-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA MARKETS ANALYSIS: New Yld Curve Lows Post Retail Data

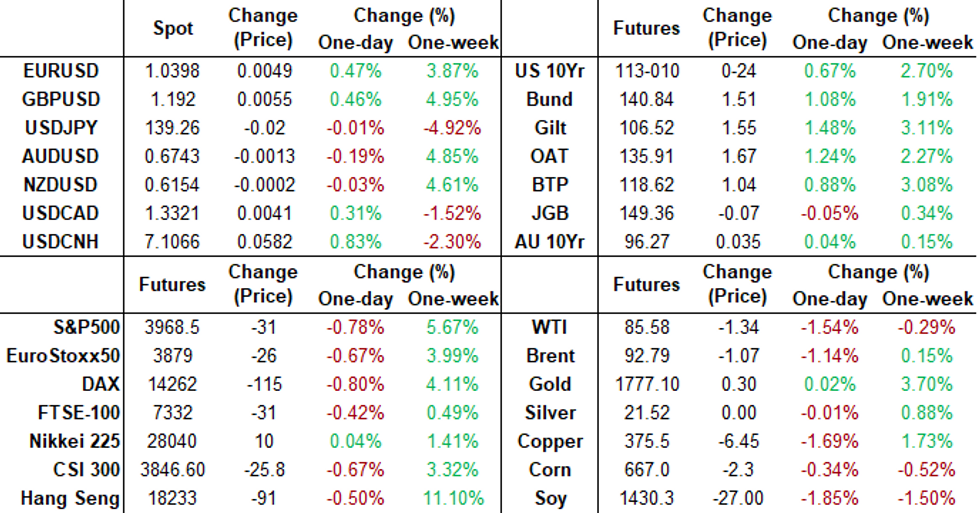

HIGHLIGHTS

- FED WALLER SAYS FED STILL HAS A `WAYS TO GO’ ON RAISING RATES, Bbg

- ECB OFFICIALS MAY FAVOR 50BP RATE HIKE IN DEC. RATHER THAN 75BP, Bbg

- Bringing Inflation Down Without a Recession Might Not Be Feasible, Fed Official Says -- WSJ

US TSYS: Rising Bonds Lifts All Durations

Focus on bull curve flattening as 2s10s falls to new all-time inverted low of -67.982 with Bonds extending session highs in late trade (30YY 3.8369% low), short end lagging after stronger Retail Sales (+1.3% vs. 1.0% est, ex-auto +1.3% vs. 0.5% est).

- Stronger revisions to prior, and a robust +0.7% M/M control group number (which is what feeds into the GDP calculations).The 1.3% overall gains included positive M/M readings in most categories.

- Short end came under heavy pressure for much of the session, tempering yr-end "step-down" pricing. Back on track in late trade: Fed funds implied hike for Dec'22 down to 49.3bs from 49.8bp, Feb'23 cumulative 83.6bp vs. 85.3bp, to 4.686%, terminal 4.905% in Jun'23 (5.08% pre-CPI).

- Tsy futures gapped higher after strong $15B 20Y bond auction (912810TM0) trades through: 4.072% high yield vs. 4.102% WI; 2.64x bid-to-cover vs. prior month's 2.5x.

- Indirect take-up climbs to 75.35% vs. 63.70% prior month; direct bidder take-up 15.40% vs. 19.86% prior; primary dealer take-up 9.25% vs. 16.43%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00372 to 3.81729% (+0.00243/wk)

- 1M +0.00714 to 3.91071% (+0.03542/wk)

- 3M +0.02458 to 4.67429% (+0.06815/wk) * / **

- 6M -0.00300 to 5.08200% (-0.00200/wk)

- 12M +0.00472 to 5.46486% (+0.01357/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.67429% on 11/16/22

- Daily Effective Fed Funds Rate: 3.83% volume: $97B

- Daily Overnight Bank Funding Rate: 3.82% volume: $275B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.149T

- Broad General Collateral Rate (BGCR): 3.77%, $441B

- Tri-Party General Collateral Rate (TGCR): 3.77%, $407B

- (rate, volume levels reflect prior session)

