-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Policy Pivot Push-Back From Collins

HIGHLIGHTS

- Fed Chair Powell Brookings event on Nov 30 added to calendar

- BOSTON FED COLLINS: 75 BASIS-POINT HIKE IS STILL ON THE TABLE

- ECB'S KNOT: RESOLUTE RESPONSE PROBABLY NEEDS RESTRICTIVE RATES, Bbg

- ECB'S KNOT: RISK OF A RECESSION HAS INCREASED, Bbg

US TSYS: Fed Terminal Up To 5.06% in June 2023

Tsys hold weaker levels after the bell, near lows/narrow range after nearly testing overnight lows through the second half. Limited reaction to existing home sales data: -5.9% less than estimated -7.1%, Oct leading indicator off more than estimated -0.4% to -0.8% MoM.

- Tsys saw renewed selling after comments from Boston Fed Pres Collins that 75bp NOT off the table - adding to decline of year-end step-down expectations after StL Fed Bullard's hawkish comments early Thursday.

- Fed Dec hike pricing up to appr 55bp now priced on OIS, or about 20% probability implied or about +1.5bp today or 2.5bp since before Bullard opined on 7% rates yesterday. Recall that pricing went as low as 51bp in the aftermath of the October CPI reading. Terminal pricing continues to rise above 5% mid-2023 to 5.06% (5.08% pre-CPI).

- Of note, the dip in year end policy-pivot expectations has contributed to heavy short end selling which in turn extends 2s10s inversion to new all-time low of 71.410 Friday morning - to -70.307 currently.

- Of note: Fed Chair Powell to speak on Nov 30 at Brookings at 1330ET - prior to this, he didn't have a speaking engagement on the calendar before the Dec FOMC. It will be a must-watch as it comes only 2 days before the pre-meeting blackout period.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00057 to 3.81214% (-0.00272/wk)

- 1M +0.00814 to 3.95671% (+0.07142/wk)

- 3M -0.01057 to 4.66486% (+0.03872/wk) * / **

- 6M +0.02028 to 5.14271% (+0.05871/wk)

- 12M 0.05157 to 5.50943% (+0.05814/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.67543% on 11/17/22

- Daily Effective Fed Funds Rate: 3.83% volume: $99B

- Daily Overnight Bank Funding Rate: 3.82% volume: $279B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.075T

- Broad General Collateral Rate (BGCR): 3.77%, $419B

- Tri-Party General Collateral Rate (TGCR): 3.77%, $401B

- (rate, volume levels reflect prior session)

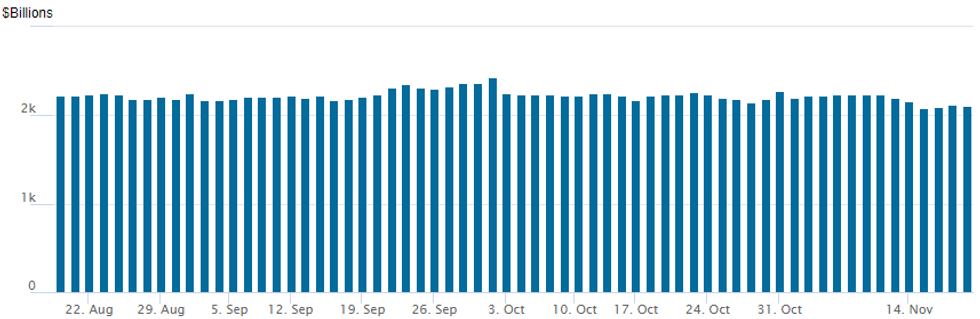

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,113.413B w/ 95 counterparties vs. $2,114.345B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

- SOFR Options:

- Block, total 19,000 SFRH3 95.31/95.43 call spds, 2.75 vs. 95.05/0.10%

- Block, 10,000 SFRU 97.00/98.00 call spds, 4.25 (splits) ref 95.205

- Block, 4,000 SFRZ2 95.56/95.75 call spds, 0.75 ref 95.46

- Block, 4,000 SFRU3 96.50/97.50/98.50 call trees, 4.5, more on screen, ref 95.205

- Block, 17,500 SFRU3 97.25/98.50 2x3 call spds, 5.5, 2-leg over, ref 95.19

- Treasury Options:

- 2,500 TYF 112.5/114 1x2 call spds, 0-1

- Over 6,300 TYF 114 calls, 39 ref 112-20.5

- 2,300 TYZ 111.5 puts, 10 ref 112-14

- 1,764 TYF 108/110 3x2 put spds

- Over 7,500 TYZ 112.75 calls, 20 last

- 8,500 TYZ 111.5/112 2x1 put spds ref 112-20

EGBs-GILTS CASH CLOSE: BTPs Outperform After Low TLTRO Repayments

Bunds outperformed Gilts Friday with continued flattening in both curves, as ECB TLTRO repayments turned out lower than expected (around E300bln vs E600bln expected), one implication of which was that German bond collateral will remain a scarce commodity.

- Both German and UK yields recovered from session highs by early afternoon.

- Gilts continued to weaken post-Thursday's budget announcement - we discuss the issuance implications of the Autumn Statement here.

- A strong session for stocks and the TLTRO results (which meant Italian paper wasn't about to flood the market) helped BTP spreads tighten further (though

- ECB rate hike pricing dived a few basis points in the wake of the TLTRO results, but bounced back quickly and finished steady on the day. Hawkish comments from ECB's Nagel and Knot helped keep a floor on rates.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.8bps at 2.106%, 5-Yr is down 0.5bps at 1.986%, 10-Yr is down 0.6bps at 2.014%, and 30-Yr is up 0.1bps at 1.929%.

- UK: The 2-Yr yield is up 6.3bps at 3.179%, 5-Yr is up 4bps at 3.295%, 10-Yr is up 3.7bps at 3.239%, and 30-Yr is up 3.5bps at 3.388%.

- Italian BTP spread down 3.3bps at 188.4bps/ Greek down 0.9bps at 225.3bps

EGB Options: Post-TLTRO Repayment Euribor Fly Features

Friday's Europe rates /bond options flow included:

- OEZ2 119.00/118.75ps vs 120.50/121.00cs, bought the ps for 2 in 4k

- ERZ2 97.87/98.00/98.12c fly, bought for 2.25 up to 2.75 in over 30k

FOREX: Greenback Falters, NZD Firms Pre-RBNZ

- The greenback faltered Friday, but respected the recent range to post an uneventful close. The USD faded despite a higher high for 10y yields posted ahead of the London close at 3.8215%.

- CAD was the poorest performer, however the price action is yet to buck the recent bearish price action in USD/CAD, which resulted in new multi-month lows and confirmed a resumption of the current downtrend. This also marks an extension of the bearish price sequence of lower lows and lower highs.

- GBP outperformed for much of the Friday session, getting an early tailwind from marginally better--than-expected retail sales. The price action extended the recovery off the post-Autumn Statement lows, and helped EUR/GBP break lower and out of the recent right range.

- NZD was among the session's best performers, with markets pre-positioning ahead of next week's expected 75bps RBNZ rate hike to 4.25%.

- Focus in the coming week turns to the Riksbank rate decision, at which the bank are expected to raise rates by a further 75bps to put the policy rate at 2.50%.

- Market volumes and liquidity are expected to thin headed into the end of next week, with the US enjoying the Thanksgiving holiday break.

