-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Sep FOMC Minutes As Expected

- MNI Scalise Wins GOP Nomination For Speaker

- FED WALLER: FED IS IN A POSITION TO `WATCH AND SEE' ON RATES, Bbg

- GERMANY SEES GDP SHRINKING BY 0.4% THIS YEAR IN REVISED OUTLOOK, Bbg

US TSYS No Surprises From September FOMC Minutes

- Treasury futures climbed off second half lows as the September FOMC Minutes showed a majority expect one more hike, while some deemed further increases not warranted.

- Fed officials continued to pencil in one additional rate increase this year in their Summary of Economic Projections. That was before a deepening selloff in longer-run Treasuries pushed 10-year yields to 16-year highs, a move some policymakers have since argued could be a substitute for additional rate hikes.

- Projected rate hikes into early 2024 are largely treading water after the minutes release: November at 9.8% (compared to 30.5% late Fri), w/ implied rate change of +1.9bp to 5.348%, December cumulative of 7.6bp at 5.405%, January 2024 5.9bp at 5.387%. Fed terminal at 5.40% in Jan'24.

- Still off early session highs where Dec'23 10Y futures (TYZ3) traded up to 108-11 earlier are currently trading 108-00.5, well inside technicals: resistance at 108-11, support at 106-12 (2.0% Lower Bollinger Band).

- Treasury futures had pared gains after the $35B 10Y note auction reopen (91282CHT1) tailed: 4.610% high yield vs. 4.594% WI; 2.50x bid-to-cover vs. 2.52x prior.

- Nomination of Scalise to replace McCarthy as House speaker appeared to improve risk sentiment somewhat as stocks traded modestly higher: S&P E-Mini futures are up 6.75 points (0.15%) at 4398,DJIA up 2.5 points (0.01%) at 33741.96, Nasdaq up 58.9 points (0.4%) at 13622.06.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.01639 to 5.33238 (-0.00869/wk)

- 3M -0.03200 to 5.39377 (-0.01297/wk)

- 6M -0.04975 to 5.43464 (-0.01982/wk)

- 12M -0.08973 to 5.35601 (-0.04055/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $95B

- Daily Overnight Bank Funding Rate: 5.32% volume: $255B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.522T

- Broad General Collateral Rate (BGCR): 5.30%, $561B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $552B

- (rate, volume levels reflect prior session)

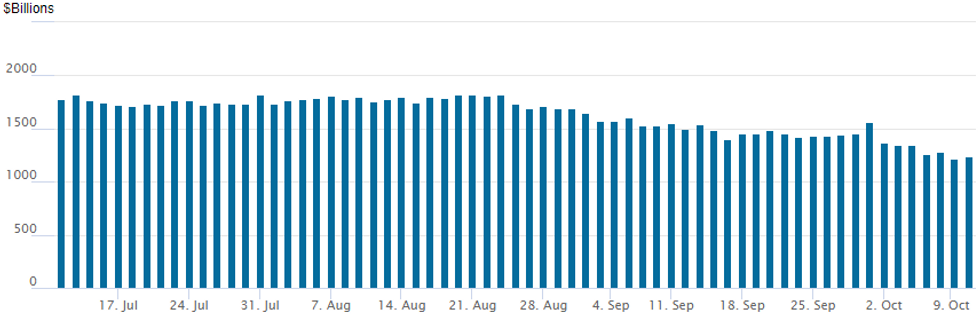

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation usage climbs to $1,239.382B w/100 counterparties vs. $1,222.440B (lowest since mid-September 2021) in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Option desks reported better low delta call trade in SOFR and Treasury options Wednesday, as underlying futures rebounded in late trade. No surprises following the September FOMC minute release (majority saw one hike, keeping rates higher for longer), while the nomination of Scalise to replace McCarthy as House speaker appeared to improve risk sentiment somewhat.- Safe haven bid as Lebanon/Israel exchanged rocket fire in addition to mildly dovish Fed speak from Gov Bowman overnight helped push TYZ3 back to late September levels (108-11 high, +20), the contract +87 at 107-31 in late trade. Rally has in turn tempered rate hike projections into early 2024: November at 9.8% compared to 30.5% late Fri, w/ implied rate change of +2.5bp to 5.353%, December cumulative of 7.4bp at 5.403%, January 2024 6.4bp at 5.392%. Fed terminal at 5.405% in Jan'24.

