-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPOSCO (POHANG, Baa1/A-/NR) S.Korea to respond to U.S. tariffs

Longfor (LNGFOR: Ba3Neg/BB-Neg/BBNeg) clarifies profit warning

MNI ASIA MARKETS ANALYSIS: Flatter Curves Ahead FOMC Minutes

- RICHMOND FED BARKIN: NOW ISN'T BEST TIME FOR FORWARD GUIDANCE ON RATES, Fox/Bbg

- RICHMOND FED BARKIN: `HIGHER FOR LONGER' DEPENDS ON HOW ECONOMY EVOLVES, Fox/Bbg

- MNI GLOBAL POLITICAL RISK: Xi To Attend BRICS Leaders Summit On Israel-Palestine

- MNI GERMANY: BBG: Germany May Be Forced Into "Drastic" 2023 Budget Overhaul

- MNI ARGENTINA: Brazil Puts Relations With Argentina "On Hold"

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Strong 20Y Bond Auction Lifts Tsys off Lows

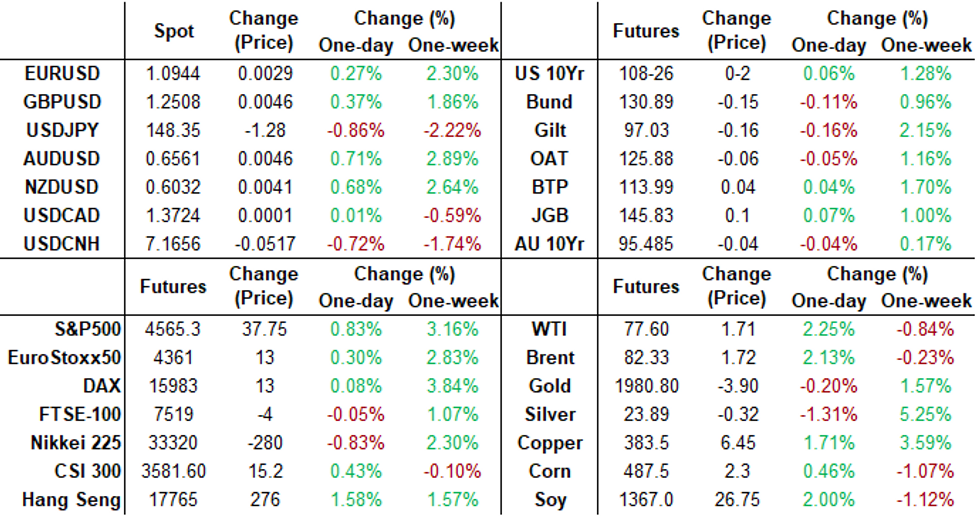

- Tsy futures drifting near post-20Y auction highs after the bell, curves bull flattening with the short end underperforming. At the moment, Dec'23 10Y futures are +4 at 108-28 vs. 108-29.5 high, 2y10y curve -4.094 at -49.314.

- TYZ3 traded in a narrow, lower range for much of the first half (108-16 to -19) until the strong $16B 20Y bond auction (912810TW8) traded through: draws 4.780% high yield vs. 4.790% WI; 2.58x bid-to-cover vs. prior month's 2.59x.

- Little react to Richmond Fed President Barkin comments on midday interview by Fox: "NOW ISN'T BIG TIME FOR FORWARD GUIDANCE ON RATES; OVERALL, CORE INFLATION NUMBERS COMING DOWN NICELY," while Barkin focuses "ON INFLATION TO DECIDE RATE MOVES".

- Little react to this morning's Conference Board’s leading index that provided another weaker than expected data set: falling -0.8% (cons -0.7%) in September after -0.7%, for its largest monthly decline since October.

- Busy schedule ahead for the shortened Thanksgiving holiday week. CME Group schedule: full session Wednesday, Thursday close (Globex reopens 1800ET), early close Friday (floor at 1300ET, Globex at 1315ET).

- Tuesday focus on Existing Home Sale and FOMC Minutes for the November meeting. Wednesday, meanwhile, sees weekly claims, durables/cap-goods and UofM conditions/inflation expectations.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00230 to 5.33483 (+0.01014 total last wk)

- 3M +0.00458 to 5.37151 (-0.01071 total last wk)

- 6M +0.00934 to 5.37281 (-0.05130 total last wk)

- 12M +0.02561 to 5.22634 (-0.08572 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $98B

- Daily Overnight Bank Funding Rate: 5.32% volume: $256B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.587T

- Broad General Collateral Rate (BGCR): 5.30%, $588B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $573B

- (rate, volume levels reflect prior session)

