-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

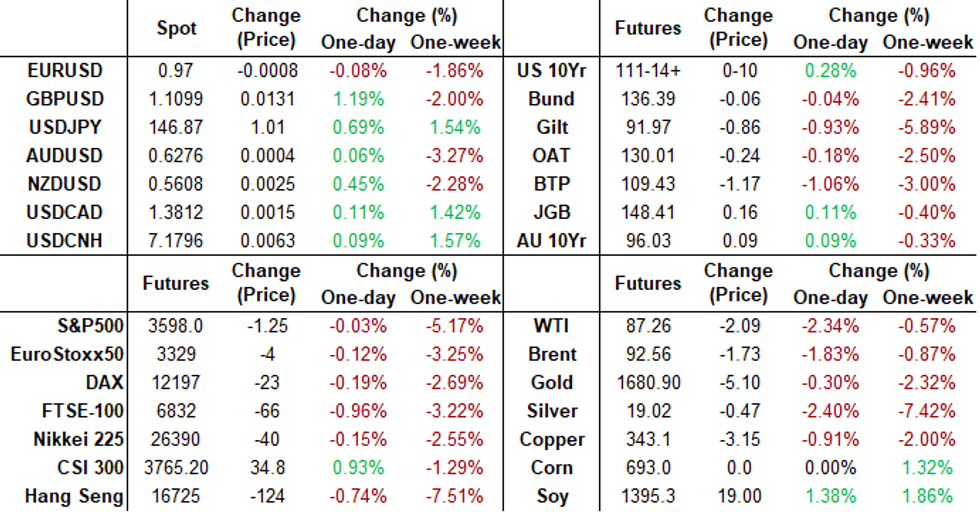

Free AccessMNI ASIA MARKETS ANALYSIS: Sep FOMC Minutes Expectedly Hawkish

HIGHLIGHTS

- MNI FED MINUTES: BETTER TO DO TOO MUCH THAN TOO LITTLE

- MNI FED MINUTES: RISKS TO INFLATION STILL WEIGHTED TO UPSIDE

- MNI BRIEF: Significant BOE Hike Still Needed In Nov - Pill

- MNI BRIEF: BOE Mann Makes Case For Front-loading Rate Hikes

Key links: MNI: Hawkish FOMC Shows No Sign Of Pivot--Minutes / MNI INTERVIEW: ECB To Hike More Than Expected, Rattle Markets / MNI: Fed Needs Measured Rate Hikes As Economy Slips-OECD

US TSYS: Sep FOMC Minutes As Expected: Hawkish

Tsy futures firmer after the bell, upper half session range - not a big reaction to the largely expected, hawkish FOMC minutes (better to do too much than too little) release.- Fed officials agreed inflation remains far too high and interest rates must keep rising to more restrictive levels and stay there for a while, showing little hint of a near-term shift in the course of policy.

- Earlier, MN Fed President Neel Kashkari speaks at town hall: downplays suggestion the Fed "not moving aggressively .. 75bp increments is very aggressive" after noting there "may be a housing downturn, but not necessarily a hard crash."

- Meanwhile, Tsy futures paring gains after $32B 10Y note auction re-open (91282CFF3) tails yet again w/ 3.930% high yield vs. 3.915% WI; 2.34x bid-to-cover vs. last month's 2.37x.

- Focus turns to CPI early Thursday: MoM (0.1%, 0.2%); YoY (8.3%, 8.1%).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00514 to 3.06457% (-0.01200/wk)

- 1M -0.00686 to 3.33871% (+0.02514/wk)

- 3M +0.07015 to 4.01086% (+0.10215/wk) * / **

- 6M +0.03671 to 4.49000% (+0.10529/wk)

- 12M -0.03072 to 5.06771% (+0.07142/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.94071% on 10/11/22

- Daily Effective Fed Funds Rate: 3.08% volume: $104B

- Daily Overnight Bank Funding Rate: 3.07% volume: $282B

- Secured Overnight Financing Rate (SOFR): 3.05%, $993B

- Broad General Collateral Rate (BGCR): 3.00%, $407B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $377B

- (rate, volume levels reflect prior session)

