-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI ASIA MARKETS ANALYSIS: Hawkish Hold from FOMC Next Week?

- MNI US: WH Confident In Legal Arguments Ahead Of SCOTUS Student Debt Ruling

- U.S. SECRETARY OF STATE BLINKEN TO TRAVEL TO CHINA ON JUNE 18 - ASSOCIATE PRESS

US TSYS: Fading Canada Jobs Move, Tsys Weaker Ahead Next Wks FOMC, ECB, BOJ Annc

- Treasury futures holding modestly weaker levels after the bell, near the middle of a decent session range. On what would have been a quiet Friday session ahead next week's FOMC (Wed), ECB (Thu) and BOJ (Fri) policy announcements, futures gapped off weaker levels following a drop in Canada employment data (-17.3k vs. +25k exp).

- Treasuries scaled back from post-Canada employment data induced highs, levels are back near opening levels with front month 10Y futures at 113-13 (-10.5). Curves extend inversion (2s10s -5.543 at -85.851) as short end rates underperformed ahead next week's bill and coupon supply (large 2s/30Y ultra flattener also note: -13,328 TUU3 102-13.75, through 102-14.12 post-time bid vs. +2,364 WNU3 135-12.

- Fed Funds implied rates are drawing to the end of the week with yesterday’s initial claims spike still weighing on pricing for next week’s FOMC but meetings later on in the year having clawed back the drop.

- The further trimming of cuts sees just 24bp from July’s terminal to year-end and 38bp from July to Jan for the smallest since Mar 09 as rate cut expectations began to surge on regional banking woes.

- Cumulative changes from current 5.08% effective: +7bp Jun (+0.5bp on the day), +20bp Jul (+0.5bp), +18.5bp Sep (+1.5bp), +9bp Nov (+2.5bp), -4bp Dec (+3.5bp) and -18bp Jan (+5bp).

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00076 to 5.14562 (+.00445/wk)

- 3M -0.00905 to 5.24154 (+.01120/wk)

- 6M -0.02492 to 5.26715 (+.02168/wk)

- 12M -0.04345 to 5.10273 (+.07576/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00258 to 5.06671%

- 1M -0.00314 to 5.21929%

- 3M +0.00472 to 5.54443 */**

- 6M +0.00314 to 5.65971%

- 12M -0.00414 to 5.78386%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.54443% on 6/9/23

- Daily Effective Fed Funds Rate: 5.08% volume: $136B

- Daily Overnight Bank Funding Rate: 5.07% volume: $293B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.402T

- Broad General Collateral Rate (BGCR): 5.04%, $597B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $586B

- (rate, volume levels reflect prior session)

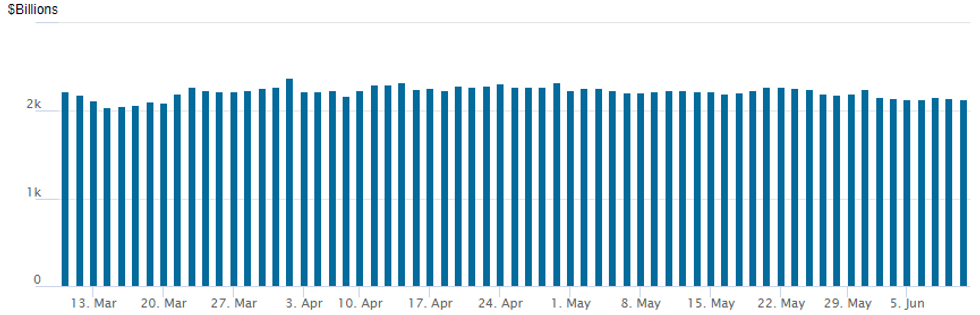

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,127.652B w/ 102 counterparties, compared to $2,141.798B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

With no data today, trading accounts plied the sidelines ahead the weekend with focus on next week's CPI and FOMC policy announcement (appr 25% chance of 25bp hike). Mixed trade on net with better upside call spread buying early in the second half.- SOFR Options:

- 7,500 SFRH4 97.50/97.87 call spds ref 95.34 to -.335

- 16,000 SFRZ3 97.50/97.87 call spds ref 94.98

- Block, 5,000 SFRM3 94.62/94.68 put spds, 1.5 ref 94.7425

- Block, 4,000 OQZ3 96.12/3QZ3 96.75 puts, 0.5 net/Blue Dec over

- 2,500 SFRM3 94.62/94.68/94.75 3x2x2 put trees, 0.75 ref 94.7425

- Block, 10,000 SFRU3 94.00 puts, 2.5 ref 94.785

- 2,000 2QM3 96.93 straddles

- 3,000 SFRM3 94.62/94.68 put spds vs. 94.81 calls ref 94.7475

- Treasury Options:

- 3,000 FVN3 106 puts, 2 ref 108-07.75

- Block/screen, 7,500 TYQ3 114/115.5/117 call flys, 18 ref 113-15

- over 6,000 TYN3 115 calls, 10-11 ref 113-13.56

- 2,300 wk2 TY 113.25 puts, 3 ref 116-16.5

- 2,000 wk2 TY 113.5 puts, 7 ref 113-18.5

EGBs-GILTS CASH CLOSE: Flattening Theme Continues To End The Week

The German and UK curves twist flattened Friday, continuing the recent flattening trend amid short-end/belly underperformance.

- With the ECB (next week) and BoE decisions in sight, the 2y segments on both curves resumed their recent rise. BoE peak rate pricing rose by 4bp to end a mixed but mostly hawkish week.

- An MNI Policy sources noted today, officials are converging on two more 25bp hikes, with a July increase probably following one certain for June.

- German 2s10s (-54.4bp) reached the most inverted closing level since mid-March; the UK equivalent is the most inverted since late Feb (-30.9bp).

- After hours we get a Fitch ratings review on Greece; GGB spreads tightened marginally having already outperformed Thursday. BTPs outperformed as BTP Valore sales closed with over E18bln in sales.

- Next week's calendar is very busy, with the ECB highlighting the European docket (and heavy EGB supply besides), but attention also on US inflation data and the Federal Reserve meeting, as well as the Bank of Japan decision.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 2.2bps at 2.916%, 5-Yr is up 0.2bps at 2.422%, 10-Yr is down 2.5bps at 2.377%, and 30-Yr is down 4.6bps at 2.516%.

- UK: The 2-Yr yield is up 4.1bps at 4.541%, 5-Yr is up 3.8bps at 4.25%, 10-Yr is up 0.6bps at 4.239%, and 30-Yr is down 0.6bps at 4.482%.

- Italian BTP spread down 4.7bps at 173.7bps/ Greek down 0.3bps at 128.6bps

FOREX: Antipodeans Perform Well, EURGBP Plumbs Fresh Year-to-Date Lows

- Despite the USD index’s moderate strength on Friday, the likes of AUD and NZD have remained well supported on Friday, rising between 0.4%-0.55% as we approach the weekend close.

- Aussie’s post RBA rally is extending and the AUDUSD bull cycle that started on May 31 remains in play with the pair trading at its recent highs. Resistance at the 50-day EMA has been cleared. The break higher strengthened on the break of 0.6733, 76.4% of the downleg in May.

- Continued progress for GBPUSD, following the break of key resistance at 1.2545, points to a stronger signal of a bottoming out of prices. 1.2592 is next up, a Fibonacci retracement which has capped the topside in today’s session and 1.2680 remains the key topside level.

- Perhaps more interesting is the cross, with EURGBP declining for four consecutive sessions and continuing to press to new YTD lows into the Friday close. The primary trend direction remains down, highlighted by a bearish price sequence of lower lows and lower highs. The focus is on 0.8547 – which has been pierced - the Dec 1 2022 low and a key support.

- The offshore Yuan (-0.30%) underperformed on Friday as greater-than-expected economic headwinds are putting pressure on the People’s Bank of China to ease policy. Following its recent guidance for banks to lower interest on deposits, this may indicate a higher likelihood of a cut to its medium-term lending facility rate as soon as next week, policy advisors and analysts told MNI. A sustained break above 7.1500 for USDCNH might expose bull channel top resistance, currently located around 7.1700.

- Lots of event risk next week highlighted by US inflation data, the FOMC meeting and the ECB rate decision. The week will also conclude with the June Bank of Japan meeting.

FX Expiries for Jun12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650-70(E1.6bln), $1.0695-00(E541mln), $1.0710-20(E839mln), $1.0740-50(E554mln), $1.0787-00(E984mln), $1.0860(E501mln)

- USD/JPY: Y139.50($503mln)

- USD/CNY: Cny7.1500($541mln)

Late Equities Roundup: Autos Driving Stocks Higher

- Stocks have pared midmorning gains, currently trading near mid-range on a generally quiet Friday session, many sidelined ahead next week's FOMC policy announcement on Wednesday. Currently, S&P E-Mini future are up 9 points (0.21%) at 4307, DJIA up 47.67 points (0.14%) at 33880.9, Nasdaq up 50 points (0.4%) at 13287.65.

