-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasury Yields Slide Further On Waller

HIGHLIGHTS

- A dovish leaning Fed Governor Waller helped accelerate an earlier rally in Treasuries, which continued to build through the session and even reversed a sell-off seen after the largest tail in a 7Y auction for a year.

- Yields sliding weighed on the USD index, with JPY a notable beneficiary as USDJPY narrows the gap substantially to last week’s low.

- Gold has cleared two resistance levels today against this backdrop, whilst crude has rebounded with the USD tailwind plus support from uncertainty over the upcoming OPEC+ meeting and potential further supply cuts.

- Australia CPI is due overnight before the November RBNZ policy rate decision (preview further below). In Europe, focus will turn to Eurozone inflation releases (preview below) before markets receive the second iteration of US third quarter GDP.

US TSYS: Treasuries See Large Rally As Waller Brings Up Potential Cut Timing

- Cash Treasuries have seen a quick further bid to fresh session highs across 2-5Y tenors, but it appeared to lack a headline driver and has since been retraced.

- It still leaves a significant rally on the day though, with 2-3Y tenors 10bp richer, having more than reversed limited cheapening impulse from the largest tail for a 7Y Tsy auction since Nov 2022 at 2.1bps (both 5Y and 10Y yields are both 1-2bps lower than pre-auction).

- TYZ3 has recently touched the joint session high of 109-17 to further push above the bull trigger at 109-08+ (Nov 17/22 high) and open 109-20 (Sep 19 high).

- The day’s main driving force has been Governor Waller leaning dovish by touting potential cut timings. Specifically, in Q&A: "If you see this [lower] inflation continuing for several more months, I don't know how long that might be—3 months? 4 months? 5 months?—you could then start lowering the policy rate because inflation's lower."

- Governor Bowman (voter) reiterating that she continues to expect the need for a further hike had little sway. Similarly, latest unscheduled BIS text remarks from NY Fed’s Williams (voter) saying “the recent news about the long-run anchoring of inflation expectations in the US is mostly reassuring” weren’t particularly surprising.

- Fed Funds show a greater likelihood of a first cut landing in May with a cumulative 20bp priced vs 14bp yesterday. They build to a cumulative 101bp of cuts in 2024.

- Tomorrow sees the second Q3 GDP release including core PCE before Fedspeak from Cleveland Fed’s Mester (’24 voter) on financial stability and the Fed’s Beige Book.

EGBs-GILTS CASH CLOSE: US Leads Yields Lower Ahead Of Eurozone Inflation

European yields fell Tuesday as a senior Federal Reserve official appeared to open the door to US rate cuts in 2024.

- Global core FI rallied sharply in the European afternoon, led by US Treasuries after Fed Governor Waller said that three to five more months of lower inflation readings could prompt rate cuts.

- Prior to that it had been a constructive session with some support lent variously by softer oil prices, soft Eurozone lending figures, and an uptick in Israel-Hamas tensions.

- On the day, the UK curve bull flattened, with Germany's bull steepening. Gilts underperformed, with hawkish-leaning comments by BoE's Haskel and Ramsden potentially weighing. ECB's Lane speaks after the close.

- Periphery EGB spreads widened modestly, with ECB President Lagarde's comments Monday pointing to a near-term reconsideration of PEPP reinvestment in the not-too-distant future.

- The European schedule picks up pace the next couple of days. Most notable is the November round of monthly flash Eurozone inflation beginning Wednesday, with Spain and Germany reporting, ahead of the Eurozone-wide figures Thursday. (MNI's preview went out today).

- German fiscal policy will be another focus, with the ruling coalition reportedly meeting Weds to discuss the 2024 budget.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 8.1bps at 2.918%, 5-Yr is down 6.8bps at 2.447%, 10-Yr is down 5.1bps at 2.497%, and 30-Yr is down 2.5bps at 2.727%.

- UK: The 2-Yr yield is down 1.1bps at 4.632%, 5-Yr is down 4.2bps at 4.212%, 10-Yr is down 3.8bps at 4.174%, and 30-Yr is down 2bps at 4.645%.

- Italian BTP spread up 2.1bps at 175.7bps / Spanish up 1.1bps at 100.3bps

EU STIR: ECB/BoE Rate Cut Probabilities Jump As Door To Fed Cuts Seen Further Ajar

ECB and BoE rate cut pricing picked back up again Tuesday, with last week's (largely PMI-related) pullback fading further. Today's key dovish catalyst was Federal Reserve Governor Waller's comments that there could be scope for US rate cuts in the coming months contingent on lower inflation.

