-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:Focus On Thu's GDP, BOC Holds Steady

- MNI BOC KEEPS KEY RATE 5%, DEBATE SHIFTS TO HOW LONG TO HOLD

- MNI BOC WATCH: Macklem Says Debate Shifts To How Long To Hold

- NETFLIX JUMPS 8.5% AS QUARTERLY SUBSCRIPTIONS BEAT EXPECTATIONS, Bbg

- BOEING MISINSTALLED BLOWN OFF MAX 9 JET PIECE: SEATTLE TIMES, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Unwinding Early Risk-On Tone Ahead GDP Data Risk

- Tsys are trading near late session lows after the bell, as are stocks ahead Thursday's busy data calendar: GDP, PCE, Wkly Claims and Tsy Sec Yellen Outlook.

- Treasury futures had recovered from Tuesday's modest sell-off Wednesday, back near Monday's close (TYH4 currently +9 at 111-16, yield 4.0955%). Risk-on tone resumes as SPX Eminis climb to new contract highs (ESH4 4933.25) following strong gains in Asia/Europe overnight.

- Treasury futures pared gains after larger than expected gains for S&P Global US PMIs for January: Mfg PMI (50.3 vs. 47.6 est, 47.9 prior); Services PMI (52.9 vs. 51.5 est, 51.4 prior); Composite PMI (52.3 vs. 51.0 est, 50.9 prior).

- Tsys gapped lower/tested lows (5Y yield climbs to 4.0671%) after $61B 5Y note auction (91282CJW2) tailed: 4.055% high yield vs. 4.035% WI; 2.31x bid-to-cover vs. 2.50x in the prior month.

- The rise in yields after the weak auction spilled over to equities as accounts took profits ahead Thursday's data. Reminder: several earnings announcements expected after the close: IBM, Seagate, Lam Research, Tesla, Raymond James and Crown Castle.

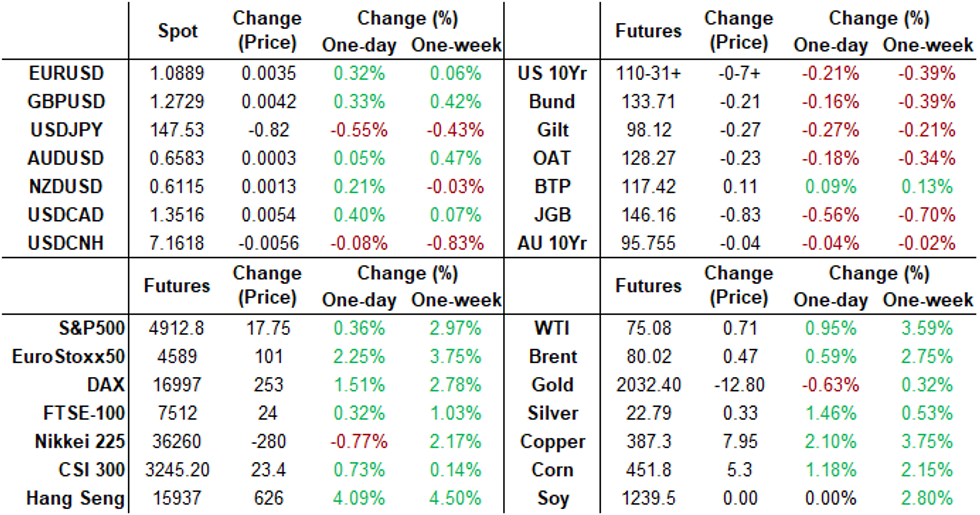

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00078 to 5.33664 (+0.00070/wk)

- 3M -0.00062 to 5.32405 (+0.00887/wk)

- 6M +0.00136 to 5.18796 (+0.02863/wk)

- 12M +0.01193 to 4.84692 (+0.04843/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.686T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $668B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $658B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $97B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $269B

