-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: June Hike Chances Subdued Post Data

- Atlanta Fed Second-Quarter GDP Growth Estimate Unchanged (2.2%)

- Bank of America Reworks Leadership in Investment Banking Unit, Bbg

- US Household Net Worth Climbs as Stock Rally Offset Housing Drop, Bbg

- GOLDMAN SACHS PRESIDENT JOHN WALDRON SAYS SEEING A TOUGHER CAPITAL MARKETS ENVIRONMENT .. SAYS CLIENTS' RISK APPETITE IS LOWER, Bbg

US TSYS: Weekly Claims Supports Tsys, Incoming Supply Weighs on Curve

- Treasury futures remain well supported in late trade after this morning's higher than expected weekly claims of 261k (largest since Dec '21) vs. 235k est, small up-revision to prior (233k vs. 232k). Little reaction to midmorning Wholesale Trade Sales/Inventories data.

- Curves have reversed early steepening, however, as support for short end rates recedes. Currently, 2s10s curve is -4.620 at -80.937 vs. -71.863 high.

- Short end move partially be due to markets expecting increased Treasury bill sales (size and breadth of durations), though latest announcement shows 13- and 26W bills steady at $65B and $58B respectively while 52W bill climbs $2B to $38B.

- As a result of this morning's post claims rally, projected rate hike chances over the next three meetings have cooled: Fed funds pricing in appr 28% chance of a 25bp hike next week vs. 38.8% earlier, July OR Sep has receded to 77.2% and 64.4% respectively vs. 91.2% and 80.0% earlier. Year end rate cut chances remain soft while Jan'24 has climbed back to fully pricing in a 25bp cut.

- Stocks, meanwhile, are trading near highs (SPX emini at 4296.5) lead by Consumer Discretionary and IT sector shares. Energy stocks have pared early week gains as crude trades lower (WTI -1.36 at 71.17)

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01521 to 5.14638 (+.00521/wk)

- 3M +0.01251 to 5.25059 (+.02025/wk)

- 6M +0.01419 to 5.29207 (+.04660/wk)

- 12M +0.04239 to 5.14618 (+.11921/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00315 to 5.06929%

- 1M +0.04072 to 5.22243%

- 3M +0.02985 to 5.53971 */**

- 6M +0.01300 to 5.65657%

- 12M +0.04171 to 5.78800%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.53971% on 6/8/23

- Daily Effective Fed Funds Rate: 5.08% volume: $137B

- Daily Overnight Bank Funding Rate: 5.07% volume: $292B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.429T

- Broad General Collateral Rate (BGCR): 5.04%, $606B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $594B

- (rate, volume levels reflect prior session)

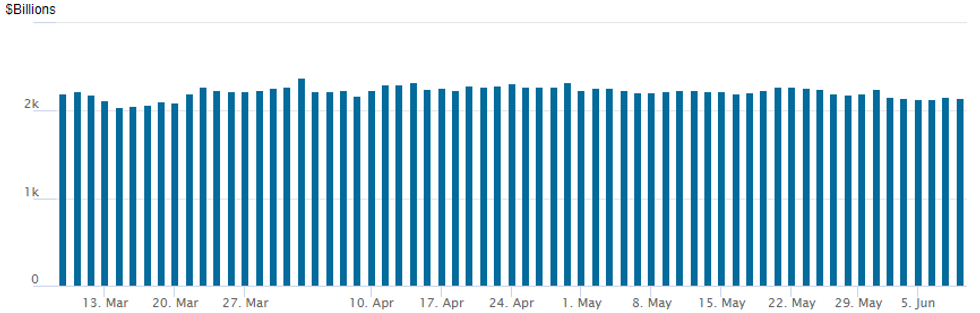

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,141.798B w/ 104 counterparties, compared to $2,161.556B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Better put trade reported with a few exceptions Thursday, despite the strong post-claims related rebound in underlying futures that tempered early expectations of a midyear rate hike. Fed funds pricing in appr 28.8% chance of a 25bp hike next week vs. 38.8% this morning, July OR Sep scaled back from nearly a full hike: 77.7% and 70% respectively vs. 91.2% and 80.0% earlier, while year end rate cut chances remained muted.

Better downside put trade carried over from overnight, particularly in Jul'23 and Aug'23 5Y puts while SOFR saw interest in September and October puts. Conditional bull curve steepener blocked at 1230:10ET, Oct'23 3.0 over Blue Oct'23.