- SOFR Options:

- over 24,000 SFRZ3 94.68/94.75/94.81/94.87 call condors ref 94.565 to -.575

- Block, 5,000 SFRZ3 94.56/95.00 call spds, 6.5 ref 94.57

- +10,000 SFRZ3 94.68/94.81 call spds 0.75 vs. 94.58/0.10%

- +1,000 SFRZ3 94.56/94.68/94.75 1x3x2 call flys, 4.75

- +2,500 0QZ3 96.00/97.00 call spds, 9.5

- +2,000 SFRX3 94.62/94.75 call spds, 1.25

- Block, -5,000 SFRH4 95.50/96.00 call psds, 3.0 vs. 94.675/0.07%

- Block, +10,000 SFRX3 94.37/94.50 put spds, 2 vs. 94.575/0.20% +7.5k more on screen

- 2,000 SFRX3 94.62/94.81 call spds ref 94.58

- 6,250 SFRX3 94.62/94.68/94.75 call flys ref 98.58

- 2,000 2QZ3 96.25/96.37/96.50/96.62 put condors ref 96.085

- 2,000 2QZ3 95.50/95.62/96.00/96.12 put condors ref 96.085

- 2,000 0QZ3 95.50/96.50 call spds vs. 3QZ3 96.25/97.25 call spds

- 1,500 2QX3/2QZ3 96.06/96.43/96.93 broken call fly spd

- 1,000 3QV3 96.12/96.25 call spds ref 96.06

- Treasury Options:

- 5,000 TYZ3 103 puts, 7 ref 108-00

- over 5,100 FVZ3 105 puts, 39.5 last ref 105-12.25

- 2,500 TYZ3 111 calls, 24 last ref 108-08

- 2,000 USX3 117 calls, 26 ref 113-14

- over 5,900 TYX3 109 calls, 32 ref 108-07.5

- 4,500 TYX3 104/105 put spds vs. TYX3 110/111 call spds

- 1,000 USX3 116/117 call spds, 6 ref 113-15

- 2,800 TYZ3 105.5 puts, 24 ref 108-03.5

- 4,200 FVX3 106 calls, 22 ref 105-17.5

- 1,500 TYZ3 110 calls, 31 ref 107-27

EGBs-GILTS CASH CLOSE: Flatter On Geopolitical Concerns

The German and UK curves flattened Wednesday, with Gilts outperforming.

- Most gains were posted in the morning, with a safe-haven bid centred around geopolitical concerns (rockets fired between Israel and Lebanon), helped by more dovish-leaning Federal Reserve participant commentary (Gov Bowman).

- Gains stalled in early afternoon, as US producer prices came in higher than expected ahead of Thursday's US CPI report; the rally resumed later in the day as oil prices dropped sharply on reports casting doubt on Iran's role in the Hamas attacks on Israel. Notably European gas prices also dropped sharply on the day.

- Yields closed near the lows, with the short end relatively stubborn: the German curve twist flattened with Schatz yields higher; 2Y UK yields were relatively flat in a bull flattening move.

- Periphery spreads mostly tightened, appearing to track oil prices in the latter half of the session, after having benefited earlier from higher equities.

- UK GDP represents the European data highlight first thing Thursday; we get several central bank speakers as well including BOE's Pill, with the ECB's September meeting accounts published - all before the US inflation report in the afternoon.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.8bps at 3.108%, 5-Yr is down 0.6bps at 2.659%, 10-Yr is down 5.7bps at 2.718%, and 30-Yr is down 10.8bps at 2.899%.

- UK: The 2-Yr yield is down 0.2bps at 4.797%, 5-Yr is down 3.8bps at 4.388%, 10-Yr is down 9.8bps at 4.328%, and 30-Yr is down 15.1bps at 4.768%.

