-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Soft Data, Crude Sales Buoy Rates

- CHICAGO FED GOOLSBEE: POSSIBLE TO CURB INFLATION W/OUT HAVING DEEP RECESSION, Bbg

- CHICAGO FED GOOLSBEE: CHINA SLOWDOWN, OIL PRICE, SHUTDOWN ARE OUTLOOK RISKS, Bbg

Key Links:MNI INTERVIEW: Fed 'Upside Surprise' To Drag On Housing - MBA / MNI INTERVIEW: Higher Rates Finally Begin To Bite US Firms / MNI: Goolsbee Sees Risk Fed Overshoots As Supply Recovers / US Treasury Auction Calendar / US$ Credit Supply Pipeline

US TSYS Markets Roundup: 10Y Yields Off New 16Y High of 4.6861%

- US rates finish at/near highs Thursday (TYZ3 at 107-31.5, +13) after a mildly volatile first half.

- Treasury 10Y yield climbed to new 16Y high of 4.6861% amid fast two-way trade on heavy volumes post data: Weekly claims came out lower than expected (204k vs 215k est) Continuing Claims near in-line (1.670M vs. 1.675M est), GDP Price Index lower than expected (1.7% vs. 2.0% est), Personal Consumption missed (0.8% vs. 1.7% est).

- Curves steepened broadly as bonds followed EGBs: Bunds, Gilts and JGBs joined the sovereign selloff, one desk noted. "Markets are either believing CBs higher for longer rhetoric or perhaps doubting the resolve to cause the pain needed to bring inflation down to target levels."

- Rates climbed higher after midmorning Pending Home Sales data came out much lower than expected: MoM (-7.1% vs. -1.0% est), YoY (-18.8% vs. -13.0% est).

- Little react to Chicago Fed President Goolsbee said the Federal Reserve can generate a rare soft landing while a "China slowdown, higher oil prices, government shutdown" are all risks to the outlook.

- Fed Chairman Powell speaking at a teacher townhall event is not making any market moving policy statements.

- Friday Data Calendar: Inventories, PCE, Chicago PMI, UofM Sentiment.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00149 to 5.31459 (-0.00292/wk)

- 3M +0.00474 to 5.39482 (-0.00499/wk)

- 6M +0.00344 to 5.47093 (-0.00862/wk)

- 12M +0.00575 to 5.47484 (-0.01079/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $99B

- Daily Overnight Bank Funding Rate: 5.32% volume: $255B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.388T

- Broad General Collateral Rate (BGCR): 5.30%, $554B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $544B

- (rate, volume levels reflect prior session)

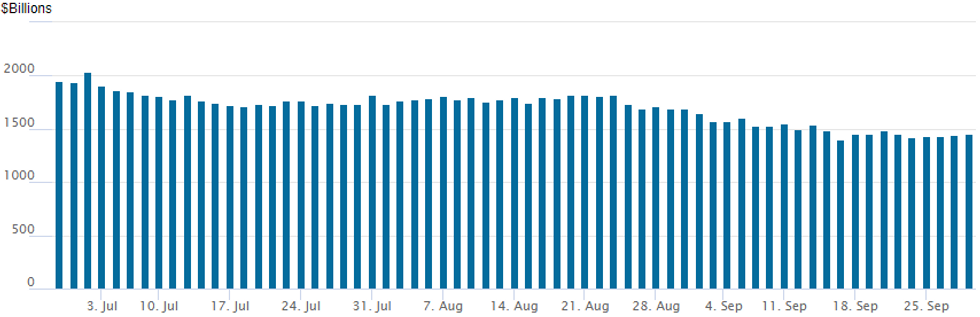

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation up to 1,453.366B w/97 counterparties, compared to $1,442.805B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury option trade remained mixed but leaned slightly toward better low delta puts and put spreads Thursday. Underlying futures have continued to gain in the second half, near late session highs at the moment. Rate hike projections into early 2024 have cooled slightly as lower crude prices tempered inflation concerns in the short term: November at 20.7% w/ implied rate change of +5.2bp to 5.379%, December cumulative of 10bp at 5.428%, January 2024 10.5bp at 5.432%. Fed terminal at 5.425% in Jan''24-Feb'24.

- SOFR Options:

- Block, 73,000 SFRZ3 96.00 combos vs. 94.53/100% at 1059ET, 40k Blocked yesterday

- Block, -10,000 SFRF4 94.12/94.25 put spds, 1.25 ref 94.61

- Block, 10,000 SFRH4 95.50/95.75 call spds, 1.75 vs. 94.605/0.05%

- 8,000 SFRX3 94.31 puts ref 94.525

- 2,000 0QX3 95.31/95.50/95.75 call trees ref 95.315

- 7,000 0QZ3 95.68/96.37 call spds ref 95.325

- Block, 3,750 SFRM4 95.50/96.00/96.50 call flys, 2.0 ref 94.765

- 2,500 SFRZ3 94.37 puts, 3.5 ref 94.525

- 2,400 0QZ3 95.5/96.00 put over risk reversals, 29.5-30.0 ref 95.305 to -.315

- Treasury Options:

- -12,740 TYX3 107.5 puts 17 over TYZ3 105.5 puts

- Block, 10,000 TYZ3 103 puts, 13 ref 107-20.5

- 3,000 TYZ3 105.5 puts, 33 ref 107-24.5

- 10,000 TYX3 105.5/106.5/107.5 put flys, 11 ref 107-17.5

- over 3,200 TYX3 111.5 calls, 5 ref 107-16.5

- 6,500 TYZ3 111/113 call spds ref 107-21 to -18

- 1,000 TYX3 105/106/107 put flys, 8 ref 107-21

- 1,800 TYX3 106.5 puts, 31 ref 107-22

EGBs-GILTS CASH CLOSE: Bund Yields Near 3% As Core FI Rout Continues

European yields rose sharply again Thursday as the core FI rout continued, amid heavy futures trading volumes.

- Bunds and Gilts sold off relentlessly through almost the entire session, shrugging off marginally softer-than-expected German/Spanish inflation prints, only finding a footing about an hour before the cash close.

- The German and UK curves ended bear steeper. Though yields finished off the highs, we still saw multiple multi-year highs set. 10Y Bund notably came within 1.7bp of the 3.00% mark but finished at a post-2011 high of 2.93%.

- 10Y Gilt yields meanwhile had risen over 20bp at one point before settling "just" 12bp higher.

- Once again it was difficult to pinpoint a trigger for the violent selloff, which could best be pinned on "higher-for-longer" bearish price action.

- 10Y BTP spreads widened to 200bp for the first time since 1Q, but ended up lower on the day as risk assets rallied after the US cash equity open.

- Friday's main focus is Eurozone inflation, which after today's prints looks likely to come in below expectations coming into the week. We also get UK GDP, German jobs data, and appearances by ECB's Lagarde, Vasle, Vujcic, Kazaks, and Visco.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.2bps at 3.286%, 5-Yr is up 7.8bps at 2.89%, 10-Yr is up 8.7bps at 2.93%, and 30-Yr is up 5.6bps at 3.089%.

- UK: The 2-Yr yield is up 6.5bps at 4.939%, 5-Yr is up 11.1bps at 4.583%, 10-Yr is up 12.6bps at 4.484%, and 30-Yr is up 11bps at 4.903%.

- Italian BTP spread down 0.8bps at 193.8bps / Spanish down 0.7bps at 109.2bps

EGB Options: Defensive Leanings On Volatile Thursday

Thursday's Europe rates / bond options flow included:

- ERH4 95.875/96.00/96.125/96.25 call condor trades 5.25 in 5k

- ERU4 96.12/96.00/95.87p fly, bought for 1.5 in 2.5k

FOREX

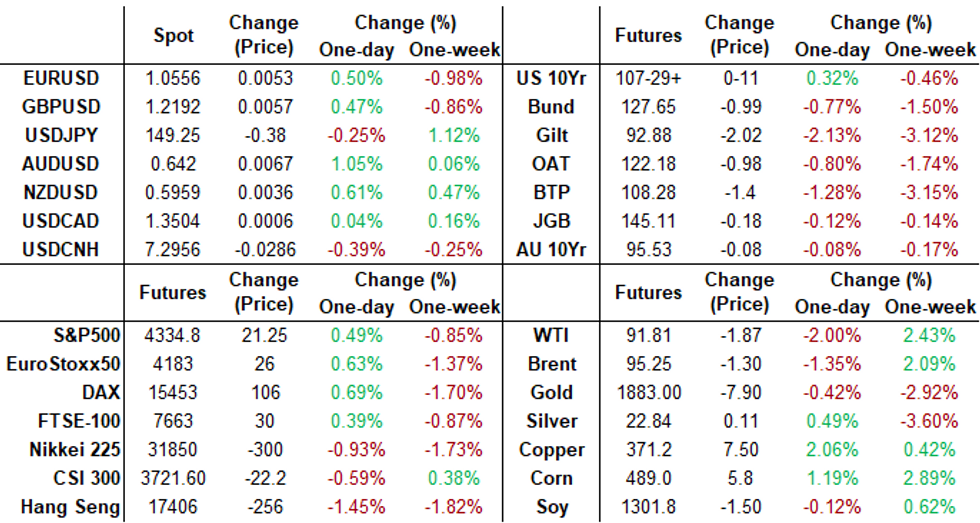

- EURUSD up 0.0054 (0.51%) at 1.0557

- USDJPY down 0.38 (-0.25%) at 149.25

FX Expiries for Sep29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.7bln), $1.0570-75(E944mln), $1.0600(E3.0bln), $1.0650(E1.3bln)

- USD/JPY: Y146.95-00($1.4bln), Y149.00-15($1.1bln)

- GBP/USD: $1.2400(Gbp590mln)

