-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

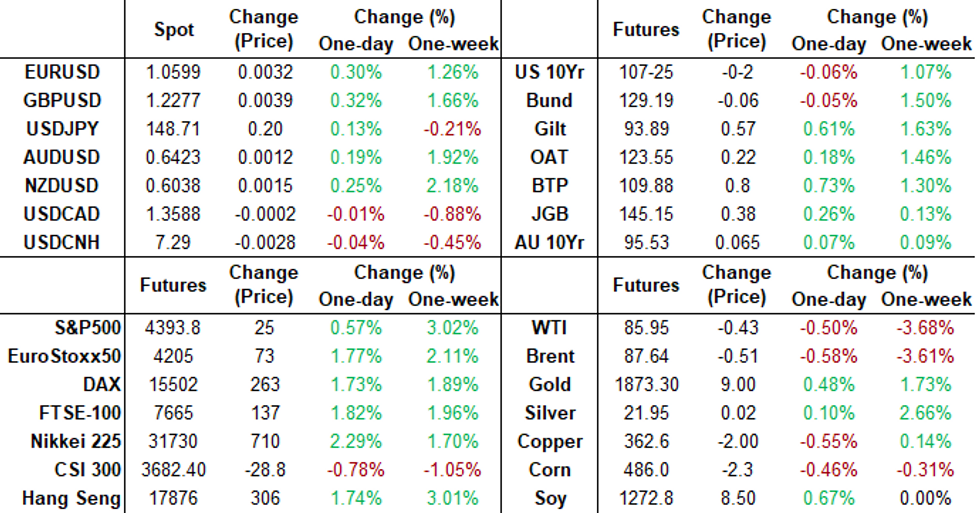

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Warms To Soft Landing

HIGHLIGHTS

- MNI SECURITY: WSJ: US Considering Deploying Second Carrier Group To Near Israel

- MNI EU: Israel & Palestine Foreign Mins Invited To EU Meeting Amid Aid Row

- MNI US: Earliest Possible Speaker Vote: 15:00 ET Wednesday

- US KIRBY: IF AMERICANS HOSTAGES, US WILL WORK TO GET THEM HOME, Bbg

- SAUDI REAFFIRMS SUPPORT OF OPEC+ EFFORTS TO STABILIZE MARKETS, Bbg

US TSYS Fed Tapping Brakes on More Hikes

- Cash Tsys resumed after extended Columbus Day holiday weekend Tuesday, 10Y yield -.1417 vs. last Friday's close at 4.6592%. Curves flattened with Bonds outperforming much of the session: 3M10Y -12.731 at -84.122, 2Y10Y -3.841 at -32.301.

- Tsy futures bounced off session lows following positive comments by Atlanta Fed Bostic as he reaffirmed his view that the Fed's benchmark interest rate is high enough to get inflation under control without dragging the economy into recession.

- Treasury futures pared gains after $46B 3Y note auction (91282CJC6) tailed: 4.740% high yield vs. 4.722% WI; 2.56x bid-to-cover vs. 2.75x prior month. The weak auction coupled with headlines the US is considering sending a second aircraft carrier to Israel spurred additional risk unwinds as stocks moved off midday highs.

- MN Fed Pres Kashkari said after the bell the rise now in 10-year yield "is a bit perplexing; one story is it is higher-growth expectations. We are seeing higher long-term treasury yields, but not higher inflation expectations." Note, SF Fed Daly speaks at the Chicago Council on Global Affairs at 1800ET.

- Rate hike projections into early 2024 held steady to slightly softer vs. late Monday: November steady at 14% (22.2% Mon morning vs. 30.5% late Fri) w/ implied rate change of +3.5bp to 5.364%, December cumulative of 7.5bp (vs. 8.2bp early Tue) at 5.404%, January 2024 5.9bp (vs. 6.4bp early Tue) at 5.387%.