- Italian BTP spread up 0.1bps at 195.1bps / Spanish down 0.6bps at 109.9bps

EGB Options Eyeing Yield Upside Overall Wednesday

Wednesday's Europe rates/bond options flow included:

- ERZ3 96.12/96.00/95.87p fly, 1x3x2, bought for -0.5 in 2.5k

- RXX3 130.00/131.50/133.00 call fly 4K given at 28, suggestions of a closing of existing position.

- OEZ3 114.50/1113.00ps 1x2, bought for 11 in 2.5k

FOREX Antipodean FX Slips Amid Turn Lower For Crude

- The USD index stands in modest positive territory on Wednesday as we approach the APAC crossover amid a turn lower for crude futures and a downtick for equity indices. Price action has weighed the most on Antipodean currencies with both AUD and NZD sliding around 0.65% on the session. Higher front-end yields in the US have supported the dollar, also placing some renewed pressure on the Japanese Yen, with USDJPY grinding back above the 149.00 handle to settle around 149.30. The FOMC minutes prompted some very marginal greenback selling off the highs.

- AUDUSD remains bearish following last week’s breach of support at 0.6331, despite the broad strength posted across the past three sessions. Last week’s break of support confirmed a range breakout and a resumption of the downtrend that started early February. This signals scope for 0.6215 next, a Fibonacci projection.

- As noted, the USDJPY uptrend remains intact. A clear break of the 150.00 handle would reinforce bullish conditions. The bull trigger is 150.16, the Oct 3 high.

- In emerging markets, both the South African rand and the Mexican peso extended their strong recoveries this week, remaining largely unfazed by the ongoing developments in the middle east.

- Focus turns to US inflation data on Thursday, where ex-food and energy (core) CPI is expected to print 0.3% M/M in September for the 2nd month in a row, still firmly higher than the unrounded 0.16% M/M readings in both June and July. Even in the case of an upside shock, this CPI report is unlikely to spur the FOMC to hike at the November meeting, and a December hike would probably require the October and November inflation prints to also show insufficient progress on inflation.

FX Expiries for Oct12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-20(E1.2bln), $1.0550(E935mln), $1.0575-90(E1.7bln), $1.0750-55(E2.8bln)

- USD/JPY: Y148.00($505mln), Y148.80-00($1.4bln), Y149.50-70($1.0bln)

- AUD/USD: $0.6425(A$659mln)

- GBP/USD: $1.2130-50(Gbp1.0bln)

- USD/CNY: Cny7.2700($1.5bln)

Late Equity Roundup: Real Estate, Utilities Lead Late Recovery

- Still off early session highs, stocks have rebounded in late trade, no surprises following the September FOMC minute release (majority saw one hike, keeping rates higher for longer), while the nomination of Scalise to replace McCarthy as House speaker appeared to improve risk sentiment somewhat.

- Currently, S&P E-Mini futures are up 6.75 points (0.15%) at 4398,DJIA up 2.5 points (0.01%) at 33741.96, Nasdaq up 58.9 points (0.4%) at 13622.06.

- Leaders: Real Estate, Utilities and Communication Services outperformed, specialized and health care REITS buoying the former: American Tower +2.99%, Boston Properties +2.82%, SBA Communications and Invitation Homes both gained +2.5%. Meanwhile, independent power and electricity providers buoyed the Utility sector: AES +2.69%, NextEra Energy +3.3%, NRG Energy +2.7%. Media and entertainment shares buoyed the Communication Services sector: Match Group +1.88%, Warner Brothers +1.75%, Google +1.7%.

- Laggers: Energy, Consumer Staples and Health Care sectors underperformed, oil and gas shares weighing on the Energy sector with crude weaker (WTI -2.17 at 83.80): Exxon Mobil -4.32% after announcing a merger with Pioneer Natural Resources earlier, Chevron -2.78%, EQT Corp -1.54%.