- SOFR Options:

- Block, 5,000 SFRV3 95.37/96.37 call spds vs. 3QV3 97.25/98.25 call spds, 3.0 net steepener

- Block, 10,000 SFRU3 98.25/99.62 put spds ref 94.81

- 4,500 SFRM3 94.62/94.68/94.75 put flys

- 2,000 SFRV3/SFRZ3 94.68/94.93/95.12 put tree spds

- 1,250 SFRZ3 96.00/97.00 call spds ref 95.00 (appr +40k from 10-10.5 Wed)

- 5,000 SFRM3 94.68/94.75/94.81 put flys, ref 94.73

- 5,000 OQM3 95.25/95.50 put spds ref 96.195

- 4,500 OQM3 95.62 puts ref 95.785

- 1,500 SFRN3 94.56/94.75/94.87 put flys,

- Treasury Options:

- 5,000 TYN3 111/112 put spds, 7 ref 113-17.5

- 2,500 FVN3 107.75/108 put spds ref 108-17 to -16.25

- over 11,000 TYN3 115 calls, 7-10

- 7,300 FVQ3 111 calls, 7.5 ref 108-03.75

- over 8,000 TYN3 112 puts, 19 ref 113-00

- 1,500 TYN3 118 calls, 1 ref 112-31.5

- 2,000 TYN3 117.5 calls, 2 ref 113-03

- over 6,600 FVN3 107.75 puts ref 108-06.25

- Block, 10,000 FVQ3 108 puts, 27 vs. 108-06.25/0.50%

- over 5,400 TYQ3 112 puts, 43 ref 113-03.5

- Block, 10,000 FVN3 108 puts, 29 ref 108-04.5

- Block, 10,000 FVQ3 107.25 puts, 30 ref 108-04.75

EGBs-GILTS CASH CLOSE: Rally Into End-Of-Day

The UK short end outperformed Thursday with a sharp drop in BoE implied hike pricing, with bull steepening in the curve.

- Bund and Gilt futures hit the session's best levels just at the cash close alongside a sharp drop in oil prices on news of a potential US-Iran nuclear deal, though have faded a little since and remain well below Wednesday's pre-Bank of Canada hike levels.

- 5.5bp of hikes were removed from the BoE implied hiking path; 1.1bp for ECB's.

- German yields pared some of Wednesday's gains but didn't keep pace with Gilts; much of Europe was on holiday, thinning trade.

- Periphery spreads narrowed sharply following recent widening: the 4bp drop in Greek spreads was noticeable ahead of Friday's Fitch ratings review.

- Friday morning sees some Eurozone national industrial production readings.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.4bps at 2.894%, 5-Yr is down 5.4bps at 2.42%, 10-Yr is down 5.4bps at 2.402%, and 30-Yr is down 4.2bps at 2.562%.

- UK: The 2-Yr yield is down 7.2bps at 4.5%, 5-Yr is down 4.4bps at 4.212%, 10-Yr is down 1.8bps at 4.233%, and 30-Yr is down 1.3bps at 4.488%.

- Italian BTP spread down 4.3bps at 178.4bps / Greek down 3.9bps at 128.9bps

EGB Options: Various Bund Call Structures Feature On A Light Holiday Thursday

Thursday's Europe rates / bond options flow included:

- RXQ3 135/136.5/137c fly bought for 29 in 2.5k

FOREX: Substantial Greenback Turnaround, Swiss Franc Surges

- The greenback has had a substantial turnaround on Thursday, with the USD index sinking to two-week lows and broad strength witnessed across the majority of G10 currencies. The Swiss Franc was the notable outperformer, amid hawkish comments from the Governor of the Swiss National Bank.

- USDCHF looks set to post an intra-day 1.10% decline as the pair consolidates around the 0.90 handle approaching the APAC crossover. The impressive CHF move comes following more hawkish remarks from SNB Governor Thomas Jordan. The central bank chief highlighted that “we have second-round effects, third-round effects, so inflation is more persistent than we initially thought”. Jordan also noted that Swiss interest rates are relatively low, so it doesn’t make sense to wait which have exacerbated the CHF rally.

- USD/CHF has significantly narrowed the gap with the 50-dma at 0.8993 - with the pair notably breaking the below the uptrendline drawn off the early May lows of 0.8820.

- The Canadian dollar has bucked the trend, underperforming its G10 counterparts despite the BOC’s hawkish surprise on Wednesday and some analysts bolstering their calls for a weaker USDCAD. TD see a break below 1.33 as the path of least resistance, with a best case from a benign US CPI and the Fed skipping a June hike next week helping CAD outperform most G10 crosses, Scotia see fundamental fair value settling closer to 1.32, and ING see quite elevated chances it hits 1.30 this summer.

- Elsewhere, the likes of the Euro, GBP, JPY, AUD and NZD are all rising between 0.75-0.90% amid the softer greenback, with the price action underpinned by the weaker US initial jobless claims data and moderately firmer global equity benchmarks. Of note, cable has made a break of key resistance at 1.2545. Progress and a close through here could begin to signal a bottoming out of prices, with 1.2592 next up, a Fibonacci retracement and 1.2680 remaining the key topside level.

