-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Headed For US Govt Shutdown

HIGHLIGHTS

- MNI US: Little Sign Of Last-Minute Deal As House GOP To Meet At 1400ET

- MNI US: Senator Diane Feinstein (D-CA) Passes Away, 90

- UAW WILL EXPAND STRIKE AGAINST FORD AND GM; STELLANTIS SPARED, Bbg

Tsys Don't Fear the Shutdown, Nor Quarter End For That Matter

- Support for Treasury futures continued to ebb in the second half, bonds steady briefly before climbing again on quarter/month end positioning. Tsys started to consolidate late morning - largely knock-on effect as EGB's pared gains ahead the weekend. Moves not related to impending US Govt shutdown expected to start Sunday.

- Current Dec'23 10Y futures +6 at 108-01.5 vs. 107-26 low, well above initial technical support of 107-05+ 1.382 proj of the Jul 18 - Aug 4 - Aug 10 price swing. Dec'23 30Y futures tapped steady after the bell but rebounded +7 to 113-23 on quarter/month-end extension trade.

- Curves steeper with the short end outperforming, 3m10Y +1.687 at -87.756, 2Y10Y +2.326 at -46.222.

- Treasury futures had extended highs following a raft of in-line data this morning that pointed to cooling inflation metrics heading into the fall.

- Fast two-way trade reported after initial data came out largely in-line:

- Personal Income (0.4% vs. 0.4% est)

- Personal Spending (0.4% vs. 0.5% est, prior up-revised to 0.09%)

- Real Personal Spending (0.1% vs. 0.0% est)

- PCE Deflator MoM (0.4% vs. 0.5% est), YoY (3.5% vs. 3.5% est)

- PCE Core Deflator MoM (0.1% vs. 0.2% est), YoY (3.9% vs. 3.9% est)

- Little observable reaction to lower than est. Chicago PMI (44.1 vs. 47.6 est, 48.7 prior) and after slightly higher UofM consumer sentiment at 68.1 vs. 67.7 est, 1- and 5Y inflation expectations in-line with expectations of 3.2% and 2.8% respectively.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00440 to 5.31899 (+0.00148/wk)

- 3M +0.00072 to 5.39550 (-0.00417/wk)

- 6M -0.00366 to 5.46727 (-0.01228/wk)

- 12M -0.00858 to 5.46626 (-0.01937/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $104B

- Daily Overnight Bank Funding Rate: 5.32% volume: $259B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.535T

- Broad General Collateral Rate (BGCR): 5.30%, $538B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $530B

- (rate, volume levels reflect prior session)

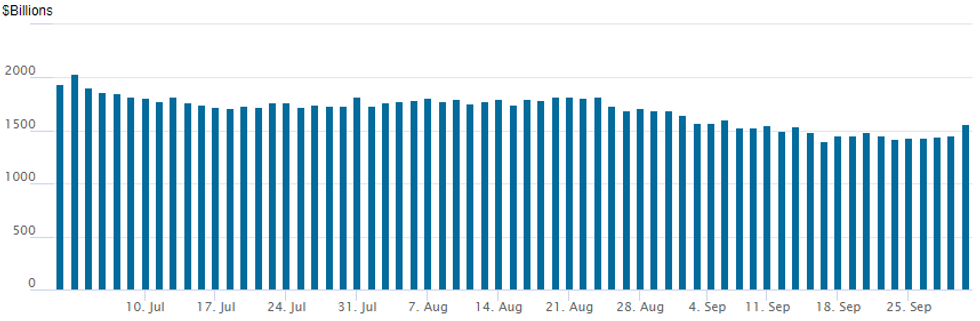

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation surges to 1,557.569B w/107 counterparties, compared to $1,453.366B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

With a few exceptions, SOFR and Treasury option trade continued to favor low delta calls and call structures Friday. Still bid in late trade, underlying futures pared support with EGBs into the European close. Rate hike projections into early 2024 continued to recede: November at 18.6% w/ implied rate change of +4.7bp to 5.374%, December cumulative of 9.8bp at 5.425%, January 2024 10bp at 5.427%. Fed terminal at 5.425% in Jan'24-Feb'24.