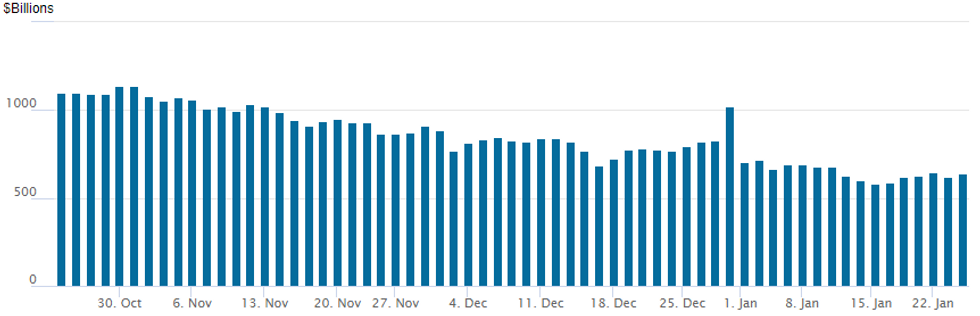

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $639.560B vs. $621.195B Tuesday. Compares to $583.103B on Tuesday, January 16 - the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties at 83 vs. 82 Tuesday (65 Tuesday last Tuesday, the lowest since July 7, 2021)

SOFR/TREASURY OPTION SUMMARY

Early paired FI trade leaned toward better SOFR Put structure buying Wednesday, even before underlying futures reversed gains/extended lows following better than expected flash PMIs tempered rate cut projections for early 2024: January 2024 cumulative -.6bp at 5.323%, March 2024 chance of 25bp rate cut -39.7% vs. -50.4% on the open w/ cumulative of -10.6bp at 5.223%, May 2024 at 74.7% vs. 80.2% on the open w/ cumulative -29.2bp at 5.036%, June 2024 97.1% (99.2% earlier) cumulative -53.8bp at 4.791%. Fed terminal at 5.32% in Feb'24.

- SOFR Options:

- +10,000 SFRH4 95.06/95.18 call spds, 0.5

- Block, 6,000 SFRJ4 94.75 puts, 1.5 ref 95.265

- +20,000 SFRU4 94.75/95.06 put spds, 5.0 ref 95.725

- +7,000 SFRJ4 95.00/95.12/95.25 put trees, 0.75 vs. 95.305/0.06

- 15,000 SFRH4 94.87/94.93/95.00 call flys

- 11,000 SFRJ4 95.31/95.37/95.56/95.62 put condors

- 1,500 SFRH4 94.87/95.12 1x4 call spds ref 94.87

- 1,600 SFRZ4 96.50/97.12 call spds ref 96.03

- 4,500 SFRH4 94.81/94.93 2x1 put spds ref 94.875

- 1,500 SFRH4 94.68/94.81/94.93 put flys ref 94.87

- over 5,400 SFRJ4 95.50 calls ref 95.305

- 1,750 3QH4 96.75 calls ref 96.545

- Treasury Options:

- 5,000 TYG4 111.75/112 call spds, 2 ref 111-08.5

- 5,000 TYK4 110 puts, ref 112-0

- 5,000 TYG4 111 puts, 6 last

- 6,300 TYG4 112 calls, 5 last

- 4,000 TYG4 111.5 calls, 14

EGBs-GILTS CASH CLOSE: Contrasting PMIs See Bunds Outperform Gilts

Bunds outperformed Gilts Wednesday as Eurozone flash PMIs disappointed, while their UK counterpart showed unexpected strength.

- In data that can best be described as "stagflationary", services PMIs came in low for both Germany and France (and consequently the Eurozone), but the survey internals showed continued price pressures and manufacturing concerns over Red Sea shipping developments.

- In contrast, UK services (and manufacturing) PMIs were above-expected, though similarly, higher cost pressures were noted.

- Later in the session, US PMI data came in strong, weighing on Bunds and Gilts into the cash close.

- The higher inflation pressures evident in the PMIs helped limit the upside to core EGBs from the weak activity implied, and the German curve bull flattened on the day, with the UK's bear flattening.

- Periphery spreads finished flat/tighter, mirroring a rally in equities.