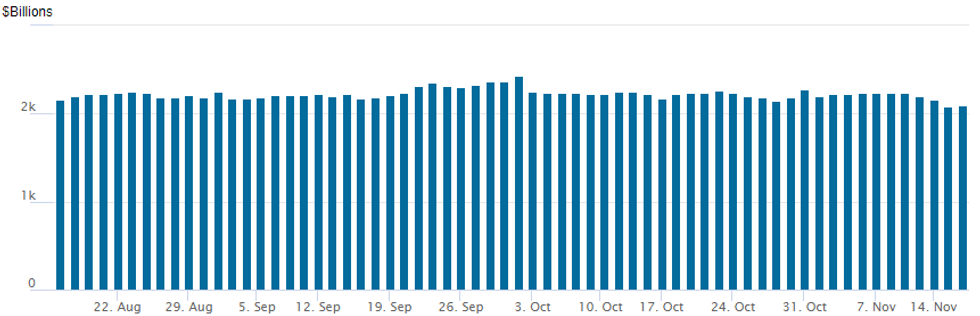

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces slightly to $2,099.070B w/ 103 counterparties vs. $2,089.574B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Another volume challenged session, accts already sidelined prior to all the data, and not thinking too deep ahead next week's holiday closures. Consistent themes: more interest in buying upside calls since last week's surprise CPI miss put year end policy pivot back on the radar. Wed's underlying rally despite stronger than expected retail sales failed to generate much follow through derivatives trading.- SOFR Options:

- Update, +20,000 SFRU3 95.62/97.00 call spds, 24.0-24.5

- Block, 5,000 SFRM 94.00/short Jun 94.50 put spds, 0.5 net midcurve over

- +25,000 SFRZ3 96.00/97.50 call spds, 30-30.5

- 2,000 SFRG 95.18/95.31/95.43 call flys ref 95.14

- Block, 2,500 Green Mar'23 97.00 calls, 25.0 vs. 96.805/0.40%

- 2,000 short Mar 94.00/94.50/95.50 broken put flys

- Eurodollar Options:

- 4,000 short Jun 98.87/99.12 call spds, ref 96.075

- Treasury Options:

- 2,750 TYZ 112.75/114 1x2 call spds, 19 net ref 113-01.5

- 2,500 TYZ2 111.5/112.5 2x1 put spds

- Block, 7,500 TYZ 113/113.5 1x2 call spds, 11 2-leg over

- +5,000 TYZ 113.5 calls, 25 vs. 113-03.5

- 5,000 TYZ 109 and 108.5 puts at 1

- 2,500 TYZ 113.75 calls, 9 ref 112-20

- 4,000 TYF 114/116 call spds ref 112-19.5

- 3,800 TYF 116.5 calls, 12 ref 112-21

EGBs-GILTS CASH CLOSE: German Inversion Deepens

European yields dropped sharply Wednesday in a mostly bull-flattening motion.

- German 2s10s inversion set a fresh record for this cycle as part of a global flattening move, which occurred despite largely in-line/above-expected global data (including 41-year high UK CPI).

- A multitude of ECB speakers (de Cos, Villeroy, Muller, Makhlouf among others) leaned mostly dovish on aggregate - terminal rate pricing fell 3bp on the day.

- BTP spreads fell again but 10Y/Bund climbed 6bp off session lows.

- Banks' early TLTRO repayments come into focus later this week (see our analysis of expectations, including links to MNI Policy exclusive interviews).

- Gilts outperformed, with yields across the curve now well below pre-Sept mini-budget. Focus now turns to the UK Autumn Statement Thursday (preview here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.5bps at 2.095%, 5-Yr is down 11.1bps at 1.955%, 10-Yr is down 11.2bps at 1.996%, and 30-Yr is down 11.5bps at 1.937%.

- UK: The 2-Yr yield is down 10.8bps at 2.993%, 5-Yr is down 12.4bps at 3.19%, 10-Yr is down 14.6bps at 3.149%, and 30-Yr is down 15.8bps at 3.313%.

- Italian BTP spread down 1.4bps at 193.8bps / Greek up 9bps at 225.3bps

EGB Options: Upside Remains The Theme

Wednesday's Europe rates/bond options flow included:

- DUF3 106.50/106.80cs, bought for 11.25 in 5k

- RXG3 125p, bought for 15 in 3k

- ERZ2 97.75/97.87/98.00c fly 1x3x2vs 97.50/97.00ps, bought the ps for 1.25 in 2k

- ERZ2 97.875/98.00/98.125c fly, bought for 1.5 in 6k

- 0RZ2 97.375/97.50cs, bought for 2.5 in 4k

- SFIZ2 96.10/96.20/96.30/96.40 call condor bought for 3.75 in 4.4k

- SFIZ2 96.35/96.45cs, bought for 3 in 4k

FOREX: Early USD Index Declines Reverse Course, CNH Underperforms On Housing Data

- Following the late knock to risk sentiment on Tuesday following reports of a missile strike crossing the Ukrainian border into Poland, the market fallout looks more contained Wednesday with the greenback initially resuming its most recent weakening trend before the USD index reverted back to unchanged levels approaching the APAC crossover.

- The stabilisation of markets follows firm intelligence reports that the errant missile strike was Ukrainian in origin, rather than Russian, leaving the triggering of NATO's collective defence far less likely after an emergency meeting this morning. Nonetheless, the sharp moves continue to underpin the fractious nature of markets at present, with front-end implied vols generally higher across G10.

