-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA MARKETS ANALYSIS: Treasuries See Renewed Cheapening Ahead Of Powell

Highlights:

- Holzmann's hawkish overtones support EUR, ECB rate pricing

- Surge in US corporate issuance weighs on Treasuries via rate-lock selling

- CAD shrugs off Ivey PMI slide, with focus on Wednesday's BoC decision

US TSYS: Treasury Yields Ending Session Near Day’s Highs With Powell Eyed

- Cash Tsys are holding close to session highs, with yields +2-3.5bps higher on the day after more than reversing an overnight bid (with 10Y real yields also +3.5bps). The grind higher for yields came through most of the US session with little by way of headline drivers and also saw a small pull back from fresh multi-decade lows for 2s10s at -93bps.

- In futures space, TYM3 trades 3 ticks lower at 111-00, recently off lows of 110-30+ with volumes below average ahead of Powell (1.13M vs 1.4M av). It helps firm up the view that Friday’s bounce appears corrective whilst support remains at the bear trigger of 110-12+ (Mar 2 low).

- As for Fed rate expectations, the terminal has pushed back higher to 5.48% in Sep (+3bp on the day) but remains off Thursday’s cycle high of 5.51% before just 13bp of cuts to 5.35% come year-end.

- Upcoming events: Powell headlines tomorrow with a Senate appearance at 1000ET, before interest in 3Y supply in what’s otherwise a light docket with the week’s data calendar gearing up to payrolls on Friday.

EGBs-GILTS CASH CLOSE: Holzmann's 50s Bear Flatten German Curve

Commentary by ECB officials drove most of the price action in Monday's trade, with Germany leading the European bear flattening move.

- There was limited reaction to ECB Chief Economist Lane's speech on underlying inflation dynamics (which reinforced that hikes were set to continue past March), but an interview with Austria's Holzmann calling for 4 consecutive 50bp hikes saw the German short end sell off sharply around midday.

- The latter set a hawkish tone following a constructive start to the session. ECB terminal rate expectations rose to a fresh cycle high just shy of 4.10%.

- Gilts followed the lead of Bunds; periphery EGB spreads were mostly wider.

- Most activity in the futures space was spread related, with the quarterly roll nearly complete ahead of Wednesday's deadline.

- Data flow picks up early Tuesday with German factory orders.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 10.1bps at 3.315%, 5-Yr is up 6.2bps at 2.898%, 10-Yr is up 3.4bps at 2.749%, and 30-Yr is up 0.1bps at 2.663%.

- UK: The 2-Yr yield is up 7.7bps at 3.776%, 5-Yr is up 5.1bps at 3.703%, 10-Yr is up 1.7bps at 3.866%, and 30-Yr is up 0.1bps at 4.214%.

- Italian BTP spread up 1.1bps at 182.6bps / Spanish up 0.2bps at 94.8bps

EU OPTIONS: Mostly Bearish Rates Trades

Monday's Europe rates / bond options flow included:

- RXJ3 129.5/128.5ps, bought for 19 in 1.5k

- Conditional bear flattener - Buys ERN3 95.875/95.625 put spread in 6k, sells 0RN3 96.125/95.875 put spread in 6k. Net paid 1.75)

- ERM3 96.375 put bought for 19 (vs 96.29)

- ERU3 96.125/96.00/95.875/95.75 put condor bought for 2.5 in 4.5k

- ERM4 96.00/96.50/97.00c fly, bought for 9.25 in 4k

FOREX: CNH Consolidates Early Losses, CHF Outperforms

- CNH extended losses early on Monday against the USD, with China's more conservative growth targets continuing to work against the currency to start the week. USDCNH has topped resistance at the 61.8% retracement for last week's leg lower, crossing at 6.9415. With prices consolidating throughout the US session, attention will turn to the more medium-term level at the 6.9815 100-dma - a tech point that successfully contained prices at the end of February.

- EURUSD continued to creep higher during Monday trade, with the pair printing a new high at 1.0694, a few pips above resistance at 1.0691 - last week's best levels. The initial catalyst for the Euro outperformance was the somewhat hawkish tone from ECB's Holzmann (Sees 4 further 50bps rate hikes this year), with the bounce off the lows for the US 10y yield failing to slow the day's uptrend in the pair.

- Despite the single currency’s outperformance on Monday, EURCHF sits slightly lower on the session following the above-estimate Swiss inflation data released earlier today. In similar vein, the Swiss Franc is the best performing G10 ccy against the greenback, rising 0.42% approaching the APAC crossover. The data has prompted notable sell-side outfits to adjust their March SNB calls, further underpinning the Franc strength on Monday.

