-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Tightening Bias Remains

- MNI EU-UK: Windsor Framework Joint Committee Meets As MEPs Approve New Trade Rules

- MNI WHEAT: Russia Foreign Min-Only Full Implementation Can Save Grain Deal

- MNI US: Passage Of Debt Limit Bill In House Could Push Biden To Negotiating Table

- ERDOGAN SAYS TURKEY PLANS TO BUILD 2 MORE NUCLEAR POWER PLANTS - bbg

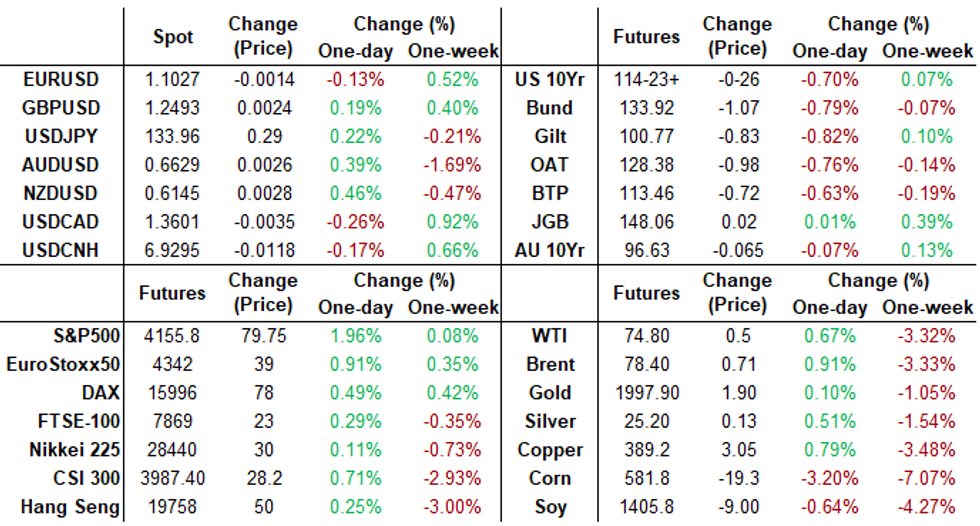

US TSYS: Near Late Lows Ahead Friday's PCE, ECI Data

Front month Treasury futures gradually extended session lows after after the Treasury $35B 7Y note auction (91282CGZ8) tailed again: 3.563% high yield vs. 3.552% WI; 2.41x bid-to-cover vs. 2.39x last month.- The initial impetus for Thursday's jump in yields (10s top 3.5357%) was the uptick in inflation as core PCE Q1 advance of 4.94% annualized for the core PCE deflator (cons 4.7%) implies a March reading bouncing back to 0.50% M/M (current consensus 0.3), from 0.30% in Feb after 0.52% in Jan.

- Jun'23 10Y futures dipped below 20-day EMA of 115-00.5 to 114-21 session low as focus turned to 114-18.5 50-day EMA. Key support has been defined at 113-30+, the Apr 19 low. A break of this support would reinstate the recent bearish theme.

- Heavy short end selling saw curves bear flattening (2s10s hit -57.777 low). As a result of re-acceleration of March inflation, implied rate hikes in the near term have firmed, May at 22.6 while Jun cumulative climbs to 28.7 at 5.116.

- Tighter policy projections for year end are well off Tuesday highs: November cumulative currently -8.8bp (-31.1bp Tue) at 4.741, Dec'23 cumulative -29.5bp (-52.1bp Tue) at 4.534. Meanwhile, Jan'24 cumulative sits at -51.9bp vs. a full three 25bp cuts late Tuesday.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01100 to 4.99321 (+.09323/wk)

- 3M -0.00197 to 5.04345 (+.06029/wk)

- 6M -0.00604 to 5.02131 (+.07826/wk)

- 12M -0.01855 to 4.72626 (+.04718/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.01443 to 4.81014%