- Thursday's highlight is the ECB decision - MNI's preview is here. The overall message will be that the ECB is getting closer to easing policy, but it is not there yet.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.5bps at 2.709%, 5-Yr is down 1bps at 2.257%, 10-Yr is down 1bps at 2.342%, and 30-Yr is down 1.6bps at 2.522%.

- UK: The 2-Yr yield is up 4.4bps at 4.419%, 5-Yr is up 2.8bps at 3.958%, 10-Yr is up 2.4bps at 4.01%, and 30-Yr is up 2.4bps at 4.607%.

- Italian BTP spread down 0.7bps at 155.9bps / Spanish unchanged at 91.8bps

FOREX USD Index Retreat Halted By Stronger US Data

- The Dollar Index spent the first half of Wednesday’s session on the retreat as global risk sentiment was lifted by news of the 50bp RRR cut in China. However, firmer-than-expected US PMI data provided some late support for the greenback, with the DXY’s decline moderating to just 0.5% as we approach the APAC crossover. The pullback comes ahead of key US growth data on Thursday, the final major release before the January FOMC meeting.

- Volatility for the Japanese Yen in the aftermath of the Bank of Japan decision on Tuesday continued, with USDJPY establishing a 174-pip range today. Largely shadowing the moves in the broader dollar index, lows of 146.66 were put in shortly before the US PMIs before consolidating to levels around 147.40 at typing. Key short-term support has been defined at 144.36, the Jan 12 low and clearance of this level would be required to signal a top.

- The Swiss Franc is another notable performer on the session, rising 0.81% against the greenback, dragging EURCHF down back down to the prior breakout level around 0.9400.

- As noted on Tuesday, HSBC recently put out a note stating that the SNB's language around the currency has become more balanced, and some data points might be signalling a return to FX reserves accumulation. However, HSBC note a shift away from a "strong franc" policy does not automatically mean a preference for a "weak franc". They continue to see EUR-CHF grinding slightly lower in 2024 to 0.93.

- A slightly less hawkish Bank of Canada prompted the Canadian dollar to underperform its peers. The combination of the BOC developments and the stronger US data saw USDCAD rise around 60 points to 1.3500.

- Overall USDCAD maintains a firmer tone, working in favour of the latest shallow pullback proving technically corrective. Last week’s gains resulted in a move above the 50-day EMA, at 1.3459, confirming an extension of the bull cycle that started Dec 27. This opens 1.3538, 50.0% of the Nov 1 - Dec 27 bear leg.

- Both Norges Bank and ECB meetings take focus on Thursday. The US sees the Q4 advance release for GDP before the monthly PCE report for December on Friday.

FX Expiries for Jan25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0825(E871mln), $1.0850(E767mln), $1.0885-00(E765mln), $1.0945-50(E1.0bln), $1.0975-80(E1.2bln), $1.1000-10(E1.4bln)

- USD/JPY: Y146.50-60($570mln), Y147.55-65($617mln)

- EUR/JPY: Y161.30(E770mln)

- GBP/USD: $1.2815(Gbp554mln)

- USD/CNY: Cny7.1900($1.5bln)

Late Equities Roundup: Paring Gains Ahead Data Risk, Earnings

- Stocks are mixed in late trade, trimming gains after S&P eminis are made new contract highs (4933.25) earlier. Middle East tensions a potential factor for the late risk unwinds, but traders point out crude remains bid (WTI +.60 at 74.97).

- Stocks had pared gains after this morning's larger than expected flash PMI gains for January tempered projected rate cuts. Paring risk ahead Thursday's Q4 GDP estimate, followed by consumer spending and PCE deflators on Friday is plausible.

- Currently, S&P E-Mini futures are up 12.5 points (0.26%) at 4906.75, Nasdaq up 88.1 points (0.6%) at 15512.85, DJIA down 28.23 points (-0.07%) at 37874.72.

- Leading gainers: Communication Services sector continued to outperform, media and entertainment shares leading: Netflix +11.59% (off highs) after better than expected rise in new service contracts. Distant second and third place: Meta +1.78%, Google +1.4%. AI demand continued to buoy chip stocks and IT sector: Advanced Micro Devices +5.15%, Applied Materials +4.98%, while Nvidia gained 3.75%.