- A late turn lower for equities cemented the Australian dollar as one of the worst performers. The weakness comes ahead of the overnight RBA decision, where the central bank are widely expected to hike rates 25bp to 3.6%.

- China trade data will also cross overnight before the focus then turns to Fed Chair Powell, due to testify on the Semi-Annual Monetary Policy Report.

US STOCKS: Equities Pare Gains Ahead Of Powell Tomorrow

- ESH3 has almost fully reversed solid gains, at one point up +0.8% as it feels some pressure from USTs, down more than 30 points for now +0.1% on the day at 4052.

- With few obvious headlines for the sharper moves lower, it could be some profit taking after yesterday's +1.6% gain, coming with some solid sell programs.

- Volumes are below average, similar to a more pronounced tailing off in TYA volumes, ahead of Powell tomorrow.

- The high of 4082.5 forms initial resistance after which sits 4100.2 (Fibo retrace of Feb 2 - Mar 2 bear leg) whilst support is notably lower at 3974.0.

- Sizeable differences across other indices: Nasdaq +0.1%, Dow +0.1% and Russell -1.5% (all E-minis), with higher real yields on the day (US 10Y +3.5bps) potentially weighing more heavily on smaller names.

ECB: Peak Depo Rate Pricing Hits New Cycle High Above 4.07%

Following Holzmann comments eyeing 200bp of further increases (50bp x 4), peak ECB depo rate pricing briefly pushed just above 4.07% for Q4 2023.

- That marked a new cycle peak, and implies 157bp of hikes from current levels (and no rate cuts in 2023).

- Peak pricing has since pulled back by 3-4 basis points, but overall: 50bp is basically a lock for March's ECB, with the probability of 50bp (vs 25bp) in May at a little over 70%.

- A cumulative 125bp of hikes is currently priced through June, with the 143bp through July is 57bp below Holzmann's rate path.

COMMODITIES: WTI Clears $80 After Reversing China Growth Target Concerns

- Crude oil has gained after reversing concerns earlier in the day on China’s 5% growth target. Elsewhere in news, Gunvor's CEO said planned Russian oil cuts of 500kbpd in March aren't yet seen in the market.

- WTI is +1.0% at $80.51, coming closer to resistance at $80.78 (Feb 13 high) as it continues recent gains. Clearance there could open key resistance at $82.89 (Jan 23 high).

- Brent is +0.5% at $86.29 having move above resistance at $86.00 (Mar 3 high) to approach $86.55 (Feb 13 high) after which lies the key $88.78 (Jan 23 high).

- Gold is -0.5% at $1846.63 in a surprising move considering a weaker dollar, although likely weighed on by US yields moving higher through the session. An earlier high of $1858.26 set new resistance (after which sits $1870.5, Feb 14 high) whilst it remains far above support at the bear trigger of $1804.9 (Feb 28 low).

MNI UST Issuance Deep Dive: Mar 2023

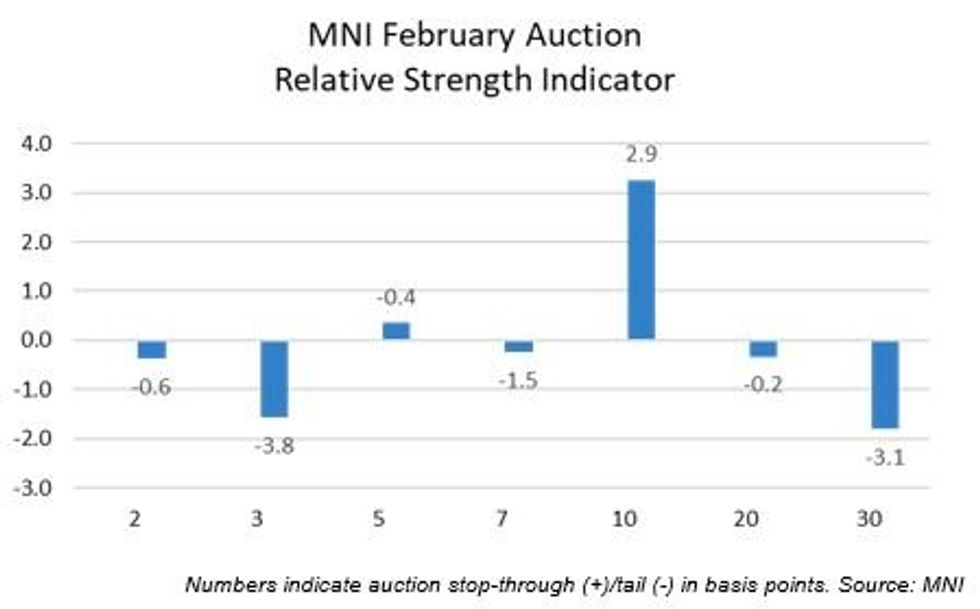

MNI's latest US Treasury Deep Dive has just been published and sent to subscribers (PDF here). Highlights:

- The main upshot from February's Treasury Refunding announcement is that there will be no changes to auction sizes in the Feb-Apr quarter, in line with MNI’s expectations.