- Wednesday Data Calendar: PPI, Fed Speak, FOMC Sep Minutes.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00770 to 5.34877 (+0.02208 total last wk)

- 3M +0.01903 to 5.42577 (+0.01124 total last wk)

- 6M +0.02993 to 5.48439 (-0.01281 total last wk)

- 12M +0.04918 to 5.44574 (-0.06970 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $100B

- Daily Overnight Bank Funding Rate: 5.32% volume: $248B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.404T

- Broad General Collateral Rate (BGCR): 5.30%, $565B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $558B

- (rate, volume levels reflect prior session)

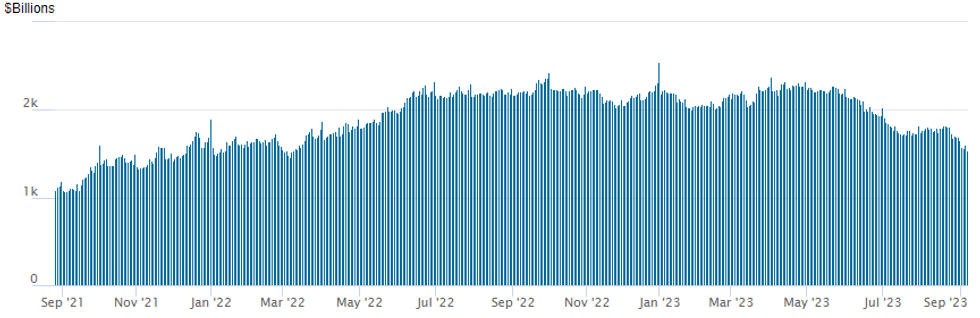

FED REVERSE REPO OPERATION: New Cycle Low

NY Federal Reserve/MNI

Repo operation usage falls to new cycle low of $1,222.440B (lowest since mid-September 2021) w/98 counterparties vs. $1,283.461B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

FI option trade remained mixed on net Tuesday. SOFR saw better low delta puts as underlying futures scaled back a portion of Monday's safe haven rally, while Treasury options see better call trade carry over from overnight. Weaker rates tempered by comments from midday comments by Atlanta Fed Bostic, rate hike projections into early 2024 held steady to slightly softer vs. late Monday: November steady at 14% (22.2% Mon morning vs. 30.5% late Fri) w/ implied rate change of +3.5bp to 5.364%, December cumulative of 7.5bp (vs. 8.2bp early Tue) at 5.404%, January 2024 5.9bp (vs. 6.4bp early Tue) at 5.387%. Fed terminal at 5.405% in Jan'24.

- SOFR Options:

- -8,500 SFRH4 94.25/94.75 put spds, 20.75

- +1,500 SFRZ3 94.62/94.75/94.87 call flys, 1.25

- over 5,000 SFRZ3 94.68 calls, 0.5 ref 94.58

- +10,000 SFRM4 96.00/97.00 call spds, 9.5 vs. 94.925/0.12%

- +4,000 SFRH4 95.00/96.00/96.50 1x1x2 call trees, 2.25cr (3 legs sold)

- 4,000 0QZ3 95.00/95.37/95.62/96.00 put condors ref 95.50

- 1,750 0QV3 95.25/95.37 3x2 put spds ref 95.50

- 3,000 0QV3 95.25 puts, 0.5 ref 95.50

- 5,500 2QV3 95.93 puts, 4.5-5.0 last ref 96.02 to -.015

- 2,500 SFRZ3 94.56/94.62/94.68 call flys, ref 94.575

- 1,500 0QV3 95.87 calls, 1.5 ref 95.50

- Treasury Options:

- +7,500 FVX3 106.5 calls, 12 ref 105-11, total volume>23.2k

- +10,000 TYX3 110/111 call spds, 11 vs. 107-22 to -22.5/0.11

- 3,250 TYX3 106/107.5 2x1 put spds, 15 net ref 107-29.5

- 2,000 TYX3 108 calls, 37 ref 107-15

- 3,000 TYX3 108.5/109/109.5/110 call condors, 0.0 ref 107-22

- over 5,400 TYZ3 110.5 calls 29 last

- over 4,300 TYZ3 110 calls 35-31, 31 last ref 107-23.5

- over 7,100 FVX3 106 calls, 18-24, 18 last ref 105-11.25

- 2,000 TYX3 107.75 puts, 50 ref 107-21

EGBs-GILTS CASH CLOSE: Bunds Underperform, BTPs And Gilts Rally

Gilts easily outperformed Bunds Tuesday.

