-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Reversal Hawkish Retail Sales React

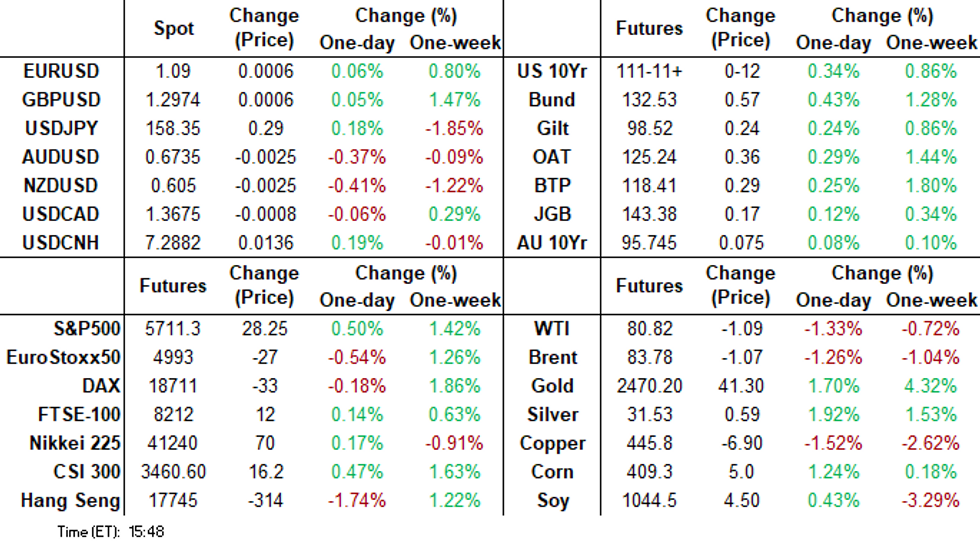

- Treasuries look to finish near early session highs - gradually unwinding the hawkish reaction to this morning's better than expected Retail Sales figures.

- Treasury curves largely unwound Monday's twist-steepening, broadly flatter with the short end underperforming despite heavy volumes in SOFR and 2Y Treasury futures.

- As a result, projected rate cuts held steady to mildly lower through year end.

US TSYS Near Highs, Gradual Unwind to Retail Sale Reaction

- Treasuries look to finish near early session highs - gradually unwinding the hawkish reaction to this morning's better than expected Retail Sales data.

- Overall retail sales saw flat (-0.02% unrounded) growth M/M, slower than the +0.3% registered in May (upward rev from 0.1%) , but above the -0.3% expected. Sales ex-autos (+0.4% vs 0.1% expected) and ex-auto/gas (+0.8% vs +0.2% expected) impressed, and also with higher revisions.

- Tsy curves bull flattened on the day, largely reversing Monday's twist steepening with 2s10s -4.431 at -27.448. Tsy Sep 10Y futures trade +12 at 111-11.5 vs. 111-12.5 high - just off Mar 25 high of 111-13. Major resistance at 111-31 (1.382 proj of the Apr 25 - May 16 - 29 price swing).

- Projected rate cut pricing into year end remains slightly cooler vs. late Monday levels (*): July'24 at -6.5% w/ cumulative at -1.6bp at 5.313%, Sep'24 cumulative -26.6bp (-27.5bp), Nov'24 cumulative -42.9bp (-44.1bp), Dec'24 -65.4bp (-65.8bp).

- Focus turns to Wednesday's Build Permits, House Starts, Beige Book, Tsy 20Y Bond auction reopen and upcoming earnings from Citizens Financial, US Bancorp, Discover Financial and Ally Financial.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00060 to 5.33399 (+0.00619/wk)

- 3M -0.00653 to 5.27924 (-0.00687/wk)

- 6M -0.02203 to 5.12855 (-0.03625/wk)

- 12M -0.03518 to 4.80059 (-0.06495/wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $2.175T

- Broad General Collateral Rate (BGCR): 5.33% (+0.01), volume: $792B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.01), volume: $770B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $88B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $245B