- EUR/GBP: Gbp0.8640(E770mln)

- AUD/USD: $0.6380(A$503mln), $0.6500(A$659mln), $0.6600(A$550mln)

- USD/CAD: C$1.3500($729mln), C$1.3510-15($610mln)

- USD/CNY: Cny7.3000($1.3bln), Cny7.3100($1.1bln)

Late Equity Roundup: Near Midday Highs, Materials Outperforming

- Stocks trading firmer but off midday highs following this morning's mixed data (lower than expected weekly claims, GDP growth steady at 2.1%). Stocks had extended highs at midday - partially tied to a drop in crude prices (WTI -1.78 at 91.90) that helps water down increased rate hike projections to temper inflation. Currently, the DJIA is up 172.07 points (0.51%) at 33723.44, S&P E-Mini Future up 33.5 points (0.78%) at 4347.5, Nasdaq up 139.5 points (1.1%) at 13233.

- Leaders: Materials, Communication Services and Consumer Discretionary sectors outperformed late, construction material stocks buoyed the former: Martin Marietta Materials +1.68%, Vulcan Materials +1.4%. Media and entertainment stocks helped Communication Services sector: Live Nation +3.05%, Charter Communications +2.35%, News Corp +1.96%.

- Meanwhile, auto makers underpinned Discretionary sector: Aptiv +3.12%, GM +2.78%, Tesla +2.12%.

- Laggers: Utilities, Energy and Consumer Staples sectors underperformed, independent power and water providers weighed on the former: AES -5.2%, American Water Works -1.96%. Oil and Gas providers weighed on the Energy sector: Haliburton -.3%, Schlumberger +.23%, Baker Hughes +.77%.

- Meanwhile, Consumer Staples weighed by household and personal products makers: Proctor & Gamble -0.8%, Kenvue -0.8%.

E-MINI S&P TECHS: (Z3) Bearish Conditions Intact

- RES 4: 4597.50 High Sep 1 and a near-term bull trigger

- RES 3: 4566.00 High Sep 15

- RES 2: 4478.37 50-day EMA

- RES 1: 4399.00 High Sep 22

- PRICE: 4350.00 @ 1515 ET Sep 28

- SUP 1: 4277.00 Low Sep 27

- SUP 2: 4259.00 Low May 31

- SUP 3: 4242.15 1.236 proj of the Jul 27 - Aug 18 - Sep 1 price swing

- SUP 4: 4194.75 Low May 24

A bear cycle in S&P E-minis remains in play and the contract traded lower Wednesday, extending the current downleg. Last week’s sell-off resulted in a break of support at 4397.75, the Aug 18 low. This breach reinforced bearish conditions and signals scope for a continuation lower. Sights are on 4242.15, a Fibonacci retracement point. Initial firm resistance is 4478.37, the 50-day EMA. Short-term gains would be considered corrective.

COMMODITIES Crude Prices Slide, Gold Surprisingly Doesn’t Benefit From Weaker USD

- Crude prices have fallen sharply as wider economic concerns and future central bank policy and rate hikes create a more bearish demand outlook. The possible US shutdown is also adding further uncertainty to markets.

- Continued supply tightness provides some upside support after yesterday saw crude inventories at Cushing fell for the seventh week with a draw of 943k this week taking stocks to the lowest since July 2022 at 21.96mbbls and close to operational lows.

- The traditional US autumn refinery maintenance is shaping up to be heavier than expected, according to Bloomberg, as a greater number of refiners shut units for work.

- However, Saudi Arabia supplied surprisingly high crude volumes to their buyers in the month of August, drawing down seaborne inventories (floating storage and in-transit volumes) by 1.5mbd on average.

- WTI is -2.1% at $91.67, unwinding a large part of yesterday’s surge and taking a step closer to support at $88.19 (Sep 26 low).

- Brent is -1.5% at $95.15 although remains notably above a key support at $91.80 (Sep 26 low).

- Gold is -0.5% at $1865.03, with surprisingly little respite from the USD index reversing yesterday’s strong gain and Treasuries ultimately rallying. A low of $1857.93 saw it push through latest support at $1865.8 (76.4% retrace of Feb 28 – May 4 bull leg), with $1839.0 (50% retrace of the same move) up next.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/09/2023 | 2300/1900 |  | US | Richmond Fed's Tom Barkin | |

| 29/09/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/09/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 29/09/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 29/09/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 29/09/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 29/09/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/09/2023 | 0645/0845 | ** |  | FR | PPI |

| 29/09/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 29/09/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 29/09/2023 | 0740/0940 |  | EU | ECB's Lagarde speaks at IEA-ECB-EIB Conference | |

| 29/09/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 29/09/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/09/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/09/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/09/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/09/2023 | - |  | UK | Publication of Treasury bill calendar for October-December 2023. | |

| 29/09/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/09/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/09/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 29/09/2023 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 29/09/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 29/09/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 29/09/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 29/09/2023 | 1645/1245 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.