- 1M +0.00957 to 5.03414%

- 3M +0.02643 to 5.29914% */**

- 6M +0.01500 to 5.38686%

- 12M +0.03286 to 5.32143%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.29914% on 4/27/23

- Daily Effective Fed Funds Rate: 4.83% volume: $115B

- Daily Overnight Bank Funding Rate: 4.82% volume: $285B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.345T

- Broad General Collateral Rate (BGCR): 4.77%, $547B

- Tri-Party General Collateral Rate (TGCR): 4.77%, $535B

- (rate, volume levels reflect prior session)

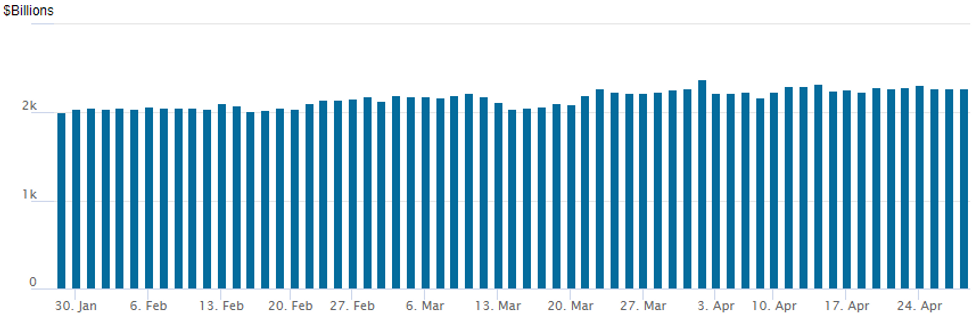

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,273.926B w/ 101 counterparties, compares to prior $2,279.561B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTIONS SUMMARY

Thursday morning's data that showed inflation accelerated in March, squelched carry-over of the prior session's better upside call buying as implied rate cuts for year end receded. Not to say there were no calls bought in the current session, but option flows proved mixed as underlying futures continued to extend session lows in late trade.- SOFR Options:

- Block, 6,750 OQM3 95.62/96.00 3x2 put spds, 8.5 net ref 96.525

- 5,000 SFRK3 94.93/95.06/95.18 call flys, 1.25 net ref 94.905

- Block, 16,000 SFRH4 93.75/94.00 put spds, 2.0 vs. 96.035

- 1,500 SFRU3 94.62/95.18/95.75 put flys, ref 95.18

- 2,000 SFRZ3 96.00/96.50/97.00/97.50 call condors ref 95.61

- -5,000 OQM3 96.25 puts, 17.5 vs. 96.56/0.30%

- +10,000 SFRU3 95.00/95.50/96.00 call flys, 5.75 ref 95.225

- Block, 2,500 SFRZ3 94.87/95.12/95.87/96.12 iron condors, 1.0 net ref 95.675

- 2,000 SFRZ3 95.00/95.50 2x1 put spds

- 4,500 SHRH4 94.50/95.00/95.50 put flys ref 96.165

- 2,000 SFRK3 95.00/95.37 call spds vs. OQK3 96.25 puts

- 2,000 SFRM3 95.00/95.18 call spds vs. 2QM3 98.00 calls

- over 3,300 SFRM3 94.81 puts ref 94.955

- 2,000 OQK3 97.50 calls, ref 96.60

- Treasury Options:

- Block/screen, 20,000 TYM3 114.5 calls, 112 vs. 114-28/0.60%

- +7,500 TYM3 112.5 puts, 11

- 6,500 FVM3 109.5/109.75 put spds, 5.5 ref 109-26.5

- 2,000 TYM3 114.5 puts, 39 ref 115-11.5

- 2,000 TYM3 117.5/119.5 call spds ref 115-09.5

EGBs-GILTS CASH CLOSE: Bearish Movement Ahead Of CPI

Bunds and Gilts weakened Thursday with modest bear steepening in the curves, as US data renewed concerns about price pressures going into Friday's inflation data.

- Thursday's stronger-than-expected US Core PCE prices reading for Q1 provided a hawkish clue for Friday's March PCE figure, which comes on the same day as several Euro area countries (incl France and Germany) post flash April CPI.

