-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

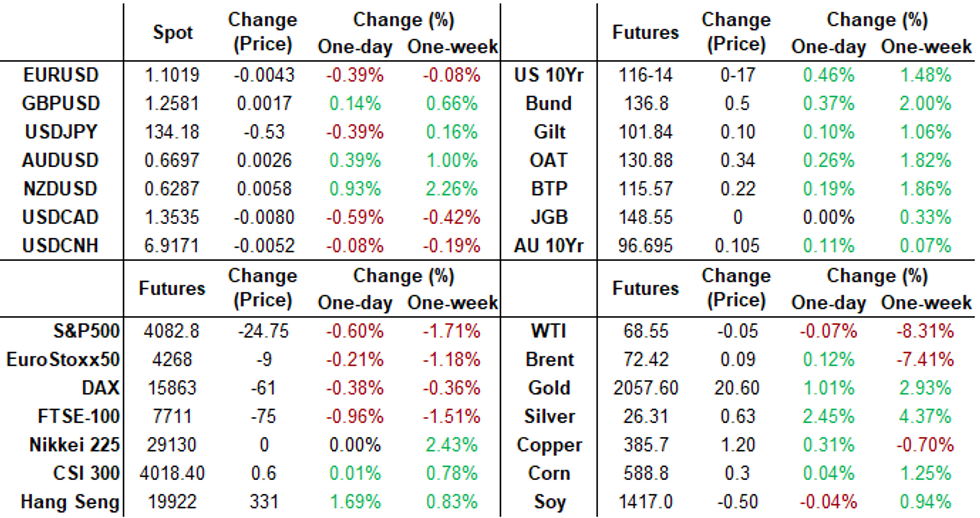

Free AccessMNI ASIA MARKETS ANALYSIS: Regional Bank Focus Vs Central Bank

- MNI: BOC PREPARED TO HIKE FURTHER IF INFLATION STICKS ABOVE 2%

- MNI SOUTH KOREA: Ambassador To US-SK Looks To Engage w/China Soon

- ECB HAWKS GAVE UP ON 50 BPS HIKE WITHOUT MUCH OF A FIGHT, Bbg

- LAGARDE SAYS IT'S VERY CLEAR THAT THE ECB ISN'T PAUSING, Bbg

- WESTERN ALLIANCE SAYS REPORT OF DEAL TALKS `ABSOLUTELY FALSE', Bbg

Key Links:MNI INTERVIEW: Fed Pause Could Make Inflation More Entrenched / MNI Fed Review - May 2023: High Bar To Further Hikes / FED: Several Analysts Maintain June (And July) Hike View / MNI Payrolls Preview: Eyeing Continued Moderation / MNI ECB WATCH: ECB Hikes 25Bps, Signals APP Reinvestments End / MNI: BOC Would Consider Persistent Market Strain For Rate Path

US TSYS: Regional Banks Wagged Treasuries, NFP Data Friday, Fed Exits Blackout

US rate markets had another whippy session, finishing higher Thursday, but off midday highs as regional bank concerns had a larger than normal effect on rates in the lead-up to Friday's April employment data (+180k est).

- Short to intermediate Treasury futures saw renewed support after the ECB hiked 25bp to 3.25%, setting the stage for steeper curves as Bonds lagged much of the day.

- Still well bid in early trade, Treasury futures marked session lows after higher than expected Unit Labor Costs (+6.3% vs. +5.5% est, near in-line weekly claims (242k vs. 240k est.

- Short to intermediate Treasury futures see-sawed higher from that point on apparently due to strong risk-off buying on regional bank concerns: PacWest Bank fell more than 60% after it confirmed it was in talks with potential investors early Thursday.

- By midmorning, shares of Western Alliance Bank sold off more than 50% after a FT wrote an article saying the bank was "exploring strategic options including a potential sale of all or part of its business". Western Alliance categorically denied the article and shares bounced but remained under pressure in the second half.

- Incidentally, Reuters exclusive reported "U.S. officials at the federal and state level are assessing the possibility of "market manipulation" behind big moves in banking share prices in recent days, a source familiar with the matter".