- With few Europe-specific drivers to price action, focus was again on the prospect of central bank tightening cycles having already reached their conclusion amid an uncertain geopolitical backdrop.

- With limited data, and speakers not really bringing anything new (BoE's Mann late Monday, and ECB's Holzmann maintained characteristically hawkish tones), weakness across EGBs and Gilts through early afternoon was largely a function of a bounce in equities.

- For the 2nd consecutive session, though, early weakness reversed after the US cash equity open, with 10Y German yields falling 7bp from session highs and UK falling 10bp.

- On the day, the German curve twist flattened, with the UK's bull flattening.

- Periphery spreads tightened, led by BTP/Bund leading the way and crashing below 200bp amid positive risk appetite and limited prospects of further ECB tightening.

- Wednesday's data slate is thin (final German CPIs), with more focus on Bund and Gilt supply, speakers including ECB's Knot and Villeroy, and the ECB inflation expectations survey.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 3.1bps at 3.07%, 5-Yr is up 2.2bps at 2.665%, 10-Yr is up 0.3bps at 2.775%, and 30-Yr is down 1bps at 3.007%.

- UK: The 2-Yr yield is down 3.5bps at 4.799%, 5-Yr is down 4.8bps at 4.426%, 10-Yr is down 5bps at 4.426%, and 30-Yr is down 5.5bps at 4.919%.

- Italian BTP spread down 11.4bps at 195bps / Spanish down 4.8bps at 110.5bps

EGB Options: Sizeable Euribor Condor Buying Features Tuesday

Tuesday's Europe rates / bond options flow included:

- OEX3 117.00/117.50cs, bought for 9.5 in 5k

- RXX3 128.50/128.00/127.50/126.50 broken p condor, bought for -1.5 in 3k.

- ERF4 96.00/95.75ps, bought for 4.5 in 5k

- 0RU4 97.50/97.75/98.00/98.12c condor, bought for 5.5 in 10k

FOREX Equities Advance Further Weighs On Greenback, EMFX Outperforms

- Despite the most recent downtick, the overall supportive price action for major equity benchmarks, and US yields hitting the lowest levels of the session are weighing on the dollar index, which now sits around 0.4% lower on Tuesday.

- In G10, the likes of EUR and GBP are performing well, both rising around 0.45% and while USDJPY is unchanged on the session, the latest price action has prompted a decent 50 pip selloff for the pair to 148.55.

- USDJPY support at last Tuesday’s low of 147.43, remains intact. The recovery from this level last week is bullish and - for now - the uptrend remains intact. Clearance of 147.43 would be a bearish development and signal scope for a deeper retracement. On the topside, a clear break of the 150.00 handle would be required to reinforce bullish conditions.

- For EURUSD, the pair looks set to finish higher for a fifth consecutive session on Tuesday, showing above the 20-day EMA in the process. As a result, the outlook is beginning to improve for the pair, however momentum measures and the medium-term trend direction remain lower for now.

- The softer greenback and improved sentiment have underpinned a solid recovery for the likes of MXN and ZAR, both rising over 1.3%.

FX Expiries for Oct11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E824mln), $1.0500-20(E1.3bln), $1.0600(E531mln), $1.0625-40(E1.1bln)

- USD/JPY: Y147.00-15($1.0bln), Y148.20-25($1.1bln), Y148.55($709mln), Y150.35-40($650mln)

- AUD/USD: $0.6475(A$617mln)

- USD/CAD: C$1.3420($1.0bln), C$1.3540($567mln)

Late Equities Roundup: Consumer Staples, Materials Sectors Outperform

- Stocks were still firmer late Tuesday, but off midday highs, the timing of which coincided with headlines the US is considering sending a second aircraft carrier to Israel. Stocks gained this morning after Atlanta Fed Bostic reaffirmed his view that the Fed's benchmark interest rate is high enough to get inflation under control without dragging the economy into recession. Currently, S&P E-Mini futures are up 26.25 points (0.6%) at 4394.75, DJIA up 155.66 points (0.46%) at 33758.51, Nasdaq up 90.9 points (0.7%) at 13573.86.