- After drifting in a slightly negative direction in morning trade, Bund and Gilt losses accelerated in the afternoon on the PCE data and as equities bounced from Wednesday's lows.

- Central bank hike expectations pared an early drop to finish flat in the case of the ECB, though BoE terminal pricing ticked up a few basis points.

- Data isn't the only risk Friday, with a closely-watched BoJ decision as well as potential month-end market dynamics.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.4bps at 2.826%, 5-Yr is up 6.2bps at 2.462%, 10-Yr is up 6.3bps at 2.46%, and 30-Yr is up 4.2bps at 2.534%.

- UK: The 2-Yr yield is up 6.8bps at 3.819%, 5-Yr is up 7.3bps at 3.665%, 10-Yr is up 6.5bps at 3.794%, and 30-Yr is up 7.1bps at 4.154%.

- Italian BTP spread up 1.8bps at 189.3bps / Spanish up 0.1bps at 104.9bps

EGB Options: Sonia Put Spread Selling, Euribor Call Fly Buying Feature

Thursday's Europe rates/bond options flow included:

- OEM3 119.50/120.50/121.50c fly, bought for 5.5 in 5k

- 2RM3 97.50/98.00/98.25 broken c fly, bought for 5.25 in 5k

- SFIM3 95.15/95.05ps sold at 1.75 in 10k

FOREX: Post-Data Greenback Surge Moderates As Equities March Higher

- After treading water throughout the European session, the greenback caught a substantial bid following the slew of US economic data. Both the GDP Price index and quarterly Core PCE registered above their surveyed median estimates, prompting around a 40-pip surge for the USD index.

- USDJPY had the most notable rally, rising from session lows around 133.25 all the way to 134.20 highs. In similar vein, EURUSD slipped briefly back below the 1.10 handle.

- Overall, a disconnect between fixed income and equities left currency markets a little directionless throughout the rest of the US session. Significant pressure on front-end US yields (2-year +15bps) was unable to halt the strong 1.85% rally for the S&P 500 which diminished any upside momentum for the greenback.

- The improved risk backdrop weighed on Euro crosses with the likes of EURAUD and EURNZD moderating some of their impressive strength seen throughout the week.

- In emerging markets, it is worth noting the substantial selloff for the Colombian peso (USDCOP +2.54%) following the president’s cabinet reshuffle and the announcement of a new finance minister. This was in stark comparison to the Brazilian real which advanced 1.35% as a result of the improved global mood and domestic fiscal headwinds easing.

- The Bank of Japan meeting will take focus overnight before a host of European growth data in the European session. In the US, attention will be on the March core PCE data, particularly of interest after today’s surprisingly strong Q1 advance release. Equally important will be the employment cost index release, followed by the MNI Chicago PMI.

FX Expiries for Apr28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0950-70(E711mln), $1.1000(E2.9bln), $1.1040-50(E1.2bln)

- USD/JPY: Y130.00-20($1.4bln), Y134.00($537mln)

- AUD/USD: $0.6600(A$1.2bln), $0.6900(A$2.1bln)

- GBP/USD: $1.2600(Gbp615mln)

- USD/CAD: C$1.3600($747mln)

US STOCKS: Best One-Day Rally for Eminis Since January 6

The best one day rally for the index since January 6 (+77.75 vs. +86.75), stocks continue to extend session highs in late trade, SPX Eminis bounced off Wednesday's April lows (4074.25) to 4157.5 high late Thursday,

- Well through 20-day EMA resistance of 4120.83, puts focus on next resistance of 4164.25, the April 24 high, a clear break above this EMA would ease bearish pressure.

- Surprising given this this morning's increased inflation metrics that underscored likely 25bp hike from the Fed next week (and tempering year-end implied rate cuts), trading desks citing better than expected quarterly earnings announcements and unconfirmed asset allocation out of Treasuries into stocks.