- Leading gainers: Consumer Discretionary and Information Technology sector are outperforming. Auto makers lead the former, notably Tesla (+4.15%), GM (+1.15%) and Ford (+1.00%) following reports that GM will adapt it's EV cars to Tesla's charging network of approximately 12,000 "superchargers" (already adopted by Ford).

- IT sector shares were mixed on net, but gains from Adobe (+4.15%), AMD (+3.15%), Qualcomm (+2.5%), Oracle (+2.0%) outperformed session laggers.

- Laggers: Materials, Real Estate and Industrial sectors underperformed. Chemical stocks traded weaker: FMC (-3.6%), IFF (-2.95%), DOW (-1.95%). Energy stocks sagged with a decline in crude on the day (WTI -1.0 at 70.29).

- For a technical perspective, S&P futures cleared recent highs earlier. This confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows, marking an extension of the bull cycle that started in October 2022. The focus is on 4327.50, Aug 16 2022 high (cont). The 50-day EMA, at 4165.06 marks a key support. A break would signal a reversal. Initial firm support is at 4217.92, the 20-day EMA.

E-MINI S&P TECHS: (M3) Resumes Its Uptrend

- RES 4: 4422.45 1.382 projection of Dec 22 - Feb 2 - Mar 13 bull cycle

- RES 3: 4400.00 Round number resistance

- RES 2: 4393.25 High Apr 22 2022 (cont)

- RES 1: 4327.50 High Aug 16 2022 (cont)

- PRICE: 4302.00 @ 1300 ET Jun 9

- SUP 1: 4217.92 20-day EMA

- SUP 2: 4165.06 50-day EMA

- SUP 3: 4146.00 Low May 26

- SUP 4: 4114.00 Low May 24 and a key support

S&P E-minis are trading higher today and the contract has cleared the recent highs. This confirms a resumption of the uptrend and maintains the bullish price sequence of higher highs and higher lows, marking an extension of the bull cycle that started in October 2022. The focus is on 4327.50, Aug 16 2022 high (cont). The 50-day EMA, at 4165.06 marks a key support. A break would signal a reversal. Initial firm support is at 4217.92, the 20-day EMA.

COMMODITIES: Crude Oil Finishing Week Lower, EU Nat Gas Surges On Hot Weather

- Crude oil is ending the session on a softer note having just about been edging out gains for most of it. It ends the session at lows but off the week’s lows briefly touched yesterday after the Middle East Eye reported on a potential US-Iran deal that could have freed up 1mpbd in exports before being reported as false.

- This from GS’s Jeff Currie earlier in the day: “We will see substantial physical inventory draws because of these OPEC production cuts, particularly during the third quarter but also in the fourth quarter. That is going to push oil prices into the low 90s $/bbl”

- Also of note in natural gas space today, the TTF front month soared 19% today to the highest since 17 May on concern for tighter supplies with well above normal temperatures forecast in Europe. Added support come from tight import supplies with a current dip in US exports due to Sabine Pass maintenance, Norway LNG and field outages and potential increased LNG supply competition from Asia amid warmer weather in both regions, all contribuing to a 35% increase over the week.

- WTI is -1.5% at $70.21, with support at $69.03 (Jun 8 low) and resistance at a key short-term $75.06 (Jun 5 high).

- Brent is -1.4% at $74.88, with support at $73.58 (Jun 8 low) and resistance at $78.73 (Jun 5 high) and the short-term bull trigger.

- Gold is -0.2% at $1962.01, retreating at the USD lifts but a relatively benign drop on the day considering the lift in Tsy yields. Technical levels unchanged with the key short-term resistance at $1985.3 (May 24 high) and support at $1932.2 (May 31 low).

- Weekly moves: WTI -2.1%, Brent -1.7%, Gold +0.7%, US nat gas +3.8%, EU TTF nat gas +35%

Monday-Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/06/2023 | - | *** |  | CN | Money Supply |

| 12/06/2023 | - | *** |  | CN | New Loans |

| 12/06/2023 | - | *** |  | CN | Social Financing |

| 12/06/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 12/06/2023 | 1530/1130 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 12/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 12/06/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 13/06/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 13/06/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/06/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 13/06/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/06/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 13/06/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 13/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/06/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 13/06/2023 | 1230/0830 | *** |  | US | CPI |

| 13/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 13/06/2023 | 1400/1500 |  | UK | BOE Bailey Lords Economic Affairs Committee Hearing | |

| 13/06/2023 | 1400/1000 |  | US | Treasury Secretary Janet Yellen | |

| 13/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 13/06/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 13/06/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.