- 97bp of cuts are now priced for the ECB between Dec 2023 and Dec 2024 - up 7bp on the day to the most since Nov 16. A first full 25bp cut is robustly priced for June 2024, with around 80% probability of a first reduction by April 2024. 84bp of cuts are seen by the October meeting.

- 90bp of BoE cuts are priced between Feb/Mar 2024 peak (just 3-4bp higher from current levels) and a year later - up 5bp on the day to the most implied cuts since Nov 21. A first full 25bp cut is still cumulatively seen by August 2024, with the first 50bp of cuts by the Nov meeting.

- Attention turns to Eurozone November inflation readings which commence first thing Wednesday morning with German state (NRW) data, with the Spanish and German national figures to come later. MNI's preview is here.

FOREX: USD Index Continues Slide As Fed’s Waller Floats Hypothetical Cuts

- Markets pounced on some dovish leaning Fed comments from Governor Waller on Tuesday which raised market pricing for rate cuts across 2024. This prompted a pullback in both front-end Tsy yields and the USD Index - which briefly printed the lowest level since mid-August. A moderate recovery following the 7-yr auction still sees the DXY down 0.3% on the session, as we approach the APAC crossover.

- Outperformance was notable for the Japanese yen, which was the key beneficiary of the lower US yields. USDJPY printed as low as 147.33 on Tuesday, an impressive 234 pips off yesterday’s highs. The move narrows the gap substantially to last week’s low of 147.15. For bears, a clearance of this level, the Nov 21 low, would cancel a reversal chart pattern and instead open 146.48, trendline support drawn from Mar 24.

- The broad greenback weakness continues to boost the likes of AUD, which posted a near four-month high at 0.6666 against the dollar, having topped resistance at 0.6632 and 0.6656 earlier in today’s session. These breaches reinforce the overall bullish theme and signal scope for a continuation higher near-term towards 0.6687, the 2.0% 10-dma envelope and 0.6723, the Aug 1 high.

- In similar vein, GBPUSD topped the $1.2700 handle, making new multi-month highs. This extends the winning streak of higher highs and higher lows to four consecutive sessions, bolstering the potential for a move to 1.2746, the Aug 30 high.

- Australia CPI is due overnight before the November RBNZ policy rate decision. In Europe, focus will turn to Eurozone inflation releases before markets receive the second iteration of US third quarter GDP.

FX Expiries for Nov29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0895-00(E1.5bln), $1.0970-75(E1.2bln)

- USD/JPY: Y148.00-15($2.1bln), Y148.50($926mln), Y149.00-05($1.1bln)

- AUD/USD: $0.6500(A$2.5bln), $0.6525(A$1.2bln)

- USD/CNY: Cny7.1700($667mln)

Larger FX Option Pipeline

- EUR/USD: Dec01 $1.0900(E1.2bln), $1.0995-00(E1.6bln); Dec04 $1.0820-35(E1.6bln), $1.0860-65(E1.1bln), $1.0925-30(E1.2bln)

- USD/JPY: Nov30 Y148.30($1.8bln), Y149.00($3.1bln), Y149.50-65($1.2bln), Y149.85-05($1.5bln), Y151.00($1.0bln); Dec01 Y151.00($1.0bln); Dec04 Y147.00($1.1bln), Y148.00($1.5bln)

- AUD/USD: Nov30 $0.6580-00(A$1.2bln)

- USD/CAD: Nov30 C$1.3000($2.7bln); Dec01 C$1.3600-20($1.8bln)

US FI OPTIONS: Upside Via Options In Rates Tuesday

Tuesday's US rates/bond options flow included:

- 0QJ4 96.00/96.87cs 1x2, bought for 15.5 in 2.5k

- SFRF4 94.75/95.00/95.25c fly bought for 2.5 in 11k total

- SFRH4 95.00/96.00cs, bought for 4.5 in 10k

- SFRJ4 94.50p, sold at 4.75 in 5k

- SFRJ4 94.75/94.93/95.25/95.43c condor, bought for 5 in 25k total, bid over

- SFRM4 94.75/95.00/95.25/95.50c condor, bought for 4.5 in 2.5k

- SFRM4 95.25/95.37/96.00/96.12c condor bought for 2 in 2k

- SFRM4 95.25/95.50/95.75c fly, bought for 2 in 10k total

- SFRJ4 94.50p, sold at 4.75 in 7k total

- SFRH4 94.81/94.93 cs, bought for 2 in 5k (on screen)