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00303 to 5.04345 (+.02475/wk)

- 3M +0.01323 to 5.07270 (-.00862/wk)

- 6M +0.00149 to 5.02843 (-.05114/wk)

- 12M -0.03346 to 4.71816 (-.09092/wk)

- O/N +0.24785 to 5.05871%

- 1M +0.01714 to 5.09871%

- 3M -0.00258 to 5.32371% */**

- 6M -0.00343 to 5.39100%

- 12M -0.03943 to 5.26014%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.33269% on 5/2/23

- Daily Effective Fed Funds Rate: 4.83% volume: $115B

- Daily Overnight Bank Funding Rate: 4.82% volume: $277B

- Secured Overnight Financing Rate (SOFR): 4.81%, $1.544T

- Broad General Collateral Rate (BGCR): 4.79%, $581B

- Tri-Party General Collateral Rate (TGCR): 4.79%, $567B

- (rate, volume levels reflect prior session)

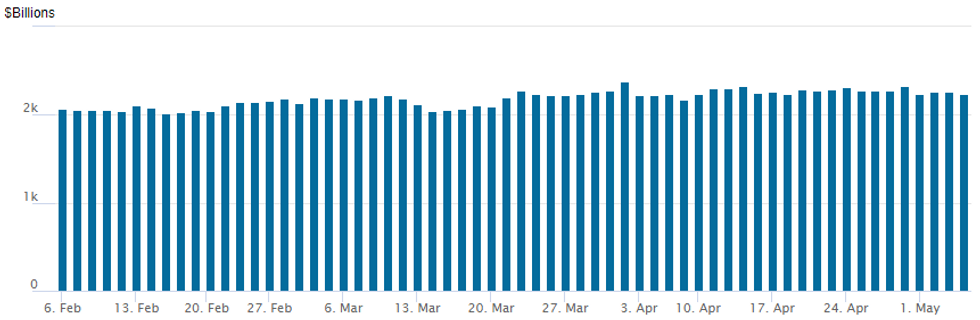

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips back to $2,242.399B w/ 101 counterparties, compares to prior $2,258.222B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTIONS SUMMARY

Thursday's salient FI option trade involved large upside SOFR call structures as underlying futures surged (SOFR Whites-Reds: SFRM3-SFRH5) as much as 0.420. Building upside hedges as implied rate cuts gathering momentum. Fed funds implied move for the next FOMC on June 14 is static at -3.1bp, while projected rate cut for September -40.6 cumulative at 4.650%, November cumulative -68.8bp at 4.373, Dec'23 cumulative -95.3bp at 4.107.

- SOFR Options:

- Block, +55,000 SFRU3 96.75/98.25 call spds vs. 27,500 OQU3 98.00 calls, 3.0 net package

- Block, 5,000 SFRM3 95.37/95.75 call spds, 2.5 ref 95.025

- Block, 5,000 SFRK3 95.18/95.43/95.68 call flys, 1.25 ref 95.02

- Block, +5,000 SFRU3 95.50 straddles, 85.0 ref 95.40

- Block/screen +20,000 SFRN3 97.00/98.00 call spds, 4.0

- Block, +10,000 SFRN3 94.50/94.75 put spds, 1.5 ref 95.415

- Block, 5,000 SFRV3 97.00/SFRZ3 97.50 call spds 2.5 net October over

- Block, 5,000 SFRN3 95.12/95.37 2x1 put spds, 2.25 net ref 95.365

- Block/screen, over +90,000 SFRN3 95.75/95.87 call spds 1.0 over 94.75/94.87 put spds, ref 95.36

- Block/screen, 20,500 SFRZ3 94.68/94.93/95/18 put flys, 4.0 ref 95.81

- 6,000 SFRU3 96.00/96.50 call spds, ref 95.37

- Block, 4,000 SFRU3 94.50/94.75 put spds, 3.75 ref 95.315

- Block/screen, 10,000 SFRK3 95.06/95.18 call spds,

- Block, 2,750 SFRN3 94.12/94.62/94.87/95.12 put condors, 7.0 ref 95.35

- Block/screen 11,750 SFRU3 98.25/98.75 call spds, 1.5 ref 95.43 to -.435

- 3,000 SFRN3 95.00/95.25 put spds ref 95.365

- 4,000 SFRU3 95.25/95.75/96.25 call flys ref 95.435

- 2,000 OQM 96.93/97.18 call spds vs. 2QM3 97.62/97.87 call spds

- Treasury Options:

- +10,000 FVM3 109.5/110.75 put spds, 30.5

- +5,000 TYN3 112.5 puts, 10 ref 116-20

- 2,300 TYN3 114 puts, 23 ref 117-05.5

- 5,000 FVN3 110 puts, 31 ref 111-10

- 1,700 TYM3 116.5/117.5/118.25 call trees ref 116-11

EGBs-GILTS CASH CLOSE: Bunds Soar As ECB Takes Back Seat To US Bank Woes

- The ECB decision received a mixed reception. Bunds jumped with the 25bp hike vs some lingering expectations of 50bp, and a lack of firm commitment to further tightening in the statement.

