-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Late Tsy Highs on Geopol Risks

- U.S. URGES ISRAEL AGAINST GAZA GROUND INVASION: WAPO

- MNI SECURITY: UN SecGen Guterres Welcomes "Growing Consensus" For Humanitarian Pause

- MNI ISRAEL: Axios-'No Progress' On Talks To Release Hostages: Israeli Officials

- MNI MIDEAST: Al Arabiya-Israel Refuses To Respond To Hamas 'Long Truce' Request

- IDF Spokesman Rear Adm. Daniel Hagari/Twitter: ISRAELI MILITARY SPOKESMAN SAYS GROUND FORCES ARE EXPANDING THEIR OPERATIONS TONIGHT

cropfilter_vintageloyaltyshopping_cartdelete

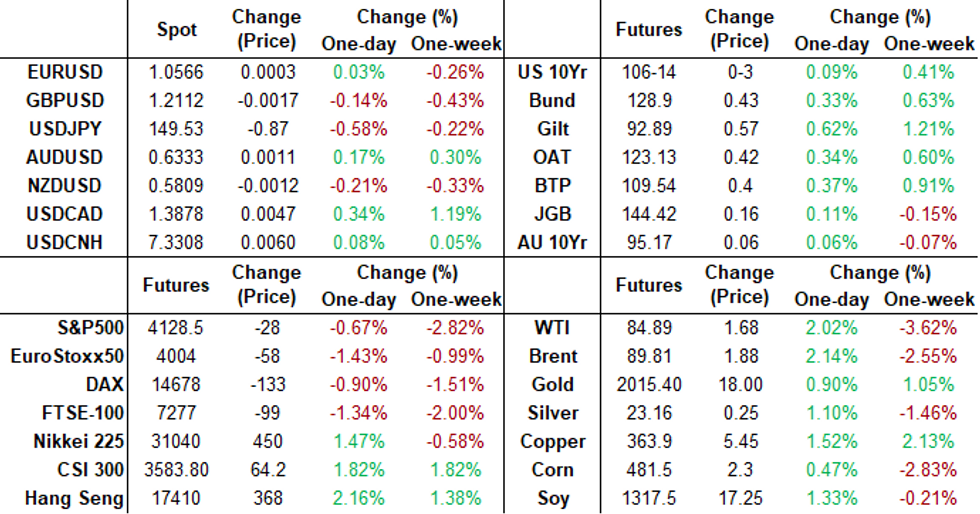

US TSYS Unwinding Risk Ahead Weekend Tsys Extending Highs

- Geopol risk over the weekend saw curves twisted steeper during the second half, short end started outperforming around the time Israeli military spokesman headlines made the rounds: "ISRAELI ARMY SAYS GROUND FORCES EXPANDING ACTIVITY IN GAZA: AP".

- Current Dec'23 2Y futures trade 101-11 (+1.88) while 10Y trades 106-15.5 (+4.5) with initial technical resistance at 106-29 (20-day EMA); 10Y yield -.0099 at 4.8346%, 2Y10Y +2.120 at -17.584.

- Early support in equities evaporated on the headlines as well, longs squaring ahead the weekend (SPX Eminis currently -29.5 at 4125.50).

- Brief two-way reported after Personal Income came in a little lower than expected (0.3% vs. 0.4% est, 0.4% prior), Personal Spending firmer (0.7% vs 0.5% exp, 0.4% prior). PCE deflator's in line: MoM (0.4% vs. 0.3% est, 0.4% prior); YoY (3.4% vs. 3.4% est, 3.4% prior/rev).

- Fast two-way noted Tsys pared gains then rebound after higher than expected UofMich 1Y inflation figure at 4.2% vs. 3.8% est (3.8% prior), 5Y in-line with exp at 3.0%.

