-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Powell Drives Relatively Contained FI and Equities Rally

- After an initially mild two-way reaction the FOMC statement, Treasuries rallied with Chair Powell's early remarks in the press conference, boosting stocks in the process but with some notable volatility.

- The USD index also began to trade on the backfoot with the presser but declines for the USD index were relatively limited, whilst crude oil mostly looked through proceedings.

- Focus quickly turns to the ECB with its rate decision and press conference on Thursday. Beyond indicating a willingness to tighten further, if necessary, the ECB is unlikely to pre-commit to an additional policy rate hike in September. Attention will also be on the advance reading of Q2 GDP from the US, before Friday’s Bank of Japan meeting.

US TSYS: Powell Drives Rally With Data Dependency Teeing Up Upcoming Releases

- Front-end cash Tsys hold 6bps richer than just before the initial FOMC statement for -3bps on the day. After an unusually small reaction to the statement, 2Y yields saw an intraday rally of 10bps early into the press conference and have since then only partly pared some of the gains.

- The presser leaned slightly dovish with reiteration of signs of progress for instance in labor market balance, played up the potential impact of tighter credit conditions and didn’t outwardly lean on some recent comments from other Fed staff that lags could be shorter than usual -- see our more detailed write-up on Powell's press conference further down this e-mail.

- It 2YY -3.1bp at 4.843%, 5YY -4.2bp at 4.108%, 10YY -2.2bp at 3.863% and 30YY +0.8bp at 3.937%.

- TYU3 trades 12 ticks higher on the day at 111-31+ off a high of 112-05+ that stopped comfortably short of 112-17+ (Jul 24 high).

- FOMC-dated OIS suggests little net change in near-term meeting expectations, with +5bp for Sep and a cumulative +11bp for Nov to a terminal 5.44% with markets seeing an almost 50/50 chance of the second hike that the median FOMC participant pencilled in with the June dots. Cuts have built since the presser, but only to where they ended yesterday with 60bps from terminal to Jun’24.

- With Powell emphasising data dependency, tomorrow sees an important docket with the 1st release for Q2 GDP, preliminary durable goods for July, jobless claims and other second tier releases (along of course with the ECB decision) before Friday's Q2 ECI and monthly PCE reports.

FOREX: USD Index Moderately Lower Following FOMC Press Conference

- As the FOMC press conference progressed, the greenback traded on the backfoot and the USD index (-0.32%) extended to fresh session lows as Powell remained non-committal around the September decision.

- The Japanese yen has outperformed Tuesday which prompted USDJPY to slide back briefly below 140 and narrow the gap with initial resistance at 139.75.

- In similar vein, EURUSD makes gradual progress to the topside, printing a fresh high for the day at 1.1107 before creeping back below the 1.11 handle as we approach the APAC crossover. The pair remains way off the week’s highs around 1.1147.

- The Australian dollar remains one of the poorest performers across G10, after the lower-than-forecast CPI print for Q2. Importantly, the trimmed mean and weighted median releases were softer than expected, helping drag AUDUSD back toward first support at 0.6725, the 200-day moving average. EURAUD has unwound a solid portion of the weakness seen to begin the week, that had largely stemmed from the poorer European data and stimulus hopes in China.

- Focus quickly turns to the ECB with its rate decision and press conference on Thursday. Beyond indicating a willingness to tighten further, if necessary, the ECB is unlikely to pre-commit to an additional policy rate hike in September. Attention will also be on the Advance reading of Q2 GDP from the US, before Friday’s Bank of Japan meeting.

EGBs-GILTS CASH CLOSE: Flatter Curves Ahead Of Fed And ECB

Bunds underperformed Gilts Wednesday ahead of the US Federal Reserve decision after the cash close, and before the ECB Thursday.

- Amid a second consecutive day of limited trading volumes, and equally scarce news/macro catalysts, the German curve leaned bear flatter, with the belly underperforming (Bobl yields +7bp).

- The 7Y German auction saw a weak reception today.

- The UK belly likewise underperformed in a twist flattening curve movement, with 2Y yields up nearly 7bp, reflecting a bounceback in BoE terminal rate expectations on the day, perhaps with an eye on next week's MPC.

- Amid the Bund selloff, periphery spreads closed a little tighter, led by Greece.