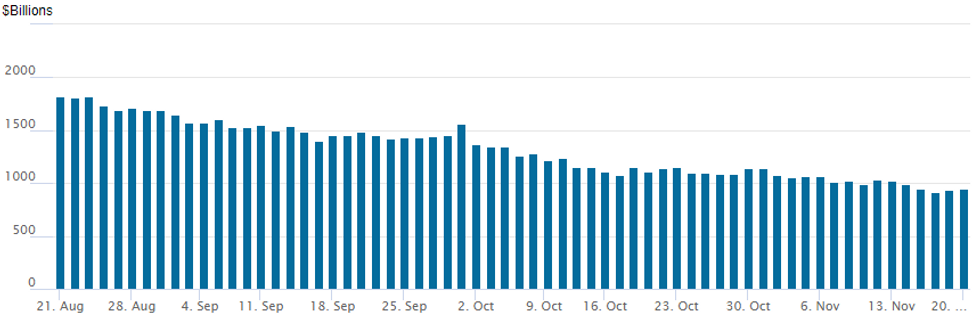

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage climbs to $953.088B w/95 counterparties today vs. $935,803B Friday - the lowest level since early August 2021. Usage fell below $1T for the first time since August 2021 last on November 9 ($993.314B) latest cycle low of $912.010B on November 16.

SOFR/TREASURY OPTION SUMMARY

Focus on low delta SOFR and Treasury overnight put structures continued through the NY session. Moderate volumes on the shortened Thanksgiving holiday week (full session Wednesday, Thursday close, Friday early close). Underlying futures steady to mildly weaker in the short end at the moment. Projected rate cut in early 2024 consolidates: December at 0bp at 5.333%, January 2024 cumulative .5bp at 5.343%, March 2024 pricing in -29.9% chance of a rate cut with cumulative at -7.5bp at 5.263%, May 2024 pricing in -41.5% chance of a rate cut with cumulative -17.8bp at 5.159%. Fed terminal at 5.34% in Feb'24.- SOFR Options:

- +5,000 SFRF4 94..56/94.68/94.81/94.93 call condors, 8.0

- Over +17,000 SFRJ4 94.43/94.50/94.68 broken put trees 1.0-1.25 ref 95.00

- Block, 4,000 2QZ3 96.25/96.50/96.62 broken put fly vs. 96.175/0.15%

- 1,500 0QZ3 94.87/95.12/95.25/95.37 put condors ref 95.575

- 2,000 0QH4 95.00/95.25 put spds vs. 0QH4 96.25/96.50 call spds ref 95.845

- Treasury Options:

- -5,000 USF4 117/118/119/120 call condors, 9

- -5,000 wk1 US 117/119 call spds 28-29

- 2,500 Weds/wkly 10Y 107.5/108/108.5 put trees ref 108-17

- -6,000 FVZ3 105.75/106/106.25/106.5 call condors, 4 ref 105-23.25

- 2,600 TYZ3 108.25 puts, 15 ref 108-17.5

- 1,000 TYZ4 106.5 puts, ref 108-14.5

- 2,000 TYZ3 109.25/109.75 call spds, 7 ref 108-17

EGBs-GILTS CASH CLOSE: Peripheries Outperform

Bunds underperformed Gilts with the German curve bear flattening Monday.

- Core FI got off to a weak start in digesting weekend developments including stronger oil prices before stabilising mid-morning, only to relapse to session's weakest levels around midday despite no discernable headline triggers.

- While they recovered from session lows, Bunds' underperformance came amid uncertainty over the medium-term fiscal impact of last week's German court ruling on the government's usage of off-balance sheet COVID funds (BBG published a sources article in the afternoon corroborating weekend reports that the debt brake might be suspended for 2023).

- Periphery EGBs benefited from Moody's after hours on Friday revising Italy's outlook to stable from negative, and revising Portugal's rating up two notches to A3 (outlook stable).

- In contrast to the German curve, the UK's twist steepened, with fiscal matters in focus in the form of the Autumn Statement's release Wednesday (and ahead of that, public finance data first thing Tuesday morning). Tuesday sees BoE's Bailey and colleagues before a parliamentary committee.

- Also Tuesday, we get several ECB speakers including Lagarde, Schnabel, and Centeno.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.3bps at 3.027%, 5-Yr is up 4bps at 2.571%, 10-Yr is up 2.3bps at 2.611%, and 30-Yr is up 0.1bps at 2.803%.

- UK: The 2-Yr yield is down 1.5bps at 4.531%, 5-Yr is down 0.7bps at 4.112%, 10-Yr is up 2.1bps at 4.125%, and 30-Yr is up 1.1bps at 4.552%.

- Italian BTP spread down 3.6bps at 173.4bps / Portuguese down 2.3bps at 64.2bps

EGB Options: Mix Of Euro Rates Trades Monday

Monday's Europe rates/bond options flow included:

- RXZ3 132.5/133.00 call spread 3K given at 3

- ERH4 96.00/95.87/95.75 put fly bought for 1 on 4K

- ERH4 96.12/96.00/95.75 1x3x2 broken put fly bought for 1.25 in +2.5k

- 2H4 97.50/97.75 call spread vs 96.75 put bought for 2.5 in 2k

FOREX Greenback Consolidating Near To Session Lows, JPY Outperforms

- The greenback extended the post US CPI weakness from last week as markets continue to remain optimistic over a soft-landing scenario. This has prompted the USD Index to breach the 200-day moving average for the first time since December last year.