- Quiet start to the week ahead, main focus on Wednesday afternoon's FOMC policy annc, ADP private employment data early Wednesday and Non-Farm payrolls next Friday. US Treasury's quarterly borrowing estimates on Monday.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00274 to 5.32412 (-0.00750/wk)

- 3M -0.00677 to 5.38321 (-0.01520/wk)

- 6M -0.01628 to 5.44063 (-0.02885/wk)

- 12M -0.03054 to 5.37295 (-0.06540/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $100B

- Daily Overnight Bank Funding Rate: 5.32% volume: $247B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.506T

- Broad General Collateral Rate (BGCR): 5.30%, $566B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $557B

- (rate, volume levels reflect prior session)

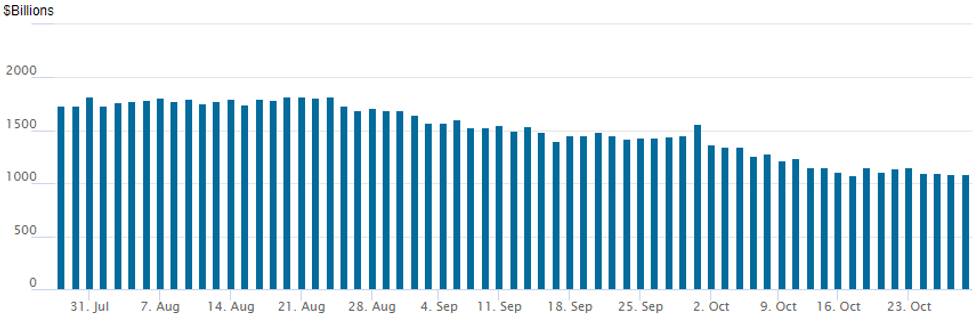

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage inches up to $1,091.858B w/100 counterparties vs. $1,089.850B in the prior session -- just above last week Tuesday's $1,082.399B - the lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR/Treasury option flow remained mixed Friday, early focus on unwinding/rolling November serial Tsy options ahead today's expiration (Nov SOFR options expire in 2 weeks). Underlying futures off lows, trading mildly higher in the short end to intermediates. As such, projected rate hikes into early 2024 inch lower: November at 0% to 5.325%, December cumulative of 4.3bp at 5.372%, January 2024 cumulative 6.9bp at 5.398%, March 2024 at 2.8bp at 5.356%. Fed terminal at 5.40% in Feb'24.

- SOFR Options:

- Block, 9,000 SFRZ3 95.87/96.25/96.50 broken call flys, 0.0 (all legs appear to be crossed at 0.75) ref 94.585

- Block, 5,000 SFRZ3 94.12/94.37 put spds, 0.5 ref 94.585

- +15,000 SFRM 94.75/94.87 call spds from 0.25-0.5 over the SFRM4 94.37/94.50 put spds

- Block, 8,000 SFRH4 93.75/94.25 2x1 put spds, 2.0 ref 94.665

- 2,000 SFRZ3 94.43/94.56 put spds, 3.5 ref 94.58

- +5,000 0QX3/0QZ3 95.75 call spds, 9.0 net (Dec over) vs. 95.395/0.12

- +2,000 2QZ3 96.00/96.37 call spds, 9.5 vs. 95.84/0.24%

- +2,000 SFRH4 96.00 calls, 9.0 vs. 94.695/0.14%

- Block 6,000 SFRF4 94.31 puts, 2.75 ref 94.67

- 2,000 SFRH4 94.18/94.56/94.75 broken put flys ref 94.66 to -.665

- 2,000 0QZ3 94.75/94.93/95.12 put trees ref 95.39

- Treasury Options: Reminder, Nov serial options expire today

- +22,000 TYZ3 107.5 calls, 33 ref 106-10.5

- over 39,500 TYX3 107.5 puts 111-112 ref 106-10 to -09.5

- +5,000 USZ3 102/106 put spds 40 ref 109-13

- 2,000 TYZ3 104/104.5/105.5 broken put flys ref 106-09

- -3,500 TYZ3 106.5 puts, 100 ref 106-12.5

- over 12,800 Wednesday weekly 10Y 107 calls, 11-13 ref 106-04 to -08

- 1,650 FVZ3 105.75/107.25 call spds

- over 5,200 TYZ3 106 puts, 58 last

- over 5,700 TYX 106.5 calls, 4 last

- over 6,200 TYX3 106 puts, 4 last

- over 5,000 TYX3 106.25 puts, 9 last

EGBs-GILTS CASH CLOSE: Bellies Outperform As BoE/ECB Implied Hikes Fade

European yields fell Friday, with Gilts outperforming Bunds, and periphery spreads tightening.