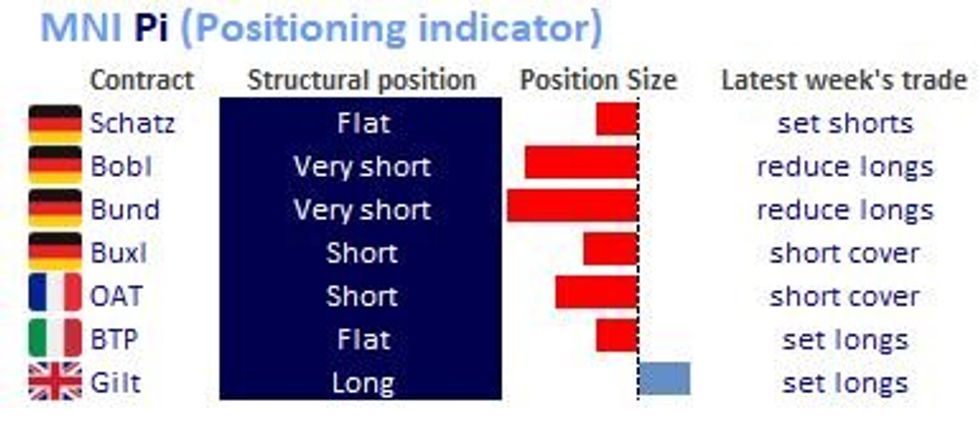

- MNI Europe Pi saw longs set in Gilt and BTP over the past week.

- While there is a decent slate of European data early Thursday (including German and Italian confidence surveys), all attention will be around the ECB's messaging attached to the expected 25bp hike (MNI's preview is here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.3bps at 3.131%, 5-Yr is up 7.3bps at 2.584%, 10-Yr is up 6bps at 2.485%, and 30-Yr is up 5.5bps at 2.519%.

- UK: The 2-Yr yield is up 6.5bps at 5.031%, 5-Yr is up 7.4bps at 4.435%, 10-Yr is up 1.3bps at 4.281%, and 30-Yr is down 1.9bps at 4.409%.

- Italian BTP spread down 1.8bps at 161.7bps / Greek down 4.1bps at 128.5bps

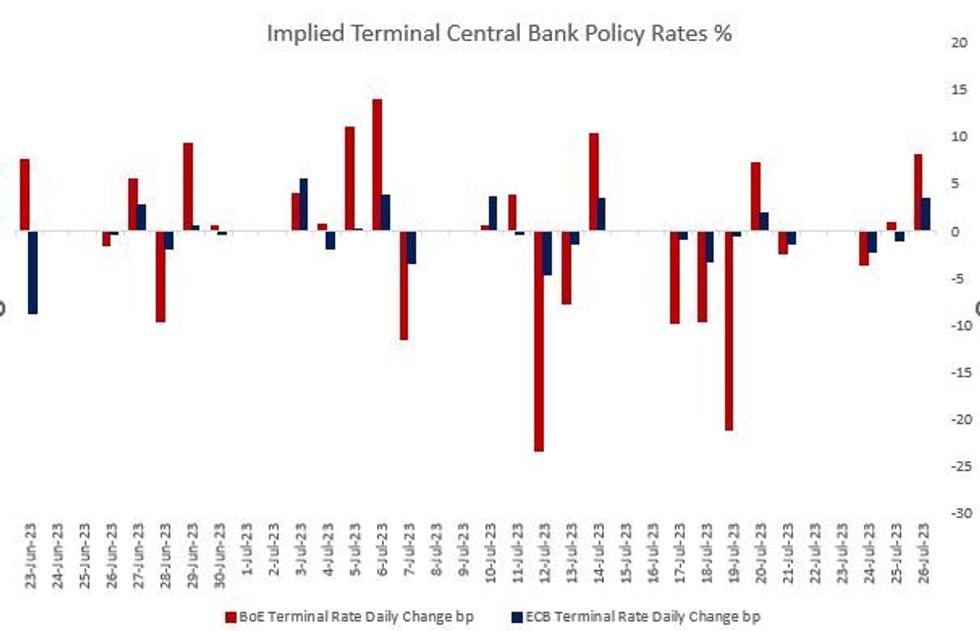

European STIR: BoE Peak Pricing Jumps, ECB Nears 4.00% With Decisions Looming

A jump in BoE peak rate pricing stood out Wednesday, to the highest since Jul 18, with ECB expectations also pushing higher amid repositioning ahead of Thursday's decision.