Expiries for Nov21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0200-25(E1.1bln), $1.0280-00(E563mln)

- USD/JPY: Y140.00($1.1bln)

- USD/CAD: C$1.3300($554mln)

- USD/CNY: Cny7.1000($590mln)

Late Equity Roundup: Gaining Late, Energy Pares Losses

Stocks indexes continued to climb off midday lows in late trade, weaker Nasdaq lagging modest gains in SPX and DJIA. SPX eminis currently trade +12.75 (0.32%) at 3968.5; DJIA +167.59 (0.5%) at 33714.71; Nasdaq -9.8 (-0.1%) at 11135.55.

- SPX leading/lagging sectors: Energy sector continues to underperform but off lows (-1.11%) w/ Diamondback Energy -4.32%, Marathon -1.98%, Devon Energy -2.35%. Communication Services (-0.43%) and Consumer Discretionary (-0.26%) follow, media & entertainment and auto makers respectively weaker (Charter Comm -2.75%, Warner Bros -1.82%, Netflix -2.59%, TSLA -2.72%). Leaders: Utilities (+1.98%), Health Care (+1.12%) and Consumer Staples (+0.79%) sectors.

- Dow Industrials Leaders/Laggers: United Health (UNH) continues to rally +13.06 at 528.37, Merck (MRK) +1.60 at 103.90, IBM +1.39 at 147.48. Laggers: Salesforce.Com (CRM) -2.66 at 147.03, Chevron (CVX) -1.75 at 182.34 and Microsoft (MSFT) -2.34 at 239.34.

E-MINI S&P (Z2): Pullback Considered Corrective

- RES 4: 4175.00 High Sep 13 and a key resistance

- RES 3: 4146.63 76.4% retracement of the Aug 16 - Oct 13 downleg

- RES 2: 4100.00 Round number resistance

- RES 1: 4050.75 High Nov 15

- PRICE: 3955.00 @ 1450ET Nov 18

- SUP 1: 3857.34 50-day EMA

- SUP 2: 3750.00 Low Nov 9

- SUP 3: 3704.25 Low Nov 3 and key short-term support

- SUP 4: 3641.50 Low Oct 21

S&P E-Minis traded lower Thursday. The short-term outlook remains bullish and a pullback is considered corrective. A bullish theme follows recent strong gains that resulted in a break of 3928.00, the Nov 1 high. This strengthens a short-term bullish condition and price has established a sequence of higher highs and higher lows on the daily scale. The focus is on 4100.00 next. On the downside, key short-term support is at 3704.25, the Nov 3 low.

COMMODITIES: WTI (Z2) Impulsive Sell-Off Extends

- RES 4: $97.38 - 61.8% retracement of the Jun 8 - Sep 26 downleg

- RES 3: $95.55 - High Aug 30

- RES 2: $90.10/93.74 - High Nov 11 / 7 and key resistance

- RES 1: $81.30/86.80 - Low Oct 18 / 50-day EMA

- PRICE: $79.75 @ 1520ET Nov 18

- SUP 1: $75.70 - Low Sep 26 and a key medium-term support

- SUP 2: $73.89 - 1.00 proj of the Aug 30 - Sep 26 - Nov 7 price swing

- SUP 3: $70.00 - Round number support

- SUP 4: $69.21 - 1.236 proj of the Aug 30 - Sep 26 - Nov 7 price swing

WTI futures remain bearish and the contract has traded sharply lower today. This confirms an extension of the reversal from $93.74, Nov 7 high. Support at $81.30, Oct 18 low and a bear trigger has been cleared. This has resulted in a break of $79.96, 76.4% of the Sep 26 - Nov 7 bull phase. Attention turns to $75.70, the Sep 26 low and the next key support. Initial firm resistance is seen at $86.80, the 50-day EMA.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/11/2022 | 0115/0915 |  | CN | PBOC LPR | |

| 21/11/2022 | 0700/0800 | ** |  | DE | PPI |

| 21/11/2022 | 0905/0905 |  | UK | BOE Cunliffe Speech at Warwick Conference | |

| 21/11/2022 | 1530/1530 |  | UK | DMO Announces Agenda for Consultation Meetings | |

| 21/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 21/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.