- Curve bellies outperformed as central bank tightening was further priced out following Thursday's in-line ECB meeting, and ahead of Eurozone October inflation data and the BoE decision next week.

- Bunds traded mostly within Thursday's ranges, rebounding from early morning losses with some pointing to disinflationary dynamics in Berlin/Brandenburg state inflation released this morning (ahead of the national German print on Monday).

- As anticipation built over next week's Oct flash inflation round (MNI's preview here), and perhaps with an eye on those German state data, ECB hike pricing diminished, with <1bp of tightening seen in the rest of the cycle, and 78bp of cuts in 2024 (5bp more than seen Thurs).

- Gilts gained more or less steadily throughout the session, though like ECB pricing, BoE rates were seen 8bp lower in the year past the peak, vs what was seen Thurs.

- Periphery spreads tightened, with BTP/Bunds heading below the tightest levels seen during Thursday's ECB press conference when Lagarde noted that PEPP policy wasn't discussed by the Governing Council.

- As noted, next week's Euro inflation data (Mon-Tue) and next Thursday's BoE decision will be the focus next week.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.8bps at 3.037%, 5-Yr is down 4.2bps at 2.683%, 10-Yr is down 2.9bps at 2.832%, and 30-Yr is down 0.2bps at 3.124%.

- UK: The 2-Yr yield is down 4.3bps at 4.777%, 5-Yr is down 6.7bps at 4.475%, 10-Yr is down 5.3bps at 4.544%, and 30-Yr is down 4.3bps at 5.025%.

- Italian BTP spread down 3.7bps at 197.2bps / Spanish down 1.3bps at 109.5bps

EGB Options: Euribor Put Condor Buying Highlights End-Week Rates Trade

Friday's Europe rates/bond options flow included:

- 0RZ3 96.875/96.75/96.625/96.375 broken put condor bought for 1.75-2 in 2.5k,8.5k on the day

- ERF4 96.00/95.75 put spread with 97.00/96.25 1x1.5 call spread, sold at 9.5 in 2k

- ERH4 96.125^ sold at 25 in 2k

FOREX USD Index Set to Post 0.35% Weekly Advance Amid Waning Equities

- Pressure on the greenback in early US trade on Friday was largely soaked up, with late equity weakness amid further geopolitical concerns providing support to the dollar as we approach the close. Despite the USD index residing in moderate negative territory on the session, it looks set to post a 0.35% advance on the week overall. Large two-way swings for US yields and weakness for equity benchmarks have been the dominant drivers for G10 pairs, however, most are in close proximity to the prior week’s closes.

- Initial headlines on Friday suggesting that ceasefire talks may be progressing well lifted the mood in currency markets, most notably by EURUSD rising from session lows of 1.0535 to within a whisker of the 1.0600 mark.

- However, the weakness for the equities approaching the weekend close as sentiment dampened on reports of increased ground incursions into Gaza from Israel produced a renewed greenback bid. This saw the likes of EURUSD and GBPUSD roughly 40 pips off the earlier highs before stablising.

- Some notable divergence between notorious safe havens on Friday sees CHFJPY extend declines on the session to roughly 1%, which eats into a healthy portion of the October rally.

- The Japanese yen is the best G10 performer on Friday ahead of next Tuesday’s BOJ decision. We anticipate that the BOJ will uphold its existing policies in the forthcoming announcement. This includes keeping the short-term interest rate at -0.1%. In a Reuters survey of economists conducted between October 17-25, 25 out of 28 economists expected no change in policy at the upcoming meeting, while the remaining three—Barclays, JP Morgan, and UBS—predicted that the BOJ would begin unwinding its accommodative stance.

- A busy week next week kicks off with Eurozone inflation readings. The Fed and the BOE then take centre stage before the US employment report on Friday.

FX Expiries for Oct30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0540-50(E2.2bln), $1.0600(E572mln), $1.0630-50(E1.3bln)

- USD/JPY: Y149.00($629mln), Y149.50($1.5bln), Y150.50($809mln), Y151.00($756mln)

- AUD/USD: $0.6140-50(A$1.8bln)

- USD/CAD: C$1.3820($606mln)

Late Equity Roundup: Energy, Financial Sectors Underperforming

- Stocks trading mostly weaker/near lows longs squared ahead the weekend, Nasdaq still managing to outperform in late trade. Currently, DJIA is down 391.23 points (-1.19%) at 32390.43, S&P E-Mini futures down 23.5 points (-0.57%) at 4132.5, Nasdaq up 39.5 points (0.3%) at 12634.09.