- ECB terminal depo Rate pricing +3.5bp to 3.98% (47bp of further hikes left in the cycle to Dec 2023). A 25bbp hike tomorrow is 96% priced, but September remains in the balance (37bp, at best a 50% prob of a consecutive 25bp raise), potentially swayed by the Governing Council's communications Thursday.

- BoE terminal Bank Rate pricing +8.1bp to 5.97% (97bp of further hikes left in the cycle to Feb 2024) Peak pricing jumped the most since Jul 14, despite few evident news/macro catalysts. Even with analysts affirming/switching to a 25bp hike expectation for August (Deutsche Bank today said they now see a 25bps rise vs 50bps hike previously expected), pricing for the next meeting held firm, with just under 50% prob of a half-point hike (46%).

US FI OPTIONS: Light And Mixed Fed Day Trade

Pre-FOMC Wednesday's US rates options flow included:

- SFRQ3 94.50p, traded for 1.5 in 3k

- SFRQ3 94.62/94.68cs traded for 0.75 in 2k

- SFRU3 94.68/94.62/94.56p fly, traded 1.75 in 10k

- SFRZ3 95.06/94.93/94.81p fly traded 0.25 in 1k

- SFRZ3 94.31/94.87^^ traded 16 in 1k

- SFRZ3 94.50/94.25ps 1x3, bought for 1 in 2k (bid over)

- SFRZ3 95.50/96.00cs with 94.25/93.75ps , bought for 4.75 in 5k (ref 94.61, 8 del)

- SFRH4 93.75/93.37ps vs SFRM4 94.00/93.50ps spread, bought the M4 for 2.75 in 15k.

- SFRZ4 95.00/94.25/93.50p fly, traded 10.5 in 2k

- 0QQ3 96.50c, traded 1 in 1k

- 0QU3 95.50/95.25ps 1x2, traded 2 and 1.5 for the 2 in 2k

- 0QU3 96.50/97.00cs, traded 2.5 in 1k

- 0QZ3 95.87/95.62/95.50p fly traded 7 in 1k

EU FI OPTIONS: Call Structures Pre-eminent Ahead Of ECB

Wednesday's Europe rates / bond options flow included:- ERZ3 96.625c, bought for 5 in 9k

- ERM4 97.00/98.00/99.00 call fly bought for 7.75 in 2k

- ERM4 98.00/98.50cs, bought for 2.75 in 10k

US STOCKS: Nudging Higher After Fed-Induced Volatility

- The S&P e-mini heads towards the end of the session nudging 0.1% higher, sitting at the high of the day’s range see with notable volatility through the FOMC press conference.

- A rally in US rates early into the presser helped ESU3 jump ~30 points to a session high of 4610.75 in a test of 4609.25 (Jul 20 high) after which lay a bull channel top at 4627.50.

- It then abruptly unwound the rally in a move that stood out compared to the relatively mild paring of gains at the same time in fixed income. Some attributed the sell-off to Powell not seeing inflation get back at 2% until about 2025 although that seemed to be pushing it and indeed the contact has since rallied back to ~4600.

- A near unchanged day for SPX (-0.02% at the close) came with two distinct leaders and laggards, with communication services +2.65% and IT -1.3%. Alphabet played an important role, rising +5.7% on the day after yesterday’s post-close earnings beat expectations, whilst Amazon slipped -0.9% after Politico reported the US Federal Trade Commission is finalizing an antitrust lawsuit against it.

- Banks have also seen a strong day though with PACW bouncing back strongly with a 27% gain after yesterday’s slump on the BANC advanced talks of buying it. It saw the KBW index rising 1.9% with regional banks +4.1%.

COMMODITIES: Crude Oil Unfazed By FOMC, Holds Decline After EIA Data

- Crude oil largely looked through the FOMC decision and press conference, having already pushed lower after the updated weekly EIA petroleum data showed a smaller than expected crude draw with an unexpected drop in refinery utilisation. Gasoline and distillate stocks have gained slightly after small draws with weekly implied demand just slightly higher.

- Specifically, Crude stocks -600 vs Exp -2,123, Gasoline stocks -786 vs Exp -1,591 and Distillate stocks -245 vs Exp -822

- Saudi Arabia is expected to extend the 1mbpd oil supply cut again into September according to a Bloomberg survey. 15 of 22 traders, analysts and refiners surveyed by Bloomberg predict it will continue into September.