- The late strength for the USD was partially underpinned by a firmer US retail sales report for October where the 1.3% overall retail sales gains included positive M/m readings in most categories. However, the dollar’s intra-day recovery could also be attributed to currency markets taking pause for breath, further evidenced by the mixed performance across G10.

- CNH was the worst performer, falling 0.8% against the greenback as data showing a continued decline in China's new home prices facilitated the upswing in USD/CNH. The value of new residential properties fell 0.37% M/m last month, which was the fastest pace of decline since Feb 2015.

- Faring better were both the Euro which consolidates just south of 1.04 and GBP which tracked either side of the 1.19 mark ahead of tomorrow’s awaited Autumn Statement.

- Overnight, Australian CPI will hit the wires before Philly Fed and Housing starts headline the US docket.

FX: Expiries for Nov17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0200(E978mln), $1.0300-05(E815mln), $1.0500(E590mln)

- USD/JPY: Y140.00-10($1.3bln)

- AUD/USD: $0.6300(A$1.4bln)

- USD/CAD: C$1.3300($1.0bln), C$1.3700($1.0bln)

- USD/CNY: Cny7.3000($2.0bln)

EQUITIES: Late Equity Roundup, Nasdaq Leads Sell-Off

Stocks mostly weaker, off lows after the FI close, OTC Nasdaq shares underperforming. Stocks reversed early gains after stronger Retail Sales (+1.3% vs. 1.0% est, ex-auto +1.3% vs. 0.5% est) tempered yr-end "step-down" pricing.

Energy and Consumer Discretionary sectors underperform. SPX eminis currently trading -35.25 (-0.88%) at 3964.75; DJIA -35.25 (-0.88%) at 3964.75; Nasdaq -184.1 (-1.6%) at 11174.99.

- SPX leading/lagging sectors: Energy (-2.22%) underperformed w/ equipment and servicer names lagging oil and gas shares (CTRA -4.66%, FANG -4.22%, MRO -4.07%). Consumer discretionary (-1.53%) weighed by autos, Information Technology (-1.42%) followed as semiconductors reversed prior session gains (Micron -6.68%, AMD -4.87%, AMAT -5.57%).

Leaders: Utilities (+0.91%),Consumer Staples (+0.44%) and Health Care (-0.03%). - Dow Industrials Leaders/Laggers: United Health (UNH) +9.25 at 512.26, McDonalds (MCD) +6.42 at 274.26 and Home Depot (HD) +4.00 at 315.93. Laggers: Salesforce.Com (CRM) -7.48 at 154.59, Chevron (CVX) -2.94 at 185.11, Caterpillar (CAT) -2.85 at 231.69.

COMMODITIES: Unwinding Missile Strike Spike

- Crude oil has fallen as geopolitical tensions faded after yesterday’s spike, with general agreement that the missile strike in Poland was wayward Ukraine air defense whilst a section of the Druzhba pipeline was reported to have restarted flows.

- The declines came despite a mostly bullish EIA report with a 5.4mln barrel drop in US crude inventories, whilst Germany warned of possible bottlenecks from the Russian oil embargo.

- WTI is -1.4% at $85.68 having earlier come close to support at yesterday’s low of $84.06. Resistance remains at $90.10 (Nov 11 high).

- Brent is -1.0% at $92.95, also coming close to testing key support at yesterday’s low of $91.53 whilst resistance remains $96.95 (Nov 14 high).

- Gold is -0.3% at $1773.98 although the trend is still seen northward with resistance at $1786.5 (Nov 15 high) and support at $1729.5 (Oct 4 high).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/11/2022 | 1230/0730 |  | US | Atlanta Fed's Raphael Bostic | |

| 17/11/2022 | 1230/1230 |  | UK | BOE Pill Speech at the Bristol Festival of Economics | |

| 17/11/2022 | - |  | UK | Autumn Statement with New OBR forecasts / Updated DMO Remit | |

| 17/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 17/11/2022 | 1300/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 17/11/2022 | 1330/0830 | *** |  | US | Housing Starts |

| 17/11/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 17/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 17/11/2022 | 1415/0915 |  | US | Fed Governor Michelle Bowman | |

| 17/11/2022 | 1430/1430 |  | UK | BOE Tenreyro Speech at Asociacion Argentina de Economia Politica | |

| 17/11/2022 | 1440/0940 |  | US | Cleveland Fed's Loretta Mester | |

| 17/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 17/11/2022 | 1540/1040 |  | US | Minneapolis Fed's Neel Kashkari | |

| 17/11/2022 | 1540/1040 |  | US | Fed Governor Philip Jefferson | |

| 17/11/2022 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 17/11/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/11/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 17/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 17/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 17/11/2022 | 1845/1345 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.