- Laggers: Energy, Financials and Health Care sectors underperformed, oil and gas shares weighed on the former after Chevron, Exxon Mobil, Phillips 66 all missed est's after weaker Q3 profits: Chevron -6.65%, Hess Energy -6.63%, Kinder Morgan -2.25%.

- Bank shares weighed on Financials: T Rowe Price -4.95%, Bank of America -4.25, AON -4.0%. Meanwhile, pharmaceutical and biotech shares weighed on the Health Care sector: AbbVie -5.8% (despite beating earnings ests and hiking Q4 guidance), Amgen -3.4%, Gilead Services -2.65%.

- Leaders: Recovering from midweek selling, Consumer Discretionary and Information Technology sectors continued to outperform late Friday, broadline retailers buoyed the former: Amazon +7.05% after beating Q3 estimates and raising forward guidance late Thu), Estsy +1.31%.

- Chip stocks buoyed the IT sector: Intel +9.25% also after beating Q3 estimates and raising forward guidance late Thu, Advanced Micro Devices +3.05% and Micron +1.67%.

E-MINI S&P TECHS: (Z3) Bear Cycle Still In Play

- RES 4: 4465.88 Trendline resistance drawn from the Jul 27 high

- RES 3: 4430.50 High Oct 12

- RES 2: 4382.41 50-day EMA

- RES 1: 4235.50/4312.52 Low Oct 4 / 20-day EMA

- PRICE: 4135.00 @ 1530 ET Oct 27

- SUP 2: 4124.19 61.8% retracement of the Mar - Jul bull leg (cont)

- SUP 1: 4122.75 Low Oct 27

- SUP 3: 4100.00 Round number support

- SUP 4: 4090.35 1.764 proj of the Jul 27 - Aug 18 - Sep 1 price swing

S&P e-minis maintain a softer tone and the contract traded lower Thursday. This week’s breach of support at 4235.50, the Oct 4 low and bear trigger, confirms a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. Moving average studies are in a bear-mode position too. The focus is on 4166.25, a Fibonacci projection. Initial firm resistance is at 4312.52, the 20-day EMA.

COMMODITIES Crude Spikes On Israeli Ground Invasion Preparation

- Crude prices spiked in the second half of the session following comments by the IDF implying expansion of operations into Gaza. WTI has been volatile throughout the day as conflicting headlines clouded the market’s assessment of the risk of further escalation with Al Jazeera earlier running potential ceasefire headlines. Despite the surge late Friday, WTI is set to finish the week down -3.5%.

- IDF Spokesman Rear Adm. Daniel Hagari says the military has ramped up airstrikes in the Gaza Strip in the last few hours: "The Air Force is striking underground targets very significantly. Ground forces are expanding the ground activity this evening."

- Physical crude markets have been more reflective of underlying economic weakness, a factor adding as another drag on oil at present, with signs of weak economic demand such as poor refined fuel demand figures in Europe and crude stockpile builds in the US. Physical barrels of sweeter grades like WTI are also being impacted by its high gasoline yield.

- WTI is +2.9% at $85.65, back at highs for the past few days amidst volatility but not troubling resistance at $89.85 (Oct 20 high).

- Brent is +3.0% at $90.59, also not troubling resistance at $93.79 (Oct 20 high).

- Gold is +1.1% at $2006.15, up strongly and covered separately.

- Weekly moves: WTI -3.5%, Brent -1.7%, Gold +1.3%, US nat gas +8.9%, EU TTF nat gas -1.1%.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/10/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 30/10/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 30/10/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/10/2023 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/10/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 30/10/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 30/10/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/10/2023 | 0930/1030 | *** |  | DE | Baden Wuerttemberg CPI |

| 30/10/2023 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/10/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 30/10/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 30/10/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 30/10/2023 | 1930/1530 |  | CA | BOC's Macklem testifies at House committee. | |

| 31/10/2023 | 2330/0830 | * |  | JP | labor forcer survey |

| 31/10/2023 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.