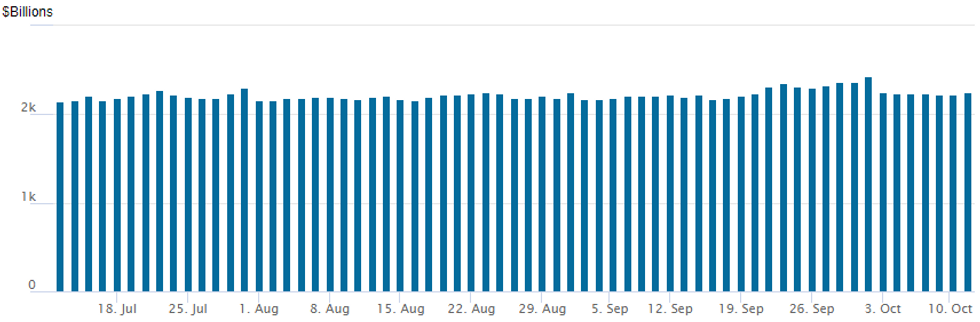

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,247.206B w/ 103 counterparties vs. $2,222.479B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Moderate volumes Wednesday, mixed trade leaned bearish: two-way puts slightly better on the buy side, early call buying shifted to sellers prior to the Sep FOMC minutes release.

- SOFR Options:

- Block, 4,000 SFRZ2 95.25/95.43 2x1 put spds, .25 net ref 95.14

- Block, -8,000 SFRZ2 95.87/96.00 call spds, 1.25 ref 95.495

- Block, 1,250 SFRV2 95.37/95.50 put spds, 4.0

- Block, 2,000 SFRV2 95.18/95.31 put spds, 0.75

- 5,000 SFRX2 95.56 puts ref 95.495

- 1,500 SFRX2 95.25/95.50/95.75 put flys

- Eurodollar Options:

- +8,000 Nov/Dec 94.50 put strips, 5.5 dd vs. 95.09/0.16%

- 2,000 Mar 95.25/95.50/95.87 broken call flys

- 2,500 Mar 96.00/96.50/97.25 broken call flys

- Treasury Options:

- +4,000 TYX 113/114 call spds, 10 vs. 111-18.5

- 3,500 TYX2 113/114/115 call trees, 6 ref 111-09

- 5,600 TYZ 108/110 put spds, 36 ref 111-09

- Block, 10,000 TYZ2 114 calls, 31 vs. 111-04/0.22%

- 3,600 TYX2 111.25 calls, 41

- 10,000 TYZ1 116/118 call spds, 6

- 2,000 TYX2 113/114 call spds

- 2,000 TYX 112.5/113 call spds, 6

- 2,500 TYX2 113 calls, 9 ref 111-00

- 1,500 TYX2 113.5/114.25/114.5 broken call flys

EGBs-GILTS CASH CLOSE: BoE Operation Spurs Long-End Rally

Gilt yields came down sharply from session highs to outperform Bunds across the curve by Wednesday's close - both the UK and German curves twist steepened.

- There was attention on both ends of the UK yield curve Wednesday: the long-end as usual eyed after last night's comments from BoE Gov Bailey confirming the end of emergency bond buys this Friday,. An FT article cited sources that purchases would be extended (helping boost global FI), but the BoE later refuted (pushing yields to session highs).

- With yields from 20Y on above 5%, the BoE's long-dated purchase op sparked a strong rally after good takeup and zero rejected offers. 2Y yields fell for most of the session, with no obvious catalyst, apart from general risk-off (BoE hike pricing didn't move much).

- EGB trading was not as active but several points of interest, including ECB hawk Holzman pulling down cumulative hike pricing to end-2022 by 4bp to 132bp, saying a 100bp hike was unnecessary and 75bp in Oct and 50bp in Dec would bring policy close to neutral.

- Attention turns back to the US, with the Fed meeting minutes later Wednesday, and CPI data Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 1.4bps at 1.827%, 5-Yr is down 0.7bps at 2.051%, 10-Yr is up 1.6bps at 2.314%, and 30-Yr is up 5.5bps at 2.356%.

- UK: The 2-Yr yield is down 27.4bps at 4.017%, 5-Yr is down 8.7bps at 4.473%, 10-Yr is down 0.7bps at 4.436%, and 30-Yr is up 1.9bps at 4.818%.

- Italian BTP spread up 4.2bps at 242.3bps / Greek up 3.3bps at 267.2bps

EGB Options: Euribor Upside, Bund Downside Feature

Wednesday's Europe rates / bond options flow included:

- RXX2 132.00/130.00/129.00 broken put fly bought for 12 in 4k

- SFIZ2 96.00/96.30/96.60 call fly bought for 3.5 in 7k

- ERU3 99.75/100.00 1x1.5 cs + 8.25k ERZ3 99.75/100.00 1x1.5 cs strip bought for flat in 8.25k

FX: US Dollar Unwinds Modest Dip On FOMC Minutes, USDJPY Eyeing 147 Again

- US real yields initially drove the bulk of the rally in Treasuries on the FOMC minutes, before breakevens broke lower as 10Y real yields climbed back.