- Equity markets are reflecting similar optimism, trading on a firm footing headed through to the Tuesday APAC crossover, with the e-mini S&P comfortably above Friday's session bests and helping underpin the bid in high beta currencies. As such, NOK is one of the best G10 performers, bolstered by higher oil prices, which has helped aide EUR/NOK toward its initial support of 11.6892.

- JPY stands closely behind as on of the best performers also, helping both USDJPY and EUR/JPY ease through Friday's lows and extend the pullback off last week's highs.

- USDJPY has traded sharply lower Monday as the pair extends the pullback from 151.91, the Nov 13 high. Support at the 50-day exponential moving average, at 149.19, has been cleared. The break of this EMA strengthens a short-term bearish theme and signals scope for a deeper correction, towards 147.43, the Oct 3 low.

- AUD, NZD have also rallied around 0.65%, with AUDUSD strength resulting in a clear break of resistance at 0.6522, the Aug 30 and Sep 1 high. The breach is an important short-term bullish development and signals scope for a continuation higher towards 0.6582.

- EURUSD briefly traded above 1.0950 on Monday, piercing 1.0945, the Aug 30 high and a key resistance. Moving average studies have crossed, highlighting a bull-mode position and a rising trend, which could signal further strength towards the August highs above 1.1000.

- The greenback weakness combined with the attractive carry profiles, also continues to support Latin American currencies which have made some impressive gains Monday, with USDBRL rising around 1.2% and USDMXN zoning in on the 17.00 handle.

- RBA minutes are due overnight before Canadian CPI and FOMC minutes headline the Tuesday docket.

FX Expiries for Nov21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0850-60(E1.5bln), $1.0925-30(E750mln)

- GBP/USD: $1.2375(Gbp624mln)

- USD/JPY: Y149.00-20($2.5bln), Y149.50($1.5bln), Y151.00($1.3bln)

- AUD/USD: $0.6520-25(A$1.1bln)

Late Equity Roundup: IT Shares Outperform Late

- Stocks continue to extend session highs in late trade, Information Technology shares taking the lead in the second half. Currently, DJIA is up 212.65 points (0.61%) at 35159.3, S&P E-Mini future are up 34.25 points (0.76%) at 4561.75, Nasdaq up 154 points (1.1%) at 14278.89.

- Leading gainers: Information Technology and Communication Services and shares outperformed, software and semiconductor shares led IT with Enphase +5.58%, Palo Alto Networks +5.03%, SolarEdge Technology +3.91%.

- Bouncing off Friday's lows, interactive media and entertainment shares supported the Communication Services sector: Paramount Global +7.47%, Netflix +2%, Verizon +1.42%.

- Laggers: Utilities and Consumer Staples sectors underperformed in late trade, gas providers weighing on the former: NRG -2%, ATO -1.35%, Xcel Energy -0.88%. Personal care manufacturers weighed on Consumer Staples: Estee Lauder -1.62%, Church & Dwight -1.13%, Clorox -1.65%.

- Corporate earnings still expected this week: Lowes, Best Buy, Burlington Stores and Kohl's early Tuesday, Autodesk, Nvidia and Deere after Tuesday's close.

E-MINI S&P TECHS: (Z3) Bulls Remain In The Driver’s Seat

- RES 4: 4597.50 High Sep and a key resistance

- RES 3: 4566.00 High Sep 15

- RES 2: 4552.38 76.4% retracement of the Jul 27 - Oct 27 bear leg

- RES 1: 4541.25 High Nov 15

- PRICE: 4561.50 @ 1440 ET Nov 20

- SUP 1: 4420.25/4400.39 Low Nov 14 / 20-day EMA

- SUP 2: 4354.25 Low Nov 10

- SUP 3: 4257.75 Low Nov 3

- SUP 4: 4122.25 Low Oct 27 and the bear trigger

S&P e-minis are unchanged and maintain a firmer tone. The contract traded sharply higher last Tuesday and is holding on to its recent gains. Resistance at 4411.88, a trendline drawn from the Jul 27 high, has been cleared. This reinforces bullish conditions and signals scope for a climb towards 4552.38, a Fibonacci retracement. On the downside, initial firm support is seen at 4400.39, the 20-day EMA.

COMMODITIES

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/11/2023 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/11/2023 | 0745/0845 | * |  | FR | Retail Sales |

| 21/11/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 21/11/2023 | 1015/1015 |  | UK | Treasury Select Hearing on MPR | |

| 21/11/2023 | 1330/0830 | *** |  | CA | CPI |

| 21/11/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/11/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/11/2023 | 1500/1000 | *** |  | US | NAR existing home sales |

| 21/11/2023 | 1600/1700 |  | EU | ECB's Lagarde discusses Inflation and democracy | |

| 21/11/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 21/11/2023 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 21/11/2023 | 1715/1815 |  | EU | ECB's Schnabel at Wurzburg Policy Lecture | |

| 21/11/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 21/11/2023 | 2100/1600 |  | CA | Canada fall economic/fiscal statement (release time is approximate) |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.