-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Regional Banks Roil Markets Again

- MNI US: Speaker McCarthy: No Progress In Debt Limit Talks

- MNI US: State Dept: US Remains Committed To Bilateral Relationship With South Africa

- Western Alliance Deposits up $600M Since May 2 to $49.4B, Bbg

- BANKS WITH MORE THAN $50B IN ASSETS TO PAY 95%: FDIC, Bbg

- BAILEY SIGNALS BOE MAY PAUSE INCREASES HIKES IF INFLATION SLOWS, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS: Short End Support Wanes Late, Projected Yr End Rate Cuts Ease

Treasury futures pared gains in the second half, curves bending flatter (2s10s -4.490 at -51.623 vs. -45.947 high) as short end rates reverse course, 2s and 5s trading weaker after the bell.- As such, projected rate cuts for late 2023 have eased slightly. September cumulative -26.9bp (-30.7bp earlier) at 4.800%, November cumulative -52.0bp (-56.1bp earlier) at 4.549%, Dec'23 cumulative -76.5bp (-81.2bp earlier) at 4.304%, while Jan'24 cumulative is running at -100.9bp vs. -105.9bp this morning. Fed Terminal currently at 5.07% in Jun'23 this morning.

- Treasury futures had dipped briefly following the BOE 25bp rate hike this morning , but quickly bounced after regional banks took the focus off the BOE rate hike announcement. Risk-off as PacWest falls 26% following 10Q filing mentions of asset quality, deposit decline and heavy goodwill impairment loss of $1.38B.

- Curves bull steepened following Core PPI inflation in April was on balance close to expected if not slightly stronger, with ex food & energy stronger but weaker when also stripping out trade services.

- Meanwhile, Treasury reacted positively after a decent $21B 30Y auction (912810TR9) trades through with 3.741% high yield vs. 3.755% WI; 2.43x bid-to-cover vs. 2.36x prior month. Indirect take-up 72.43% vs. 69.12% prior; direct bidder take-up 17.36% vs. 19.80% prior; primary dealer take-up 10.21% vs. 11.09%.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00220 to 5.05929 (+.00903/wk)

- 3M -0.01177 to 5.08634 (+.04761/wk)

- 6M -0.02846 to 5.02255 (+.07704/wk)

- 12M -0.06103 to 4.67255 (+.11895/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00142 to 5.06171%

- 1M -0.00057 to 5.10743%

- 3M -0.02172 to 5.32071% */**

- 6M -0.04972 to 5.34871%

- 12M -0.08700 to 5.26586%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.34243% on 5/10/23

- Daily Effective Fed Funds Rate: 5.08% volume: $120B

- Daily Overnight Bank Funding Rate: 5.07% volume: $284B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.410T

- Broad General Collateral Rate (BGCR): 5.02%, $579B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $568B

- (rate, volume levels reflect prior session)

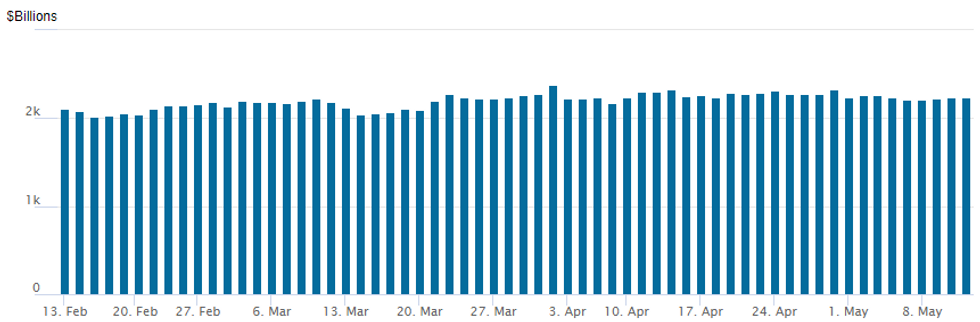

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,242.243B w/ 102 counterparties, compares to prior $2,233.149B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Treasury options saw better upside call structure interest Thursday after PPI did not surprise to the upside following Wednesday's near in-line CPI. Inflation measures decelerating, spurring upside risk positioning as projected rate cuts in the fall to year end firmed (three consecutive 25bp hikes starting in September).- Treasury Options:

- Block, 11,000 TYM3 117/120 1x2 call spds vs. TYN3 119.5 calls, 14 net

- 5,000 TYM3 116 puts, 34 ref 116-12.5

- 10,000 FVM 111.75 calls, 15

- Block, -25,000 FVM3 110/112.5 call spds vs. 110-25/0.18% vs. +25,000 FVN3, 7 net/June over

- 2,000 TYN3 117 calls, 111

- 10,000 TYU3 119.5/121.5 call spds ref 116-24

- 2,000 TYN3 120/121 call spds, 6 ref 116-23.5

- SOFR Options:

- Block, 4,000 SFRU3 94.62/94.87/95.00/95.25 put condors on a 4x3x3x2 ratio, 8.5 net ref 95.365

- Block/screen -10,000 SFRH3 96.37 calls, 68.5 vs. 96.40/0.50%

- Block, 5,000 SFRZ3 96.00/96.50/97.00 call flys, 4.0 net ref 95.845

- over 6,000 SFRM3 94.87 puts, ref 94.97

- 2,500 SFRM3 95.00/95.06 call spds, ref 94.97

- Block, 3,750 SFRU3 94.25/94.50/94.62 broken put trees, 0.5 2-legs over ref 95.295

- 2,000 SFRK3 5.31/95.43/95.56 call flys ref 94.95

Equities Roundup

Stocks have dipped recently, Emini's still inside the session range after inching off midmorning lows. It appears the late session dip was simply program driven as levels are rebounding. S&P E-Mini Future currently down 17.75 points (-0.43%) at 4134.25 (from 4125.0 on the move); Nasdaq up 2.3 points (0%) at 12309.44; DJIA down 298.89 points (-0.89%) at 33232.04.

- Financial sector shares helped spur morning losses (heavy selling in PacWest after morning 10Q filing spooked markets has bounced) even as FDIC says that protecting uninsured depositors cost $15.8 billion. Energy sector shares are currently underperforming as Crude prices slip lower (WTI -1.70 at 70.86.

- On the flip-side, Communication Services and Consumer Discretionary sectors continue to outperform.

- From a technical point of view, S&P E-minis continues to trade above the 50-day EMA, which intersects at 4104.97. A continuation higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A breach of this level would confirm a resumption of the bull trend that started Mar 13.

- Key support has been defined at 4062.25, the May 4 low. A move through this support would be a bearish development.

E-MINI S&P TECHS: (M3) Holding Above The 50-Day EMA

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4223.00 High Feb 14

- RES 1: 4173.25/4206.25 High May 10 / 1

- PRICE: 4135.50 @ 1415 ET May 11

- SUP 1: 4062.25 Low May 4 and key near-term support

- SUP 2: 4052.50 Low Mar 30

- SUP 3: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

- SUP 4: 4006.00 Low Mar 29

S&P E-minis continues to trade above the 50-day EMA, which intersects at 4104.97. A continuation higher would refocus attention on key resistance and the bull trigger at 4206.25, the May 1 high. A breach of this level would confirm a resumption of the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this support would be a bearish development.

COMMODITIES: Demand Fears Return To The Fore

- After some tentative sessions earlier in the week, crude oil has slipped more notably on demand fears as higher than expected US initial jobless claims helped extend earlier declines. WTI leads the way as it moves nearer $70/bbl again, a level last seen prior to Friday’s payrolls report. More recently, prices move close to earlier session lows along with a broader deterioration in risk sentiment

- WTI is -2.3% at $70.88, moving closer but still some way off support at $68.48 (May 5 low). The day’s most active strikes in the CLM3 have been at $75/bbl calls very closely followed by $70/bbl puts.

- Brent is -1.9% at $74.96, currently testing support again at $74.95 having earlier pushed to a low of $74.61 before bouncing. Next support would be seen at $71.28 (May 4 low).

- Gold is -0.8% at $2014.18, sliding with USD strength in further pullback off yesterday’s high of $2048.19. Wide technical ranges after large recent moves see support untouched at $1999.6 (May 5 low).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/05/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/05/2023 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 12/05/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 12/05/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/05/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 12/05/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/05/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 12/05/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/05/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/05/2023 | 0800/1000 |  | EU | ECB de Guindos Lecture at Academia Europea Leadership | |

| 12/05/2023 | 1115/1215 |  | UK | BOE Pill & Shortall Monetary Policy Report National Agency Briefing | |

| 12/05/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/05/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 12/05/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/05/2023 | 1820/1420 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.