- That helped see DXY briefly at the day’s lows before retracing a large part of the move, although the moves are lost when looking at the bigger picture in recent weeks as DXY moves back to circa 1.5% below cycle highs seen in days after the Sep 21 FOMC.

- Similarly, USDJPY fell -0.15% on the minutes but has clawed most of this back, closing in again on 147.00 (currently 146.89) with the pair maintaining a recent bullish tone as it crossed above the previous intervention zone during APAC trade, registering a fresh multi-decade high in the process.

- Comments earlier from BOJ Governor Kuroda repeated his pledge to continue with his easing policy because the Japanese economy is still recovering from the impact of the Covid-19 pandemic, and inflation is expected to moderate over the following year.

Late Equity Roundup: Resilient After Expected Hawkish FOMC Minutes

Little reaction to largely expected Sep FOMC minutes with a hawkish tone" better to do too much, than too little" in addressing inflation. Stock indexes trading mildly higher, holding inside narrow session range after the FI close, Energy and Consumer Staples still outperforming. Currently, SPX eminis trade +2.50 (+0.1%) at 3601.75; DJIA +83.99 (0.29%) at 29319.06; Nasdaq +22.7 (0.2%) at 10447.13.

- SPX leading/lagging sectors: Energy (+1.12%) with equipment and services outpacing oil and gas. Consumer Staples +0.67% with food/beverage and tobacco shares leading. Laggers: Utilities underperforming (-3.16%) weaker across the board, Entergy (ETR) -3.34%, Nexera (NEE) -3.08%, Duke (DUK) -2.77%. Real Estate (-0.98%) and Materials (-0.48%) follow.

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) +3.07 at 297.28, United Health (UNH) +1.95 at 501.76, JPM +2.21 at 104.17. Laggers: Walmart (WMT) -1.27 at 131.40, Boeing (BA) -1.04 at 130.53, Home Depot (HD) -1.33 at 281.56.

E-MINI S&P (Z2): Bearish Outlook

- RES 4: 4234.25 High Aug 26

- RES 3: 4175.00 High Sep 13 and a key resistance

- RES 2: 3886.13 50-day EMA

- RES 1: 3820.00 High Oct 5

- PRICE: 3600.50 @ 1515ET Oct 12

- SUP 1: 3571.75 Low Oct 3 and the bear trigger

- SUP 2: 3558.97 1.382 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 3: 3506.38 1.50 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 4: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis remains below last week’s high of 3820.00 on Oct 5. This level marks a key resistance, where a break is required to reinstate a short-term bullish theme. The broader trend remains down and attention is on the bear trigger at 3571.75, the Oct 3 low. A break of this level would confirm a resumption of the broader downtrend and open 3558.97, a Fibonacci projection.

COMMODITIES: Crude Oil Falls Further Back As OPEC Cuts Demand Forecasts

- Crude oil falls circa -2% to continue to chip away at last week’s 17% surge higher in the case of WTI.

- The move lower was kickstarted by OPEC cutting its 2022 oil demand growth forecast by 460kbpd to 2.64mbpd and its 2023 forecast by 360kbpd to 2.34mbpd, before continuing the move after a small beat for US PPI inflation even if rates markets didn’t move materially on it.

- Geopolitics/security remains front and centre, with Poland seeing many signs pointing to the Kremlin behind a leak in the Druzhba pipeline but that it’s too early to say whether sabotage or just an accident.

- WTI is -2.4% at $87.2, clearing support at the 50-day EMA of $87.61 to open $79.14 (Sep 30 low).

- Brent is -1.9% at $92.5, clearing support at the 50-day EMA of $92.67 to open $85.00 (Sep 30 low).

- Gold is +0.4% at $1673.32, moving further off support at $1659.7 (Oct 3 low) with still some distance to the bull trigger at $172.95 (Oct 4 high).

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/10/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 13/10/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/10/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 13/10/2022 | 0730/0930 |  | EU | ECB de Guindos Speech at (M&A) España y Europa Event | |

| 13/10/2022 | - |  | EU | ECB Lagarde & Panetta IMF/World Bank Annual Meetings | |

| 13/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/10/2022 | 1230/0830 | *** |  | US | CPI |

| 13/10/2022 | 1300/1400 |  | UK | BOE Mann Speech at Peterson Institute for Internat. Economics | |

| 13/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/10/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 13/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 13/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 13/10/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 13/10/2022 | 1700/1300 |  | US | Atlanta Fed Raphael Bostic | |

| 13/10/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.