EU FI OPTIONS: Mixed Trade Tuesday

Tuesday's Europe rates/bond options flow included:

- 0RF4 97.12/97.00/96.87p fly, bought for 2.1 synth in 5k

- SFIM4 94.90/95.05/95.20 call fly paper paid 1.25 on 4.25K

- Bund weekly (expiry Friday) 132.5/133cs, sold at 7 in 2.3k

US STOCKS: S&P Holding Narrow Range With Cross Currents Underneath

- A sizeable rally in Treasuries has provided little macro tailwind for stocks today, despite it being driven in real yield terms (10Y nominal -4.3bps, real -6.4bp) in a change from yesterday’s lower inflation breakeven led move.

- ESZ3 at 4560.75 (unch) is within the day’s narrow range. Trend conditions remain bullish with resistance seen at 4580.5 (Nov 22 high), which it came close to earlier with a fleeting high of 4577.25, after which lies key resistance at 4597.50 (Sep 1 high).

- E-minis see the S&P near in line with Nasdaq 100 (0.05%), underperforming the Dow (+0.2%) and outperforming the Russell 2000 (-0.3%).

- In cash space, SPX is led by consumer discretionary (+0.5%, helped by Tesla +3.8%) and real estate (+0.5%) again with lower rates, closely follow by utilities (+0.5%) and consumer staples (+0.4%). Healthcare (-0.4%) is a clear lagger followed by tech/industrials (-0.05%), with tech suffering from Nvidia -1.2% after Micron has slipped -2.9% for its worst decline in two months after higher operating expenses.

COMMODITIES: Crude Futures/Precious Metals Surge Amid Weaker USD Backdrop

- Crude oil prices have rallied sharply on Tuesday, despite easing from their intraday highs in late trade. Price action was unable to breach last Friday’s highs, residing just above the $77 mark for WTI. Crude is rebounding amid the ongoing weakness for the US dollar and is also finding support from uncertainty over the upcoming OPEC+ meeting and potential further supply cuts, coupled with lower output from Kazakhstan as storms impact CPC loadings.

- OPEC+ talks on oil policy are difficult, making a further delay or a rollover possible according to four OPEC+ sources cited by Reuters.

- For Natural Gas, Henry Hub plummeted once again near US close and is trading just above its intraday low of $2.683/MMBtu. It is set for its lowest closing level since late September. Record domestic production is adding to healthy storage and an expected drop in demand next week due to a warning weather forecast.

- In precious metals, some dovish leaning Fed comments and the associated weaker greenback has prompted a strong 1.4% rally for both spot gold and silver.

- Spot gold extends its impressive run to trade at the highest level since May and significantly narrow the gap with the year’s highs at $2,063. Analysts appear to remain bullish on the yellow metal with strategists at Bank of America, stating they believe gold could finish 2024 at $2,400 per ounce, if earlier Fed rate cuts were to manifest.

- Mining weekly reported that in their recently published Metals and Mining Outlook for 2024, the BofA analysts said that while the war in the Middle East has boosted gold in the near term, “the yellow metal ultimately remains a trade on rates, so once the Fed announces a decisive end to the hiking cycle in 2Q, new buyers should come into the market.”

FIXES AND PRIOR SESSION REFERENCE RATES

SONIA FIX

1M 5.20330 0.0002

3M 5.23890 -0.001

6M 5.27010 -0.008

12M 5.19940 -0.0264

REPO REFERENCE RATES (rate, change from prev. day, volume):

- Secured Overnight Financing Rate (SOFR): 5.32%, no change, $1602B

- Broad General Collateral Rate (BGCR): 5.30%, no change, $594B

- Tri-Party General Collateral Rate (TGCR): 5.30%, no change, $582B

Monday saw a $81B increase in SOFR volumes to $1602B, back closer to the Nov 16 joint recent high of $1640B, whilst the rate stayed steady.

NEW YORK FED EFFR (rate, chg from prev day):

- Daily Effective Fed Funds Rate: 5.33%, no change, volume: $97B

- Daily Overnight Bank Funding Rate: 5.32%, no change, volume: $253B

No change in EFFR yesterday whilst volumes edge lower but remain in recent ranges.

