-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Fed Willing to Hike if Needed

- Treasuries look to finish weaker but off lows, little overall reaction to May 1 FOMC minutes

- Tsys largely mirrored moves in EGBs during overlapping hours, weaker after higher than expected UK CPI overnight.

- Rate cut projections continue to recede from last week's CPI-related highs, first full 25bp cut expected in November

US TSYS Weaker But Off Lows, Little React to May 1 FOMC Minutes

- Treasuries drifting near midrange for the day after the bell, not a major reaction to the May 1 FOMC minutes.

- Tsys largely mirrored moves in EGBs during overlapping hours - trading weaker after higher than expected inflation data via UK CPI overnight. Treasury futures climbed off early session lows to late morning session highs, in-line with a recovery in Gilts.

- Little react to Existing home sales miss in April at 4.14m (cons 4.23m) after an upward revised 4.22m in March (initial 4.19m). The latest profile leaves sales -1.9% M/M in April after a smaller than first thought decline of -3.7% M/M in March, still retracing the surprise 9.5% jump in Feb.

- Main focus was on the FOMC minutes: “Participants noted disappointing readings on inflation over the first quarter and indicators pointing to strong economic momentum, and assessed that it would take longer than previously anticipated for them to gain greater confidence that inflation was moving sustainably toward 2%,” the minutes said. Some officials also appeared willing to contemplate interest rate increases if conditions appear to worsen.

- Rate cut projections are slightly lower vs. late Tuesday levels (*): June 2024 at -5% w/ cumulative rate cut 0bp at 5.323%, July'24 at -16.0% (-20%) w/ cumulative at -5.2 (-6.3bp) at 5.283%, Sep'24 cumulative -17.8bp (-19.9bp), Nov'24 cumulative -25.6bp (-27.6bp), Dec'24 -40bp (-43.7bp).

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00009 to 5.32216 (+0.00240/wk)

- 3M +0.00139 to 5.33085 (+0.00505/wk)

- 6M -0.00074 to 5.29392 (+0.01071/wk)

- 12M -0.01052 to 5.14754 (+0.02502/Wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.929T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $726B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $715B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $76B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $265B

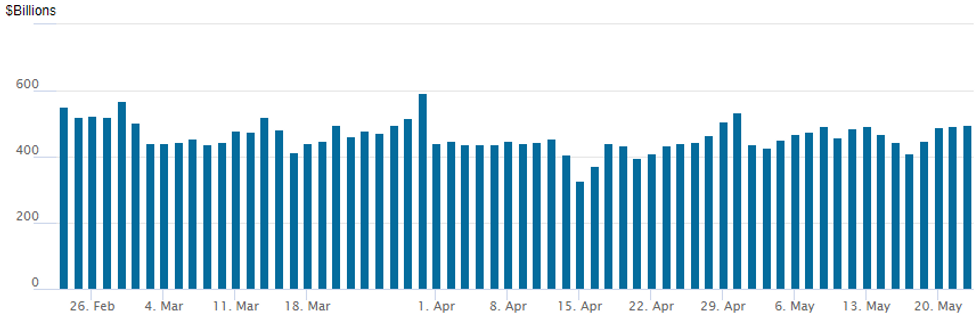

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage inches up to $496.382B from $491.720B prior; number of counterparties 84. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

SOFR option trade revolved around downside puts Wednesday, modest overall volumes occurring well before the May 1 FOMC minutes release (generally a non-event). Rate cut projections are slightly lower vs. late Tuesday levels (*): June 2024 at -5% w/ cumulative rate cut 0bp at 5.323%, July'24 at -16.0% (-20%) w/ cumulative at -5.2 (-6.3bp) at 5.283%, Sep'24 cumulative -17.8bp (-19.9bp), Nov'24 cumulative -25.6bp (-27.6bp), Dec'24 -40bp (-43.7bp).- SOFR Options:

- -5,000 SFRU4 94.62/94.87 put spds 10.25 ref 94.855

- -5,000 SFRH4 94.25/94.62 2x1 put spds 0.0 ref 95.31

- +4,000 SFRZ4 95.50 puts, 52.5 vs. 95.08/0.72%

- +10,000 SFRU4/SFRZ4 94.75 put spds +1.75

- +5,000 0QU4 95.00/95.75 3x1 put spds 15.0 ref 94.845

- Block/screen, total 25,000 0QU4 95.00/95.75 3x1 put spds, 15.0-15.5 ref 95.695 to -.70

