hawkish policy expectations.

- From a technical standpoint, a continued decline would pave the way for weakness towards the next key support at 3925.00, Mar 2 low. This level is a bear trigger and a breach would confirm a resumption of the bear leg that started on Feb 2.

E-MINI S&P (H3): Watching Support

- RES 4: 4208.50 High Feb 2 and key resistance

- RES 3: 4141.59 61.8% retracement of the Feb 2 - Mar 2 bear le

- RES 2: 4100.20 61.8% retracement of the Feb 2 - Mar 2 bear leg

- RES 1: 4082.50 High Mar 6

- PRICE: 3978.50 @ 1525ET Mar 8

- SUP 1: 3974.00 Low Mar 3

- SUP 2: 3925.00/3901.75 Low Mar 2 / Low Jan 19

- SUP 3: 3787.62 76.4% retracement of the Dec 22 - Feb 2 bull cycle

- SUP 4: 3819.00 Low Jan 6

The S&P E-Minis trend condition is bearish and yesterday’s move lower signals the end of the recent corrective bounce. A continuation lower would pave the way for weakness towards the next key support at 3925.00, Mar 2 low. This level is a bear trigger and a breach would confirm a resumption of the bear leg that started on Feb 2. For bulls, a break of 4082.50, the Mar 6 high, is required to reinstate a bullish theme.

COMMODITIES: Inventory Draw Can’t Offset Fed Gloom

- Crude oil prices have seen a steadier but still solid decline after yesterday’s Fed Chair Powell-induced slide with opening the door to faster rate hikes, which continue to weigh on risk sentiment. There was little support for prices from the first decline in EIA crude inventories in eleven weeks.

- WTI is -1.5% at $76.42 having moved closer to support at $75.83 (Mar 3 low) after which sits key short-term support at $73.80 (Feb 22 low). Most active strikes in the CLJ3 today have been $75/bbl puts.

- Brent is -1.0% at $82.43 having earlier cleared $82.36 (Mar 3 low) briefly to open $80.25 (Feb 23 low).

- Gold is +0.1% at $1815.34 with the DXY reversing an earlier decline for ultimately little changed after yesterday’s surge. It leaves gold still close to the bear trigger at $1804.9 (Feb 28 low).

- Trafigura see Brent in the $90s by mid-year on rebounding China demand.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/03/2023 | 0130/0930 | *** |  | CN | CPI |

| 09/03/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/03/2023 | 0700/0800 | ** |  | SE | Private Sector Production |

| 09/03/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 09/03/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/03/2023 | 1500/1000 |  | US | Fed Vice Chair Michael Barr | |

| 09/03/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 09/03/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/03/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/03/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 09/03/2023 | 1840/1340 |  | CA | BOC's Rogers "Economic Progress Report" speech |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.