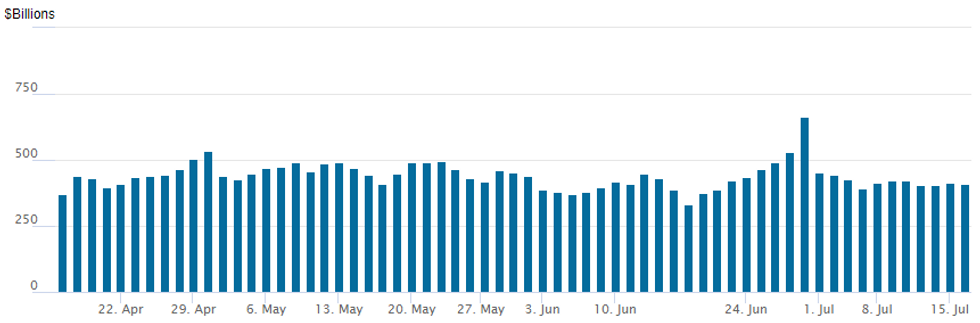

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage recedes up to $409.594B from $413.280B on Monday. Number of counterparties at 67 from 65 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Mixed two-way trade in SOFR and Treasury options reported Tuesday as underlying gradually reversed this morning's hawkish reaction to much stronger than expected Retail Sales. While Tsy curves bull flattened, projected rate cut pricing into year end remains slightly cooler vs. late Monday levels (*): July'24 at -6.5% w/ cumulative at -1.6bp at 5.313%, Sep'24 cumulative -26.6bp (-27.5bp), Nov'24 cumulative -42.9bp (-44.1bp), Dec'24 -65.4bp (-65.8bp). Salient flow includes:- SOFR Options:

- Block, 5,000 SFRH4 95.50/95.75/96.00/96.25 call condors, 6.5 ref 95.73

- +4,000 SFRU4 94.81/94.87/94.93/95.00 call condors, 3.25

- 10,000 0QQ4 95.75/96.00/96.12 put trees vs 5,000 96.50 calls, 0.25

- -4,000 SFRZ4 95.50/96.00 1x2 put spds, 18.0

- +4,000 SFRU4 94.75/94.87/95.00/95.12 call condors 8.75

- +10,000 SFRM5 95.75/96.00/96.25/96.50 call condors 5.25

- +3,000 SFRX4 95.50/95.62/95.75/95.87 call condors, 1.5

- -5,000 0QU4 96.12/96.50 call spds 12.5 over 95.62 puts

- 2,500 SFRU4 94.56/94.81/94.93 broken put flys

- -10,000 SFRZ4 95.25 puts, 8.5

- Block, 15,000 0QQ4 96.00 puts, 5.0 ref 96.265

- Block, 10,000 0QU4 96.00 puts, 5.0 vs. 96.265/0.22%

- Block, 5,000 SFRZ4 95.62/95.87/96.12 call flys, 2.0

- Block, 7,500 SFRZ4 94.93/95.00/95.06 call flys, 2.0

- 8,500 SFRU4 94.93/95.00/95.06 call flys

- 1,500 SFRU4 94.93/95.00/95.06 call flys ref 94.975

- 5,000 SFRX4 95.31/95.50/95.68 call flys ref 95.39

- 10,000 SFRM5 95.75/96.00/96.25/96.50 call condors ref 96.04

- 2,000 SFRZ4 95.25/95.37 call spds 5.0 over SFRZ4 94.87/95.00 put spds

- Treasury Options:

- -16,000 FVU4 108/109 call spds, 14.5 ref 107-15.5

- +12,000 TYU4 112/113 call spds 27 ref 111-06.5

- -10,000 TYQ4 111.5/112 2x3 call spds, 10 vs. 111-03.5/0.16%

- over 23,000 TYQ4 110 puts, 4-5 ref 111-08.5 to -03.5

- 1,500 USQ4 121/122.5/125 call flys ref 120-00

- 3,000 TYQ4 107.5/108/108.5 put trees ref 111-10.5

- over 8,800 TYQ4 110 puts, 4 last ref 111-10

- 5,000 TYU4 111.5/112 call spds 13 ref 111-08.5

- 2,200 TYQ4 109.25/TYU4 106 put spds ref 111-09

- over 9,000 TYU4 108.5 puts, 6 last ref 111-08.5

- +5,000 TYV4 114/115 call strip, 33

- 1,800 USQ4 122/124 call spds ref 119-25

- 1,500 TYU4 108.5/109.5 2x3 put spds

EGBs-GILTS CASH CLOSE: Solid Gilt Gains Ahead Of UK CPI

European government bonds strengthened Tuesday despite strong US economic data briefly casting doubt on near-term Fed rate cut narratives.

