-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Weak Price Pressures Persist

US TSYS SUMMARY: Weak PCE Numbers Help Keep Yields Rangebound

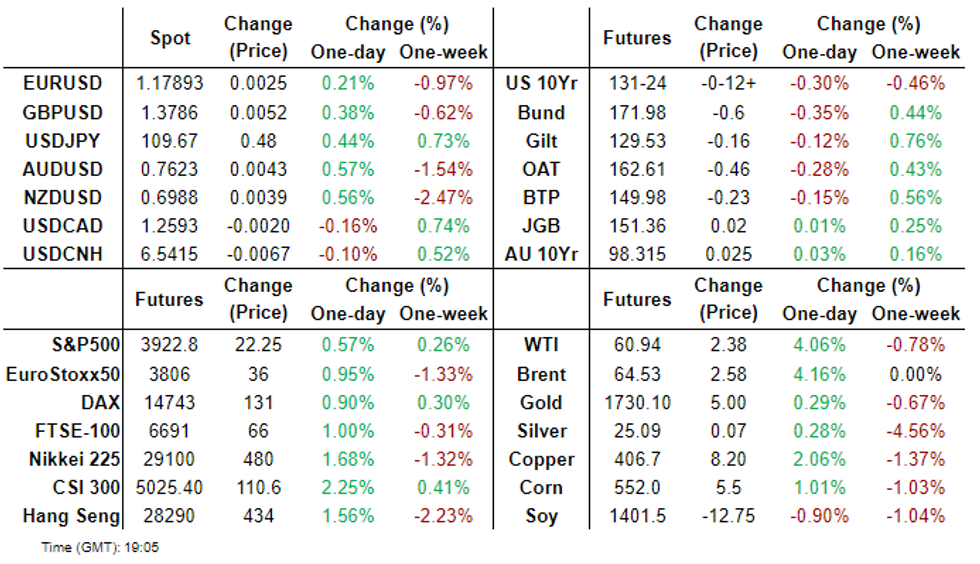

Treasuries saw modest weakness Friday, with 10-Yr yields rising to firmly within the middle of the week's (1.5872-1.7051%) range after rebounding from 1.5% handles on Wednesday and Thursday.

- Curve steepening took a bit of a breather, with 5s30s retracing Thursday's sharp post-7Y auction rise. Indeed, the short and long end outperformed on the curve 2Y +0.2bps, 5Y +2.0bps, 10Y +2.7bps, 30Y +1.0bps.

- With no supply and limited Fed speaker activity (Philly Fed Pres Harker said on BBG TV that rising market yields were a "good sign because it shows optimism"), focus was on data.

- Tsys headed higher after personal income/spending data came in line for Feb, but with downside revisions to PCE inflation figures. Trimmed mean PCE inflation figures released later in the afternoon by the Dallas Fed confirmed that price pressures remain very weak. Less noticed, wholesale inventories data came in weak, leading to downward revisions to Q1 GDP 'nowcasts'.

- Even so, long-end breakevens kept rising, hitting new cycle highs for 10s as oil prices picked up pace.

- Next week's highlights are largely on the data side, with nonfarm payrolls Friday, and MNI Chicago PMI and ISM Manufacturing PMI providing a status check on economic activity.

