-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI ASIA MARKETS ANALYSIS - Markets Defensive in US' Absence

HIGHLIGHTS:

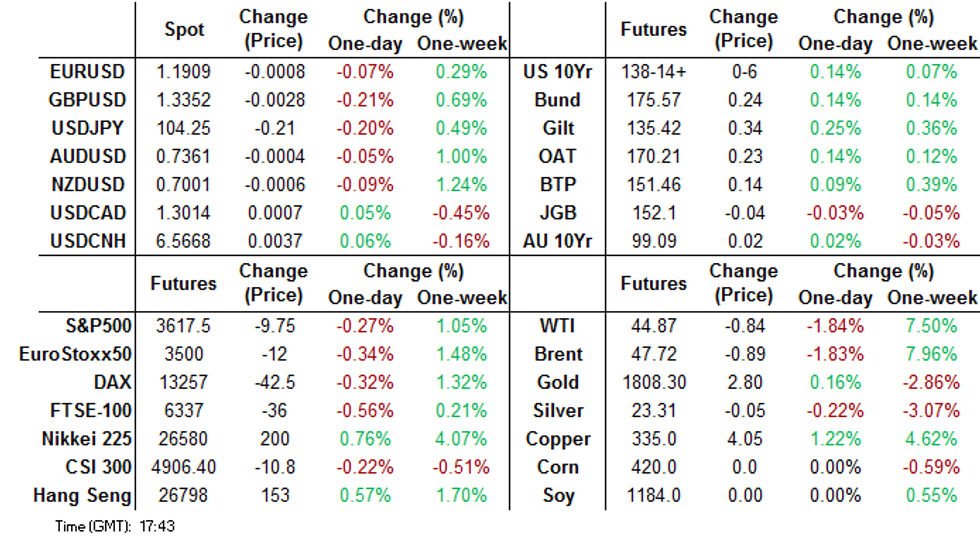

- Markets a touch defensive in holiday-thinned trade

- SEK softer as Riksbank extend QE programme

- Oil rally eases, WTI & Brent drop 1%

BOND SUMMARY: Steady Gains On Thanksgiving Thursday

With U.S. markets closed for Thanksgiving holidays, core FI on both sides of the Atlantic (futures in the case of US Tsys) saw steady gains albeit on predictably light volumes.

- The European rally accelerated in the afternoon following comments by ECB's Lane and release of the October Governing Council meeting accounts which were consistent with further easing in December. Cash curves flattened, with Gilts outperforming Bunds.

- Periphery EGBs had a strong day - Portugal 10s touching negative yielding territory - but spreads finished slightly wider as Bunds rallied.

- Very little on the agenda Friday in the U.S. with a half day for market trading. In Europe we get ECB's Panetta and Schnabel speaking, Italian bond supply, and French flash Nov inflation data.

- Dec Bund futures (RX) up 22 ticks at 175.55 (L: 175.16 / H: 175.57)

- Mar Gilt futures (G) up 35 ticks at 134.52 (L: 134.07 / H: 134.56)

- Dec U.S. 10-Yr futures (TY) up 6/32 at 138-14.5 (L: 138-07.5 / H: 138-14.5)

- Italy / German 10-Yr spread 0.6bps wider at 118.9bps

EUROPE SUMMARY: Light Trade Centres On Sterling, Bund Spreads

Today's options flow included:

- LH1 99.87/100/100.12/100.25c condor, sold at 7 in 10k (ref 99.965)

- 2LF1 99.75p vs 100.00/100.12cs 1x2, bought the Put for 1 in 3.5k

- RXF1 176.50/176.00 1x1.5 put spread bought for 1 in 1k

- RXH1 177.00/176.00 put spread bought for 33 in ~1.1k vs DUH1 112.30/112.20 put spread sold at 3 in ~8.2k

FOREX: Modest Defensive Trade in Holiday-Thinned Markets

Currency markets were understandably a touch quieter than average on Thursday, with the Thanksgiving holidays stateside keeping newsflow and price action thin. JPY modestly outperformed as those still trading took a slightly defensive stance, with CHF rising in tandem. Recent ranges, however, were respected, providing few new technical signals.

In Sweden, the Riksbank opted to expand their QE programme by more than expected, adding an additional SEK 200bln of purchases. SEK was sold in response, prompting a 0.4% rally in EUR/SEK - although the majority of the move has since retraced.

JPY, CHF were strongest, GBP, NOK and SEK the weakest.

Focus Friday turns to French inflation & GDP numbers and speeches from ECB's Panetta & Schnabel. Nonetheless, partial closures across the US will likely keep action muted.

EQUITIES: European Markets End Lower

Continental equity markets finished the Thursday session lower, although losses were minor as markets took a defensive view. Spain's IBEX-35 underperformed, with the index shedding around 0.75%, while German, French markets were broadly flat.

Energy sector was a laggard as the recent oil rally eased, while financials also traded heavy. Defensive sectors including tech and healthcare stemmed the losses, inching higher on Thursday.

COMMODITIES: WTI and Brent Markets Cap Recent Rally

Having extended the November rally in crude oil prices to close to 30%, WTI and Brent crude futures eased Thursday, with the benchmark contracts coming off just over 1% apiece.

Precious metals held up slightly better, with spot gold edging back above the $1,800/oz mark. The 200-dma remains key support at $1799.08, which has succeeded in slowing declines this week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.