FED: RRP Counterparties Lowest Since Nov 2022

- RRP usage ticked up $6B to $873B today, further consolidation of Friday’s sizeable $66B decline to $866B, to what was the lowest since Jul'21.

- The number of counterparties fell further to 91, its lowest since mid-Nov'22.

- It comes increased demand at recent bill auctions with bid-to-covers pushing higher (see here).

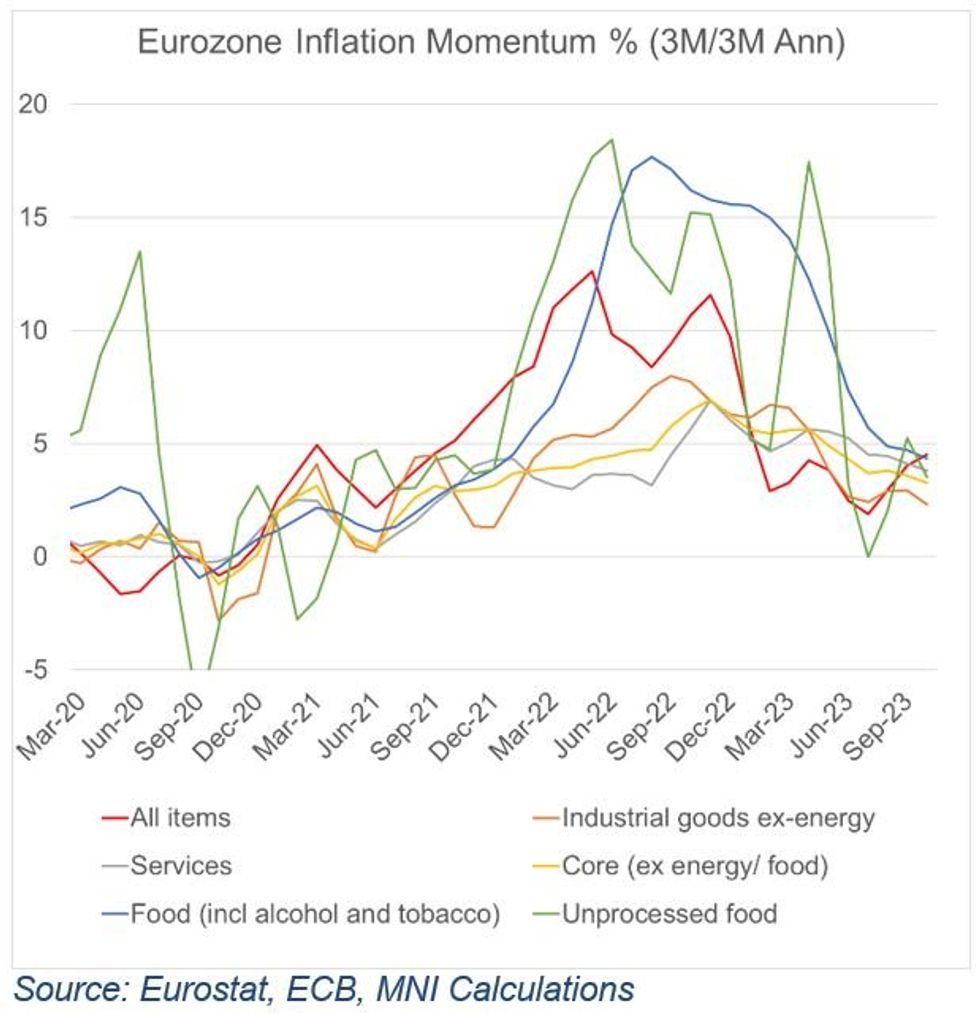

MNI Eurozone Inflation Preview – November 2023

EXECUTIVE SUMMARY

The Easy Part Is Ending, The Last Mile Begins

The November round of monthly flash Eurozone inflation data begins on Wednesday Nov 29 with Spain and Germany reporting, and the French, Italian, and Eurozone-wide figures printing on Thursday Nov 30.

- After seeing disinflationary progress over the past several reports, including October delivering the first Y/Y headline HICP print below 3% since August 2021, the ECB will be closely watching this month's price dynamics ahead of its December meeting.