- Core FI rallied in morning trade, alongside a move lower in equities and oil, but the constructive move stalled out in early afternoon.

- While US retail sales and import price readings were higher than expected, thereby trimming Federal Reserve easing expectations slightly, the global core bond sell-off was capped by soft Canadian inflation data.

- Core European FI subsequently recovered most losses, with Gilts outperforming Bunds on the day. The UK curve bull steepened, with Germany's bull flattening. Periphery spreads closed mixed, with BTPs outperforming and GGBs underperforming.

- Attention turns to Wednesday's UK CPI data - MNI's preview is here (including an outlook for Thursday's labour market release).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.6bps at 2.763%, 5-Yr is down 5.2bps at 2.393%, 10-Yr is down 4.5bps at 2.427%, and 30-Yr is down 4.4bps at 2.616%.

- UK: The 2-Yr yield is down 8bps at 3.985%, 5-Yr is down 5.2bps at 3.887%, 10-Yr is down 5.2bps at 4.049%, and 30-Yr is down 5.8bps at 4.548%.

- Italian BTP spread down 0.3bps at 127.2bps / Greek up 0.8bps at 96.5bps

EGB Options: Large Call Structures Feature As ECB Decision Approaches

Tuesday's Europe rates/bond options flow included:

- RXQ4 133.00/134.50/135.50/139.50 call condor vs 130.00/127.50 put spread, paper sells the call condor & buys the put spread, 6K given at 16, exiting existing position

- RXU4 133.00/134.00/135.50/139.50 call condor vs. 129.50/127.50 put spread, paper buys the call condor for 4.0 & 4.5 on 6.5K

- ERZ4 96.75/96.62/96.50 put ladder paper paid 2.5 on 45K

- ERZ4 96.75/96.87/97.00 c fly bought for 2 in 10k

- ERH5 97.125/97.375/97.625/97.875 call condor paper paid 5.25 & 5.5 on 20K

- ERM5 97.50/97.75/98.00/98.25 call condor paper paid 4.25 & 4.5 on 15K

- 0NZ4 96.60/97.00 call spread 4.5k given at 7

FOREX: Greenback Firms on Above Consensus Retail Sales, Antipodeans Lag

- The USD index gained some moderate ground on Tuesday following above-expectation US retail sales figures in June. While the DXY remains 0.15% higher approaching the APAC crossover, we are off best levels as most major pairs slowly retrace the post-data reaction.

- Underperforming on the session has been both AUD and NZD, falling over half a percent with the softer Chinese data on Monday still potentially weighing at the margin.

- AUDUSD notably traded back down to test the prior breakout level around 0.6715, a level that closely matches with initial firm support at 0.6708, the 20-day EMA. Overall, bullish conditions remain intact for the pair and the latest pullback appears to be a correction.

- In similar vein, NZDUSD trades half a percent lower and is now below 0.6050. Overnight NZDUSD straddle pricing points to a 35 pip breakeven which incorporates the second quarter CPI print scheduled Wednesday, potentially pointing to 0.6000 marking strong support for the pair. We pointed out yesterday that some desks have noted RBNZ cut expectations seem to be relatively stretched at this point, potentially setting a high bar for tomorrow’s data to confirm the market’s bias.

- USDJPY has exhibited an 86 point range and trades close to 158.50 at typing. The Japanese Yen has remained in the spotlight following last week’s US inflation data and subsequent intervention from the BOJ. Latest reports suggest that the Japanese government intervened to the tune of Y5.6trl across two phases last Thursday and Friday, in what appears to be a more tactical approach to strengthen the currency.

- Focus turns to inflation data for both New Zealand and the UK on Wednesday. US building permits and industrial production is also scheduled.

