-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk Buoyed Ahead Fed Blackout

HIGHLIGHTS

- MNI FED WALLER: Risk Management Approach Main Push Back To Cuts Priced

- MNI FED WALLER: Real Rates Pretty Close To Sufficiently Restrictive

- MNI FED WALLER: Might Need More Hikes On Looser Conditions

- PHILLY FED FED HARKER: REPEATS BACKING FOR 25 BP RATE HIKES GOING FORWARD .. SEES FED RAISING RATES A FEW MORE TIMES THIS YEAR, Bbg

- KC FED GEORGE: ECONOMY IS RESPONDING TO WORK FED IS DOING .. ENCOURAGING TO SEE INFLATION COMING DOWN .. but INFLATION STILL WELL ABOVE FED'S TARGET" Bbg

US TSYS: Risk Buoyed Ahead Fed Blackout

Tsys weaker across the board but off midday lows after the bell, 30YY +.0943 at 3.6555% vs. 3.6646% high, yield curves bear steepening (2s10s +4.530 at -69.177. Decent volumes (TYH3 >1.2M) on a relatively subdued session w/ the Federal Reserve heading into policy blackout at midnight (through Feb 2).

- Sole data point underscored move: Existing home sales fell by less than expected in December, -1.5% M/M (cons -3.4%) after -7.9% M/M, faring better than the latest slide in pending home sales. It left an 18% decline on the year for the sharpest annual decline since 2008.

- While Bonds dragging short end rates lower, market expectation for 25bp hike at next FOMC on Feb 1 stable: Fed funds implied hike for Feb'23 25.8bp, Mar'23 cumulative steady 45.1bp to 4.783%, May'23 steady at 55.6bp to 4.888%, terminal dips slightly to 4.890% in Jun'23.

- No concerted headline driver, Bond weakness more tied to concerted commentary from various central bank officials (not just Fed) on improved global outlook in past couple weeks lending to intermediate-long end pressure on those growth prospects.

- Risk buoyed by dovish comments from Fed Gov Waller, favoring another downshift at the next meeting ending February 1 to a 25bp rate hike but anticipates continued tightening going forward.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00429 to 4.30514% (-0.000857/wk)

- 1M +0.00471 to 4.51314% (+0.05871/wk)

- 3M +0.00028 to 4.81557% (+0.02314/wk)*/**

- 6M +0.02114 to 5.10200% (+0.00086/wk)

- 12M +0.04258 to 5.34729% (-0.00971/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $100B

- Daily Overnight Bank Funding Rate: 4.32% volume: $273B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.231T

- Broad General Collateral Rate (BGCR): 4.27%, $453B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $433B

- (rate, volume levels reflect prior session)

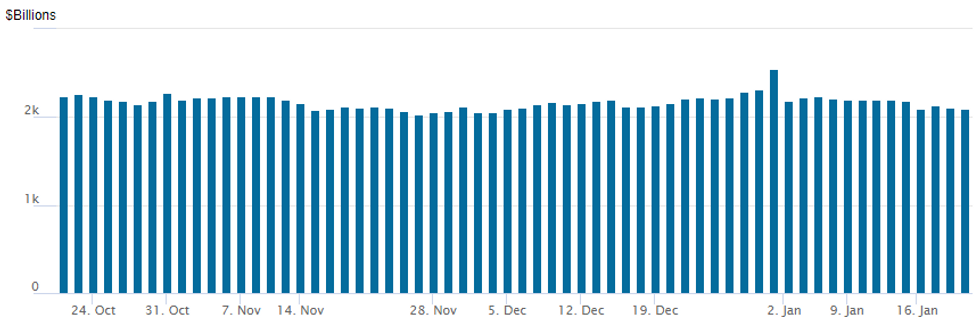

FED Reverse Repo Operation

NY Fed reverse repo usage slips to $2,090.523B w/ 98 counterparties vs. prior session's $2.110.145B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Overnight option trade a little more paired compared to Thu's heavy upside call positioning for policy pivot over the next couple Fed meetings. Pick-up in put structures carried through Friday's session w/ weaker underlying scaling back small portion dovish pricing- SOFR Options:

- Block, +9,500 SFRG3 95.06/95.18/95.31 call flys, 7.0

- Block, +20,000 SFRU3 94.68/95.18/95.37 put trees, 5.5-6.0 net ref 95.265

- Block, 8,000 OQZ3 95.75/96.25 put spds, 9.5 ref 97.105

- Block, 4,000 SFRZ3 95.00/95.25/95.50 put flys, 3.5 vs. 95.595/0.05%

- Block, 8,000 SFRJ3 94.75/94.93 put spds, 2.5 vs. 95.095/0.14%

- Block, 5,400 SFRZ3 98.25/99.00 call spds, 1.5 ref 95.635

- 9,000 SFRG3 95.12/95.18 2x1 put spds, 0.75

- Total, 7,500 (5K block) SFRG3 95.12/95.18/95.25 put trees ref 95.155

- Total 22,000 (6.5k block) SFRJ3 94.93/95.06/95.18 put flys, 1.5 ref 95.10

- -10,000 SFRM3 95.18/95.31/95.43 call flys 1.0

- +8,000 SFRG3 95.06/95.18/95.31 call flys, 6.75

- 3,000 SFRJ3 95.18/95.31/95.43 put flys ref 95.105

- Over 14,700 SFRZ3 95.37/95.50 put spds ref 95.645

- 2,800 SFRM4 98.25/98.50 call spds, ref 96.72

- Block, 1,250 SFRU3 94.81/94.93/95.12 2x3x1 put flys, 1.5 net ref 95.28

- Block, total 14,000 OQJ3 96.00 puts, 6.0 vs. 96.725 -.73/0.15%

- 1,500 SFRJ3 95.31/95.43/95.56 call flys, ref 95.11

- +7,250 SFRJ3 95.06/95.12/95.25/95.37 call condors, 1.5 ref 95.11

- Total 9,500 (3k Block) SFRJ3 94.93/95.06/95.18 put flys, 1.5 ref 95.105 -.11

- Block, 1,500 SFRH3 95.12/95.25/95.43 broken call flys, 3.25 ref 95.155

- Treasury Options:

- -5,000 USH 124/128 put spds, 45 ref 130-26

- -5,000 USJ 129/130 put spds, 21

- -5,000 USM 129/130 put spds, 23

- 2,000 USM3 129/130 put spds, 24 ref 132-17

- 2,000 FVG3 110.25/110.5 call spds, 3 ref 109-26.25

- Over 11,900 TYG3 116 calls, 11 ref 115-10

- +1,000 TYH3 118/119/120 call flys, 4

EGBs-GILTS CASH CLOSE: Bunds Underperform As ECB Hikes Re-Priced

Bund yields on Friday rose the most of any session this month, continuing their underperformance of Gilts as European curves bear steepened.

- Weakness across the German curve came as ECB's Lagarde pledged to "stay the course of resilience" on monetary policy, with 2023 hike pricing completing a full reversal of the dovish move earlier this week (143bp, where they entered the week, vs a low of 126bp on Tues).

- UK long-end yields rose sharply too, though short end weakness was relatively more contained, with very weak Dec retail sales data out early this morning.

- With ECB tightening expectations ratcheting higher, BTPs underperformed overall with spreads vs Bunds widening more than 10bp, closing the week above 180bp having tested the 170bp handle.

- Attention early next week will be on flash Jan PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.9bps at 2.577%, 5-Yr is up 8.6bps at 2.21%, 10-Yr is up 11.2bps at 2.177%, and 30-Yr is up 14.3bps at 2.141%.

- UK: The 2-Yr yield is up 3.6bps at 3.49%, 5-Yr is up 5.9bps at 3.296%, 10-Yr is up 10.3bps at 3.378%, and 30-Yr is up 10.9bps at 3.721%.