- SOFR Options:

- Block, +7,500 SFRH4 97.00 straddles 181.0 vs. 95.73/0.50% vs.

- Block, -5,000 SFRZ5 96.50 straddles 161.5 vs. 96.08//0.18

- Block, 15,000 SFRH4 94.25/94.62/94.81/95.56 call condors, 13.5

- +10,000 SFRH4 94.75/95.25 call spds, 7.75 vs. 94.64/0.20%

- Block, 5,000 0QZ3 95.62/96.00 put spds 28.0 vs. 95.445/.20% vs.

- Block, 5,000 2QZ3 96.12/96.50 put spds, 24.5 vs. 96.08/0.10%

- -1,500 SFRZ4 95.50 straddles, 116.5

- +5,000 0QX3 95.50/95.75 put spreads 17.0 ref 95.445

- 3,600 SFRX3 94.87/95.00 call spds ref 94.55

- +28,000 SFRZ3 94.62/94.68/94.75/94.81 call condors, 1.5 ref 94.555

- 3,500 0QV3 96.00 calls, .5 ref 95.43

- 1,000 SFRX3 94.56 straddles

- Small SFRF4 and SFRG4 94.62/94.68/94.87 call flys

- Treasury Options:

- +25,000 TYX 111 calls, 7 ref 108-01.5

- +20,000 TYX3 110/112 call spds, 11 ref 108-01.5

- 1,750 TYZ3 107 puts, 50, total volume over 5,800

- +9,000 FVX3 104.75/105.25 put spreads, 11.5 vs. 105-16/0.10%

- 1,000 TUZ3 102/103/103.75 broken call flys ref 101-11.5

- 2,100 FVZ3 106 calls, 35.5 last

- 2,000 FVX3 106.25 calls, 16 ref 105-12.75

- over 7,700 FVX3 106 calls, 21.5 ref 105-13.75

- over 5,900 TYX 109 calls, 33 last

- over 2,300 TYX3 107.5 puts ref 108-06

- Block, 6,000 TYX3 106.25 puts, 16 ref 108-06

- 2,000 TUZ3 103 calls ref 101-11.75

- over 3,400 USX3 116 calls, 102 last

FOREX USD Regains Some Lustre Through European Close

- The USD drift extended further in early Friday trade, pushing the likes of EUR/USD and GBP/USD back toward the week's best levels before the trade began to reverse across US hours, with the greenback undeterred by a softer MNI Chicago PMI headline as well as lower prices paid and new orders subindices.

- GBP flipped from being one of the session's more solid performers to now being bottom of the table alongside JPY, CHF and CAD. NZD was the best performing currency in G10, benefiting from a pullback in oil prices after the recent rally and the modest steadying of risk sentiment evident in the softer greenback and steadier global equity market.

- NZD/USD showed back above the 50-dma to touch 0.6049, but faltered on the approach to the 100-dma of 0.6082.

- The majority of sell-side month-end FX rebalancing models all pointed to USD buying into the month-end fix, so markets clearly remained wary of underlying USD demand across US hours.

- Focus in the coming week turns to the RBA, NBP and RBI rate decisions. The release of the September Nonfarm Payrolls report remains unclear, with the government shutdown this weekend potentially delaying the release beyond the originally scheduled October 6th.

FX Expiries for Oct02 NY cut 1000ET (Source DTCC)

- EUR/USD: Y149.00-05($1.1bln), Y150.00($729mln)

- GBP/USD: $1.2300-10(Gbp570mln)

- AUD/USD: $0.6500(A$668mln)

Equities Roundup: Energy, Health Care and Financials Lagging

- Stocks are paring early session gains, DJIA underperforming: down 188.86 points (-0.56%) at 33482.34, S&P E-Mini Future down 15.5 points (-0.36%) at 4323.25, Nasdaq up 11.4 points (0.1%) at 13215.7.

- Laggers: Energy, Health Care and Financials sectors underperforming, equipment and services providers weighing on the Energy sector: Schlumberger -2.69%, Baker Hughes -2.45, Halliburton -2.32%.