- Leaders: Consumer Staples, Materials and Consumer Discretionary sectors outperformed, retail names supported the former: Target +4.25%, Dollar Tree +4.05%, Sysco +1.25%. Metals, mining and chemical stocks buoyed the Materials sector: Albemarle +3.55%, Sealed Air Corp +3.1%, International Flavors and Fragrances +2.67%. Autos and parts makers led the former: GM and Tesla +1.75%, Aptiv +1.6%, Ford +1.2%, Borg-Warner +1.06%.

- Laggers: Information Technology, Real Estate and Energy sectors underperformed, midday support for IT cooling in late trade with hardware makers lagging: Juniper Networks -1.65%, Corning -0.69%, Apple -0.5%. Residential REITS weighed on Real Estate: UDR inc -0.7%, Mid-America Apartment and Invitation Homes both -0.4%. Meanwhile, oil and gas shares lagged the Energy sector with crude holding weaker in late trade (WTI -0.5 at 85.88): APA -0.65%, EQT Corp -0.5%.

- Reminder, Q4 earnings cycle gets underway with several bank shares reporting this Friday: JP Morgan, Wells Fargo, Blackrock, PNC Financial and Citigroup expected.

E-MINI S&P TECHS: (Z3) Bear Cycle Still In Play

- RES 4: 4566.00 High Sep 15 and a key resistance

- RES 3: 4514.50 High Sep 18

- RES 2: 4441.61 50-day EMA

- RES 1: 4381.68 20-day EMA

- PRICE: 4372.25 @ 08:28 BST Oct 10

- SUP 1: 4235.50 Low Oct 4

- SUP 2: 4194.75 Low May 24

- SUP 3: 4166.25 1.50 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 4: 4134.00 Low May 4

A bear cycle in S&P E-minis remains in play, despite Friday’s sharp corrective rally and the follow through this morning. The contract traded lower last Wednesday, confirming a resumption of the bear leg once again. This maintains the price sequence of lower lows and lower highs and signals scope for weakness towards 4194.75, the May 24 low. Pivot resistance is 4441.61, the 50-day EMA. Ahead of the 50-day average is resistance at 4381.68, the 20-day EMA.

COMMODITIES: Oil End of Day Summary: Crude Falls

Crude is weaker on the day although has recovered some of its earlier losses. The market is weighing demand concerns tight supplies and risks from the conflict in Israel despite the current limited impact on flows. The risk of higher for longer interest rates have been weighing on oil markets this month with focus this week on the US September CPI data due out on Thursday.

- WTI NOV 23 down -0.3% at 86.09$/bbl

- WTI NOV 23-DEC 23 up 0.04$/bbl at 1.82$/bbl

- Strong crude curve backwardation is reflecting the tight supply concerns although prompt spreads eased back after an initial surge yesterday while the longer dated spreads held onto the earlier gains.

- Venezuela and the US have progressed in talks that may allow an additional foreign firm to take Venezuelan oil in return for debt repayment according to Reuters sources.

- Saudi Aramco has notified at least four North Asian buyers that it will supply full contractual volumes of crude oil in November, sources with knowledge told Reuters.

- Chinese onshore crude inventories have been drawing lower since late July according to Vortexa figures.

- Russia’s Putin and Iraqi PM Mohammed al-Sudani met in Moscow today ahead of the Russian Energy Week forum they are both set to attend tomorrow.

- JP Morgan maintains its Brent year end price target of $86/bbl despite higher geopolitical tensions in the Middle East.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/10/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 11/10/2023 | 0815/0415 |  | US | Fed Governor Michelle Bowman | |

| 11/10/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 11/10/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 11/10/2023 | 1230/0830 | * |  | CA | Building Permits |

| 11/10/2023 | 1230/0830 | *** |  | US | PPI |

| 11/10/2023 | 1415/1015 |  | US | Fed Governor Christopher Waller | |

| 11/10/2023 | 1615/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/10/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 11/10/2023 | 1800/1400 | * |  | US | FOMC Rate Decision |

| 11/10/2023 | 2030/1630 |  | US | Boston Fed's Susan Collins |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.