US: Weak Trimmed Mean Inflation Suggests Fed Getting Further Away From Goal

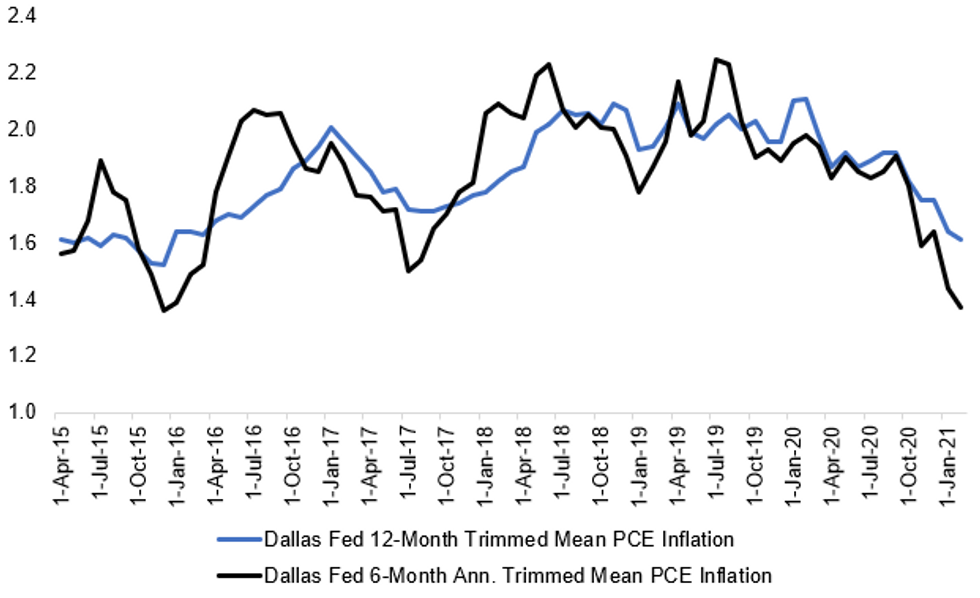

The Feb reading for core PCE prices - +1.4% Y/Y, down slightly from 1.5% in Jan - may belie an even bigger slowdown in price pressures in the month.

- The Dallas Fed's trimmed mean PCE metric, which excludes the most volatile price movements, continues to head lower: 1.61% on the 12-month reading (from 1.64% in Jan), and 1.37% on a 6-month annualized basis (1.44% in Jan). Those figures are the lowest since 2015, and compare to figures just above 1.9% seen as recently as September 2020. See chart below.

- While the test for higher inflation will come later in the year as the economy opens up from lockdown and fiscal stimulus comes through the pipeline, for the moment, price pressures are clearly headed downward.

- As ex-Atlanta Fed Pres Lockhart told our policy team back in January (see MNI EXCLUSIVE: Fed SEP Must Show Sustained Inflation For Hikes on Jan 29), FOMC members will be looking at such metrics as trimmed mean inflation to help determine whether they are getting closer to their inflation goal. On recent evidence, they are not.

Dallas Fed, MNI

Dallas Fed, MNI

US: Q1 GDP Forecasts Continue To Come Down

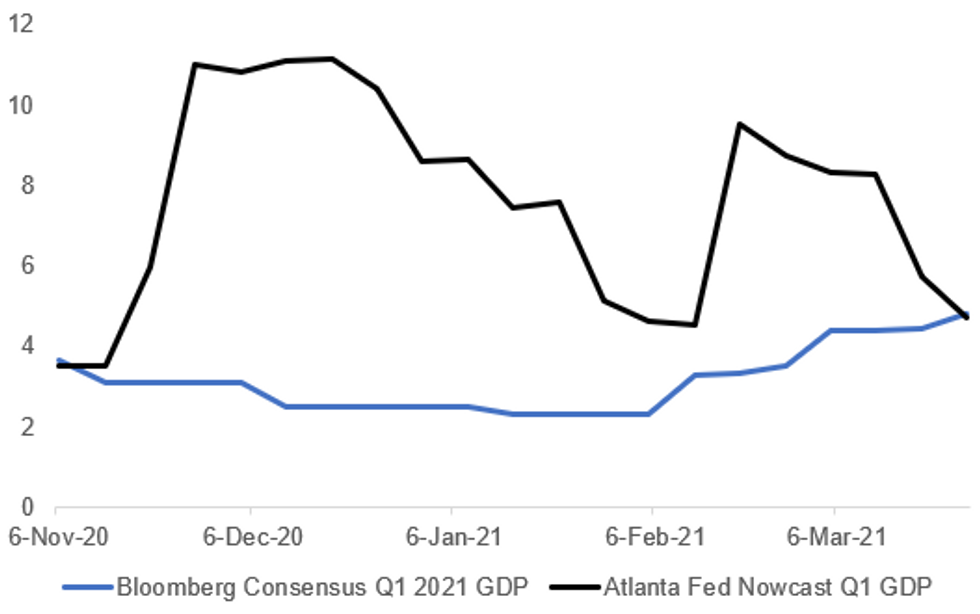

The Atlanta Fed's GDPNow foreacst for Q1 2021 fell to 4.7% Q/Q SAAR in the latest set of revisions today, with the nowcast's model dragged down by weaker inventory figures out this morning (and offsetting stronger-than-expected private consumption).