- To be sure, November HICP is expected to see further declines, to 2.7% Y/Y (2.9% prior) for headline and 3.9% Y/Y core (4.2% prior), which would only reinforce the overwhelming market conviction that ECB rates have reached their peak.

- But beyond the disinflationary readings of the past few months, the "easy part" in the disinflationary process is arguably coming to an end, with the ECB increasingly eyeing the "last mile" of bringing inflation down to 2% over the forecast horizon.

- In this regard the November report should be regarded in two ways: “mechanically”, in the sense that base, weighting and seasonal effects will be contributing heavily to disinflation and some will reverse higher in the next few months; and two – structurally, with further downward momentum in the core components likely to be necessary for ECB policymakers to have comfort that broader progress will continue into 2024.

- Our preview includes analysis of price categories to watch, assessments of underlying inflation trends, outlooks for the French, German, Italian, and Spanish national inflation prints, and sell-side analyst previews.

FOR FULL PDF ANALYSIS:

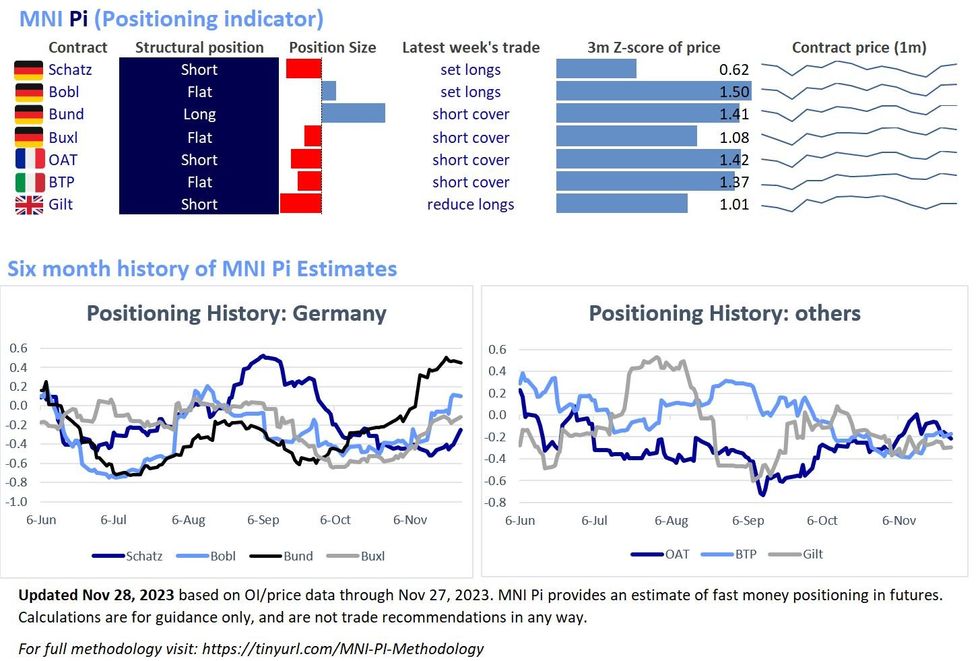

MNI Europe Pi (Positioning Indicator): Mixed Into The Roll

EXECUTIVE SUMMARY:

- With Eurex contracts entering the quarterly roll (Dec/Mar) later this week ahead of the Dec 7 deadline, MNI Europe Pi shows mixed structural positioning.

- German contracts run the gamut from Short to Long, with Flat/Short positioning prevailing overall.

- The most recent week saw relatively cautious trade, with mostly short covering and long reduction in evidence.

Full PDF Analysis:

- GERMANY: Schatz enters the roll period in the same short structural positioning in which it has been since early October. Since our update on Nov 20, the other contracts have not shifted, with Bobl remaining flat, Bund long, and Buxl flat. The most recent week of trade was indicative of long-setting in Schatz and Bobl, with short covering in Bund and Buxl.

- OAT: OAT has tilted back toward short structural positioning where it spent most of the Jul-Oct period, having been flat in our last update. Last week's trade was evident of some short covering.

- GILT: Gilt structural positioning is nominally short though we caution against making any conclusions given the distorted signal from the ongoing roll (which is nearly complete).

- BTP: BTP structural positioning remains flat, with some short cover in evidence in the most recent week of trade.