- More hawkish was Lagarde's "we are not pausing" and emphasis on requiring multiple future "decisions" to get to sufficiently restrictive territory; the announced end of APP reinvestments starting in July; and a lack of TLTRO bridging loans announced. Periphery spreads closed the day wider.

- Ultimately though US banking concerns and related equity volatility had a much bigger impact, with Treasuries pulling Bunds and Gilts to session highs in a strong risk-off move.

- Hike expectations faded, with ECB terminal dropping by 12bp and BoE 11bp - helping to drive short-end cash curve outperformance.

- Focus early Friday will be on ECB speakers (Simkus and Elderson scheduled), with the US jobs report taking centre stage later.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 16.2bps at 2.479%, 5-Yr is down 12.3bps at 2.122%, 10-Yr is down 5.7bps at 2.19%, and 30-Yr is down 0.5bps at 2.366%.

- UK: The 2-Yr yield is down 9bps at 3.678%, 5-Yr is down 8.7bps at 3.482%, 10-Yr is down 4.3bps at 3.653%, and 30-Yr is down 2.6bps at 4.069%.

- Italian BTP spread up 6.1bps at 193.2bps / Spanish up 3bps at 109.8bps

EGB Options: Rate Cut Play Via Call Spread Features Pre-ECB Meeting

Thursday's Europe rates / bond options flow included:

- RXN3 136.50/137.50/138.00 'broken' call fly Bot for 20 in 2k

- ERM4 98.50/99.50 cs 1x2, bought for 2.75 in 4k (traded in morning pre-ECB)

- ERM3 96.375/96.50/96.75 'broken' call ladder Bot for 5 (Bot the 1 leg) in 4k

FOREX: EURJPY Slumps Post ECB, NZD Outperforms

- Following the FOMC decision and amid the ongoing concerns for the US banking sector, the Japanese Yen has continued to benefit and is among the best performers in G10 on Thursday. With some residual pricing being pulled out for ECB hiking expectations following the ECB decision, the Euro has underperformed on the day.

- Despite sitting 50 points off session lows, EURJPY remains 0.9% lower as we approach the APAC crossover. The pair continues to retrace the post BOJ bounce from last Friday in what is considered to be a correction for now. Overall, the trend condition remains bullish following recent gains. Price action has seen pierce initial support at 147.50, the 20-day exponential moving average. Below here, key short-term support has been defined at 146.29, the Apr 25 low, where a break is required to signal a short-term reversal.

- In similar vein, USDJPY remained under pressure on Thursday, extending the pullback from Tuesday’s high of 137.77 high to over 400 pips. Today’s 133.50 low fell just shy of last Friday’s, BOJ day, low at 133.38. A clear breach of this support zone would undermine the recent bullish theme and signal scope for a deeper pullback.

- NZD was a standout today, leading the G10 advance. MNI reported last month the RBNZ’s focus would shift to employment figures, which would shape its May 24 decision. Tuesday’s robust data has underpinned NZD since and price action may have been exacerbated by the substantial move lower for AUDNZD to fresh one-month lows below 1.0650 in recent sessions.

- With the key driver for currency markets remaining the downward pressure on front-end US yields and the accumulation of Fed rate cut pricing later this year, emphasis will be on the latest US jobs data before the weekend close. Bloomberg consensus looks for further moderation in payrolls growth in April with the +182k estimate its softest since Dec’20, with less clear-cut potential impacts from weather and seasonal adjustment this month.