- -8,000 0QU4 95.87/96.12/96.25/96.50 call condors, 3.5 vs. 95.685/0.05%

- 2,250 SFRN4 94.81/95.25 1x2 call spds

- 5,600 SFRQ4 94.68/94.81/94.93 put flys ref 94.85

- 3,000 SFRU4 94.37/94.62 put spds, ref 94.85

- 1,500 SFRQ4 94.81/94.83/95.12 broken call trees ref 94.85

- 2,000 SFRU4 94.37/94.62 put spds ref 94.85

- 1,500 2QN4 95.62/95.93 put spds ref 96.08

- Treasury Options: Reminder, June options expire Friday

- 5,250 TYN4 110.5/112/113.5 call flys, 9 ref 109-12.5

- 1,600 USM4 110/USQ4 114 put spds

- 2,000 TUM4 101.5/101.62 put spds

- 2,000 TYM4 108.75/109.25 strangles 11

- 1,500 FVU4 107/109 1x2 call spds ref 106-04

- over 6,300 TYM4 109 puts, 6-12

- 1,500 TYU4 108.5/110 strangles

EGBs-GILTS CASH CLOSE: Services CPI Surprise Sinks UK Short End

The UK curve bear flattened sharply Wednesday, with Gilts underperforming Bunds, as the April CPI report pushed back the expected timing for the first BoE cut.

- An 0.5pp upside surprise to April services CPI was the key detail that triggered a short-end UK selloff as implied BoE cuts were pared sharply.

- There is now a <10% chance seen of a reduction at the June MPC (vs a coin flip prior to CPI), with around 50% chance of a reduction by August (had been basically fully priced).

- Just after the cash close, PM Sunak confirmed earlier rumours by announcing a UK election in July, but this brought little Gilt market impact.

- EGBs were weighed down in the morning by UK CPI reverberations as well as supply (multiple EUR syndications), but pared some losses in late trade.

- Influenced by UK developments, the German curve bear flattened, while periphery EGB spreads tightened modestly after having widened earlier in the session.

- Thursday's schedule includes flash May PMIs and Eurozone negotiated wage data, and a panel appearance by BoE's Pill.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.8bps at 3.008%, 5-Yr is up 4bps at 2.584%, 10-Yr is up 3.5bps at 2.534%, and 30-Yr is up 2.7bps at 2.669%.

- UK: The 2-Yr yield is up 14.2bps at 4.452%, 5-Yr is up 12.5bps at 4.136%, 10-Yr is up 10.2bps at 4.232%, and 30-Yr is up 7.2bps at 4.683%.

- Italian BTP spread down 0.8bps at 129bps / Spanish down 0.3bps at 76.4bps

EGB Options: Multitude Of Sonia Trades After CPI Report Wednesday

Wednesday's Europe rates / bond options flow included:

- RXN4 134.50/135.00cs sold at 2.5 in 10k (said to be closing)

- ERN4 96.37/96.25ps 1x2, bought for 1 in 3.5k.

- ERV4/ERX4/ERZ4 96.37/96.25/96.12p fly strip, bought for 3.25 in 4k.

- SFIM4 94.95/95.05/95.15c fly bought for 0.25 in 2k

- SFIQ4 95.20/95.40/95.70 broken call fly sold at 1.25 in 10k (liquidation)

- SFIU4 95.25/95.50/95.75c fly sold at 1.75 in 10k (liquidation)

- SFIU4 94.75/94.50ps, bought for 1.25 in 2k

- SFIU4 95.15/95.30/95.50/95.60c condor bought for 2.25 in 9k

- SFIZ4 95.25/95.50/95.75c fly sold at 3.5 in 4k

- SFIZ4 95.20/95.00ps, sold at 7.5 in 5k

- SFIZ4 95.20/95.35/95.60/95.75c condor bought for 4 in 4k

FOREX GBP Supported Following Hot UK CPI, Election Announcement Has Little Impact

- Higher US yields and slightly lower equities offered moderate support to the greenback on Wednesday as markets awaited the FOMC minutes release. However, action across G10 was mixed amid central bank action and notable data releases.

- GBP was the early outperformer on the back of the hotter-than-expected UK inflation print, with the services CPI component of particular interest, and seen limiting the Bank of England's ability to cut rates as soon as June. Markets now price fewer than 2 full 25bps rate cuts across 2024, helping underpin GBP's outperformance into the NY crossover.

- Despite reversing in early US trade, cable has edged back towards the earlier highs of 1.2761, as the UK announced a snap general election, to be held on July 04. Wednesday’s move lower in EURGBP has resulted in a break of support at 0.8531, the Apr 30 low, and confirms an extension of the reversal that started May 9. The daily low intersects with 0.8504, the Mar 8 low and exposes 0.8498, the Feb 14 low.

- NZD also continues to outperform G10 peers on the more hawkish-than-expected RBNZ decision, at which the bank kept rates unchanged but signalled that policy would be kept much tighter, for much longer, and could even resume raising interest rates until inflation and inflation expectations are curtailed.

- Price action on Wednesday also saw EURNZD trade down to the lowest level since March 11, closely coinciding with a test of trendline support, drawn from the December 2022 lows as well as exactly matching the 38.2 Fibonacci retracement of the Dec 2022/Aug 2023 price swing.