- Health Care also weighed by equipment and services providers: HCA -1.63%, Insulet Corp -1.53%, Becton Dickinson -1.45%. Meanwhile, insurance names weighed on Financials: Travelers -1.63%, Chubb -1.52%, Everest Group -1.35%.

- Leaders: Consumer Discretionary, Information Technology and Real Estate sectors outperformed. Apparel and luxury goods buoyed Discretionary stocks, Nike +6.63% after reporting better than expected earnings and revenue growth guidance while global apparel and footwear company VFC gained 6.33%.

- Meanwhile, software and semiconductor stocks helped support IT sector again: Micron +4.37%, Trimble +3.25%, Accenture +2.27%. Management and development shares buoyed Real Estate sector: CBRE +1.55%, CoStar Group +.10%

- Technicals: A bear cycle in S&P E-minis remains in play and the latest recovery appears to be a correction. The recent break of support at 4397.75, the Aug 18 low, reinforced bearish conditions and signals scope for a continuation lower. Sights are on 4242.15, a Fibonacci retracement point. Initial firm resistance is 4472.85, the 50-day EMA. Ahead of the 50-day average is resistance at 4399.00, the Sep 22 high, and 4435.53, the 20-day EMA.

E-MINI S&P TECHS: (Z3) Resistance Remains Intact

- RES 4: 4597.50 High Sep 1 and a near-term bull trigger

- RES 3: 4566.00 High Sep 15

- RES 2: 4435.53/4472.85 20- and 50-day EMA values

- RES 1: 4399.00 High Sep 22

- PRICE: 4338.75 @ 1545 ET Sep 29

- SUP 1: 4277.00 Low Sep 27

- SUP 2: 4259.00 Low May 31

- SUP 3: 4242.15 1.236 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 4: 4194.75 Low May 24

A bear cycle in S&P E-minis remains in play and the latest recovery appears to be a correction. The recent break of support at 4397.75, the Aug 18 low, reinforced bearish conditions and signals scope for a continuation lower. Sights are on 4242.15, a Fibonacci retracement point. Initial firm resistance is 4472.85, the 50-day EMA. Ahead of the 50-day average is resistance at 4399.00, the Sep 22 high, and 4435.53, the 20-day EMA.

COMMODITIES Crude Just About Holds Gains For The Week, Gold Slumps

- Crude has extended losses during US hours and is trading lower on the day. However, WTI is set for a small net gain on the week. Today’s support comes from a weaker US dollar (a support that faded into the NY session as the USD bounced) plus the ongoing drawdown in global inventories ad supply tightness from OPEC+ cuts.

- U.S. Rig Count fell by 7 on the week to 623, according to Baker Hughes Sep. 29. Separately, US Crude Production reached its second highest ever level in July, driven by a record high output from Texas’ Permian Basin.

- US oil demand fell in the month of July to 20.12mbpd from a five-year seasonal high of 20.72mbpd in June 2023 but up compared to 19.93mbpd in Jul 2022 according to the latest monthly data from the EIA.

- The Biden administration on Friday released its expected plan to phase down oil and gas auctions in federal waters with a release that includes a maximum of three sales in the Gulf of Mexico through 2029.

- WTI is -1.1% at $90.71 (X3) in another step back towards support at $88.19 (Sep 26 low) despite the technical outlook having appeared bullish.

- Brent is -1.1% at $92.01 (Z3), still a little way off a key support at $90.41 (Sep 26 low) whilst resistance remains at $95.35 (Sep 28 high).

- Gold is -0.8%, another torid session despite the USD ultimately slightly lower on the day and Treasuries rallying, with perhaps further technicals at play. It’s through yesterday’s $1857.8 for a low of $1846.58, moving closer to $1839.0 (50% retrace of Sep 28, 2022 - May 4 bull leg).

- Weekly moves: WTI +0.7%, Brent +0.1%, Gold -3.9%, US nat gas +11.3%, EU TTF nat gas +5.2%.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/09/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 30/09/2023 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 30/09/2023 | 1400/1500 |  | UK | BoE's Cunliffe Speaks in Leeds | |

| 01/10/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 01/10/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.