FX: Expiries for May05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E1.6bln), $1.0925(E1.1bln), $1.0950-55(E1.6bln), $1.1000(E1.4bln), $1.1050-55(E1.4bln), $1.1075-80(E1.9bln), $1.1100(E2.8bln), $1.1150(E1.4bln)

- USD/JPY: Y133.50($1.3bln), Y135.00($632mln)

- AUD/USD: $0.6600(A$736mln), $0.6630(A$777mln)

- USD/CAD: C$1.3685($1.8bln), C$1.3695($1.9bln)

- USD/CNY: Cny6.9500($510mln), Cny7.0500($1.4bln)

Equities Roundup: Western Alliance Off Lows; Earning Up Next

Stocks seeing modest sell pressure after drifting off midday lows, session moves all largely bank stress (or denial thereof) headlines. Second half trade is relatively calm as market sets sights on earning after the close and Friday's headline jobs data. DJIA is currently down 300.87 points (-0.9%) at 33112.96; S&P E-Mini Future down 22 points (-0.54%) at 4086.25; Nasdaq down 18.2 points (-0.2%) at 12007.61.

- PacWest Bank fell more than 60% after it confirmed it was in talks with potential investors early Thursday. By midmorning, shares of Western Alliance Bank sold off more than 50% after a FT wrote an article saying the bank was "exploring strategic options including a potential sale of all or part of its business". Western Alliance categorically denied the article and shares bounced but remained under pressure in the second half.

- S&P E-minis traded to a low of 4063.00 today, bouncing after a breach of short-term level at 4068.75, the Apr 26 low. A clear break of this level, however, would signal scope for a deeper short-term pullback.

- From a trend perspective, the condition remains bullish - moving average studies are in a bull-mode position. Clearance of 4206.25, Tuesday’s high, would confirm a resumption of the trend.

- Quarterly earnings cycle resumes after the close, salient stocks include: Cirrus Logic, Apple, DraftKings, American International Group, Carvana, Lyft, DoorDash, GoDaddy, NCR Corp, Expedia, Motorola Solutions, and Goodyear Tire & Rubber.

E-MINI S&P TECHS: (M3) Remains Above Key Support

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4223.00 High Feb 14

- RES 1: 4206.25 High May 1

- PRICE: 4085.50 @ 1400 ET May 4

- SUP 1: 4068.75 Low Apr 26 and a key support

- SUP 2: 4061.11 38.2% retracement of the Mar 13 - Apr 18 bull leg

- SUP 3: 4052.50 Low Mar 30

- SUP 4: 4018.75 50.0% retracement of the Mar 13 - Apr 18 bull leg

S&P E-minis have traded to a low of 4063.00 today. The contract has found support and this leaves price above a key short-term level at 4068.75, the Apr 26 low. A break of this level would signal scope for a deeper short-term pullback. From a trend perspective, the condition remains bullish - moving average studies are in a bull-mode position. Clearance of 4206.25, Tuesday’s high, would confirm a resumption of the trend.

COMMODITIES: Oil Consolidates Prior Decline After Wild Open, Gold Shifts Higher

- Crude oil is closing out the session with minimal change from yesterday’s latest slide and a 9.5% decline in two days. It recovered from a surprise overnight 7% slump in WTI at the open that was quickly reversed and with no sign of such a fast decline in Brent when it opened later on.

- WTI is -0.1% at $68.55 off that brief low of $63.64 having cleared a key support at $64.58 to open $62.43 (Dec 2, 2021 low).

- In options space, $65/bbl puts have just edged out $75/bbl calls for most active strikes in the CLM3.

- Brent is +0.15% at 72.44, off a low of $71.28, breaching $74.66 (76.4% retrace of Mar 20 – Apr 12 bull run) and next opening a key support at $70.10 (Mar 20 low).

- Gold is +0.5% at $2049.94 despite a partial reversal in USD weakness of the past few days, instead benefiting from uncertainty as bank fears weigh. It’s off an overnight high of $2062.99 and US session high of $2059.62 but having breached prior resistance at $2048.7 (Apr 13 high). It opens $2070.4 (Mar 8 high) after which sits the all-time high of $2075.5 (Aug 7, 2020 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/05/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/05/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 05/05/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/05/2023 | 0630/0830 | *** |  | CH | CPI |

| 05/05/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/05/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/05/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/05/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 05/05/2023 | 0800/1000 |  | EU | ECB Elderson Speech at European University Institute | |

| 05/05/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 05/05/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 05/05/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/05/2023 | 1230/0830 | *** |  | US | Employment Report |

| 05/05/2023 | 1645/1245 |  | US | Minneapolis Fed's Neel Kashkari | |

| 05/05/2023 | 1700/1300 |  | US | St. Louis Fed's James Bullard | |

| 05/05/2023 | 1700/1300 |  | US | Fed Governor Lisa Cook | |

| 05/05/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.