Late Equities Roundup: United Health Drives DJIA Powers to New Highs

- The Dow, largely driven by gains in United Health after beating earnings expectations this morning (+5.91%), continues to outperform S&P Eminis and Nasdaq, extending record highs in late trade. Currently, the DJIA up 720.57 points (1.79%) at 40928.28, S&P E-Minis up 30.5 points (0.54%) at 5713.25, Nasdaq up 18.4 points (0.1%) at 18489.54.

- Industrials and Materials continue to lead gainers in late trade, airlines buoying the former: Delta +5.84%, United Airlines gained 5.05% and American Airlines +4.8%. Construction materials supported the latter: Martin Marietta Materials +3.68%, Vulcan Materials +3.12%.

- Information Technology and Communication Services sectors underperformed, semiconductor stocks weaker as they paired recent gains: Micron -2.36%, Broadcom -2.16%, Nvidia -2.07%. Meanwhile, interactive media and entertainment weighed on the Communication Services sector: Google -1.42%, Meta -1.34%, Live Nation -1.11%.

- Note, earning results mostly supportive for banks: PNC Financial trade +4.63%, Bank of America +5.66%, Morgan Stanley +1.56%, State Street +6.51%, while Charles Schwab bucked the trend trading -9.31%.

- Upcoming earnings: Citizens Financial, US Bancorp, Discover Financial and Ally Financial on Wednesday; KeyCorp, M&T Bank and Blackstone on Thursday; Fifth Third, Regions Financial, Comerica, American Express and Huntington next Friday.

E-MINI S&P TECHS: (U4) Bulls Remain In The Driver’s Seat

- RES 4: 5764.00 3.50 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5741.34 3.236 proj of the Apr 19 - 29 - May 2 price swing

- RES 2: 5715.50 Intraday High Jul 17

- RES 1: 5708.25 High Jul 12

- PRICE: 5712.25 @ 1505 ET Jul 16

- SUP 1: 5569.65 20-day EMA

- SUP 2: 5502.75/5461.50 Low Jul 2 / 50-day EMA

- SUP 3: 5398.75 Low Jun 11

- SUP 4: 5267.75 Low May 31 and key support

The trend condition in S&P E-Minis is bullish and the contract is holding on to its recent gains. The continuation higher last week confirms a resumption of the uptrend and maintains the bullish sequence of higher highs and higher lows. Moving average studies are in a clear bull-mode set-up too and this continues to highlight positive market sentiment. Sights are on the 5713.31, a Fibonacci projection. Firm support is at 5569.65, the 20-day EMA.

COMMODITIES Spot Gold Rises To Fresh Record High, Crude Slides On Day

- Spot gold rose through the May highs today to reach a fresh all-time record above $2,466. Renewed focus on Fed rate cuts following the US inflation data last week remains the primary driver, with last Thursday’s break back above $2,400 kick starting the next leg higher.

- Currently, spot is trading just below the highs at $2,465/oz, up 1.8% on the day.

- Having now breached the bull trigger, technical conditions remain firmly in bullish territory, signalling scope for a move towards $2,481.5, the 2.764 Fibonacci projection of the Oct 6 - 27 - Nov 13 price swing.

- Meanwhile, silver is also up by 2.0% today to $31.3/oz.

- For silver, the recent break of $30.853, the Jun 21 high, is a bullish development. A continuation higher would signal scope for a test of the key resistance and bull trigger at $32.518, the May 20 high.

- In contrast, copper has fallen by another 1.7% to $445/lb today, amidst concerns about weaker demand in China, leaving prices down by 3% so far this week.

- A bearish corrective cycle that started May 20, remains in play for now. A resumption of the bear leg would open $426.12, a Fibonacci retracement.

- WTI has lost ground today, facing further weakness amid sustained demand fears out of China and USD strength.

- WTI Aug 24 is down 1.5% at $80.7/bbl.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/07/2024 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 17/07/2024 | 0600/0700 | *** |  | UK | Producer Prices |

| 17/07/2024 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/07/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/07/2024 | 1030/1130 |  | UK | King's Speech | |

| 17/07/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/07/2024 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/07/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 17/07/2024 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 17/07/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 17/07/2024 | 1335/0935 |  | US | Fed Governor Christopher Waller | |

| 17/07/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 17/07/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 17/07/2024 | 1800/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.