- Russia will increase its crude exports in September on the back of higher refinery maintenance according to Reuters sources.

- WTI is -1.1% at $78.77 having earlier just remained within yesterday’s $79.90 after which lies key resistance at $81.44 (Apr 12 high).

- Brent is -1.0% at $82.81, pulling back off a high of $83.84 touching yesterday’s $83.85 after which lies key resistance at $85.47 (Apr 12/13 highs).

- Gold is +0.4% at $1973.03 after two-way trade albeit in a relatively tight range around the FOMC decision and presser. Resistance remains at the bull trigger of $1987.5 (Jul 20 high).

FED: Powell Emphasizes Meeting-By-Meeting Approach With September Live (1/2)

Chair Powell has indicated in the past that the FOMC was going to take a data-dependent, and meeting-by-meeting approach - but this was the first time it came off as genuine with no predetermined decision for the next meeting.

- His comments on that subject pointed to disagreement among FOMC participants ("would say there's a range of views on the committee. When you see the minutes in three weeks you will see that.")

- About as close to guidance as Powell got: "Between now and the September meeting, we get two more job reports, two more CPI reports...an ECI report...and lots of data on economic activity. All of that information is going to inform our decision as we go into that meeting. I would say it is certainly possible that we would raise the funds rate again at the September meeting if the data warranted. And I would also say it's possible that we would choose to hold steady at that meeting. We're going to making careful assessments, as I said, meeting by meeting."

- On the same note, he pushed back again on the one-on-one-off hike pace narrative, which seemed fairly evident as the base case as recently as the June meeting but today he further clarified that consecutive hikes were on the table: "a more gradual pace doesn't go immediately to every other meeting. It could be two out of three meetings."

FED: Powell Leans Slightly Dovish Overall (2/2)

But if you look past the question of the pace of hikes, which was really the only possible answer for a true meeting-by-meeting perspective (and probably required given internal FOMC divisions) the presser leaned slightly dovish.

- While Powell predictably downplayed the June CPI report, he reiterated several times that they were seeing progress, for instance in labor market supply/demand.

- He also played up the potential impact of tighter credit conditions (which was not a given today, considering how the banking sector appears to have held up well, and seemingly greater discomfort among FOMC hawks about their decision to agree to a June pause) as a consideration in policy.

- Perhaps the Senior Loan Officer Survey that the Fed saw in advance at this meeting was weaker than Powell let on.

More hawkish were Powell sounding the usual notes about "higher for longer" ("we think we're going to need to hold policy at a restricted level for some time and we need to be prepared to raise further if we think that's appropriate.")

- And he certainly didn't back off of the SEP projections for one further hike this year. The shift in statement language on economic activity reflected the staff's new non-recession forecast, which is marginally hawkish, but he saw it in the context of a soft landing remaining possible.

Some pointed to his comments that the Fed would stop raising and start cutting "long before you got to 2% inflation", as hawkish - "because we don't see ourselves getting at 2% inflation until 2025 or so".

- But that's just the June SEP inflation projection (headline PCE 2.1% by Q4 2025), and Powell is clearly saying that they WILL be cutting long before that. Indeed he also said "many people wrote down rate cuts for next year. I think the median was several for next year. That's just going to be a judgment that we have to make then a full year from now."

MNI Europe Pi Update: Gilt Longs Re-Emerging Ahead Of ECB (And BoE)

Heading into the ECB decision Thursday (and BoE the following week), European bond futures positioning has mostly moved in a cautious direction.

- Over the most recent week (the 5 sessions to Jul 25), OI and price data is suggestive of short covering in Buxl and OAT, and some longs closed in Bobl and Bund. Schatz saw some fresh short-setting, while BTP and Gilt stand out with longs set over the past week.

- Yesterday saw longs reduced across all contracts apart from Schatz and Gilt which saw shorts set.

- Versus our Jul 17 Pi update, Schatz structural positioning now reads flat (vs "short" previously), Bobl and Bund remain "very short", with Buxl drifting into slightly "short" territory (vs "flat" previously). OAT and BTP positioning remains short and flat, respectively. There are nascent longs seen in Gilt (vs flat previously), where it had last been in early May, and for most of Q2 (and as noted above, we saw Gilt longs set over the past week).

- Our next full Pi positioning update will be published Monday Jul 31.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.