MNI RBNZ Preview - November 2023: Economy Developing Broadly As Expected

EXECUTIVE SUMMARY:

- We expect the RBNZ to leave rates at 5.5%, where they have been since May, at its final meeting for 2023. Bloomberg consensus is unanimous at 5.5%. As a result, the focus will be on the accompanying updated forecasts, statement and press conference.

- In terms of projections, there are likely to be some near-term revisions with the medium-term little changed, which is the time horizon that the MPC focuses on. As the economy is evolving broadly as the RBNZ expected, the OCR forecast is likely to be little changed and headline CPI inflation still return to target in Q3 2024.

- The MPC will still want to send a strong message that policy needs to remain restrictive to bring inflation back to target. It won’t want easing brought forward and risk a reduction in mortgage rates. Its neutral stance should be maintained and the “high for longer” message is likely to be unchanged. There is unlikely to be further tightening but the first cut looks around a year away or possibly longer.

Click to view full preview:

US DATA: Conf Board Labor Differential Points To Further Unemployment Rate Increases

- The Conference Board consumer confidence index was higher than expected in November at 102.0 (cons 101.0) for an improvement after a downward revised 99.1 (initial 102.6).

- Within the survey, the labor market differential was near unchanged in November but from a downward revised October leaving it at 23.9.

- It’s the lowest since Apr’21 and comes with the highest measure of “jobs hard to get” since Mar’21.

- Recall the step down from the low 30s to 27 in Aug-Sep came with the surprise move higher in the unemployment rate to 3.8% in August, which has since drifted to 3.9% in October.

- There appears to be a structural break in the relationship with the unemployment rate post-pandemic but for what it’s worth, the level of the labor market differential would historically have been closer to an u/e rate between 4-4.25%.

US DATA: Regional Fed Mfg Surveys Point To Firmer ISM

- Today’s Richmond Fed mfg index surprisingly fell to -5 (cons +1) in November after +3, back to its lowest since August after the largest monthly fall in eighteen months.

- It completes the regional Fed manufacturing surveys for this month, a majority of which have improved from October (Empire from -4.6 to +9.1, Philly from -9 to -5.9, Kansas from -8 to -2) although Dallas was little changed (-19.2 to -19.9).

- Indeed, the unweighted average of the five has increased from -7.6 to -4.7 for its highest reading since Jul 2022.

- Combined with the S&P Global PMI only dipping slightly from 50.0 to 49.4 in its preliminary Nov release, these manufacturing surveys imply upside bias to the ISM survey after its surprise 2.3pt drop to 46.7 back in October [see chart]. The MNI Chicago PMI on Thursday will be watched for further clues ahead of ISM on Friday.

US DATA: Mixed House Price Data Vs Strong Expectations

- FHFA house prices were stronger than expected in September, rising 0.6% M/M (cons 0.5) after an upward revised 0.7% (initial 0.6%).

- The S&P CoreLogic 20-city measure meanwhile was softer than expected, especially with revisions, rising a seasonally adjusted 0.67% M/M (cons 0.8) in Sept after a downward revised 0.82% M/M (initial 1.01%).

- The August downward revision for S&P CoreLogic (0.9% from initial 0.78%) partly offset some of this but there still appears a disconnect with the consensus for the Y/Y figure, which was inline at 3.92% Y/Y (cons 3.9%).

- It’s worth watching prices over the next couple of months with relative supply starting to lift back closer to pre-pandemic levels.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/11/2023 | 0030/1130 | *** |  | AU | CPI Inflation Monthly |

| 29/11/2023 | 0030/1130 | *** |  | AU | Quarterly construction work done |

| 29/11/2023 | 0100/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 29/11/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 29/11/2023 | 0700/0800 | *** |  | SE | GDP |

| 29/11/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 29/11/2023 | 0700/1500 | ** |  | CN | MNI China Liquidity Survey |

| 29/11/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 29/11/2023 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 29/11/2023 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 29/11/2023 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 29/11/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 29/11/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 29/11/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/11/2023 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 29/11/2023 | 1000/1100 | ** |  | IT | PPI |

| 29/11/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 29/11/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 29/11/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 29/11/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 29/11/2023 | 1330/0830 | * |  | CA | Current account |

| 29/11/2023 | 1330/0830 | *** |  | US | GDP |

| 29/11/2023 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 29/11/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 29/11/2023 | 1845/1345 |  | US | Cleveland Fed's Loretta Mester | |

| 29/11/2023 | 1900/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.