- MNI's expectation is that nominal coupon sizes will not change through at least Q3 2023

- After extremely strong results in January as all 7 nominal coupon auctions stopped through, February’s sales were poor, with 6 of 7 auctions tailing.

- This came as Fed hiking expectations were revised to the upside and recession risks to the downside, kicked off by strong January jobs data on the first Friday of the month.

MNI BoC Preview, Mar'23: Maintaining The Conditional Pause

- The BoC is unanimously expected to keep rates on hold at 4.5% on Wednesday and for the most part echo January’s pivot to guidance of a conditional pause whilst leaving the door open to further hikes.

- Data has been mixed. Employment was far stronger than expected but CPI showed some moderation and GDP was surprisingly soft, albeit partly offset by hawkish implications from weaker productivity growth.

- Surprises should never be ruled out from the BoC, with a weaker CAD adding inflationary pressure at the margin. However, market reaction could be limited with focus on nuances of the single page statement before potentially more detail in Thursday’s Economic Progress Report from Senior Dep Gov Rogers.

- Full report here: https://marketnews.com/mni-boc-preview-mar-23-maintaining-the-conditional-pause

Canadian rates have been dragged higher by the substantial higher for longer push in the US

CAD: Ivey PMI Slide Faded By Markets

- The Ivey PMI fell back from 60.1 to 51.6 in Feb to almost fully unwind the spike higher in Jan, with the reversal following last week's weaker than expected Q4 GDP print.

- The volatile survey had limited impact on markets with USDCAD ~15 pips off session highs and GoC yields back near Friday's close (or slightly above for the 2Y) having reversed a bid after the open.

- Local attention is on the BoC decision on Wed - widely expected to hold at 4.5% - with little else scheduled before then, although Powell's appearance tomorrow could see notable spillover.

FX OPTIONS: Expiries for Mar07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0570-85(E1.3bln), $1.0620-30(E1.0bln), $1.0675-85(E922mln), $1.0710-30(E938mln), $1.0740-45(E1.0bln), $1.1000(E1.4bln)

- USD/JPY: Y136.00-10($783mln), Y136.50-65($774mln)

- GBP/USD: $1.1950(Gbp572mln), $1.1975(Gbp721mln), $1.1994-00(Gbp1.0bln)

- USD/CAD: C$1.3600-15($1.3bln)

- USD/CNY: Cny6.9500($1.4bln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/03/2023 | - | *** |  | CN | Trade |

| 07/03/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/03/2023 | 1500/1000 | ** |  | US | Wholesale Trade |

| 07/03/2023 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 07/03/2023 | 1500/1000 |  | US | Fed Chair Jerome Powell | |

| 07/03/2023 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/03/2023 | 2000/1500 | * |  | US | Consumer Credit |

| 08/03/2023 | 0700/0800 | ** |  | DE | Industrial Production |

| 08/03/2023 | 0700/0800 | ** |  | DE | Retail Sales |

| 08/03/2023 | 0900/1000 | * |  | IT | Retail Sales |

| 08/03/2023 | 0930/0930 |  | UK | BOE Dhingra at Resolution Foundation | |

| 08/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/03/2023 | 1000/1100 | *** |  | EU | GDP (final) |

| 08/03/2023 | 1000/1100 | * |  | EU | Employment |

| 08/03/2023 | 1000/1100 |  | EU | ECB Lagarde at Women's Day WTO Event | |

| 08/03/2023 | 1000/1100 |  | EU | ECB Panetta Intro at Euro Cyber Resilience Board | |

| 08/03/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/03/2023 | 1315/0815 | *** |  | US | ADP Employment Report |

| 08/03/2023 | 1330/0830 | ** |  | US | Trade Balance |

| 08/03/2023 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 08/03/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 08/03/2023 | 1500/1000 |  | US | Fed Chair Jerome Powell | |

| 08/03/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 08/03/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/03/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 08/03/2023 | 1900/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.