- Laggers: Materials and Utility sectors underperformed in late trade, chemical stocks weighed on the former: Dupont de Nemours -12.68% after weak output spurred a downgrade from BMO. Eastman Chemical -2.63%, Celanese Corp -2.01%. Independent power and water providers weighed on the Utility sector: American Water Works -3.36%, Sempra -1.58%, AES -1.60%.

- Looking ahead: several earnings announcements expected after the close: IBM, Seagate, Lam Research, Tesla, Raymond James and Crown Castle.

E-MINI S&P TECHS: (H4) Northbound

- RES 4: 5000.00 Psychological round number

- RES 3: 4982.62 1.50 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 4952.45 1.382 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 4931.75 Intraday high

- PRICE: 4902.25 @ 15:30 ET Jan 24

- SUP 1: 4804.36/4713.85 20- and 50-day EMA values

- SUP 2: 4702.00 Low Jan 5

- SUP 3: 4594.00 Low Nov 30

- SUP 4: 4550.75 Low Nov 16

The uptrend in S&P E-Minis remains intact and this week’s move higher reinforces current conditions. Resistance at 4841.50, the Dec 28 high has recently been cleared, confirming an extension of the price sequence of higher highs and higher lows. Moving average studies remain in a bull-mode condition, highlighting positive market sentiment. Sights are on 4952.45 next, a Fibonacci projection. Key support lies at 4713.85, the 50-day EMA.

COMMODITIES Crude Buoyed By Large Stock Draw, Gold Slips Nearer To Support

- WTI continues to trade higher on the day with China stimulus measures helping early on and then in particular larger than expected US crude stock draws, although it has relinquished some of its earlier gains.

- EIA Weekly US Petroleum Summary - w/w change week ending Jan 19, Crude stocks -9,233 vs Exp -908, Crude production -1,000, SPR stocks +920, Cushing stocks -2,008.

- North Dakota oil production disruption drops further Wednesday to around 170-220kbpd according to the pipeline authority.

- The first oil from the expanded TMX pipeline in Canada is expected to be loaded onto a ship at Vancouver in April, according to Jason Balasch, Trans Mountain’s senior director of business development, cited by Bloomberg.

- WTI is +1.02% at $75.13 off a high of $75.84 which took a step closer to the bull trigger at $76.31 (Dec 26 high).

- Brent is +0.6% at $80.06 off a high of $80.73, hitting resistance at $80.75 (Jan 12 high) and still a little way off the key resistance at $81.45 (Dec 26 high).

- Gold is -0.84% at $2012.31, having traded poorly through the cash equity open before extending declines on the solid US PMI data on top of a stabilisation of the greenback in FX markets. It takes a large step closer to support at $2001.9 (Jan 17 low).

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/01/2024 | 0700/0800 | ** |  | SE | PPI |

| 25/01/2024 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/01/2024 | 0800/0900 | ** |  | ES | PPI |

| 25/01/2024 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 25/01/2024 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/01/2024 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 25/01/2024 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 25/01/2024 | 1315/1415 | *** |  | EU | ECB Deposit Rate |

| 25/01/2024 | 1315/1415 | *** |  | EU | ECB Main Refi Rate |

| 25/01/2024 | 1315/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 25/01/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 25/01/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/01/2024 | 1330/0830 | *** |  | US | GDP |

| 25/01/2024 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 25/01/2024 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 25/01/2024 | 1345/1445 |  | EU | ECB Monetary Policy Press Conference | |

| 25/01/2024 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/01/2024 | 1500/1000 | * |  | CA | Payroll employment |

| 25/01/2024 | 1500/1000 | *** |  | US | New Home Sales |

| 25/01/2024 | 1515/1615 |  | EU | ECB's Lagarde ECB Podcast - latest monetary policy decisions | |

| 25/01/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 25/01/2024 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/01/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/01/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/01/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 26/01/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.