- This marks the first time that the Nowcast model has an estimate for the quarter that is below the Bloomberg economists' consensus (last 4.8%, just over half the 9.5% seen as of mid-Feb).

- While of course it's the next few quarters that the market is counting on to deliver a significant rebound in activity, the short-term forecasts appear to have become a little over-exuberant.

Atlanta Fed, BBG, MNI

Atlanta Fed, BBG, MNI

SHORT-TERM RATES

USD LIBOR FIX - 26-03-2021

O/N 0.07338 (-0.00212)

1W 0.08463 (-0.00025)

1M 0.10725 (-0.00188)

2M 0.13738 (-0.00037)

3M 0.19900 (0.006)

6M 0.20325 (-0.00063)

12M 0.28075 (0)

STIR: New York Fed EFFR for prior session (rate, chg from prev day):

- Daily Effective Fed Funds Rate: 0.07%, no change, volume: $79B

- Daily Overnight Bank Funding Rate: 0.07%, no change, volume: $270B

REPO REFERENCE RATES (rate, change from prev. day, volume):

- Secured Overnight Financing Rate (SOFR): 0.01%, no change, $956B

- Broad General Collateral Rate (BGCR): 0.01%, no change, $385B

- Tri-Party General Collateral Rate (TGCR): 0.01%, no change, $351B

NY Fed Operational Purchase Schedule

Next scheduled purchases:

- Mon 3/29 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 3/30 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 3/31 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Pause for Easter Holiday, Resume April 5:

- Mon 4/05 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

OPTIONS: Eurodollar/Tsy Summary

Friday's options flow included:

- EDU1 99.93c, traded 0.25 in 6k

- EDZ2 99.37/99.50/99.62/99.75c condor, traded 2.5 in 2k (ref 99.555, 7del)

- 0EZ1 99.37/99.25/99.12p ladder traded 1.5 for the 2 in 1.2k

- 0EZ1 99.75/99.87cs 2x5, traded for flat in 4k

- 0EH2 99.25/99.00ps vs 99.75c, bought the ps for half in 15k

- 0EU1 99.625/99.50 ps bought for 2 in 5k (ref 99.675/99.68)

- 2EN1 99.37c, traded 3 in 2.6k (ref 99.695, 18 del)

- 2EZ1 98.75/98.50ps, traded 6.5 in 5k

- 2EM1 99.37/99.50cs 1x2, bought for 2.25 in 1k (ref 99.32)

- 2EM1 99.25/99.00ps 1x2, bought for 2 in 4k (ref 99.32)

- 2EU1 99.25/99.50cs 1x2, bought for 5.5 in 2k (ref 99.11, 10 del)

- 3EJ1 98.87/98.62/98.37p fly, traded 9.5 in 2k

- 3EN1 98.87/99.00cs, vs 98.12p bought the put for 6 in 10k (ref 98.43, 33del)

- TYM1 130.00/133.50 ^^ now sold down to 48 in 1k. Was 51s earlier in 2+k

EGBs-GILTS CASH CLOSE: Bunds And Gilts Fade At End Of Strong Week

Bunds and Gilts faded at the end of a strong week, with bear steepening in both curves as equities headed higher. Periphery spreads were flat/lower.

- Little in the way of impactful news flow, EU leaders pushed forward with some vaccine rollout plans while still appearing to mull its options on export limits.

- We saw a bit of a risk-on move in the afternoon on headlines that the UK and EU had reached a post-Brexit deal on financial services cooperation, but this was more of a framework than a firm deal. Also some headlines (but little reac) on Germany's top court temporarily delaying the country's participation in the pandemic recovery fund.

- Next week's holiday-shortened schedule includes Eurozone CPI and final PMIs (Italy and Spain watched for their readings), otherwise few speakers (ECB's Lane and Villeroy) and limited supply.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.1bps at -0.715%, 5-Yr is up 2.2bps at -0.676%, 10-Yr is up 3.8bps at -0.346%, and 30-Yr is up 4.1bps at 0.216%.

- UK: The 2-Yr yield is up 1.5bps at 0.061%, 5-Yr is up 1.7bps at 0.332%, 10-Yr is up 2.8bps at 0.757%, and 30-Yr is up 4bps at 1.282%.