- Italian BTP spread up 10.6bps at 181.6bps / Spanish up 3.1bps at 95.8bps

EGB Options: Limited End-Week Trade Includes Euribor Risk Reversals

Friday's Europe rates / bond options flow included:- DUH3 106.50c, bought for 6 in 12k

- RXH3 135/132 put spread bought for 44.5 in 2.5k

- ERU3 96.12/97.12 RR, bought the put for 1.25 in 3k

- ERZ3 96.12/97.12 RR, bought the put for 2.25 in 3k

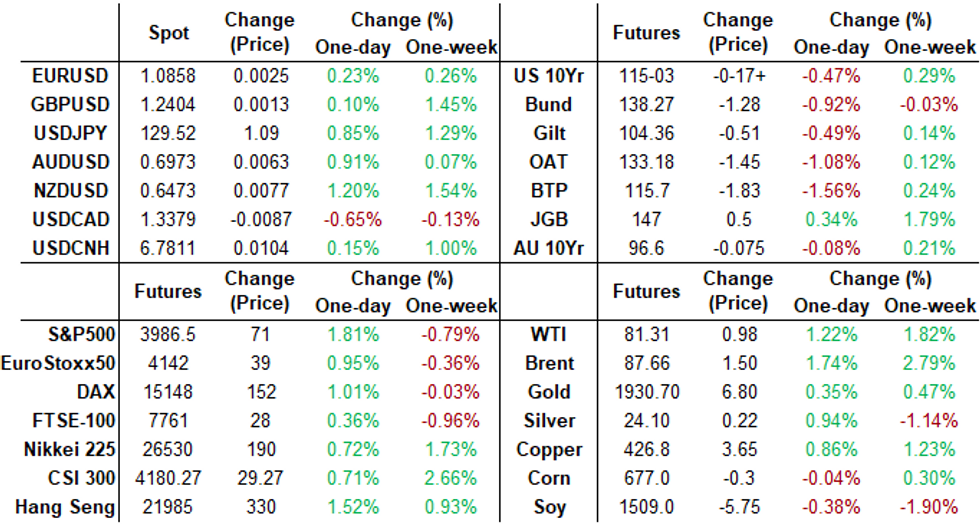

FOREX: USDJPY Posts Impressive 225-Pip Range, Antipodean FX Rallies With Equities

- The USD index remains close to unchanged on Friday with very little newsflow or data driving specific momentum across G10 currency markets. An initial surge for USDJPY contributed towards broad greenback strength in early US trade, however the late rally for major equity indices prompted broad USD weakness and saw the DXY trade from highs of 102.50 all the way back to 102 approaching the week’s close.

- USDJPY boasted an impressive recovery off the overnight 128.36 lows to trade as high as 130.61. Despite the lack of news trigger, the BOJ were very active again in yield curve control overnight, upping their purchase operations toward shorter maturities and appearing largely unfazed by the rip higher in core CPI overnight, which rose to a 41 year high.

- As the dust settled on the move, equities traded with a very positive tone, with most major indices extending above Thursday’s highs and eating into the sizeable weekly declines.

- Perky risk sentiment bolstered the likes of AUD and NZD with the latter rising 1.2% and erasing the entirety of the post Ardern resignation announcement losses from the prior day. NZDJPY is posting a 2.1% advance on Friday.

- The Euro was much more subdued and a moderate dip down to the 1.0800 mark found solid support back to the highs of the day ~1.0860. Topside focus remains on 1.0913, a Fibonacci projection amid a number of sell-side analysts upgrading their EURUSD forecasts over the past fortnight.

- Worth noting that not only do the Fed enter their blackout period before the Feb 01 meeting, China will also be out all next week for Lunar New Year. Highlights on the docket next week include the Bank of Canada decision as well as the first reading of Q4 US GDP.

FX: Expiries for Jan23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-25(E1.3bln), $1.0800-25(E1.0bln), $1.0900-25(E1.3bln)

- USD/JPY: Y135.65($526mln)

Late Equity Roundup: Extend Rally Ahead Fed Blackout

Major indexes continued to extend gains late Friday, risk buoyed by dovish comments from Fed Gov Waller before the Fed enters policy blackout at midnight. Communication Services and Information Technology sectors continued to outperform. SPX eminis currently trades +62.75 (1.6%) at 3978.5; DJIA +252.6 (0.76%) at 33296.64; Nasdaq +257.3 (2.4%) at 11109.47.