- Chinese PPI/CPI data is due overnight on Friday, with Canada employment the key release to close the week. All eyes remain focused on the US CPI print next Tuesday, which precedes the June FOMC decision.

FX Expiries for Jun09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0695-00(E1.1bln), $1.0720-25(E759mln), $1.0750-60(E697mln), $1.0800(E622mln)

- USD/JPY: Y139.00($996mln), Y140.00($972mln)

- USD/CAD: C$1.3350-65($837mln), C$1.3390-00($1.0bln), C$1.3450($1.7bln), C$1.3500($2.1bln)

- USD/CNY: Cny7.10($990mln), Cny7.20($644mln)

EQUITIES ROUNDUP, HOLDING FIRMER

- Stocks trading firmer in the second half, SPX Emini and Dow Industrial futures outperforming. Some tech stocks continue to buoy IT sector (Deutsche Bank upgraded Adobe target to $500 earlier) while auto shares are helping Consumer Discretionary stocks for a second day.

- At the moment S&P E-Mini Future are up 16.5 points (0.39%) at 4290.75, DJIA up 145.87 points (0.43%) at 33812.75, Nasdaq up 100.1 points (0.8%) at 13204.1.

- Leading gainers: Consumer Discretionary sector continued to lead the modest rally, autos leading with Tesla up 3.37%, Aptiv +1.55%. Information Technology sector shares were a close second as semiconductor and hardware makers traded strong (ADBE +4.75%, AMD and NVCA both +3.2%).

- Laggers: Real Estate, Energy and Materials sectors traded weaker, Energy lagging for a second consecutive session with WTI crude sagging to 69.06 session low.

- For a technical perspective, S&P E-minis remain in consolidation mode but the trend condition is bullish. Resistance at 4244.00, Feb 2 high and a bull trigger, has recently been cleared. The break reinforces bullish conditions and confirms a resumption of the uptrend that started in October 2022. The focus is on 4327.50 next, the Aug 16 2022 high (cont). The 50-day EMA, at 4159.67 remains a key support. A break is required to signal a reversal.

E-MINI S&P TECHS: (M3) Outlook Remains Bullish

- RES 4: 4400.00 Round number resistance

- RES 3: 4393.25 High Apr 22 2022 (cont)

- RES 2: 4327.50 High Aug 16 2022 (cont)

- RES 1: 4305.75 High Jun 5

- PRICE: 4295.00 @ 1320 ET Jun 8

- SUP 1: 4229.00 Low Jun 2

- SUP 2: 4209.46 20-day EMA

- SUP 3: 4159.67 50-day EMA

- SUP 4: 4144.00 Low May 24 and a key support

S&P E-minis remain in consolidation mode but the trend condition is bullish. Resistance at 4244.00, Feb 2 high and a bull trigger, has recently been cleared. The break reinforces bullish conditions and confirms a resumption of the uptrend that started in October 2022. The focus is on 4327.50 next, the Aug 16 2022 high (cont). The 50-day EMA, at 4159.67 remains a key support. A break is required to signal a reversal.

COMMODITIES: Crude Oil Whipsaws On Iranian Deal Story and Subsequent Denial

- Crude oil heads towards the end of the session with moderate losses that mask a much sharper decline that was subsequently reversed concerning Iranian exports.

- WTI slumped to a low of $69.03 after the Middle East Eye reported about a potential US and Iran interim deal ‘on nuclear enrichment and oil exports’ that could have potentially released up to 1mbpd of oil exports.

- That in turn would have counteracted Saudi’s voluntary commitment at the start of the week, something that provided narrow upward sentiment to oil markets this week. The shunt lower started to be reversed before accelerating with the White House subsequently saying such a report is false, almost completely unwinding the initial drop.

- WTI is -1.8% at $71.19, having punched through $70.00 (Jun 2 low) to open $67.03 (May 31 low).

- Brent is -1.4% at $75.88, having cleared $74.18 (Jun 2 low) with its low of $73.63, with a more concerted push lower potentially opening $71.50 (May 31 low).

- Gold is +1.2% at $1963.6 as it benefits from a consistently weaker USD through the session and falling yields after a spike in initial jobless claims. Resistance remains at the key short-term $1985.3 (May 24 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/06/2023 | 0130/0930 | *** |  | CN | CPI |

| 09/06/2023 | 0130/0930 | *** |  | CN | Producer Price Index |

| 09/06/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 09/06/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 09/06/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 09/06/2023 | 0800/1000 |  | EU | ECB de Guindos in Capital Requirements Seminar at EU Parliament | |

| 09/06/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 09/06/2023 | 1400/1000 | * |  | US | Services Revenues |

| 09/06/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/06/2023 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.