- Meanwhile, food and beverage shares weighed on Consumer Staples: Lamb Weston -5.12%, Keurig/Dr Pepper -3.5%, Bunge -3.06%. Health Care weighed down by dialysis stocks: Davita -18.37%, Baxter -13.32%, Insulet -9.12% largely due to Novo Nordisk's successful diabetes treatment Ozempic.

- Reminder, Q4 earnings cycle gets underway with several bank shares reporting this Friday: JP Morgan, Wells Fargo, Blackrock, PNC Financial and Citigroup expected.

E-MINI S&P TECHS: (Z3) Bear Cycle Hits Pause

- RES 4: 4566.00 High Sep 15 and a key resistance

- RES 3: 4514.50 High Sep 18

- RES 2: 4432.24 50-day EMA

- RES 1: 4419.00 High Oct 11

- PRICE: 4405.50 @ 12:28 BST Oct 11

- SUP 1: 4235.50 Low Oct 4

- SUP 2: 4194.75 Low May 24

- SUP 3: 4166.25 1.50 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 4: 4134.00 Low May 4

The e-mini S&P trades higher for a fourth consecutive session, with the index holding just below the week’s highs ahead of the Wednesday cash open. Overall, a bear cycle remains in play, however downside momentum has paused in favour of a corrective rally. Pivot resistance remains above at the 50-day EMA at 4432.24, with the medium-term outlook remaining bearish the longer price holds below this level.

COMMODITIES Oil Summary: Crude Extends Earlier Fall

Crude markets have extended earlier declines, helped by a NY times report that multiple pieces of intelligence show that key Iranian leaders were surprised by the Hamas attack in Israel.. Demand concerns due to the risk of higher for longer central bank rates are limiting upside.

- Brent DEC 23 down -2.6% at 85.38$/bbl

- WTI NOV 23 down -3.1% at 83.28$/bbl

- The Biden administration has not ruled out new sanctions against Iran in relation to the renewed conflict in the Middle East, but no decisions have been made yet, US Treasury Secretary Janet Yellen said.

- Mercuria’s deputy CEO Magid Shenouda said oil could hit $100/bbl if the Middle East situation escalates.

- ARA crude inventories rose 2mn bbls or 4.1% in the week ended October 6 to 51.4mn bbls according to Genscape.

- The day delayed API oil inventory data is due for release today at 16:30 ET ahead of the EIA weekly data tomorrow.

- OPEC+ crude oil production increased by 333kbpd in September to 40.85mbpd, amid higher output from Nigeria, Iran and Kazakhstan according to a Platts survey.

- Crude output cuts this year have boosted OPEC spread production capacity to the biggest in more than a decade except for during the covid driven demand decline. OPEC spare capacity will be more than 4mbpd this year and in 2024 and about 4% of global supplies according to the US EIA.

- Caspian CPC Blend loadings are expected at 1.3-1.4mn bpd in November according to Bloomberg sources.

- Saudi Aramco is in discussions on acquiring a 10% stake in Shandong Yulong Petrochemical, according to Bloomberg.

- MNI COMMODITY WEEKLY: Middle East Instability Draws Questions Around Iranian Barrels but US Intelligence Quashing Fears - https://enews.marketnews.com/ct/x/pjJscQDZk7kI6ag1KxwiTw~k1zZ8KXr-kA8x6nHC5LxptIPjO1OcQ

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/10/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/10/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 12/10/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 12/10/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/10/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/10/2023 | 0740/0940 |  | EU | ECB's Elderson attends EC Summit | |

| 12/10/2023 | 0900/1000 |  | UK | BoE's Pill speaks in Marrakesh | |

| 12/10/2023 | 1100/1300 |  | EU | ECB's Panetta participates in IMF panel | |

| 12/10/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 12/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 12/10/2023 | 1230/0830 | *** |  | US | CPI |

| 12/10/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 12/10/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 12/10/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 12/10/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 12/10/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/10/2023 | 1700/1300 |  | US | Atlanta Fed's Raphael Bostic | |

| 12/10/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/10/2023 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/10/2023 | 2000/1600 |  | US | Boston Fed's Susan Collins |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.