- Re: earnings, the following is a list of larger stocks expected after the close: T-Mobile US Inc; Capital One Financial Corp; Hartford Financial Services; L3Harris Technologies Inc; Amazon.com Inc; Olin Corp; United States Steel Corp; Intel Corp; Weyerhaeuser Co; Pinterest Inc; Gilead Sciences Inc; Snap Inc; Amgen Inc.

E-MINI S&P TECHS: (M3) Bear Cycle Still In Play

- RES 4: 4223.00 High Feb 14

- RES 3: 4198.25/205.50 High Apr 18 and key resistance / High Feb 16

- RES 2: 4164.25 High Apr 24

- RES 1: 4157.50 High Apr 27

- PRICE: 4155.00 @ 1530ET Apr 27

- SUP 1: 4061.11 38.2% retracement of the Mar 13 - Apr 18 bull leg

- SUP 2: 4052.50 Low Mar 30

- SUP 3: 4018.75 50.0% retracement of the Mar 13 - Apr 18 bull leg

- SUP 4: 4000.00 Round number support

A strong sell-off in S&P E-minis this week has resulted in a break below both the 20- and 50-day EMAs. The break of the 50-day EMA strengthens short-term bearish conditions and signals scope for an extension lower, towards 4061.11 next and 4018.75, Fibonacci retracement points. On the upside, the 20-day EMA at 4120.83 marks initial resistance, a clear break above this EMA would ease bearish pressure.

COMMODITIES: Unusually Steady Session For Crude Whilst Gold Ends Flat

- Crude oil has seen an unusually steady and narrow session, edging out relatively small gains compared to recent moves of 0.5-1%. Despite the mild recovery, it’s still trading circa 3$/bbl down so far this week with concern for central bank rate hikes next week. An expected recovery in China remains an upside risk and the upcoming holiday period could bring a potential short term boost to fuel demand.

- The discount at which Canadian heavy oil trades to the benchmark could shrink by roughly 4$/bbl according to industry consultant Turner, Mason & Co. It could come within a year or so of the start up of TMX with shipping expected 1Q24.

- WTI is +0.7% at $74.80, still comfortably off next resistance at the key short-term $79.18 (Apr 24 high).

- Brent is +0.9% at $78.40, still comfortably off resistance at $83.06/$85.15 (Apr 25/19 highs).

- Gold is unch at $1989.19 after a mixed session as it unwound earlier gains with the USD firming after on net more inflationary than expected US data ahead of another important schedule tomorrow. It hasn’t troubled resistance at $2015.1 (Apr 17 high) nor support at $1969.3 (Apr 19 low).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/04/2023 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 28/04/2023 | 2350/0850 | * |  | JP | Retail sales (p) |

| 28/04/2023 | 2350/0850 | ** |  | JP | Industrial production |

| 28/04/2023 | 2350/0850 | * |  | JP | labor forcer survey |

| 28/04/2023 | 0300/1200 | *** |  | JP | BOJ policy announcement |

| 28/04/2023 | 0530/0730 | *** |  | FR | GDP (p) |

| 28/04/2023 | 0530/0730 | ** |  | FR | Consumer Spending |

| 28/04/2023 | 0530/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 28/04/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/04/2023 | 0630/0830 | ** |  | CH | retail sales |

| 28/04/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 28/04/2023 | 0645/0845 | ** |  | FR | PPI |

| 28/04/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 28/04/2023 | 0700/0900 | *** |  | ES | GDP (p) |

| 28/04/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/04/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 28/04/2023 | 0800/1000 | *** |  | IT | GDP (p) |

| 28/04/2023 | 0800/1000 | *** |  | DE | GDP (p) |

| 28/04/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/04/2023 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 28/04/2023 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 28/04/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/04/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/04/2023 | - |  | EU | ECB Lagarde at Post-Eurogroup Meeting Press Conference | |

| 28/04/2023 | - |  | EU | ECB Lagarde, Panetta, de Guindos at Eurogroup / ECOFIN Meeting | |

| 28/04/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/04/2023 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/04/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/04/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 28/04/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/04/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.