- RBNZ Governor Orr will kick off Thursday’s event risk before New Zealand report retail sales for Q1. Eurozone flash PMIs then headline the calendar before US jobless claims and new home sales also cross.

FX Expiries for May23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0755-75(E772mln), $1.0900(E1.5bln)

- GBP/USD: $1.2670-90(Gbp571mln), $1.2735-55(Gbp776mln)

- USD/CAD: C$1.3600($639mln), C$1.3665-75($929mln)

Late Equities Roundup: Extending Lows Post FOMC Minutes

- Stocks not liking the minutes from the May 1 FOMC minutes, extending lows as markets focus on the Fed's willingness to hike if necessary to combat inflation -- nothing really new. Currently, the DJIA is down 243.38 points (-0.61%) at 39629.81, S&P E-Minis down 29.25 points (-0.55%) at 5316.5, Nasdaq down 91.3 points (-0.5%) at 16741.12.

- Energy and Materials sectors continued to underperform in late trade, equipment and services shares weighing on the former: Schlumberger -3.48%, Haliburton -3.0%, Baker Hughes -2.79%. Metals and mining shares weighed on the Materials sector: Freeport McMoRan -5.72%, Newmont -3.68%, Steel Dynamics Inc -1.35%.

- Health Care and Industrials sectors outperformed late, pharmaceuticals and biotech shares buoyed the Health Care sector: Moderna +10.81%, Pfizer +2.28%, J&J +1.48%. Service providers supported the Industrials sector: Dayforce +2.80%, Equifax +1.92%, Broadridge Financial Services +1.85%.

- Of note, the IT sector pared back first half support but individual chip stocks remained strong: First Solar +16.2%, Analog Devices +9.09% as a strong outlook outweighed revenue decline, Enphase +8.36%. Reminder, Nvidia and Synopsys report earnings after the close.

E-MINI S&P TECHS: (M4) Holding On To Its Gains

- RES 4: 5417.75 2.00 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5400.00 Round number resistance

- RES 2: 5372.73 1.764 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5349.25 Intraday high

- PRICE: 5340.25 @ 14:35 BST May 22

- SUP 1: 5240.67 20-day EMA

- SUP 2: 5185.94 50-day EMA

- SUP 3: 5036.25 Low May 2

- SUP 4: 4963.50 Low Apr 19 and bear trigger

The uptrend in S&P E-Minis remains intact and the contract is holding on to its latest gains. Recent gains have resulted in a break of a key resistance at 5333.50, Apr 1 high. This confirms a resumption of the primary uptrend and signals scope for a climb to 5372.73, a Fibonacci projection. Moving average studies remain in a bull-mode set-up, highlighting a clear uptrend. Initial support is at 5240.67, the 20-day EMA.

COMMODITIES Copper Retreats From Record High, Crude Falls

- Copper futures have fallen sharply today, as investors look to take profits after prices had risen more than 30% since the start of March to a record high earlier this week.

- Analysts suggest this is a short-term pullback, as copper is projected to remain in a multi-year deficit ahead.

- Copper is down 5.5% on the day at $482/lb.

- Copper futures remain in a clear uptrend, with the contract recently trading through a key resistance at $503.95, the Mar 2022 high. A clear breach of this level would open $520.65, a Fibonacci projection. Initial key support lies at $474.40, the 20-day EMA.

- Meanwhile, spot gold is down by 1.6% at $2,382/oz, leaving the yellow metal ~$68 below the record high reached on Monday.

- The medium-term technical outlook for gold remains bullish, with attention on 2452.5 next, a Fibonacci projection. On the downside, the 50-day EMA, at $2293.9, represents a key support.

- WTI is headed towards its lowest close since March 12 amid continued concerns that interest rates will remain ‘higher for longer’. A further build in US stocks will also add downside.

- WTI Jul 24 is down 1.4% at $77.6/bbl.

- A bearish theme in WTI futures remains intact, with attention on $75.64 next, the Mar 11 low. Initial firm resistance to watch is at $83.63, the Apr 26 high.

- Henry Hub front month is headed for its highest close since mid-January, supported by rising temperatures, lower production levels year on year, and rising LNG feedgas supplies.

- US Natgas Jun 24 is up 4.5% at $2.79/mmbtu.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 23/05/2024 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 23/05/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/05/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/05/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/05/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/05/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/05/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/05/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/05/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/05/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/05/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/05/2024 | 1000/0600 | *** |  | TR | Turkey Benchmark Rate |

| 23/05/2024 | - |  | EU | G7 Finance/CB Meet | |

| 23/05/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 23/05/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/05/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (Flash) |

| 23/05/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/05/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/05/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 23/05/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/05/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/05/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/05/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/05/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 23/05/2024 | 1900/1500 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.