- SPX leading/lagging sectors: Communication Services (+3.63%) underpinned by interactive media and entertainment names: Netflix (NFLX) +7.57% after reporting huge subscriber addition in 4th quarter +7.66 million vs. 4.57 million est. Other leaders: Match +5.83%, Google +5.11%, Dish +5.56%. Information Technology (+2.29%) saw semiconductor shares (NVDA +5.88%, QCOM +3.59%, MPWR +2.89%) edge past software and servicer names (FIS +4.25%, ADSK +4.69%, INTU +4.74%).

- Laggers: Utilities (0.18%), Health Care (0.25%) and Consumer Staples (0.52%) sectors underperformed, pharmaceuticals and biotechs weighed on Health Care sector (LLY -1.94%, GILD -0.98%, JNJ -0.93%).

- Dow Industrials Leaders/Laggers: Microsoft (MSFT) extended gains by +7.48 to 239.43 after annc plan to lay off 10,000 employees. Salesforce (CRM) +4.61 at 151.02, American Express (AXP) +4.42 at 151.27. Laggers: Goldman Sachs (GS) -9.01 at 341.74, JNJ -1.62 at 167.91, Merck (MRK) -0.58 at 109.32.

E-MINI S&P (H3): Short-Term Bear Threat Remains Present

- RES 4: 4194.25 High Sep 13

- RES 3: 4180.00 High Dec 13 and the bull trigger

- RES 2: 4090.75 High Dec 14

- RES 1: 4035.25 High Jan 18

- PRICE: 3980.0 @ 1515ET Jan 20

- SUP 1: 3901.75/3891.50 Low Jan 19 / Low Jan 10

- SUP 2: 3788.50/78.45 Low Dec 22 / 61.8% of Oct 13-Dec 13 uptrend

- SUP 3: 3735.00 Low Nov 3

- SUP 4: 3670.00 76.4% retracement of the Oct 13 - Dec 13 uptrend

S&P E-Minis traded lower again Thursday. A key short-term resistance has been defined at 4035.25, the Jan 17 high and price has traded through support at 3930.77, the 50-day EMA. A clear break would highlight a potential bearish reversal and expose 3891.50, the Jan 10 low. On the upside, the contract needs to clear 4035.25 to cancel any developing bearish threat and confirm a resumption of recent bullish activity.

COMMODITIES: Crude Oil Sees Second Week Of Gains On China Demand Hopes

- Crude oil prices have continued yesterday’s push higher, reversing Wednesday’s risk-off slide for Brent and coming close to it for WTI, buoyed by a climb in e-mini S&P. In doing so, Brent is now 2.1% higher ytd and WTI 1.3%, helped broadly by China re-opening and potential supply disruptions offsetting other potential weaker demand.

- WTI is +1.2% at $81.31, moving closer to resistance at $82.38 (Jan 18 high) after which sits the key $83.27 (Dec 1 high). Most active strikes in the CLH3 have been $80/bbl puts.

- Brent is +1.8% at $87.70 off a high of $87.79 that starts to probe key short-term resistance at $87.85 (Jan 18 high) after which sits $89.18 (Dec 1 high).

- Gold is -0.2% at $1929.35 but ends a mixed week higher. Resistance remains $1935.2 (Apr 25, 2022 high).

- Weekly moves: WTI +3.7%, Brent +2.9%, Gold +0.5%, US nat gas -15%, EU TTF nat gas +3%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/01/2023 | 1430/1530 |  | EU | ECB Panetta Intro at ECON Hearing | |

| 23/01/2023 | 1500/1000 | ** |  | US | leading indicators |

| 23/01/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/01/2023 | 1745/1845 |  | EU | ECB Lagarde Speech at Deutsche Boerse | |

| 24/01/2023 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.