- Italian BTP spread unchanged at 96.4bps/ Spanish spread down 1.3bps at 63.3bps

OPTIONS: Europe Summary

Friday's options flow included:

- 3RM1 100.7/100.50/100.62c fly, sold at 3 in 5k

- 3RM1 100.25/100.00 put spread bought for 2.75 in 10k

- 3RZ1 100/99.50ps, bought for 4.5 in 4k

- 3RZ1 100/99.87ps vs 100.50/100.62cs, bought the ps for 0.25 in 4k

- 0LM1 99.625/99.50 put spread bought for 1 in 27.5k

- 2LU1 99.25/99.00ps, bought for 4.75 in 2.5k

- 2LU1 99.00p, bought for 4 in 12.5k. Was also bought in 12.5k (25k total). Some were done straight, some versus 99.44

FOREX: GBP Sees Support as EU & UK Seal FinReg Deal

- JPY retreated while AUD, NZD and NOK gained Friday as risk sentiment bounced after a tumultuous week. Equity markets looked to close the session with gains, draining recent strength from the greenback, which rolled off Thursday's multi-month high. JPY weakness put USD/JPY at new YTD highs, which equalled June 2020's best levels of 109.85.

- GBP saw some support ahead of the London close as Bloomberg reported that the EU and UK had sealed a deal over post-Brexit financial regulation. The piece reported that the move could allow UK financials firms to claw back some access to the Single Market that had been lost when the UK's transition period ended at the beginning of this year.

- GBP/USD climbed close to 1% off the week's lows, narrowing the gap with key resistance at the 1.3834 50-dma.

- The coming week is shortened due to Good Friday, although Nonfarm Payrolls is still scheduled for release. MNI Chicago Business Barometer and ISM data also cross. There are no central bank decisions of note.

FX OPTIONS: Expiries for Mar29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-15(E610mln), $1.1935(E1.1bln), $1.1950(E728mln), $1.2000(E910mln)

- USD/JPY: Y107.00($841mln), Y107.80($708mln), Y108.70-75($1.9bln)

- EUR/GBP: Gbp0.8585-95(E1.4bln), Gbp0.8600-10(E1.5bln-EUR puts)

- AUD/USD: $0.7700-05(A$519mln)

- USD/CNY: Cny6.51($645mln), Cny6.55($880mln)

EQUITIES: Stocks Shrug Off Tumultuous Week, E-mini S&P Finds Support

- Stock markets headed into the Friday close higher, with the S&P 500 cash adding just shy of 1% and outperforming both the Dow Jones and NASDAQ indices. Materials and tech names were the leaders, while utilities and communication services were the sole sectors in the red.

- In futures space, the e-mini S&P rose back above the 50-dma support (tested mid-week) at 3868.25, narrowing the gap with the alltime highs posted Mar 18 at 3988.75.

- Across Europe, continental indices finished uniformly higher, with Spain's IBEX-35 outperforming and adding 1.1%. France's CAC-40 lagged, but still finished higher by 0.6% having outperformed earlier in the week.

COMMODITIES: Oil Price Bounce Caps Off Volatile Week

- Overall, renewed global restrictions, Chinese demand concerns and the stronger dollar have spurred volatility in the whole of the commodity space this week.

- Oil prices rebounded 4.5% on Friday, likely closing unchanged on the week after multiple 5% price swings. The weeks price action was exacerbated by headlines regarding the Suez Canal blockage, prompting major shipping companies to re-route to other shipping lines. Oil traders have for the most part shrugged off the news event as only a small percentage of the world's crude is shipped through the canal.

- Precious metals succumbed to the persistent strength of the US dollar. Gold struggled to gather momentum in either direction but will likely close 0.5% lower on the week. The USD appreciation had a larger impact on silver continuing a short-term technical bear leg. Despite the rebound from yesterday's lows at $24.41, spot has dropped 4% on the week. A similar story in copper where futures dipped aggressively to 395 but recovered back to 406cents/lb to close the week down 1.5%.

- Greenback strength also prompted a reversal in bitcoin with prices dipping nearly $10,000 at Thursday's lowest point of $50,450. Additionally, $6 billion in quarterly options expiring Friday has impacted volatility. Prices are approaching back to $54k heading into the weekend.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.